Creating a bogus receipt template can be useful for testing purposes, such as validating the accuracy of receipt scanners or developing software that processes receipts. Ensure that the template looks realistic enough to mimic genuine receipts but is clearly distinguishable as a fake to avoid any legal issues.

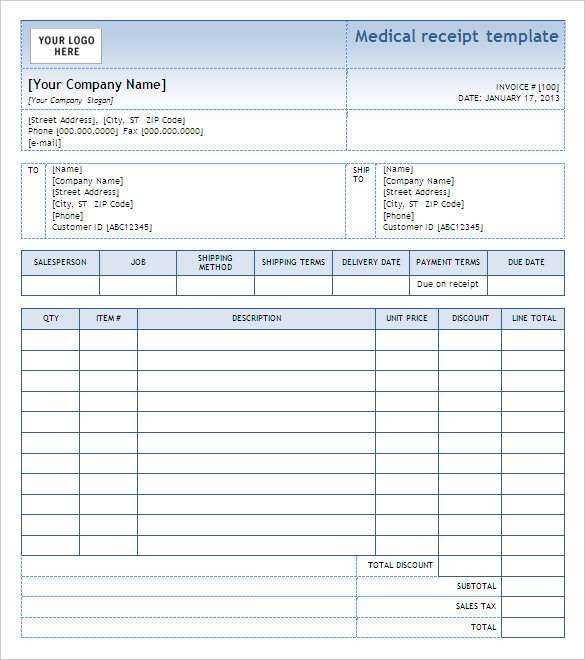

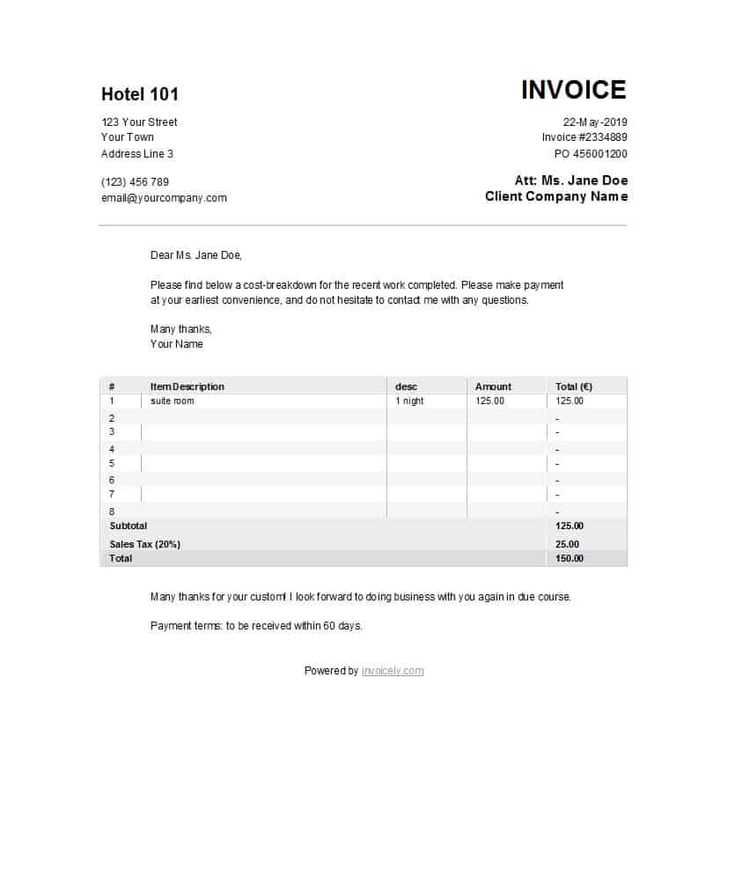

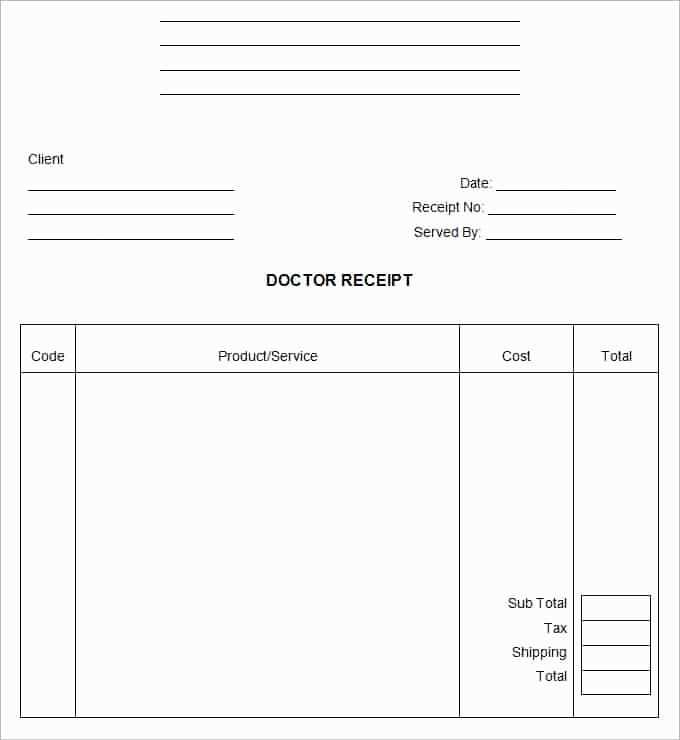

Begin by setting up a standard receipt layout. Include common elements like a store name, address, contact details, date, items with prices, and a total. Use a font that is easily readable but not too distinct to maintain a lifelike appearance. Be sure to add a footer with fake legal disclaimers or refund policies, which further adds authenticity.

To prevent any confusion or misuse, include a bold disclaimer on the template stating that the receipt is not valid for actual transactions. This will ensure that it is only used in appropriate situations, such as software testing or design mockups.

Detailed Guide on Bogus Receipt Templates

When using bogus receipt templates, make sure to focus on the accuracy of the data you include, as it can be easy to overlook small details that could raise suspicion. Start with the basic structure of a real receipt, ensuring it includes the vendor name, date of transaction, product or service description, and the total amount paid. Pay attention to font style and size; using fonts too different from standard ones may stand out.

Design Tips

Avoid cluttering the receipt with unnecessary information. Only include what is necessary for the context. Keep the layout simple, with clear sections that are easy to read. The inclusion of company logos and address information should match a typical business format, but don’t overdo it to maintain realism. Ensure the payment method (cash, credit card, etc.) aligns with the type of purchase indicated.

Common Pitfalls to Avoid

Double-check your spelling and formatting. Even small errors like inconsistent date formats or incorrect item names can be easily spotted. Be aware of using common terms or phrases that may seem out of place for the product or service being “purchased.” Avoid overly generic store names that do not resemble actual businesses.

How to Recognize a Bogus Receipt Template

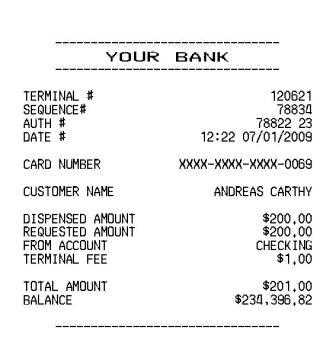

To spot a fake receipt, closely examine the following key details:

- Fonts and Formatting: Check for inconsistent fonts or unusual formatting. Official receipts usually maintain a consistent style throughout.

- Missing or Altered Information: Verify that all required fields, such as store name, address, date, and item details, are present and accurate. Fake receipts often omit crucial information or show discrepancies.

- Barcode or QR Code: Genuine receipts typically include a scannable barcode or QR code. Fake templates may have distorted or missing codes.

- Receipt Number: A legitimate receipt will have a unique identification number. Bogus receipts often lack this or show a duplicate number.

- Company Branding: Look for the store’s official logo or branding. A fake receipt may have a low-quality or blurred logo, or it might be missing entirely.

- Alignment of Items and Prices: Check that items and prices are properly aligned. Fake receipts sometimes display misaligned text or irregular spacing.

By verifying these details, you can better differentiate between real and fake receipts. Always be cautious when receiving receipts that seem off in appearance or content.

Legal Implications of Using Fake Receipt Templates

Using fake receipt templates can lead to severe legal consequences, including criminal charges. If someone is caught creating or using fraudulent receipts, they can face charges for fraud, which may result in fines, restitution, or imprisonment depending on the severity of the offense.

In many jurisdictions, producing fake documents with the intent to deceive others is considered a form of forgery. Forgery is a criminal offense, and penalties can include both jail time and hefty fines. Additionally, individuals who use fake receipts to mislead businesses or government agencies may be held liable for damages and penalties, depending on the situation.

Furthermore, businesses that accept or process fake receipts risk facing penalties, including loss of their operating license or legal action from regulatory authorities. It’s important for organizations to implement procedures to verify receipts and ensure the legitimacy of all documents they receive.

If an individual uses fake receipts to claim tax deductions, they are committing tax fraud, which can have serious financial and legal repercussions. Tax authorities closely investigate suspicious claims, and those found guilty can be fined or face imprisonment. The IRS and similar organizations take such offenses seriously, and even small-scale fraud can lead to criminal charges.

Always be cautious about the potential risks of using fake receipt templates. In some cases, the consequences of getting caught may extend beyond fines and jail time, impacting one’s reputation and future opportunities. The best course of action is to avoid any involvement in fraudulent activities and ensure all documentation is legitimate and truthful.

Best Practices for Creating Legitimate Receipts for Personal Use

Ensure your receipt includes clear details such as the date, item description, price, and the total amount paid. This makes the document transparent and trustworthy.

Use an accurate and identifiable business name or your own personal details if it’s for an individual purchase. Avoid generic or non-specific names that may cause confusion.

Include a receipt number to track transactions and add legitimacy. This can be particularly useful for personal record-keeping.

Use a consistent format across all receipts. This creates a uniform and organized system, making it easier to manage personal finances or document keeping.

Incorporate tax details if applicable. This is especially important if you’re tracking purchases for tax purposes or personal budgeting.

Make sure to specify the method of payment (e.g., credit card, cash, bank transfer) to clarify the transaction and its legitimacy.

If the receipt is for a service rather than a product, provide a detailed breakdown of the service, including duration and any specific terms agreed upon.

Always retain a copy of your receipts. Digital or physical copies can be stored for easy access and as a backup if you need to refer to the transaction later.