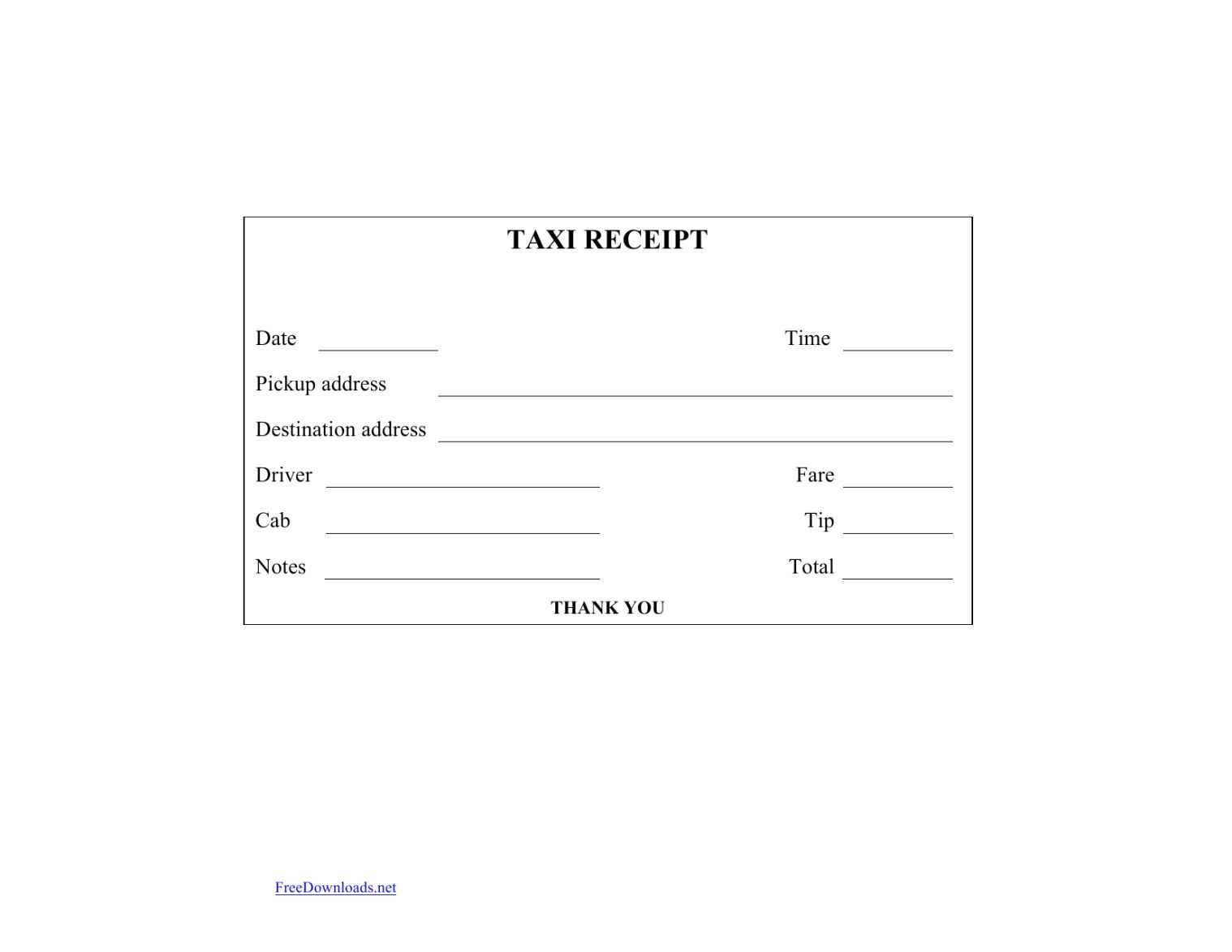

Best Format for a Cab Receipt

A cab receipt in India should include all relevant details to ensure transparency and compliance with tax regulations. Below is the ideal format:

- Company Name & Logo: Clearly visible at the top.

- Receipt Number: Unique for every transaction.

- Driver Details: Name and contact number.

- Customer Name: Optional but useful for corporate claims.

- Trip Details: Pickup and drop locations, date, and time.

- Vehicle Information: Registration number and type.

- Fare Breakdown: Base fare, distance fare, waiting charges, taxes, and total amount.

- Payment Method: Cash, card, UPI, or digital wallet.

- Tax Information: GST details if applicable.

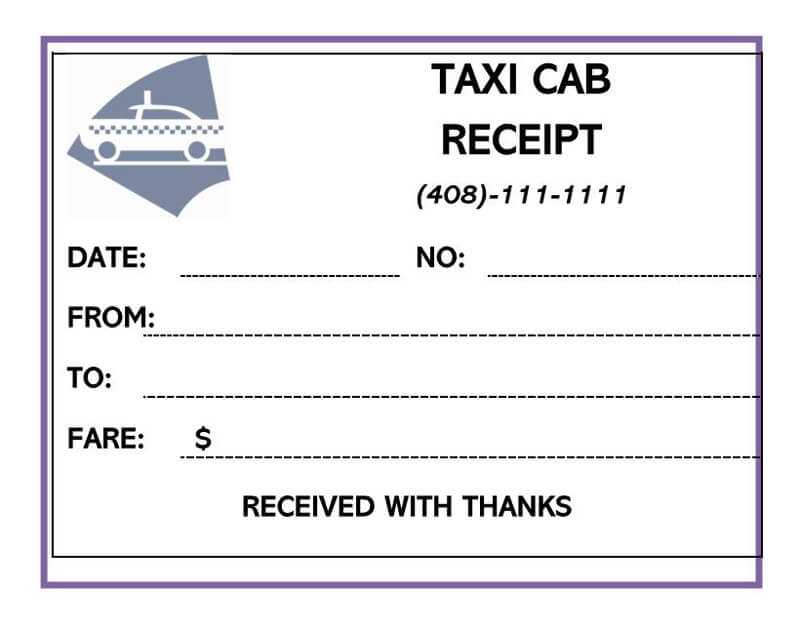

Sample Cab Receipt Template

Use the following structure as a reference:

Cab Service Name Address Contact: +91-XXXXXXXXXX GSTIN: XX-XXXXXXXXXXXXX ---------------------------------- Receipt No: 123456 Date: DD/MM/YYYY Time: HH:MM AM/PM ---------------------------------- Customer Details Name: John Doe (Optional) Trip Details Pickup: Location A Drop: Location B Distance: XX km Duration: XX mins Fare Breakdown Base Fare: ₹XX.XX Distance Fare: ₹XX.XX Waiting Charges: ₹XX.XX Tax (XX% GST): ₹XX.XX Total Amount: ₹XXX.XX Payment Mode: UPI/Card/Cash Driver Name: XYZ Vehicle No: XX-XX-XXXX

Why a Structured Receipt Matters?

Cab receipts serve as proof of payment for business reimbursements and tax deductions. Standardized receipts help avoid disputes and ensure compliance with financial policies.

Creating Digital Receipts

Platforms like Excel, Google Docs, and invoice generators can automate receipt creation. Ride-hailing apps like Uber and Ola provide digital receipts with all required details.

A well-structured receipt ensures clarity, transparency, and easy record-keeping for both drivers and passengers.

Cab Receipt Template India: A Practical Guide

Key Components of a Taxi Receipt Template in India

Legal and Tax Compliance for Taxi Receipts in India

How to Create a Digital Ride Receipt Template

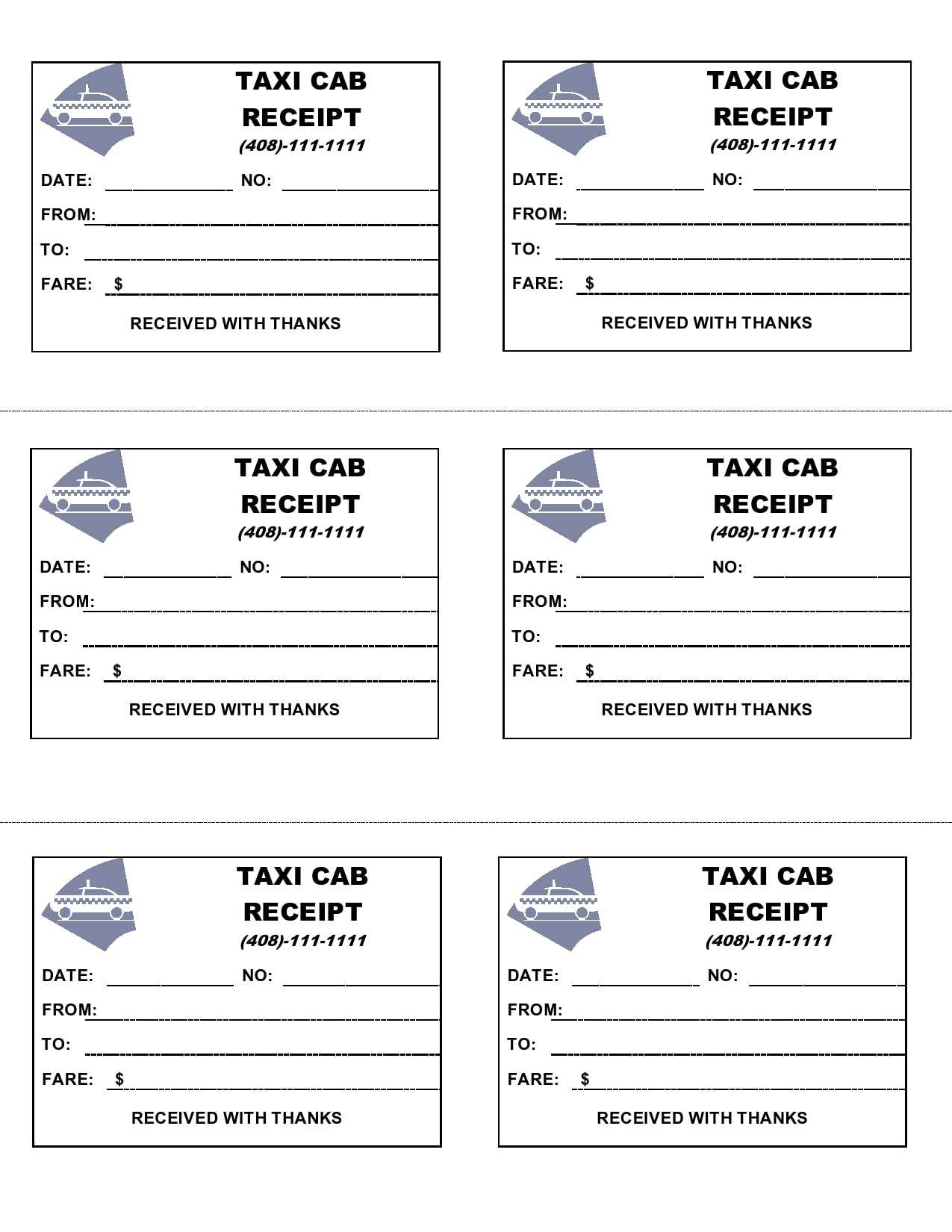

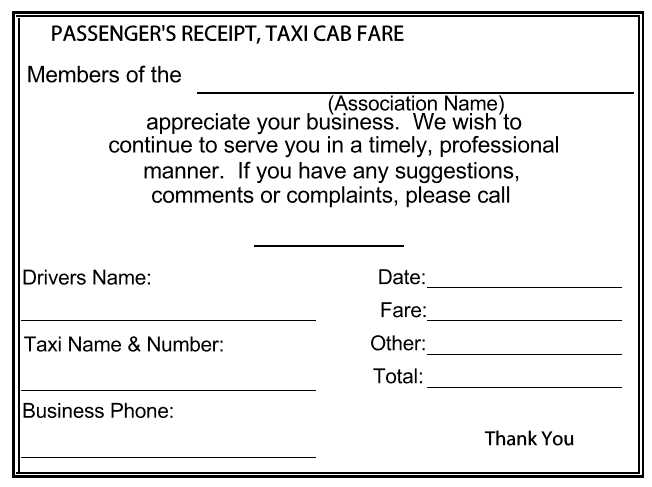

Best Formats for Printable Taxi Receipts

Customizing Ride Receipt Templates for Business Use

Common Mistakes to Avoid When Designing Ride Receipts

Key Components of a Taxi Receipt Template in India

A proper taxi receipt should include essential details for both passengers and businesses. Ensure the receipt contains the following:

- Trip Details: Date, time, and distance traveled.

- Fare Breakdown: Base fare, per-kilometer charge, tolls, and applicable taxes.

- Vehicle Information: Registration number and type of vehicle.

- Driver Details: Name, contact number, and license ID.

- Company Information: Business name, GSTIN (if applicable), and contact details.

- Payment Method: Cash, card, UPI, or digital wallet.

- Unique Receipt Number: For tracking and tax purposes.

Clarity in layout and structure ensures quick verification and legal compliance.

Legal and Tax Compliance for Taxi Receipts in India

Businesses issuing taxi receipts must follow tax regulations to avoid penalties. If the service provider is GST-registered, include the GST rate (5% for transport services) and tax amount separately. Receipts should also mention whether fares include GST or if it’s charged additionally. Digital ride-hailing platforms must align with local government regulations, ensuring that receipts comply with electronic invoicing norms.

Proper documentation helps in seamless audits and financial tracking. For companies providing corporate travel services, receipts should meet reimbursement standards to avoid disputes.