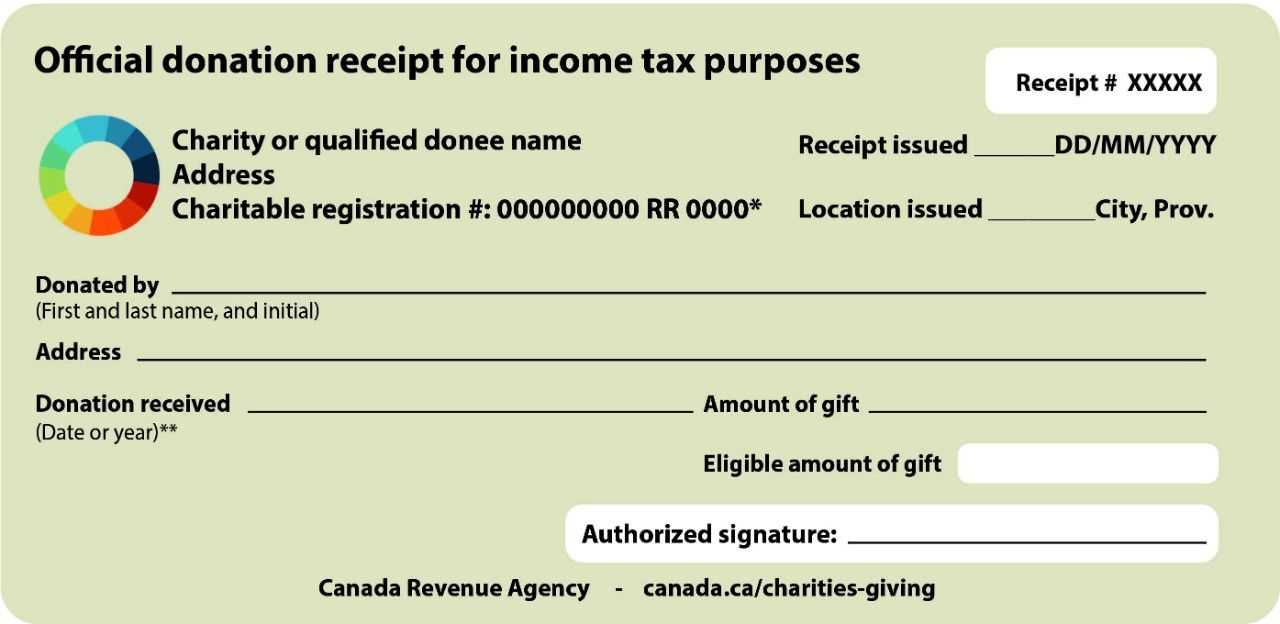

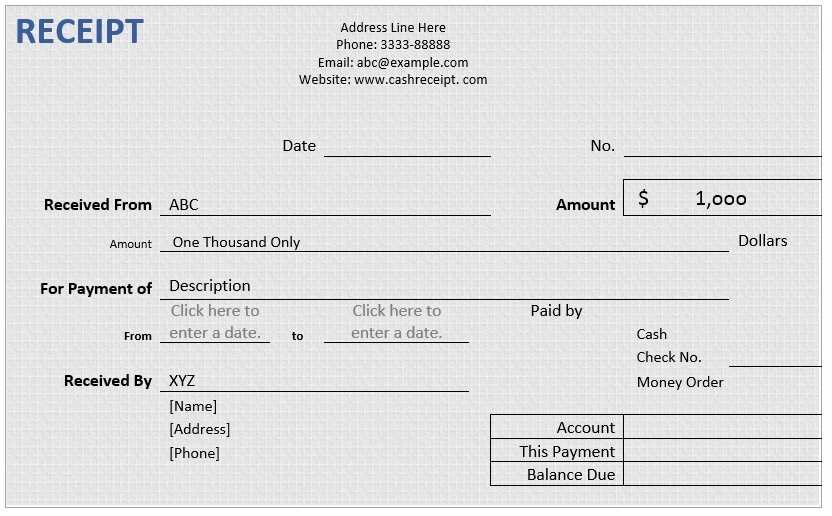

To create a Canadian receipt that meets all necessary legal and financial standards, focus on clarity and completeness. Include the business name, address, and contact details at the top. Ensure the receipt includes a unique transaction number for tracking and auditing purposes. Always specify the date of the purchase or service to avoid any confusion.

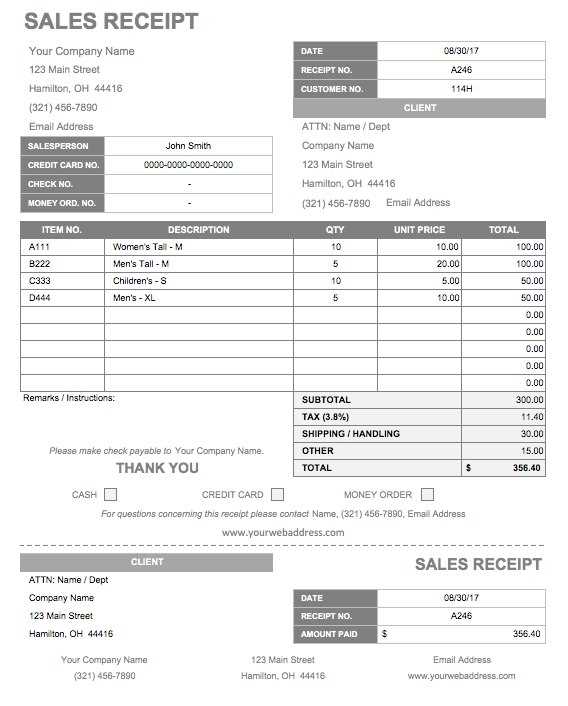

List the items or services sold with corresponding prices, taxes, and totals. Be transparent about the tax rate applied–whether it’s the GST, HST, or PST–depending on the province where the transaction took place. It’s important to break down tax amounts separately for easy reference. If a discount was applied, note the reduced price clearly.

Finally, include payment information, such as the method of payment (credit card, cash, etc.), and confirm the amount paid. This helps both parties keep accurate records for future reference or returns. Keep the format simple and professional to ensure that your receipts are easy to understand and can be quickly processed by customers or financial institutions.

Here is the corrected version without repetitions:

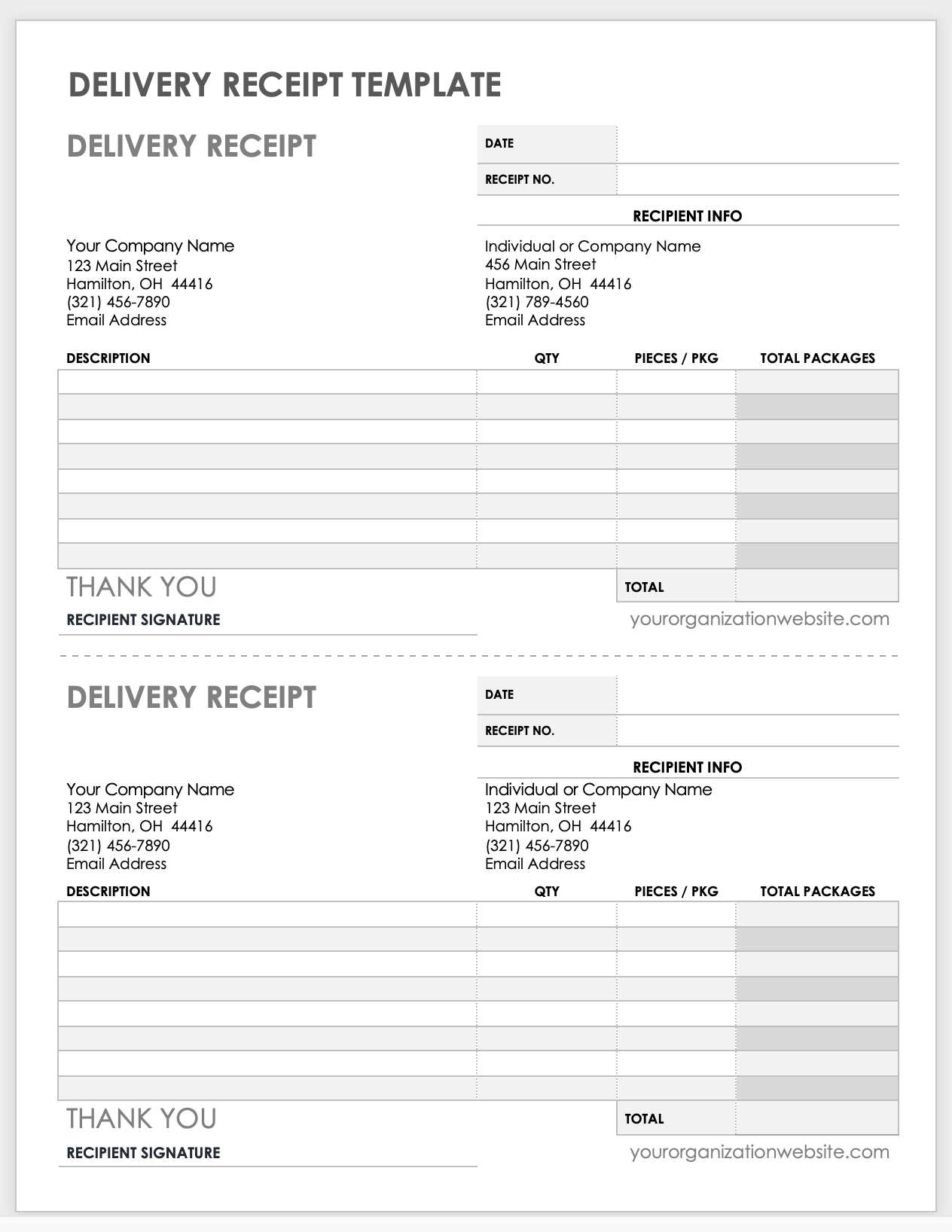

When creating a receipt template for Canadian use, ensure it includes clear, concise details that avoid redundancy. The most critical components should be displayed in an organized manner. Start with the business name and contact information at the top. Below that, provide the date of purchase and a unique transaction number for reference.

Breakdown of the Receipt

Each item purchased should be listed clearly, showing the description, quantity, price per unit, and total cost. Avoid repeating details for the same item. For taxes, break them down into applicable types (e.g., GST, PST) and list the amounts separately. This ensures full transparency for the customer.

Additional Information

End the receipt with a total amount, which includes taxes, and provide payment details such as the method used (cash, card, etc.). If applicable, include refund or return policy statements at the bottom. Double-check for any unnecessary repetitions and keep the layout clean.

Canadian Receipt Template: A Practical Guide

How to Create a Legally Compliant Canadian Receipt Template

Key Information to Include in a Receipt

Common Mistakes to Avoid When Designing a Receipt Template

To create a legally compliant Canadian receipt template, include these key details: business name and contact info, date of transaction, a clear description of goods or services, amount paid, taxes (if applicable), and the payment method. Make sure the receipt is clear, easy to read, and in a standard format to avoid confusion.

The following elements are mandatory for compliance with Canadian regulations:

- Seller’s Name and Address: Ensure the business name and physical address are listed. This includes the phone number or email for customer inquiries.

- Receipt Number: Include a unique serial number for each receipt for tracking purposes.

- Transaction Date: Include the specific date of the transaction for record-keeping.

- Detailed Description of Items: List the products or services provided, with enough detail to avoid ambiguity.

- Total Amount: Display the total paid amount clearly, including taxes and fees.

- Taxes: Specify any applicable sales taxes (GST/HST, PST), and the rate charged. This is particularly important in provinces with provincial sales tax (PST).

- Payment Method: Indicate whether the payment was made by credit card, cash, cheque, etc.

Here are common mistakes to avoid:

- Omitting Tax Information: Failing to list taxes can lead to legal issues, particularly with GST/HST or PST obligations.

- Unclear Descriptions: Be specific about what was purchased to avoid confusion or disputes later.

- Missing Serial Numbers: A receipt number should be unique for each transaction to ensure easy tracking and accounting.

- Incorrect Business Info: Double-check your contact details to ensure they are up to date for customers seeking assistance or refunds.

- Neglecting Payment Methods: Always specify how the payment was made–this helps with returns and customer service.

This will help avoid unnecessary repetition, while maintaining the meaning and structure of the text.

To create a clear and concise receipt template, ensure each item is presented only once. Repeating the same details, such as the business name or payment methods, can clutter the receipt and confuse the reader. Instead, use placeholders where necessary and keep the layout simple.

Focus on Key Information

Highlight the most important details, such as the product or service, price, and total amount. Avoid restating information that’s already evident, like the date or transaction ID, unless required for clarity. If there are specific instructions or notes, keep them to a minimum and make them easy to locate without redundant explanations.

Use Clear Sectioning

Break the receipt into logical sections. For example, separate the list of items purchased, taxes, and total costs into distinct blocks. This approach allows you to repeat section titles without redundancy, improving readability and keeping the structure intact. This layout keeps the receipt user-friendly, while avoiding unnecessary word repetition.