Key Elements for a Clear and Professional Receipt

When crafting a car dealer receipt, focus on clarity and accuracy. This ensures that both the dealer and the customer are on the same page about the transaction details.

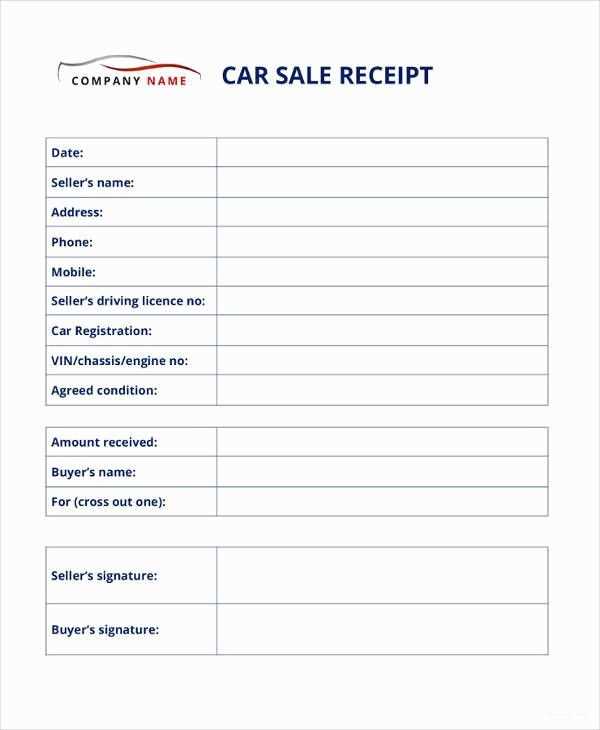

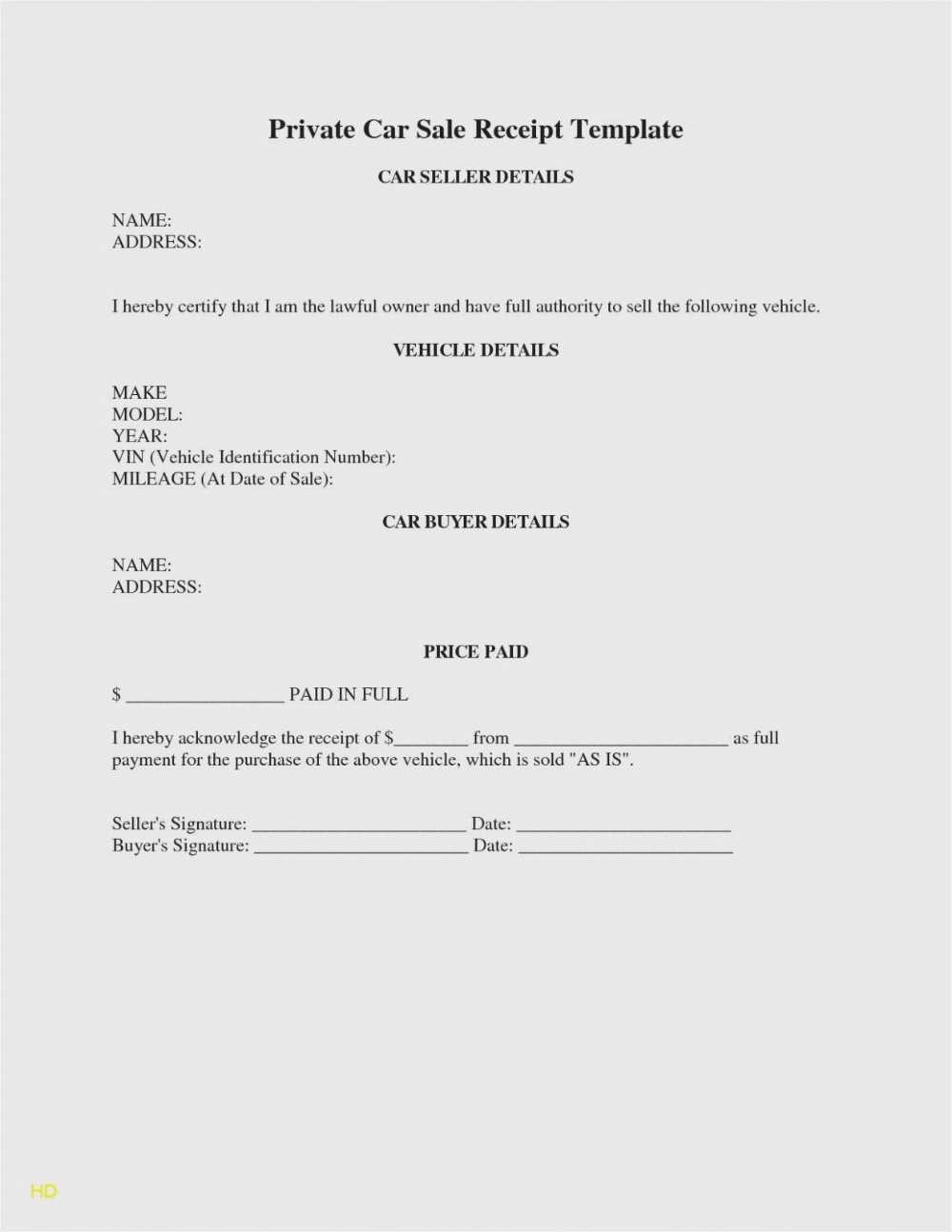

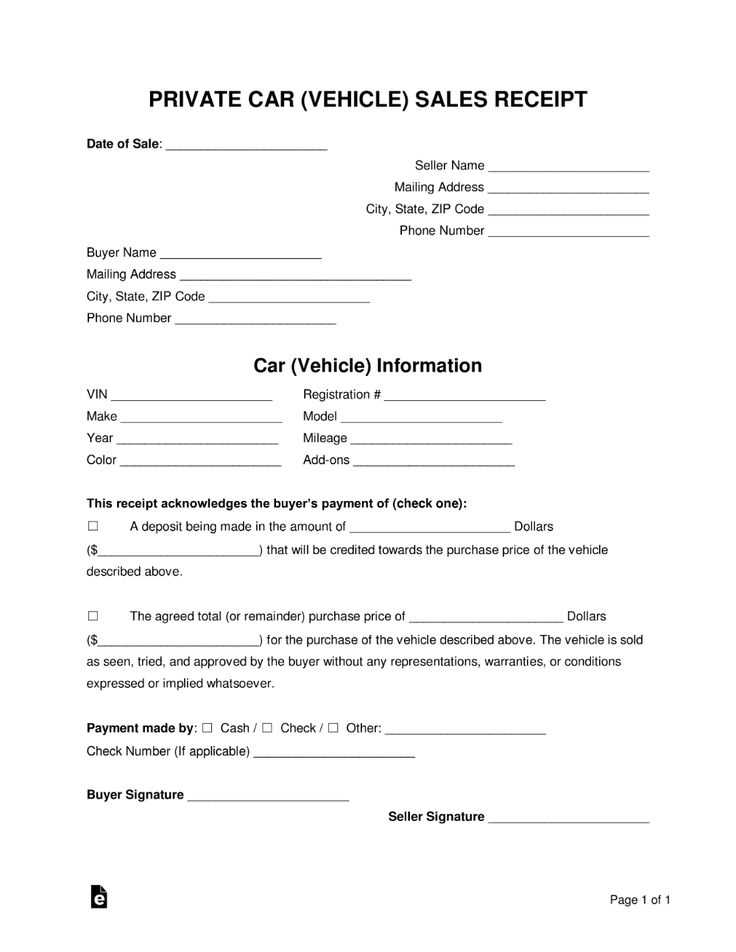

1. Dealer Information

Include the name of the dealership, contact details, and address. This will help both parties easily reach out in case of future inquiries.

2. Customer Details

List the customer’s full name, address, and contact information. Make sure this matches their ID or driver’s license for verification.

3. Vehicle Information

Clearly note the make, model, year, VIN (Vehicle Identification Number), and color of the vehicle. This eliminates any confusion about the car being purchased.

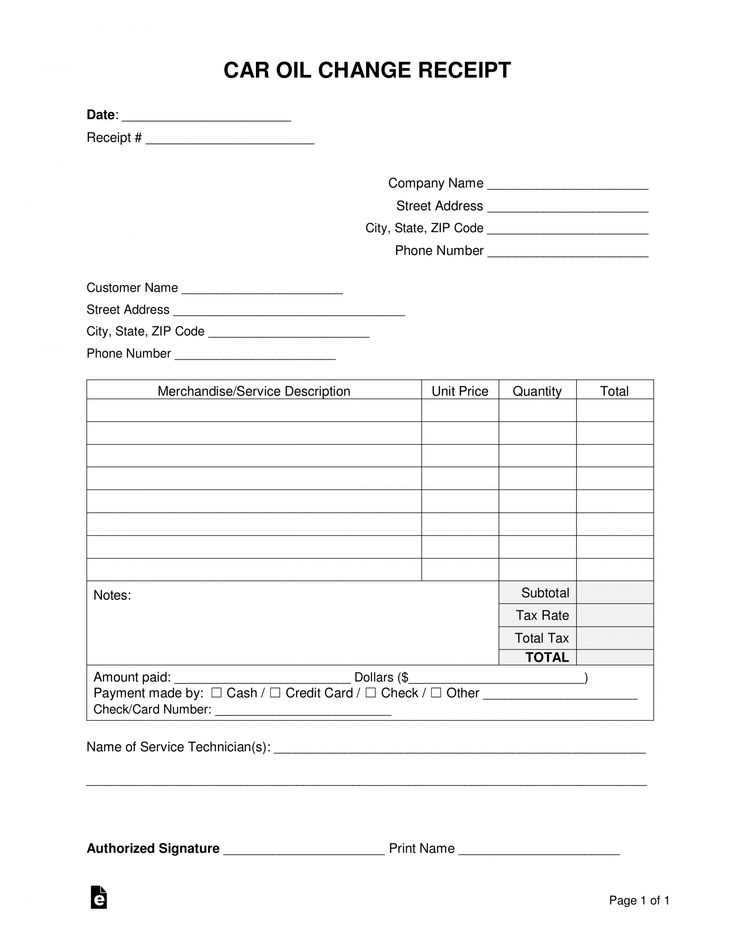

4. Transaction Breakdown

- Price: Include the agreed price for the vehicle.

- Tax: Mention applicable sales tax, which varies based on location.

- Fees: List any extra charges such as documentation fees or registration.

- Discounts: Show any discounts or promotional offers applied to the purchase.

5. Payment Details

Detail the payment method, whether it’s a cash payment, financing, or a trade-in. For financing, mention the loan amount and payment terms.

6. Date of Transaction

Record the exact date of the transaction to avoid confusion in case of disputes or returns.

7. Dealer’s Signature

Both the dealer and the customer should sign the receipt. This confirms the accuracy of the details and both parties’ agreement to the terms.

Final Thoughts

Provide a clear and easy-to-read receipt for your customers. It’s not just a document; it’s a record of the transaction that could be useful for future reference. Ensure all details are correct and organized for smooth communication down the line.

Car Dealer Receipt Template

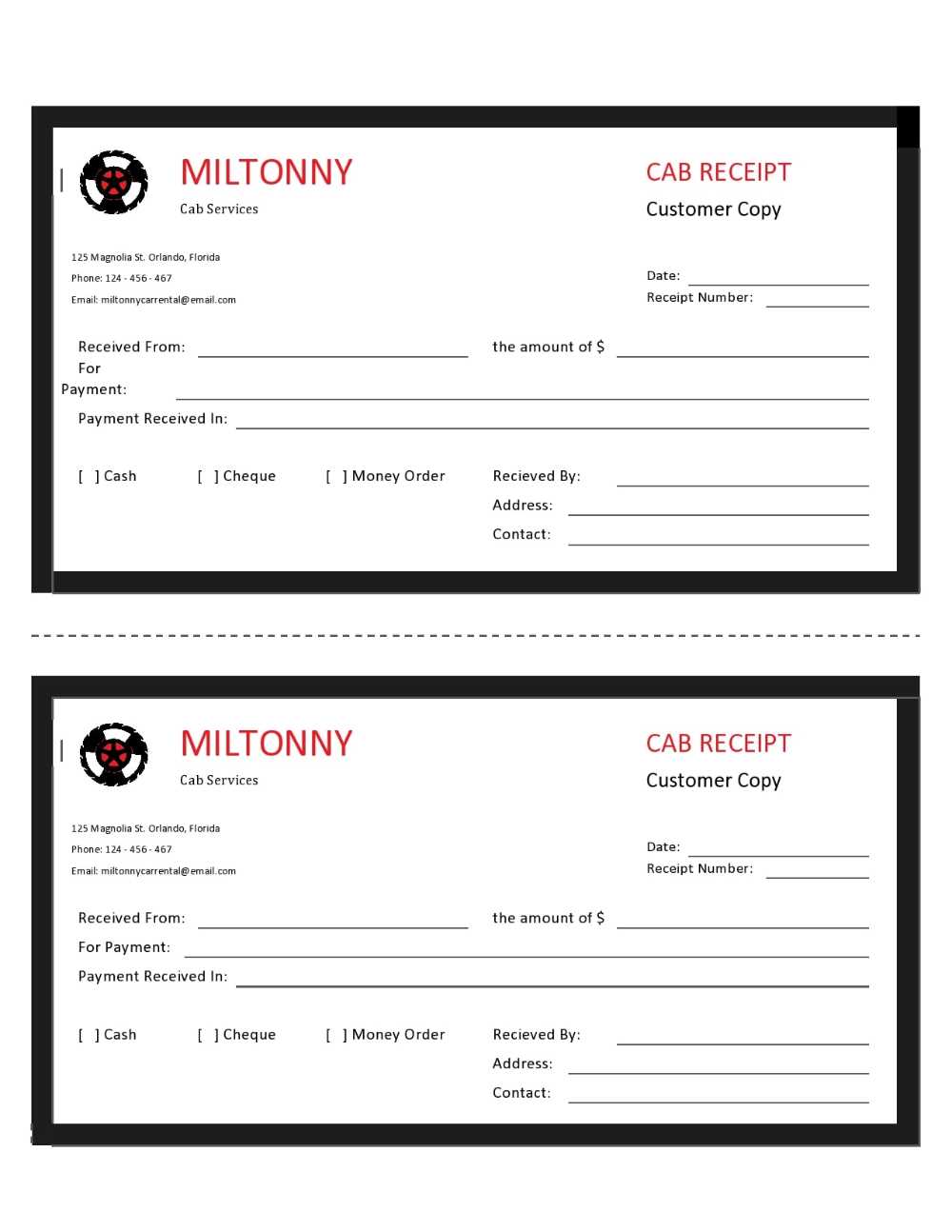

Designing a Professional Layout for a Dealer Receipt

Including Critical Information: What Should Appear on the Document

Customizing the Template for Various Types of Transactions

Incorporating Tax Details and Additional Charges

Creating a Digital Version of the Document Template

Ensuring Compliance with Local Laws and Industry Standards

Focus on a clean and organized layout when creating a dealer receipt template. Prioritize clear headings, sufficient spacing, and logical section placement. Start by including essential details such as the dealership’s name, address, and contact information at the top. Follow with the buyer’s information, vehicle details, and the transaction breakdown. Include itemized costs, taxes, and any additional fees for transparency. Ensure the font is easy to read and the document flows logically, making it simple for both the customer and the dealer to understand the charges.

Critical Information to Include

Incorporate the following sections: receipt number, date of purchase, buyer’s and seller’s contact details, vehicle identification number (VIN), model, year, make, and color. Itemize all costs, including the base price, taxes, additional charges like registration or documentation fees, and any optional add-ons like warranties or accessories. A signature line for both parties should be included to validate the transaction.

Customizing for Different Transactions

For different types of sales, adjust the template to reflect the nature of the transaction. For used car sales, include the car’s condition, mileage, and any repairs done. For leasing agreements, specify the lease terms, monthly payments, and contract duration. A rental or financing agreement would require additional details like payment schedule, interest rate, and total cost over time. Customization ensures the receipt fits the specific needs of each deal.

Include clear tax details based on local laws, including the sales tax rate and the total tax amount. If there are any additional charges (e.g., late fees, admin fees), make sure these are clearly outlined. For the digital version, create a template that can be easily filled out electronically. Ensure compatibility with devices and software commonly used by your team or customers, allowing for easy storage and retrieval.

Finally, ensure your receipt complies with local legal requirements, including any mandatory disclosure of tax rates and consumer rights. Keep updated on industry regulations to guarantee that your templates meet all necessary legal standards for vehicle transactions.