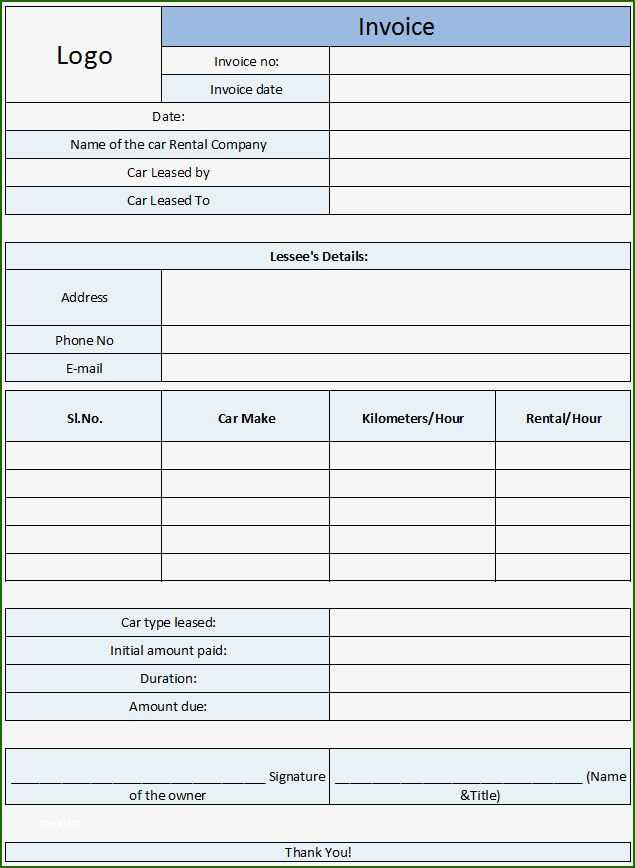

If you’re looking to create a car hire receipt, consider starting with a simple, clear format that includes all the necessary details. A good template should list the vehicle rental date, the car type, rental duration, and the total amount paid. You’ll also want to include any additional charges like insurance, taxes, or extra services provided. Make sure each item is well-organized, making it easy for both the renter and the service provider to understand the breakdown of costs.

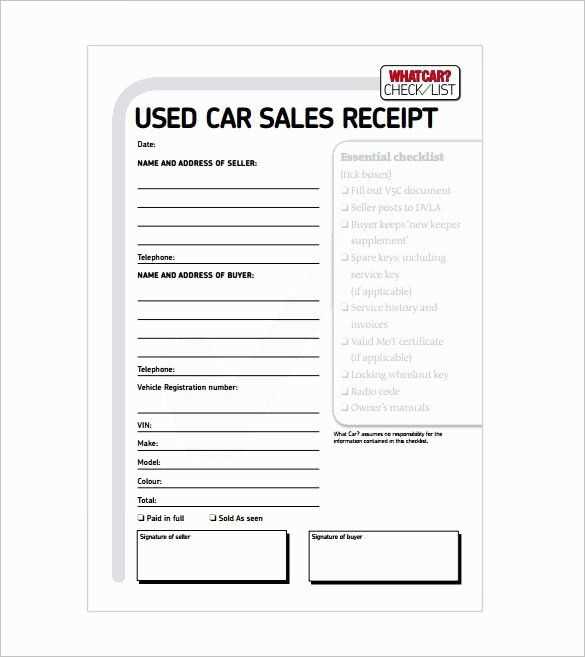

In the template, clearly state the rental company’s name and contact details, as well as the renter’s information. This helps establish trust and makes future references easier. Be sure to include the rental agreement number and a description of the vehicle, including the make, model, and registration number. These elements ensure the receipt is both accurate and legally sound.

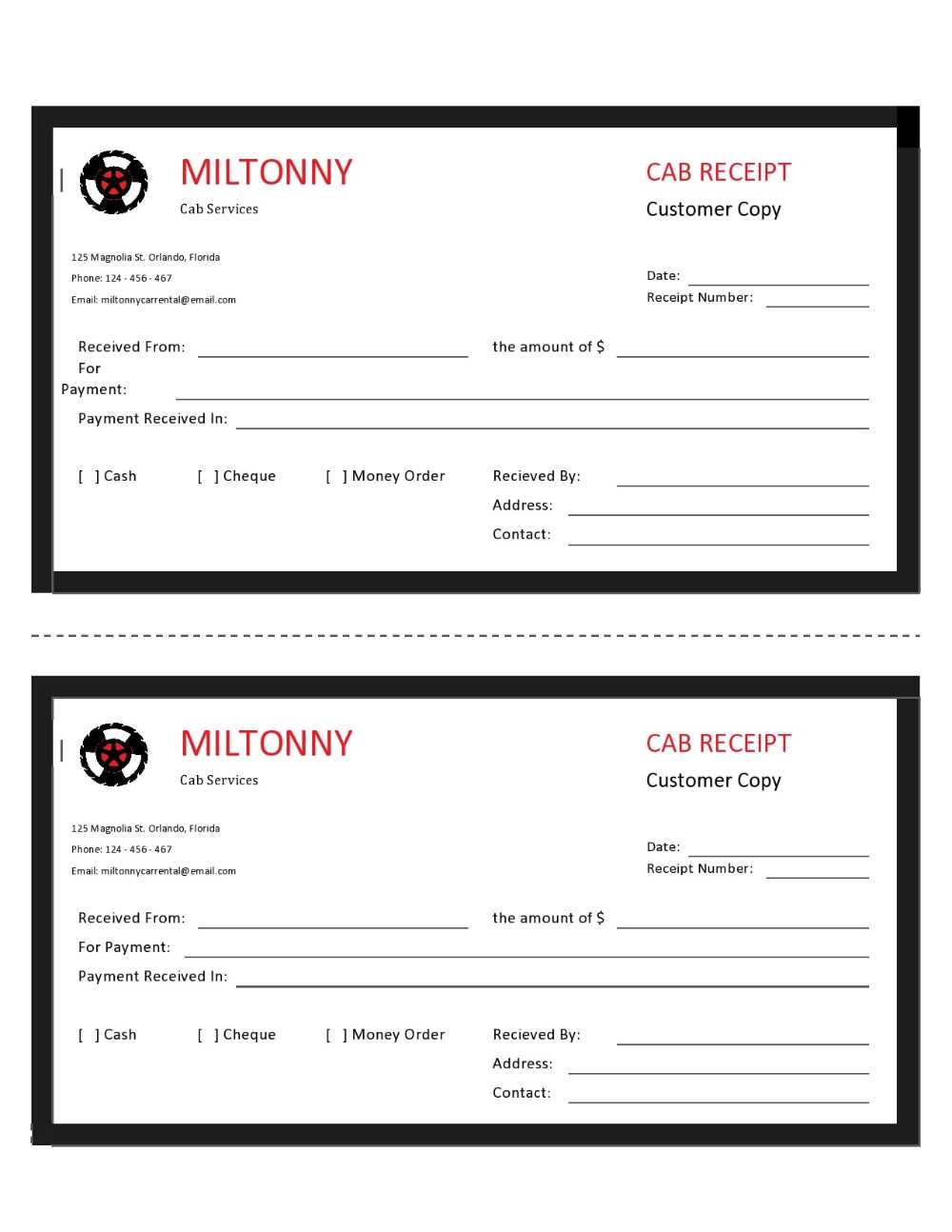

Lastly, add a section for payment method and transaction details. This could include the card used, payment date, and any deposit or balance due. Keeping the receipt straightforward yet detailed will prevent confusion and make your transaction records easier to manage.

Here’s a revised version where I’ve removed the repetitions while keeping the meaning and structure intact:

To streamline the car hire receipt, remove any redundant information. Make sure the receipt includes clear details: rental dates, car model, rental agency, and payment terms. List additional services separately, such as insurance or extra mileage charges. Avoid repeating the same data in multiple sections.

Structure Your Receipt Clearly

Begin with the rental agency’s contact details at the top, followed by the customer’s information. Include the car details (model, registration number) and rental period. The cost breakdown should follow, with taxes and any other fees clearly itemized.

Include Payment and Rental Terms

Provide payment details at the bottom, specifying the total amount, payment method, and due dates. Highlight any policies, such as fuel charges or late return penalties, in a concise and separate section.

- Car Hire Receipt Template Overview

A car hire receipt template clearly outlines the rental transaction, making it easy for both the provider and customer to understand the charges involved. This template typically includes key details such as the rental period, vehicle information, total cost, and any additional fees. Having a structured receipt helps prevent disputes and ensures transparency in the process.

Key Components

The following details should be included in a car hire receipt template:

- Rental Company Name and Contact Information

- Customer’s Full Name

- Rental Period (Start and End Date)

- Vehicle Make, Model, and Registration Number

- Total Amount Charged

- Additional Charges (e.g., insurance, extra equipment)

- Payment Method

- Signature of Both Parties (if necessary)

Template Format

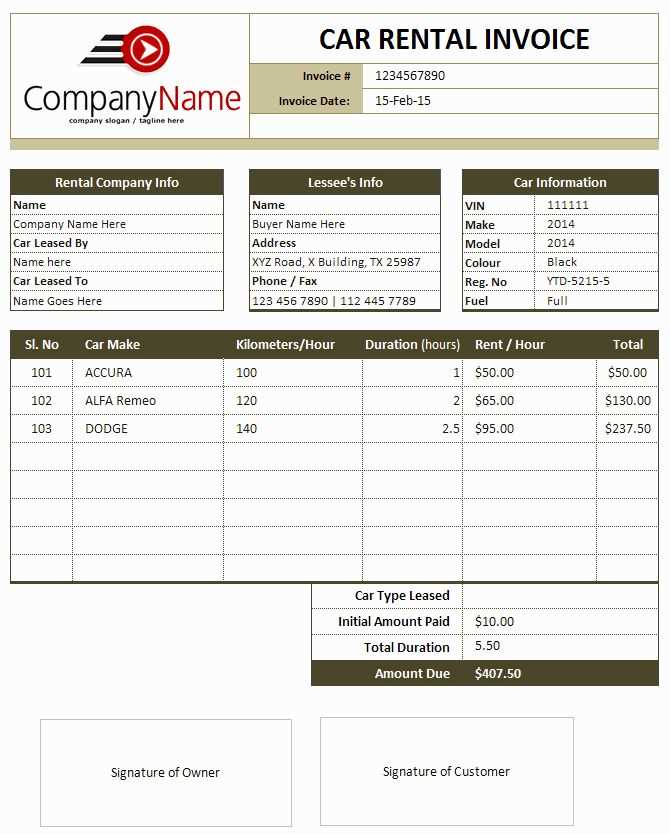

A well-organized template should present these details in a clear, concise manner. Below is an example of a simple table layout:

| Details | Information |

|---|---|

| Rental Company | XYZ Car Rentals |

| Customer Name | John Doe |

| Rental Period | February 1 – February 7, 2025 |

| Vehicle | Ford Focus, AB123CD |

| Total Amount | $250 |

| Additional Charges | Insurance: $20, GPS: $15 |

| Payment Method | Credit Card (Visa) |

| Signature | _________________ |

Using this format allows both parties to easily track the terms of the rental agreement and reduces confusion during the transaction process.

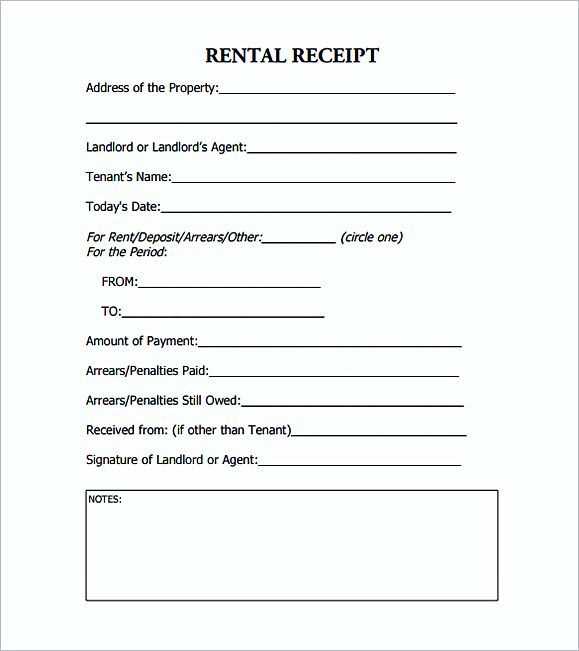

A well-structured rental receipt should include all the key details to ensure clarity and accuracy. Start by placing the business name and contact information at the top. This establishes the identity of the company providing the service.

Include Transaction Details

Follow with the receipt date, the rental period (start and end dates), and the total amount paid. This should be easy to locate and verify by the customer.

Break Down Charges

List individual charges such as the base rental fee, insurance, taxes, and any additional services like GPS or child seats. Specify the rate for each charge, along with any discounts applied, to give a transparent view of the pricing.

Conclude with payment method details, including whether the payment was made by credit card, cash, or other means. This section helps confirm how the transaction was completed.

Make sure to include the following details in the car hire receipt:

- Rental Company Details: Include the name, address, and contact information of the rental company.

- Customer Information: Add the name, address, and driver’s license number of the person renting the car.

- Vehicle Information: List the car’s make, model, license plate number, and vehicle identification number (VIN).

- Rental Period: Specify the start and end dates of the rental, including pick-up and drop-off times.

- Total Rental Cost: Clearly state the total cost, including any taxes, fees, and additional charges for insurance or equipment.

- Payment Information: Mention the method of payment and the total amount charged.

- Deposit Information: If a deposit was taken, note the amount and its return conditions.

Additional Considerations

- Fuel Policy: Indicate whether the car was returned with a full tank or if there were fuel charges.

- Damage or Violation Fees: Mention any charges for damages, traffic violations, or tolls during the rental period.

- Terms and Conditions: Ensure the receipt includes a reference to the rental agreement and any specific terms agreed upon.

Rental receipts must meet specific legal requirements depending on the location of the rental. Generally, a receipt should clearly state the rental company’s name, address, and contact details. The date of the rental transaction must be recorded, along with the rental period and vehicle details (such as make, model, and registration number).

In some regions, tax information must also be included, such as the tax rate and the total tax charged on the rental. This is crucial for both businesses and customers to comply with local tax laws. If the payment was made via card or online transaction, the receipt must show the payment method used.

Failure to include required details can lead to legal complications for both the renter and the rental agency. Always ensure that the receipt is clear and provides all necessary information to avoid issues with tax authorities or customer disputes.

| Detail | Required Information |

|---|---|

| Company Information | Company name, address, and contact details |

| Transaction Date | Date of rental transaction |

| Rental Period | Start and end date of the rental period |

| Vehicle Details | Make, model, registration number |

| Tax Information | Tax rate and amount charged (if applicable) |

| Payment Method | Payment method used (e.g., credit card, cash) |

Adjust the rental period details to match the exact duration for which the car is rented. Specify the start and end dates clearly, including times, to avoid confusion. For a daily rental, the receipt should list a flat daily rate. For longer rentals, such as weekly or monthly, ensure to reflect any applicable discounts or special rates that apply to extended periods.

For rentals extending over multiple days, consider adding a section that calculates the total cost based on the number of days, along with any additional charges like insurance, fuel, or extra mileage. Customize your receipt format to include the date range, ensuring that customers can easily identify their rental’s specific period.

If the rental period involves multiple segments (e.g., a combination of daily and weekly rates), clearly break down the cost for each segment on the receipt. This will enhance transparency and help customers understand how the final total was calculated.

Finally, for long-term rentals, you may wish to add a note about payment terms for extended bookings, such as due dates or recurring billing if applicable. This customization ensures your receipt remains accurate for each rental scenario.

A car hire receipt is a key document for tracking business expenses. For accounting, it’s vital to store and organize these receipts accurately. Keep the receipt as proof of the rental transaction, which helps categorize the cost as a business expense for tax deductions or reimbursement purposes.

Recording the Details

Ensure the receipt includes the rental date, total cost, and itemized charges. These details are important for accounting records. Organize receipts by date, vehicle type, and rental location to simplify tracking in your accounting system. This will also make it easier for future audits or reconciliations.

Tax and Expense Reporting

For tax purposes, you can claim the car hire as a business expense if it’s related to work activities. Maintain a clear record of the transaction to facilitate expense reporting at the end of the fiscal year. If the vehicle was used for both personal and business reasons, you may need to apportion the costs accordingly.

Be specific about the rental details. List the car model, pickup and drop-off dates, and location. This provides the customer with a clear understanding of what they’re paying for.

Break Down Charges Clearly

- Separate rental costs, insurance, taxes, and any additional services.

- Indicate daily or weekly rates and whether they include fuel or mileage limits.

- If there are any penalties, such as for late returns, show them distinctly with amounts and terms.

Provide Clear Payment Information

- Include the total payment, indicating the method (credit card, cash, etc.).

- Display any deposits, discounts, or special offers applied to the charge.

Double-check that each charge is easy to identify. Avoid hidden fees and ensure transparency to build trust and prevent disputes. Customers should leave with a receipt that clearly outlines all details, helping them track their spending without confusion.

This version reduces redundancy while preserving clarity.

Remove unnecessary information that does not directly contribute to the understanding of the receipt. Simplify the layout while keeping it functional. Limit the use of jargon or overly detailed descriptions that could confuse users.

- Ensure all key data is easy to locate: include rental dates, vehicle type, and total cost in a concise format.

- Focus on clarity: Present taxes, insurance, and additional fees in separate line items for transparency.

- Avoid repeating the same information across different sections–once is enough.

- Make sure the font is legible, and the structure follows a logical flow, from vehicle details to payment summary.

By cutting down on redundant elements and structuring the information clearly, you ensure a more user-friendly experience without losing any important details.