Key Information for Carpet Cleaning Receipts

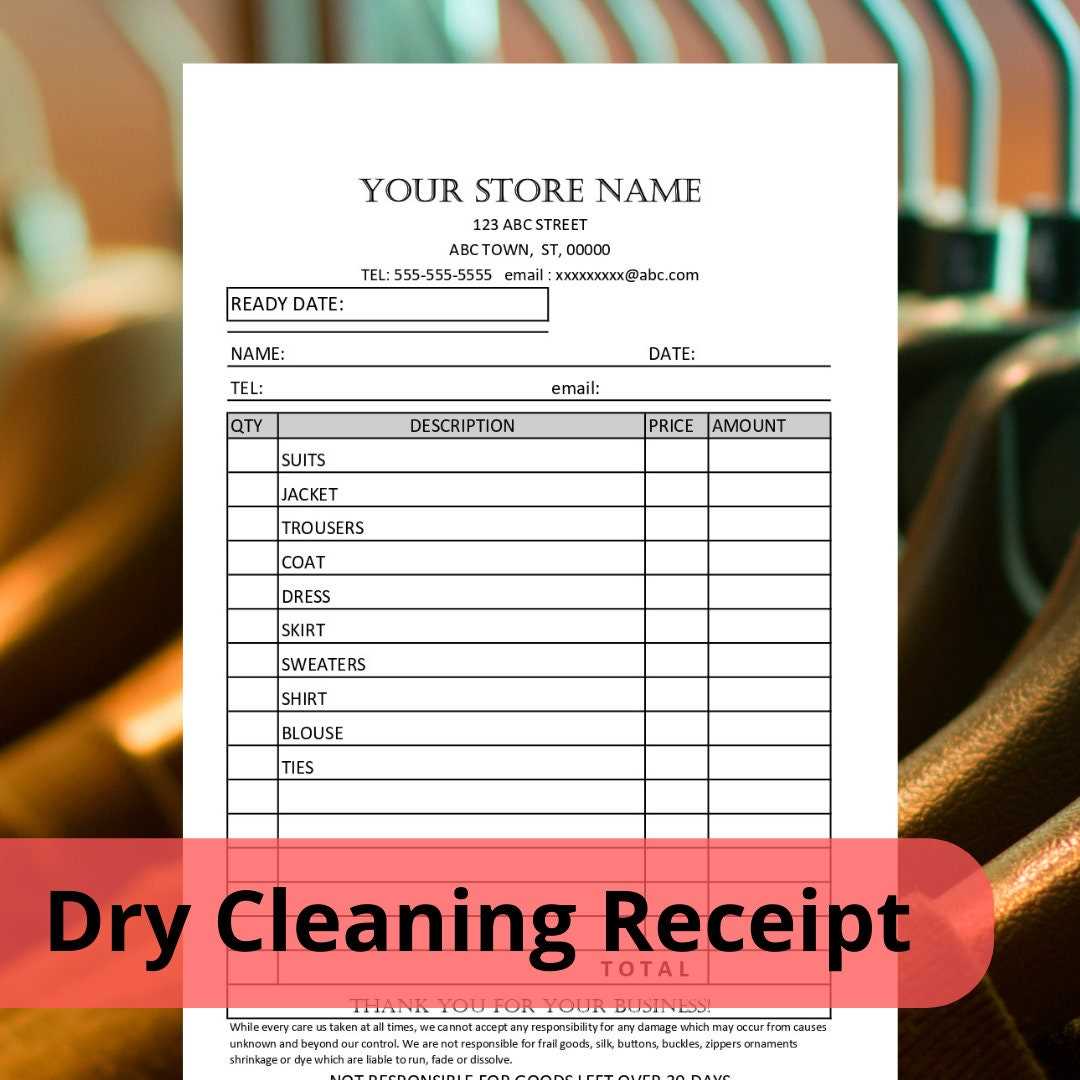

A clear and straightforward carpet cleaning receipt includes the following details:

- Customer Information: Name, address, and contact details.

- Service Provider Information: Business name, contact info, and registration number.

- Invoice Number: Unique for tracking and referencing.

- Service Date: The date when the cleaning service was provided.

- List of Services: Description of services provided (e.g., deep cleaning, stain removal).

- Cost Breakdown: Itemized charges for each service rendered.

- Total Amount: Final price, including taxes or discounts.

- Payment Information: Payment method used (e.g., credit card, cash).

How to Use This Template

Start by filling in the required customer and service provider details. Include a clear list of services performed, such as upholstery cleaning, deodorizing, or stain treatment. Itemize each service with its cost, and make sure to specify the total amount. Always ensure the receipt is easy to read, and make it available immediately after service completion.

Example Layout:

- Customer Info: Jane Doe, 123 Elm St, (555) 123-4567

- Provider Info: XYZ Carpet Cleaners, 456 Oak Rd, (555) 987-6543

- Invoice Number: 2025-001

- Service Date: February 10, 2025

- Services Provided:

- Deep Cleaning – $100

- Stain Removal – $50

- Deodorizing – $25

- Total Amount: $175

- Payment Method: Credit Card

Tips for Creating Receipts

- Be clear and concise in listing services to avoid confusion.

- Use professional language and ensure all charges are accurate.

- Provide contact details in case of disputes or further inquiries.

Carpet Cleaning Receipt Template

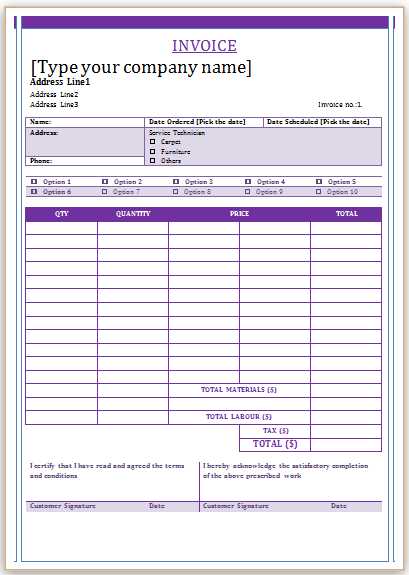

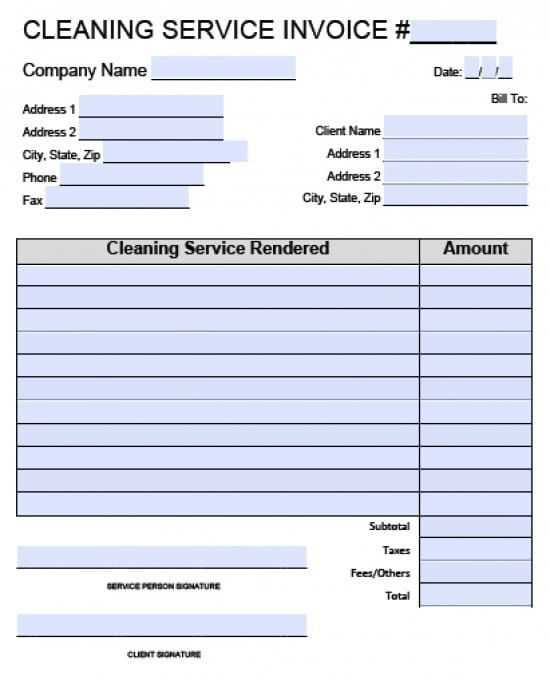

Key Details to Include in a Service Invoice

Designing a Professional Layout for Your Document

Mandatory Legal and Tax Information for Records

Choosing the Right Format: Digital vs. Paper Copies

Customizing Documents for Different Cleaning Services

Common Mistakes to Avoid When Drafting a Receipt

Include the client’s name, address, and contact details at the top of the receipt for easy reference. Ensure that the date of service, a unique invoice number, and the service description are clearly stated. List the specific cleaning services provided, including the square footage or number of rooms cleaned, and the rate applied. Be transparent about any additional charges or discounts. Provide a total amount due with the tax breakdown, if applicable.

Design the layout to be neat and clear. Use professional fonts and a well-organized structure, with bold headers for each section like “Service Details” and “Payment Summary”. Ensure that all critical details such as the company’s contact information and payment instructions are easy to locate. The use of a logo can add a personal touch without overwhelming the design.

Include mandatory information such as tax registration number and any other legal requirements based on your location. This ensures the receipt is compliant with tax laws and can be used for business record-keeping. If offering services to multiple locations, make sure to list any state-specific tax or legal obligations relevant to the transaction.

Consider the format that best suits your operations. Digital receipts can be sent via email, offering a quick and eco-friendly option. Paper receipts, while traditional, are useful for in-person transactions and may be preferred by clients. Make sure your system allows for easy conversion between the two formats, depending on customer preference.

Customize the receipt template for different types of cleaning services, such as carpet, upholstery, or rug cleaning. Tailor the service descriptions and rates to match the specific job done, ensuring the document accurately reflects the work provided. Including an option to add extra services or products, like stain protection, adds flexibility for future transactions.

Avoid common mistakes such as unclear service descriptions or incorrect totals. Always double-check the tax calculations and make sure all required information is included. Missing or vague details can lead to confusion or disputes with clients, potentially harming your business reputation.