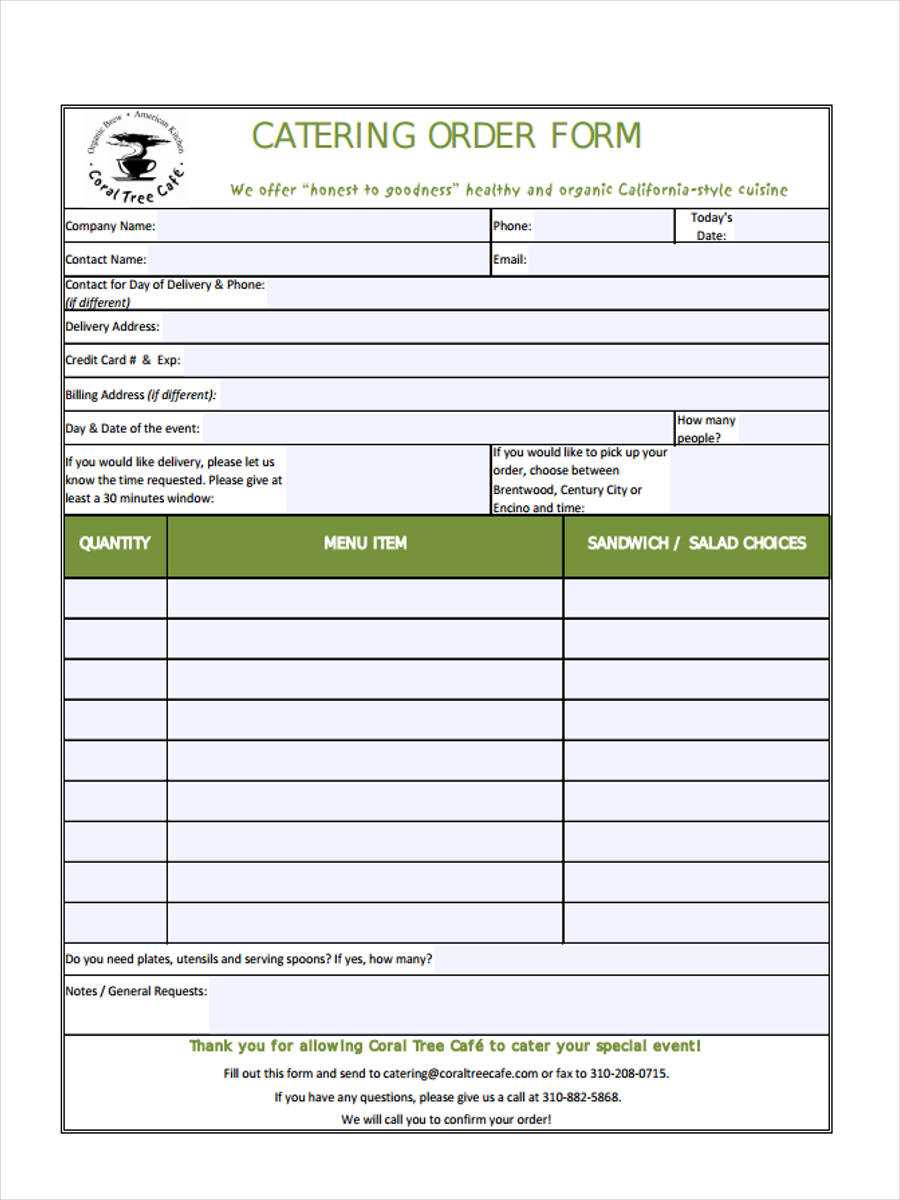

Key Elements of a Catering Receipt

A well-structured catering receipt ensures transparency and smooth financial transactions. Include the following details:

- Business Information: Name, address, contact details, and tax ID if applicable.

- Customer Details: Name, address, and contact information of the client.

- Invoice Number: A unique identifier for tracking and record-keeping.

- Date: The issue date and, if relevant, the event date.

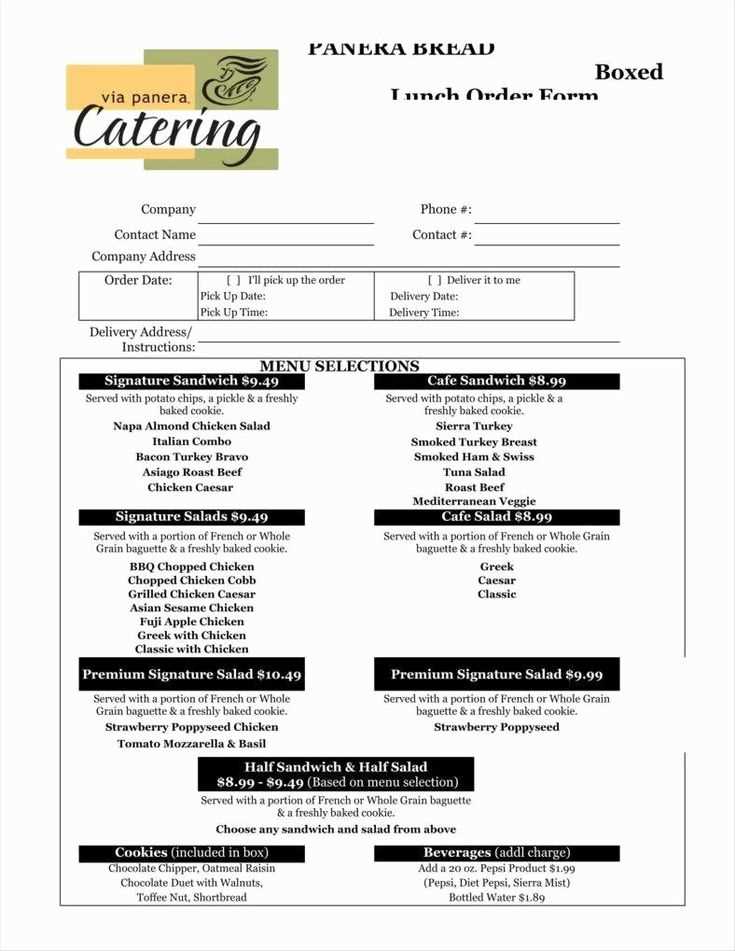

- Itemized List: Breakdown of services, including food, beverages, equipment rental, and staffing.

- Quantities and Rates: Number of items or hours worked, with corresponding unit prices.

- Subtotal, Taxes, and Discounts: Clear calculation of all charges.

- Total Amount: Final sum due, with the preferred payment method.

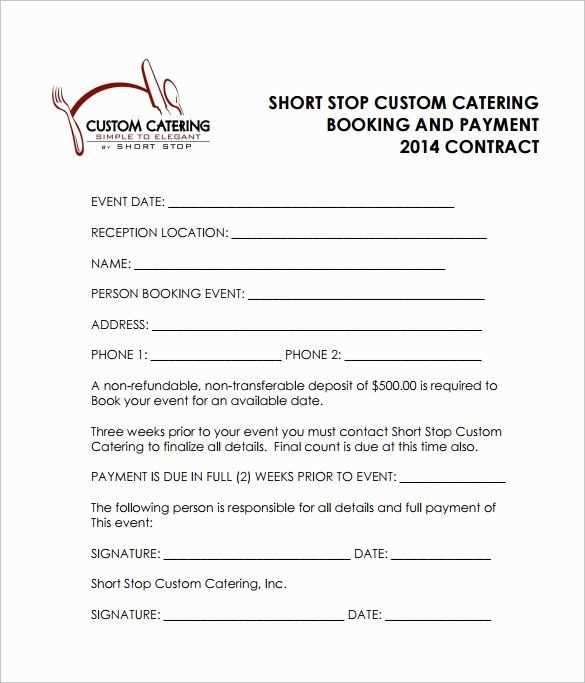

- Payment Terms: Due date, deposit requirements, or late fee policies.

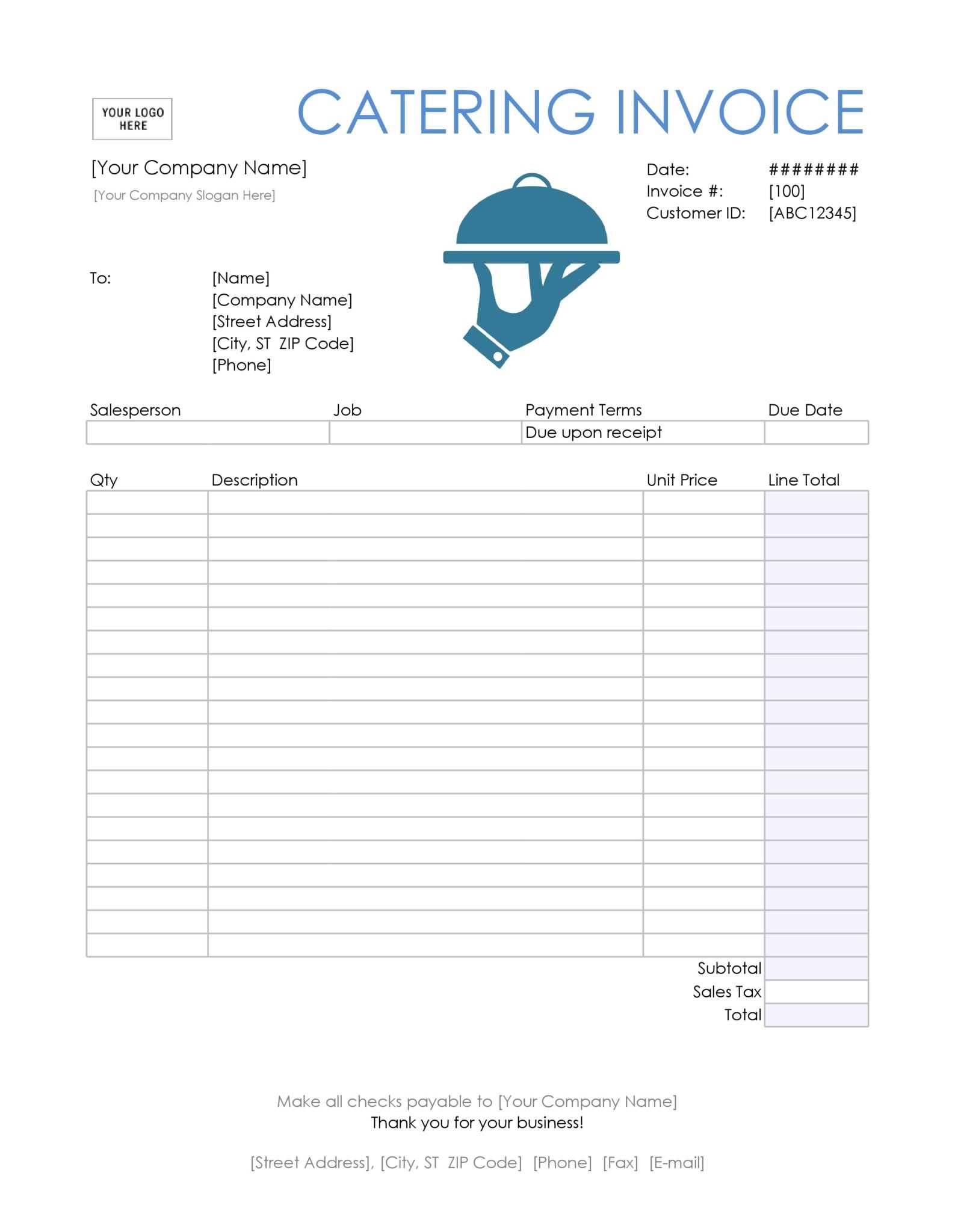

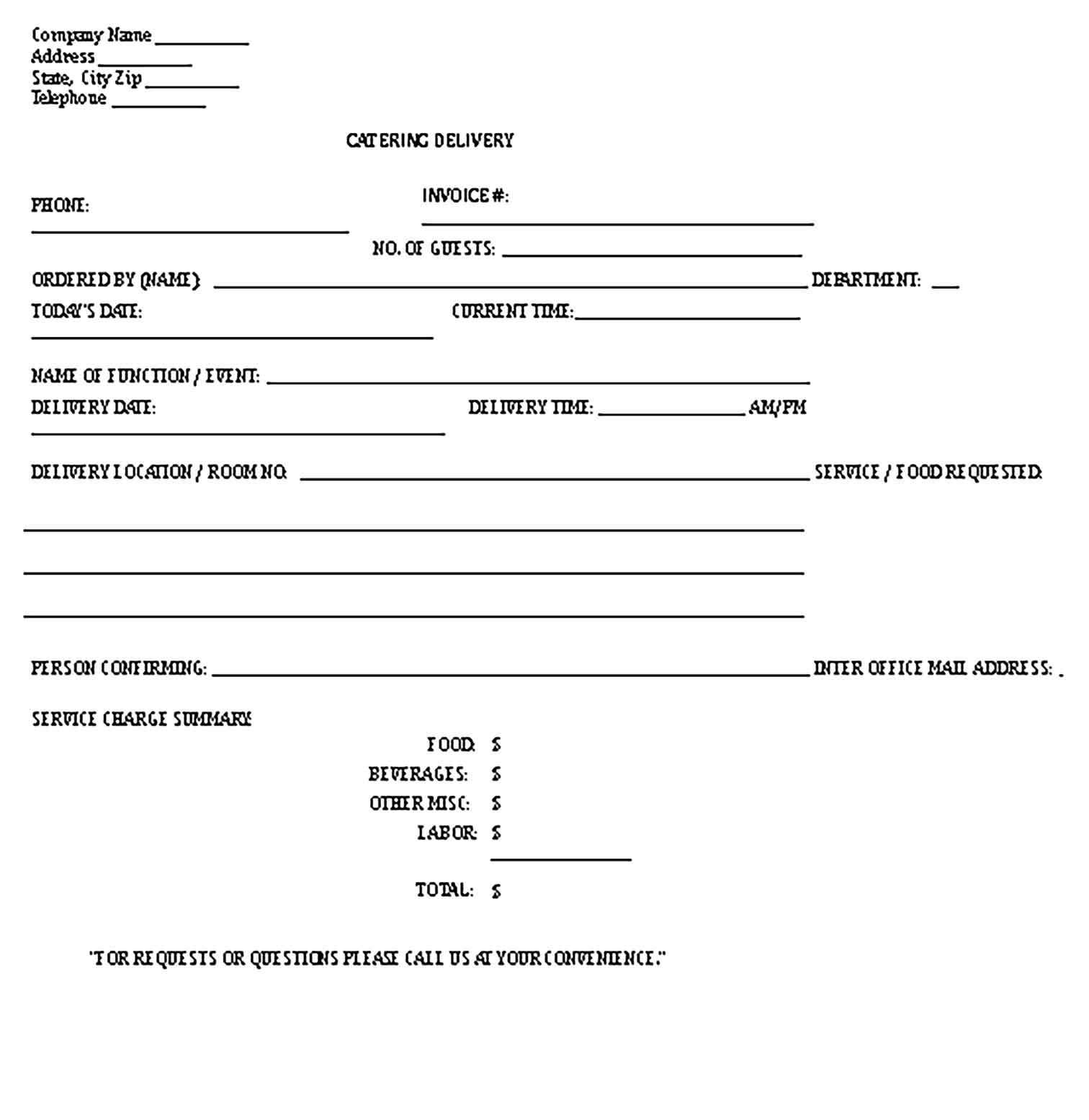

Template Example

Use this structure to create a professional catering receipt:

[Business Name] [Business Address] [Phone Number] | [Email] | [Website] [Tax ID] RECEIPT Receipt No: [####] Date: [MM/DD/YYYY] Customer: [Client Name] Event Date: [MM/DD/YYYY] Description Qty Unit Price Total ------------------------------------------------- [Item/Service] [X] [$XX.XX] [$XX.XX] [Item/Service] [X] [$XX.XX] [$XX.XX] Subtotal: [$XX.XX] Tax (X%): [$XX.XX] Discount: [-$XX.XX] Total: [$XX.XX] Payment Method: [Cash/Credit/Check] Paid: [$XX.XX] | Balance Due: [$XX.XX] Thank you for your business!

Customization Tips

Adapt the template based on your specific needs:

- Include a logo for branding.

- Adjust tax rates based on location.

- Add payment instructions for online transfers.

- Include a section for customer signatures if required.

Best Practices

Ensure accuracy and professionalism by:

- Double-checking calculations before issuing the receipt.

- Providing digital and printed copies for convenience.

- Keeping records for tax and accounting purposes.

Catering Receipt Template

Essential Components of a Catering Receipt

Include the business name, address, and contact details at the top. Specify the event date, location, and type of service provided. List menu items, quantities, and individual prices clearly. Show subtotals, applicable taxes, and the final amount due. Add payment details, including method and date received. Conclude with terms, cancellation policies, and a signature line if required.

Structuring a Catering Receipt for Clarity

Organize sections in a logical order, using bold headers for easy reference. Use columns to separate descriptions, quantities, and prices. Ensure calculations are accurate and clearly displayed. If discounts or deposits apply, show them separately. Keep the layout simple and professional for quick review by both parties.

Legal and Tax Aspects of Catering Receipts

Include a unique receipt number for record-keeping. Ensure tax rates comply with local regulations and are itemized correctly. Retain copies for audit purposes. If the catering service involves gratuities or additional service fees, disclose them transparently. Confirm that all business information aligns with official registration details to avoid compliance issues.