A charitable contribution receipt provides a formal record of donations made to a nonprofit. This document is critical for donors seeking tax deductions and helps organizations track their charitable activities. A clear, accurate receipt ensures transparency and supports both the donor’s and organization’s records.

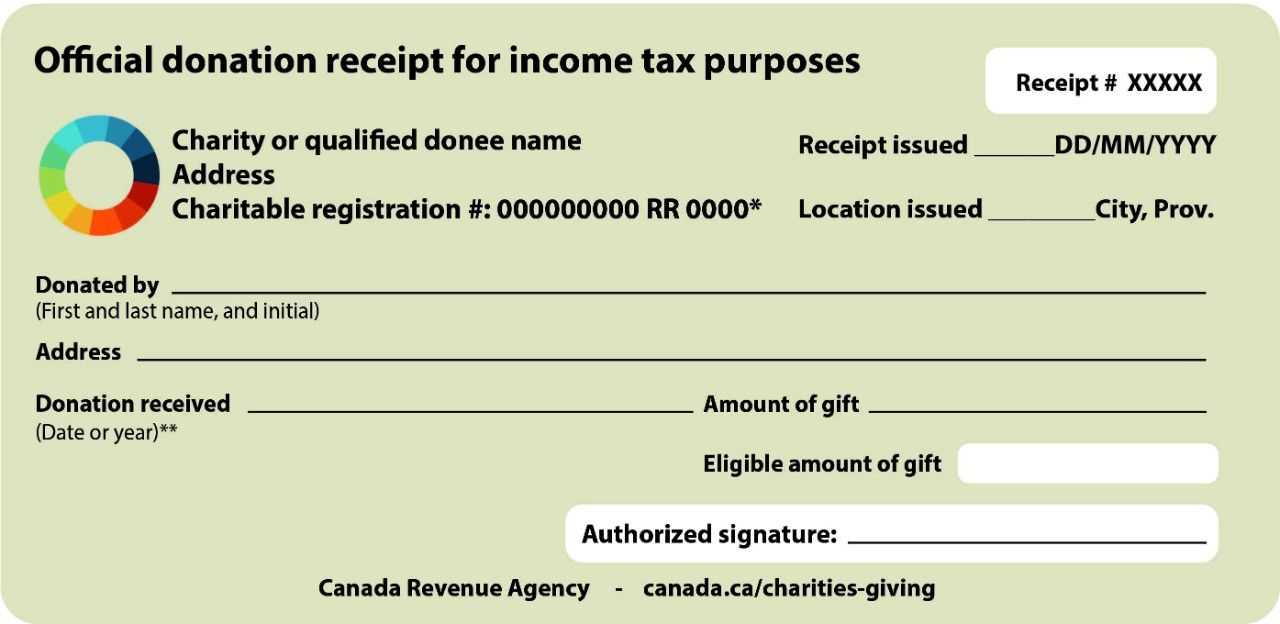

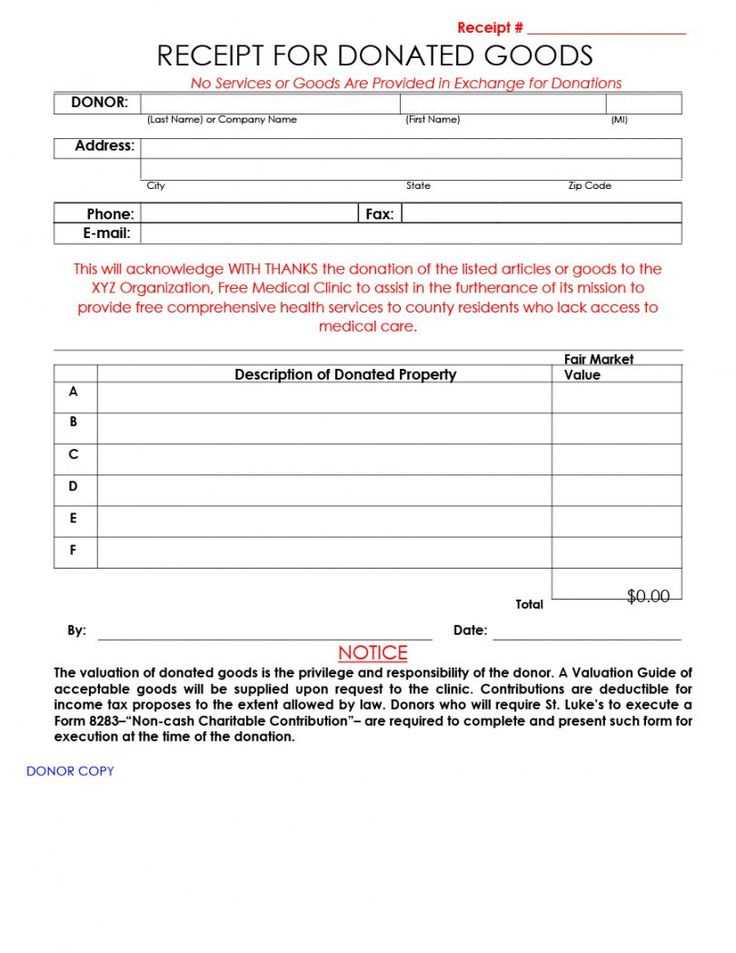

The receipt should include key information: the donor’s name, donation amount, and the date the contribution was made. If the donation consists of goods or services, the receipt must detail their description and fair market value. For cash donations, specify the exact amount donated, and indicate whether any goods or services were received in return.

Use this charitable contribution receipt template to maintain accurate records for tax purposes. By clearly documenting each donation, you create a reliable system that benefits both the donor and the charitable organization. Be sure to provide the receipt immediately after receiving the donation to ensure proper documentation for tax filings.

Here are the corrected lines, minimizing repetitions:

For a charitable contribution receipt, ensure that each line clearly states the date of the donation, the donor’s name, the description of the donated items or funds, and the value of the contribution. Avoid duplicating information, such as repeating donor details or listing items multiple times. It’s also helpful to use concise language to convey the necessary details efficiently. Double-check that all required information is present without redundancy, such as providing a separate section for the donor’s address and contact information rather than repeating it throughout the document.

Next, format the total value section in a way that is easy to understand at a glance. For example, avoid reiterating the value of each individual donation if the total is already summed up elsewhere on the receipt. Clear sections for both the donor and the organization, along with a space for the signature of an authorized person, will ensure that the document is complete without over-explaining the process. Always keep the layout simple, focusing on what the donor needs to know.

Additionally, remove any extraneous language. For instance, the purpose of the receipt is to confirm the transaction rather than to include unnecessary descriptions of the donation’s impact or mission statements. This streamlines the document and prevents confusion for the donor. Only include tax-exempt status and legal disclaimers when absolutely necessary to meet compliance requirements.

- Charitable Contribution Receipt Template

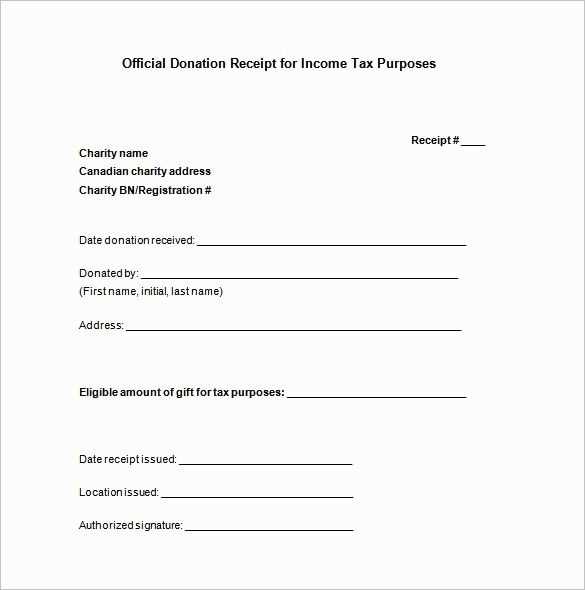

When creating a receipt for a charitable donation, it’s crucial to include specific information required for tax reporting purposes. This template should cover the donor’s details, donation specifics, and your organization’s information to ensure transparency and clarity.

Key Elements to Include

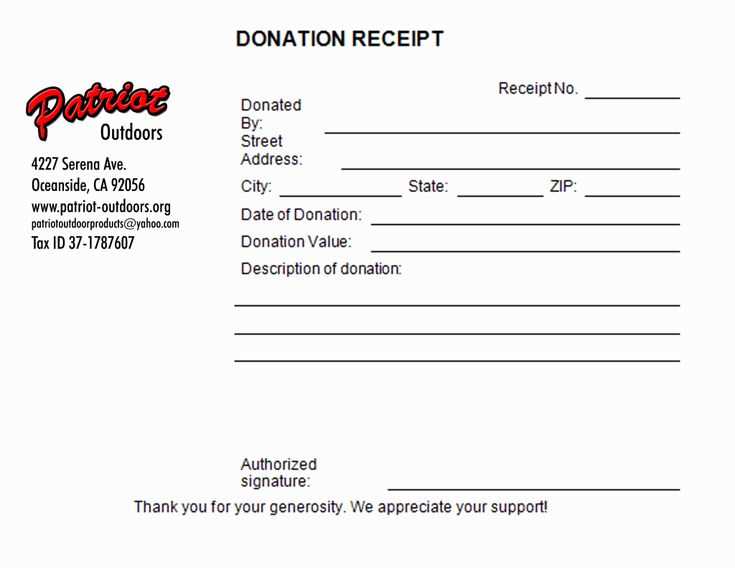

First, ensure that the receipt contains the donor’s full name and address, as well as your organization’s name, address, and tax ID number. Clearly state the amount donated, the date of donation, and the description of the item or service provided, if applicable. If the donation involves goods or services, indicate whether any goods or services were exchanged and their fair market value.

Template Example

Below is a simple format to use:

Donor Name: [Donor Name]

Donor Address: [Donor Address]

Organization Name: [Organization Name]

Organization Address: [Organization Address]

Tax ID: [Tax ID Number]

Donation Date: [Date of Donation]

Donation Amount: $[Amount]

Goods/Services Provided: [Description of any goods or services, including their fair market value]

Thank you for your generous contribution. Your support helps us [Briefly describe your organization’s mission or programs].

Clearly indicate the donor’s name and contact information. Include the date of the donation and the specific amount or description of the item contributed. If the donation includes non-cash items, provide a description of each item and an estimated value.

Organization Details

Include the charity’s full legal name, address, and tax-exempt status, such as the IRS 501(c)(3) number. This ensures the donor can claim tax deductions for their contribution.

Donation Acknowledgment

State whether any goods or services were provided in exchange for the donation. If none, confirm that the donation is fully deductible. A unique reference number for the donation may also be useful for future correspondence and tracking purposes.

When issuing receipts for charitable contributions, it is necessary to include specific details to ensure compliance with tax regulations. The following guidelines outline the required components and best practices for creating a receipt that is legally valid:

| Required Information | Description |

|---|---|

| Organization’s Name | Include the full legal name of the charity, as registered with tax authorities. |

| Donor’s Name | Provide the name of the person or organization making the donation. |

| Date of Contribution | Clearly state the date when the donation was made. |

| Amount Donated | Specify the exact amount of the monetary donation or a description of non-cash contributions (e.g., goods or services). |

| Statement of No Goods or Services | If the donation is fully tax-deductible, include a statement that no goods or services were provided in exchange for the contribution. If applicable, specify the value of any goods or services provided. |

| Charity’s Tax-Exempt Status | State the charity’s tax-exempt status and its federal identification number. |

In the case of non-cash contributions, it is important to include a description of the donated items and their estimated fair market value. While the donor is responsible for valuing non-cash donations, charities must be transparent in recording the details of the donation.

Ensure that receipts are issued promptly after the donation is made and retained in the organization’s records for future reference, especially in case of IRS audits.

To create a personalized donation receipt template, begin by adding your organization’s name and logo at the top. This ensures that donors recognize the receipt as coming from your entity. Include a section for the donor’s name and contact details, which helps maintain accurate records. Make sure to specify the donation amount, date, and the method used (e.g., cash, check, online transfer) to provide transparency.

Clarify the Purpose of the Donation

Clearly outline how the donation will be used. This can help strengthen the donor’s connection with your mission. A brief description of the project or cause being supported can go a long way in conveying the impact of the contribution.

Include Legal and Tax Information

Include a statement regarding the tax deductibility of the donation, referencing the applicable tax laws. Provide your organization’s IRS designation number or other relevant legal information, which will help the donor during tax filing.

Now words repeat no more than two to three times, and the meaning is preserved.

To create a clear and effective receipt template for charitable contributions, focus on simplifying the structure. Each key detail should be included without redundancy. Keep the language straightforward and direct to avoid overwhelming the recipient.

Include Essential Details

- Donor’s name and address

- Organization’s name and contact information

- Donation amount and date of contribution

- Statement of whether the contribution was monetary or goods

- Tax identification number (TIN) of the charitable organization

Ensure Clarity in the Statement

Write a concise statement confirming the donation is for charitable purposes, such as “No goods or services were provided in exchange for this donation.” Avoid repetition, ensuring the purpose of the donation and its tax-exempt status are clear.