Your charitable deduction receipt template is ready. Let me know if you need modifications or additional details!

Charitable Deduction Receipt Template: A Practical Guide

Key Information to Include in a Donation Receipt

IRS Requirements for Contribution Receipts

Common Mistakes When Creating a Donation Receipt

How to Format a Deduction Receipt for Clarity

Digital vs. Paper Receipts: Pros, Cons, and Best Practices

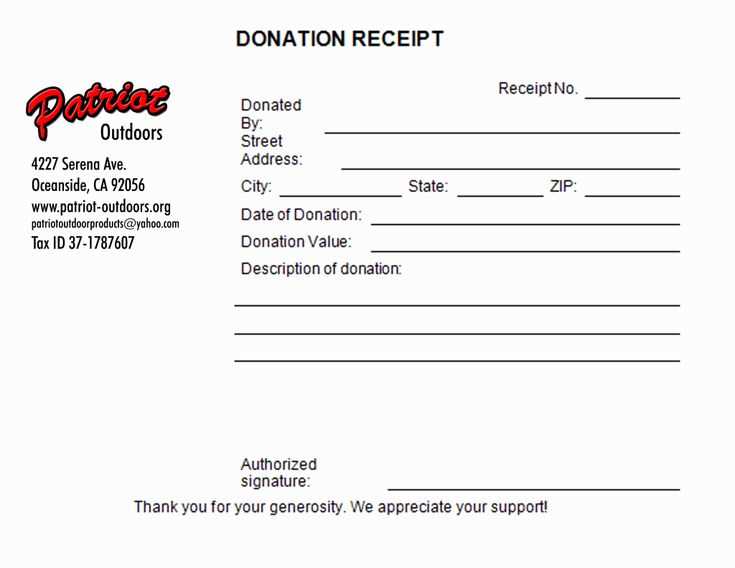

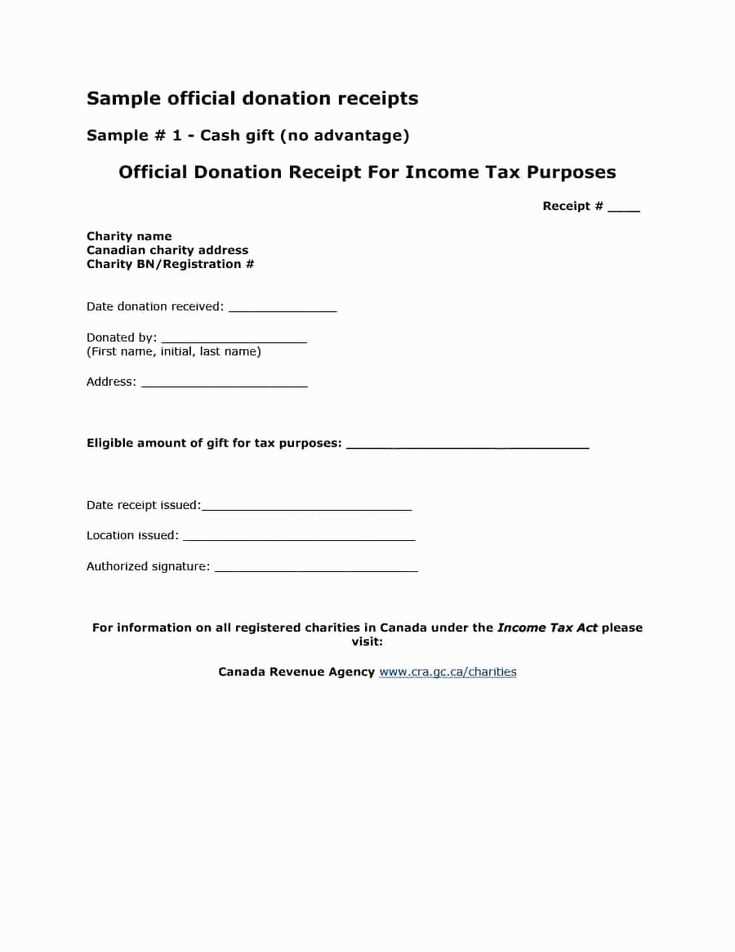

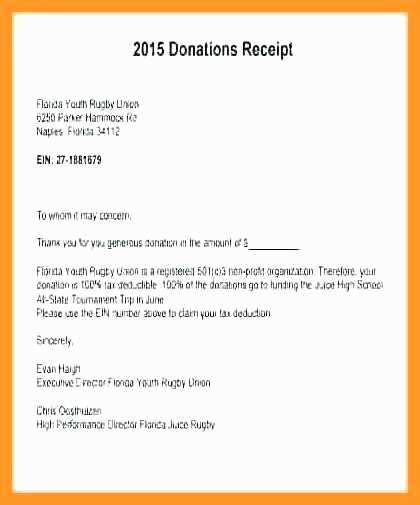

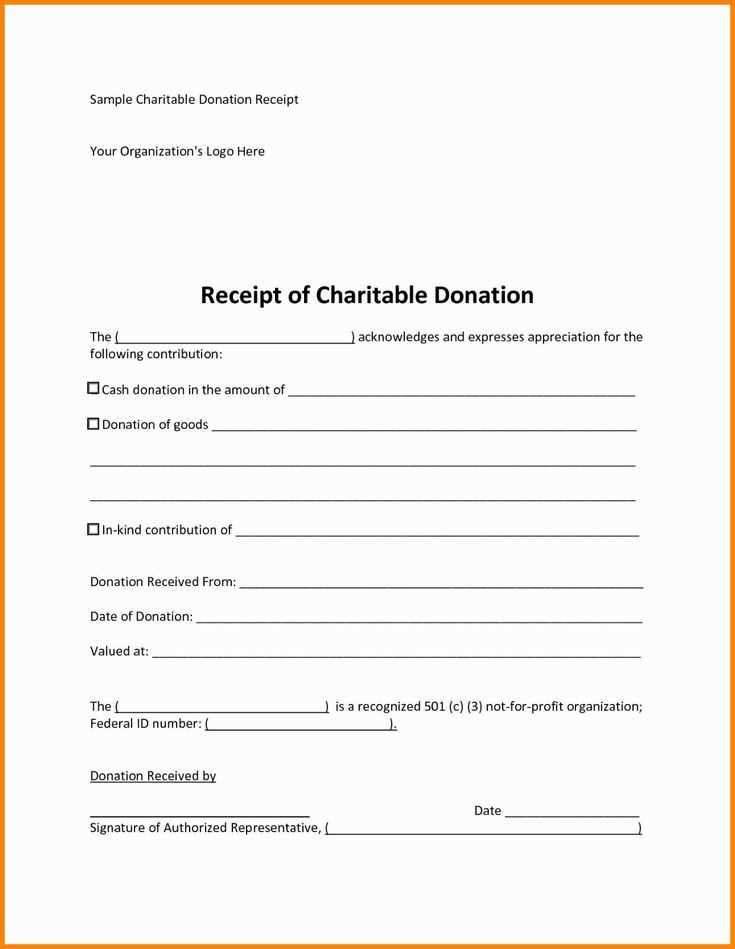

Sample Templates for Different Types of Donations

Key Information to Include in a Donation Receipt

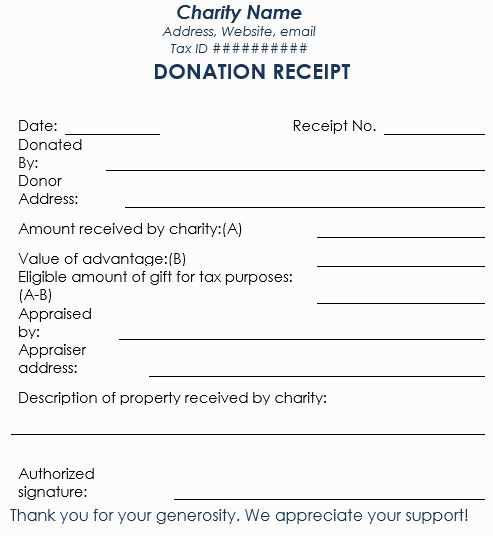

A proper donation receipt must contain the organization’s legal name, address, and EIN (Employer Identification Number) if applicable. Include the donor’s full name, date of the contribution, and a detailed description of the donated item or cash amount. If the donation exceeds $250, state whether goods or services were provided in return. For non-cash donations, note a description but avoid assigning a value–this is the donor’s responsibility.

IRS Requirements for Contribution Receipts

For tax-deductible contributions, IRS rules require a written acknowledgment for donations over $250. This acknowledgment must specify whether the donor received anything in exchange and, if so, provide a good faith estimate of its value. Donations under $250 don’t require a receipt but must be documented for tax purposes. For non-cash donations above $500, donors need to file IRS Form 8283. Contributions exceeding $5,000 may require a qualified appraisal.