A well-structured charitable gift receipt ensures that donors can claim tax deductions while providing transparency for your organization. To create a proper receipt, include the donor’s name, the organization’s details, the donation amount or description, and a statement confirming that no goods or services were exchanged, unless applicable.

The receipt should clearly state the organization’s legal name, address, and tax-exempt status. If the donation is monetary, specify the exact amount. For non-cash contributions, describe the item without assigning a value–it’s the donor’s responsibility to determine the fair market value.

For recurring donations, issue receipts for each contribution or provide a consolidated annual summary. Digital receipts are widely accepted, but ensure they include all required details. Keeping clear, consistent records benefits both donors and your organization, reinforcing trust and compliance.

Here’s an option with repetition removed while maintaining the meaning:

To create a clear and concise charitable gift receipt, it is important to provide the necessary information without redundancy. Start by including the donor’s name, address, and contact details. Make sure to indicate the date of the donation, a brief description of the donated items or monetary amount, and a statement confirming whether the donor received any goods or services in return. The value of the donation should be estimated if applicable.

Key elements to include:

- Donor’s name and contact information

- Date of the donation

- Description of the donation (monetary or goods)

- Confirmation of whether goods or services were provided in exchange

- Estimated value of the donation if applicable

Sample format:

Donor Name: John Doe

Address: 123 Charity Lane, City, State, ZIP

Donation Date: January 1, 2025

Description: Cash donation of $100

Goods or Services Received: None

Estimated Value: $100

Ensure all necessary details are included to guarantee the donor receives proper acknowledgment for tax purposes.

- Charitable Gift Receipt Template

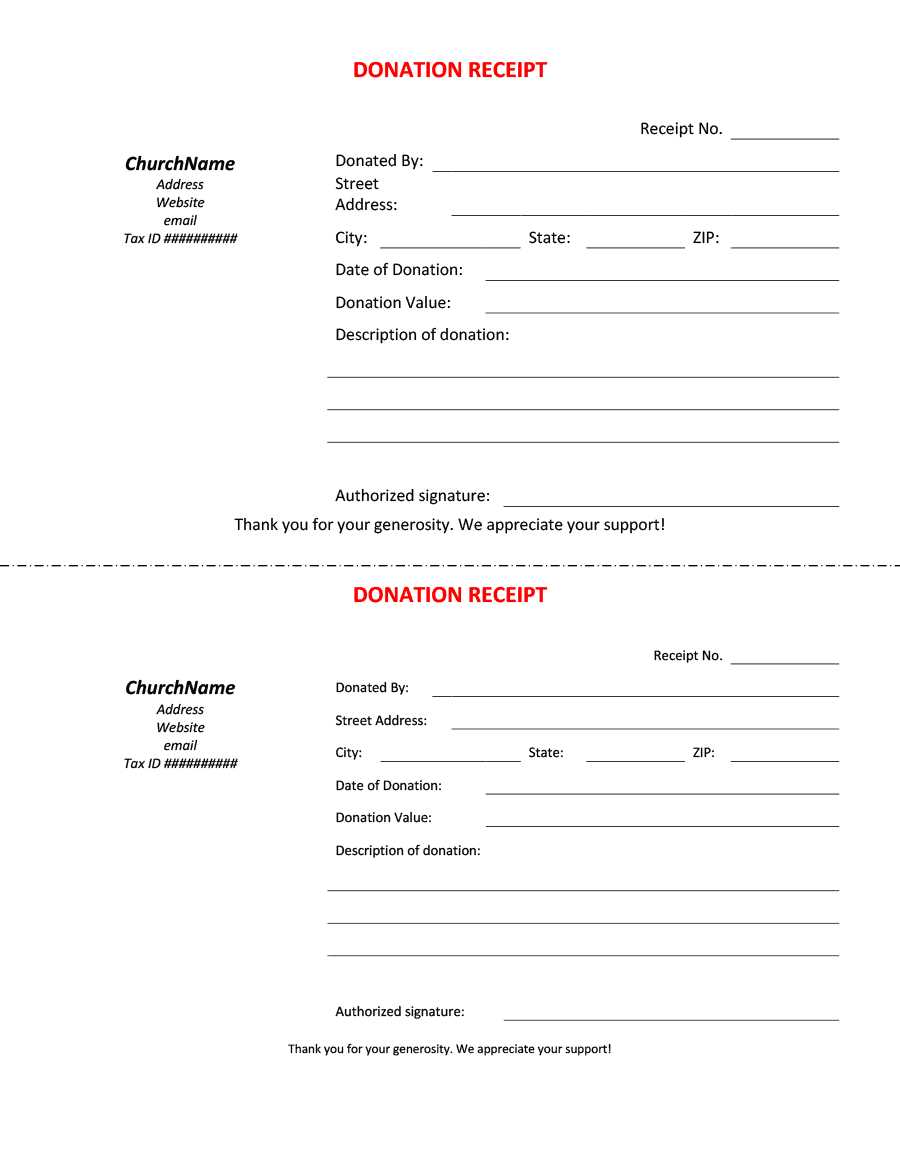

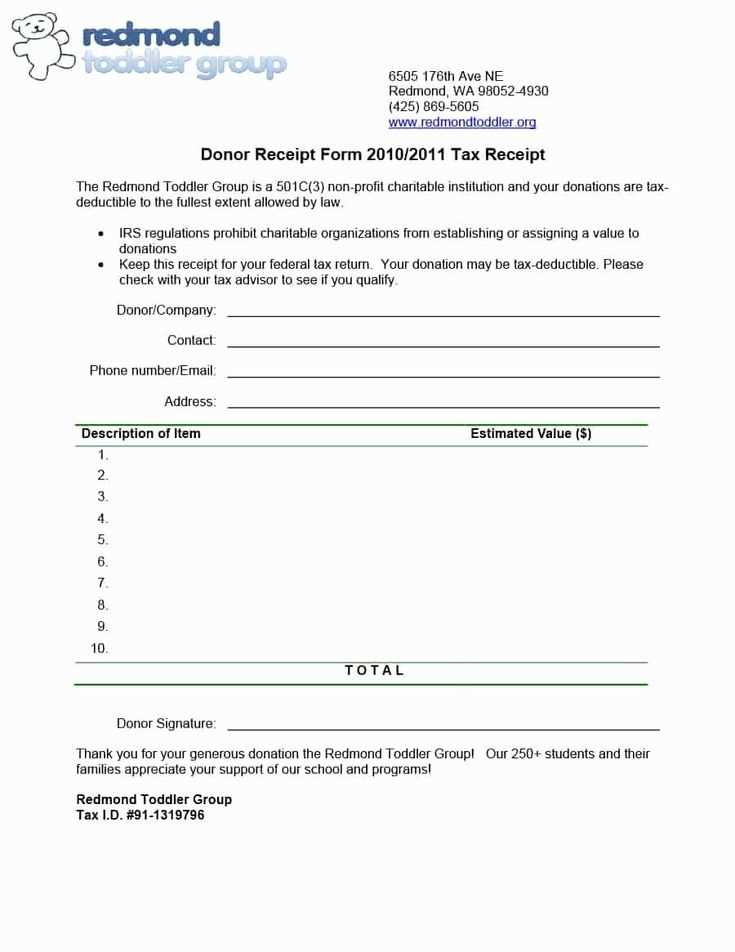

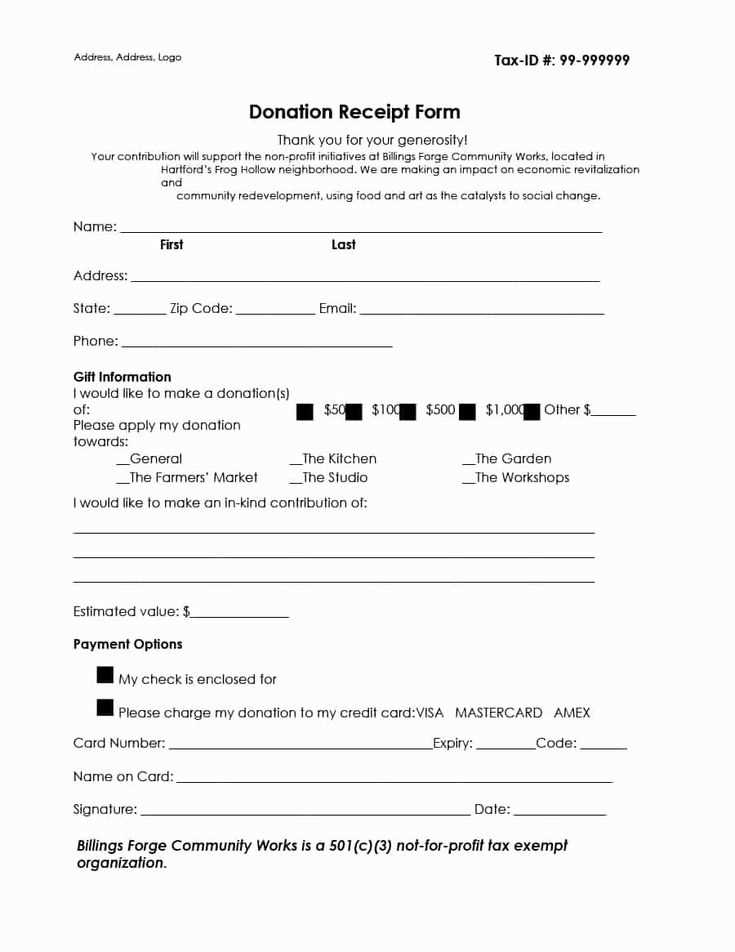

A charitable gift receipt should clearly state the donation details, including the donor’s name, the amount donated, and a statement confirming whether the donation is tax-deductible. A template for a charitable gift receipt helps ensure that all necessary information is recorded correctly for tax purposes. Include the name of the charity, the donation date, and any goods or services provided in exchange for the gift.

The receipt should also mention if the donor received anything in return for the contribution. If no goods or services were provided, the receipt should explicitly state this to avoid any confusion. Use straightforward language and avoid unnecessary complexity to make sure donors understand the information provided.

Ensure that the charity’s tax-exempt status is indicated on the receipt. This is crucial for donors who intend to claim tax deductions. Include the organization’s EIN (Employer Identification Number) for verification purposes. If the donation involves goods or services, describe them with their estimated value.

Lastly, ensure the receipt is signed by a representative of the charity and includes their contact information. This adds a personal touch while ensuring legal compliance. Keep the receipts organized and provide them to donors in a timely manner for tax filing and record-keeping purposes.

Donation receipt date: Always include the exact date of the donation. This ensures the timing of the gift is clear for both tax and record-keeping purposes.

Donor’s information: Include the donor’s full name and contact details. This helps the organization keep accurate records and ensures the donor receives proper acknowledgment for their contribution.

Organization details: Clearly state the name of the organization receiving the donation, along with its tax-exempt status and contact information. This confirms the legitimacy of the charity and provides the donor with the necessary information for tax deductions.

Donation amount: Specify the amount of the donation. For monetary donations, include the exact dollar amount. If the gift is in-kind, describe the item(s) and estimate their value.

Statement of goods or services: If any goods or services were provided in exchange for the donation, clearly list them and state their estimated value. This ensures the donor can subtract the value of any benefits received from the tax-deductible portion of the gift.

Tax-deductible statement: Acknowledge whether the donation is fully tax-deductible or if part of it is not. This transparency helps the donor accurately report their gift on their tax return.

Signature of authorized person: Include the signature of a representative from the organization, confirming the receipt. This adds authenticity and finality to the donation receipt.

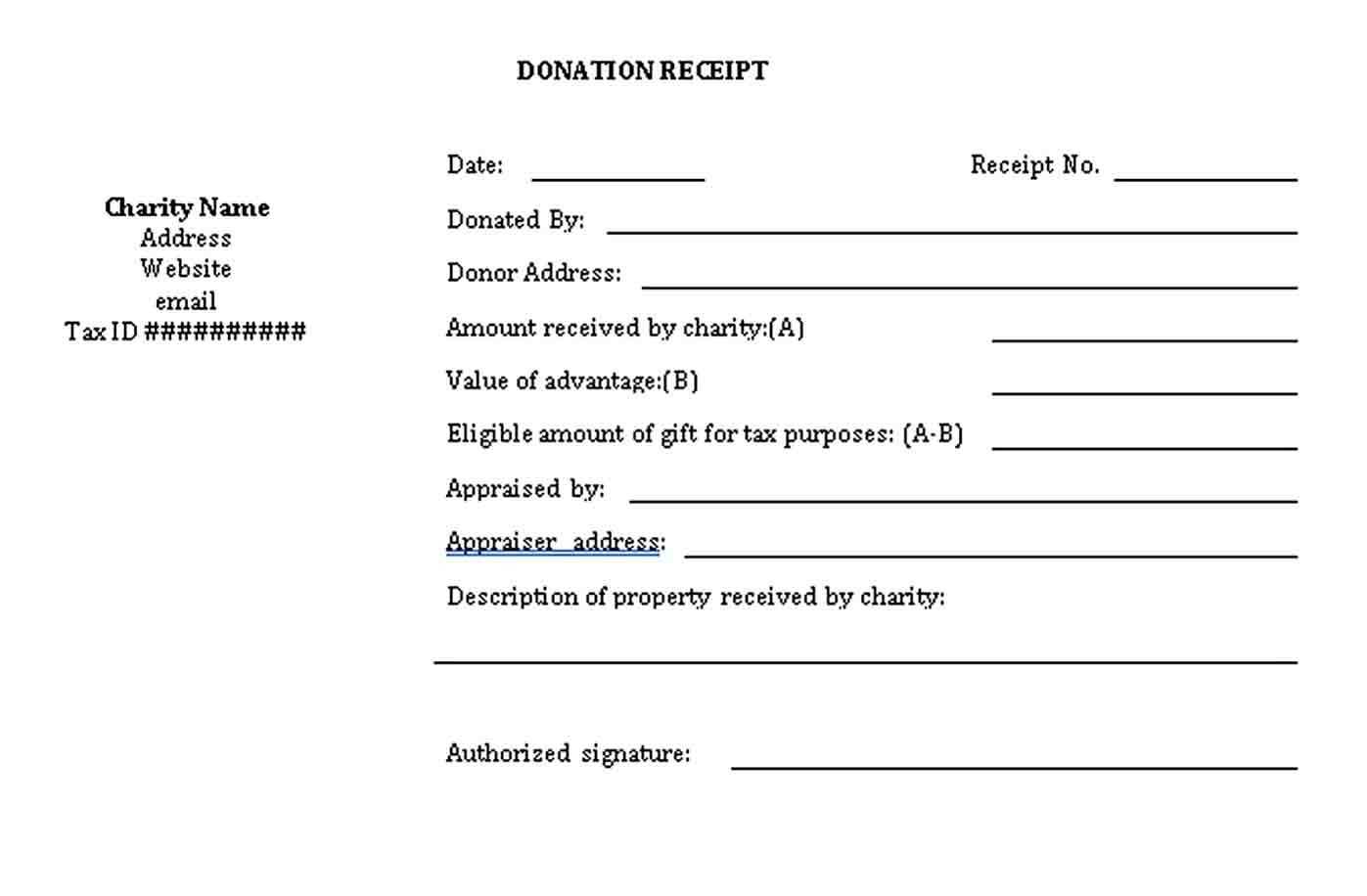

A valid gift acknowledgment must meet specific legal requirements to be recognized by tax authorities. These guidelines ensure transparency and compliance for both donors and recipients. Here are the key legal points to follow:

- Written Acknowledgment: The IRS mandates that charitable organizations provide a written acknowledgment for donations of $250 or more. This acknowledgment must be received before the donor files their tax return.

- Description of the Gift: The acknowledgment must include a detailed description of the donation, especially for non-cash contributions. This helps clarify the value and nature of the gift.

- Donation Amount: For monetary gifts, the acknowledgment should state the exact amount donated. For non-monetary gifts, it should note whether the donor received any goods or services in exchange for the donation.

- Goods and Services Disclosure: If the donor received goods or services in return for the gift, the acknowledgment must include a good-faith estimate of the value of those goods or services. This ensures the donor understands the net value of the gift for tax purposes.

- Tax-Exempt Status: The acknowledgment must state that the organization is a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code. This confirms the organization’s eligibility to receive tax-deductible donations.

- Organization Details: Include the full name of the charitable organization and its address. This helps establish the legitimacy of the organization for both parties involved.

By adhering to these legal requirements, charitable organizations can ensure that their donors can properly claim tax deductions while avoiding any potential issues during an audit.

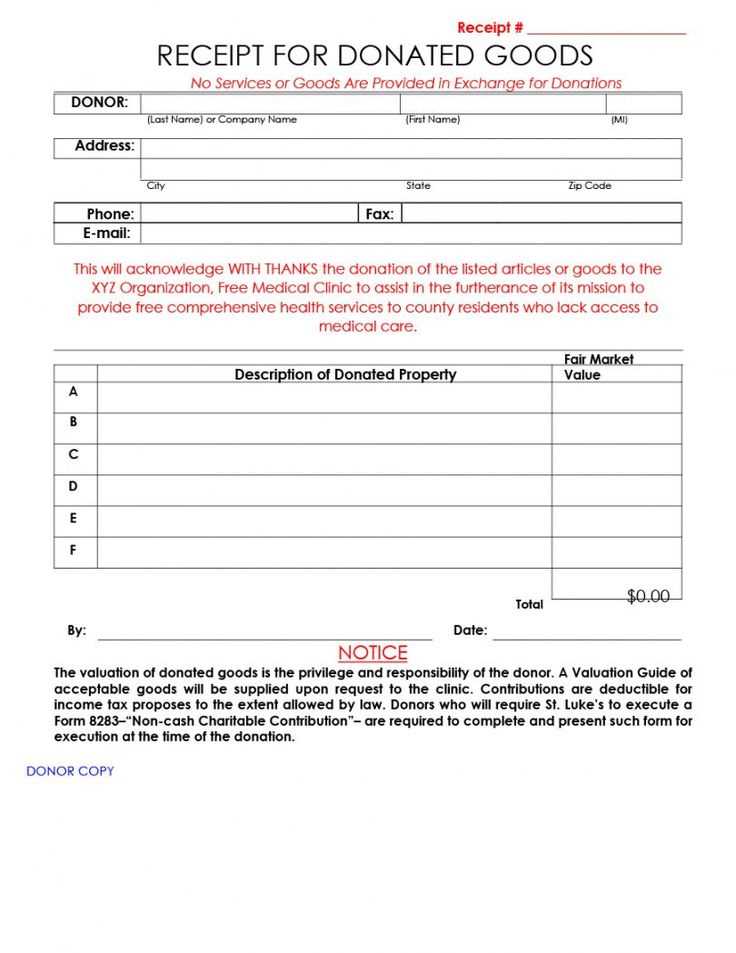

Adjust your charitable gift receipt template to reflect the type of donation accurately. Customization is key for maintaining clarity and transparency with donors. Below are guidelines for tailoring the template based on various contribution types.

Cash Donations

For cash donations, the template should clearly state the amount donated. Include a brief mention of the donor’s method of payment, such as check, money order, or online transaction. It’s important to note that a statement of the non-valuation of the donation is necessary, as the IRS does not allow you to estimate the value of cash gifts.

Non-Cash Contributions

Non-cash donations, such as goods or property, require a more detailed description. Include the itemized list of donated goods, their estimated value (if applicable), and a statement clarifying whether the donor was given an appraisal or relied on their own estimation. For high-value items like art or real estate, advise the donor to seek a qualified appraisal for tax purposes.

| Contribution Type | Required Customization |

|---|---|

| Cash Donations | Amount donated, method of payment, statement of non-valuation |

| Non-Cash Donations | Itemized list, estimated value, statement on appraisal |

| Recurring Donations | Frequency of donation, total amount given during the year |

| Securities or Stocks | Number of shares, market value on the donation date |

For recurring donations, specify the payment frequency (e.g., monthly, annually) and include the total amount donated throughout the year. This is crucial for tax reporting and transparency.

For donations in the form of securities or stocks, include the number of shares and the market value on the date the gift was made. It’s important to note that the IRS requires a valuation for these types of gifts, so including accurate details ensures proper tax documentation.

Each customization step should align with the donation’s nature, ensuring the donor receives the correct tax information and your nonprofit complies with regulatory requirements.

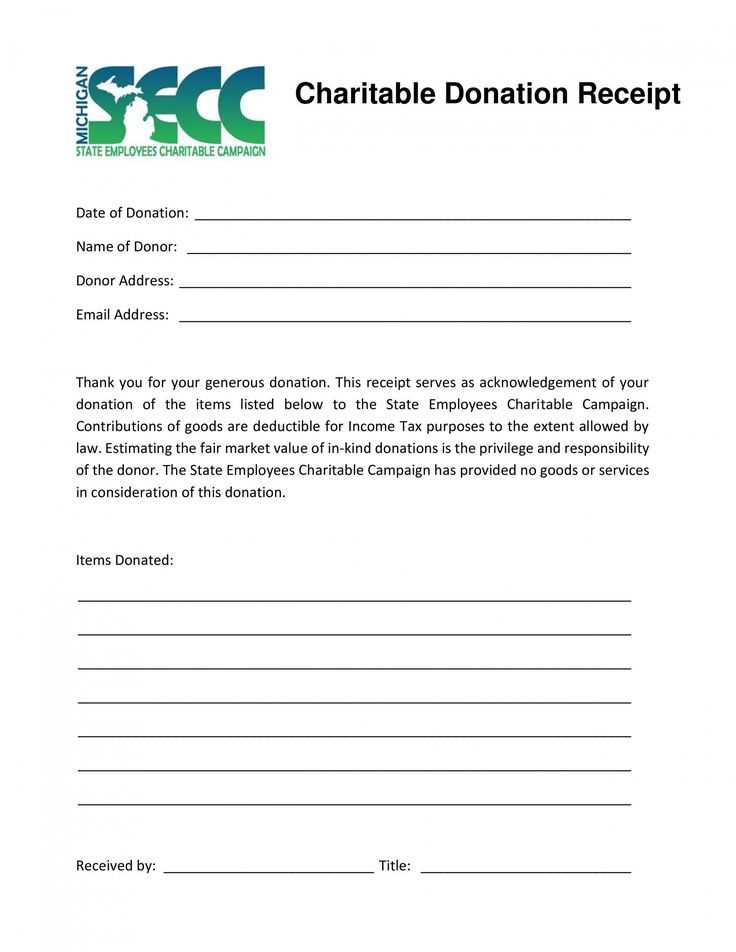

Charitable Gift Receipt Template: Key Elements to Include

To create an effective charitable gift receipt, include the following key elements:

1. Donor Information

Start with the name and contact details of the donor. Include their full name, address, phone number, and email to ensure that the receipt can be traced back to the correct individual. This information should be easily accessible for both the donor and the charity.

2. Donation Details

Clearly describe the donated items or the monetary value. For cash donations, specify the amount given. For non-cash gifts, list a description of the item or services provided. If applicable, provide an estimated value of the donation, but clarify that the donor is responsible for determining the value of non-cash items.

Ensure that you also mention the date the donation was received, as this is crucial for both the charity and the donor for tax reporting purposes.

3. Charity Information

Provide the charity’s name, address, and EIN (Employer Identification Number). This makes the receipt valid for tax purposes. It helps the donor when filing their taxes and also assures them that the donation is being properly recorded.

4. Acknowledgment of No Goods or Services

If the charity didn’t provide any goods or services in exchange for the donation (other than token items like thank you notes), explicitly state this on the receipt. For example: “No goods or services were provided in exchange for this donation.” This helps prevent any confusion during tax preparation.

By following these guidelines, you’ll create a clear, compliant, and professional charitable gift receipt template.