Charitable ReceiptAnswer in chat instead

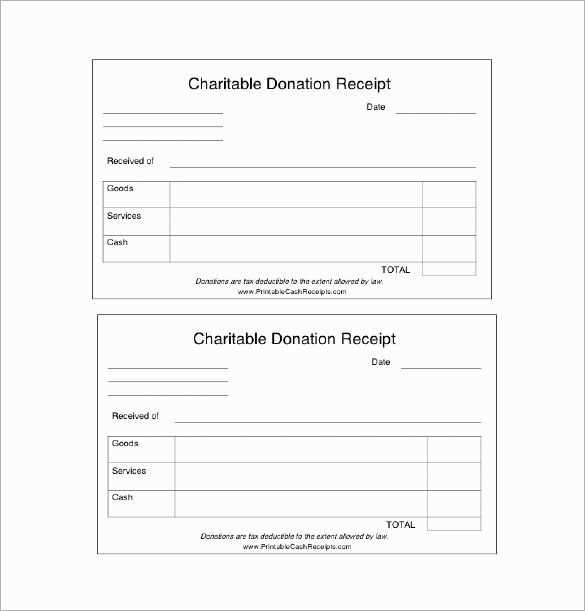

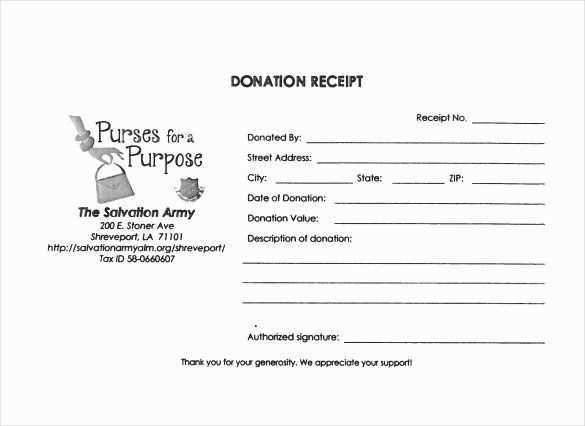

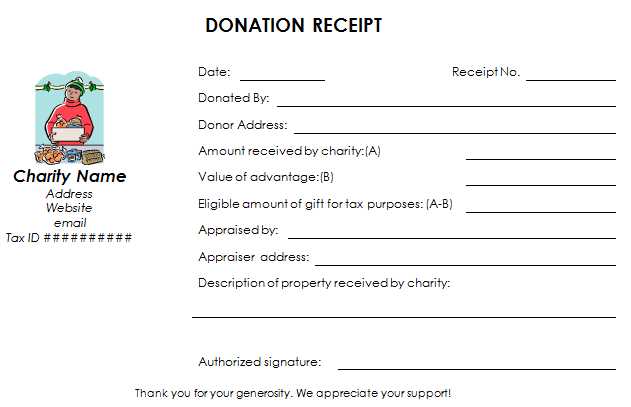

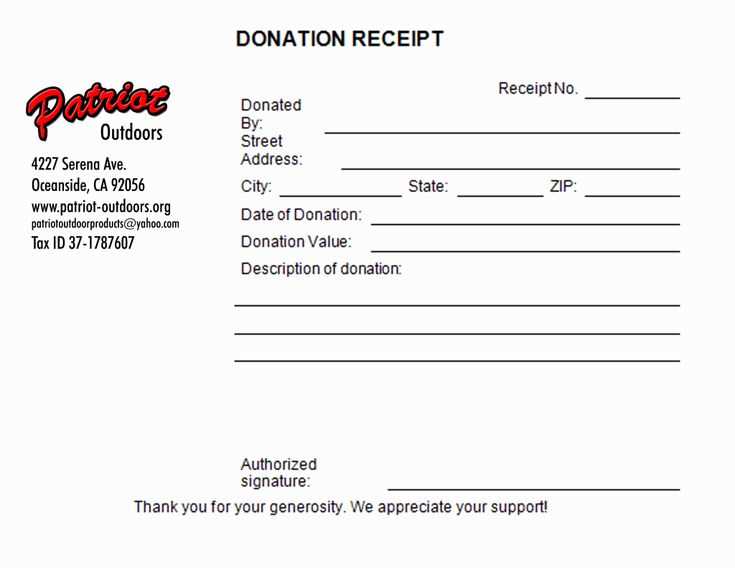

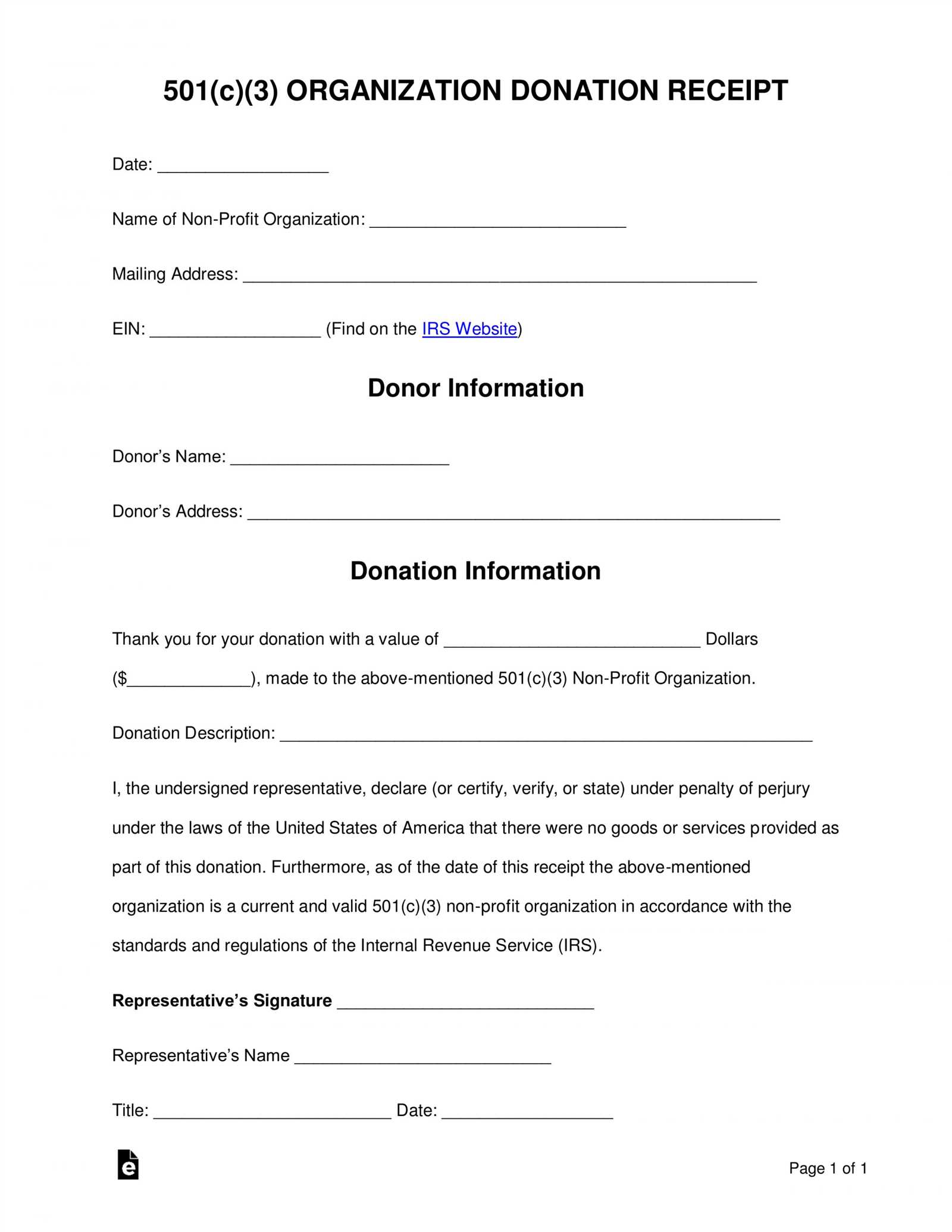

Charitable Donation Receipt Template

Key Elements to Include in a Donation Receipt

Legal Requirements for Receipts in Different Jurisdictions

How to Create a Digital Donation Receipt

Common Mistakes to Avoid When Issuing Receipts

Customizing a Template for Various Types of Donations

Best Practices for Storing and Managing Receipts

Key Elements to Include in a Donation Receipt

Ensure every receipt contains the organization’s legal name, address, and tax identification number. Clearly state the donor’s name, donation date, and the amount or a description of the donated goods. If applicable, mention whether any goods or services were provided in return, along with their estimated value. For monetary donations, specify the exact amount received. For non-cash contributions, include a brief description but let the donor determine the value. A statement confirming the organization’s tax-exempt status and the donor’s eligibility for tax deductions strengthens compliance.

Legal Requirements for Receipts in Different Jurisdictions

Regulations vary, so check local tax authorities for specific rules. In the U.S., donations over $250 require a written acknowledgment stating whether any benefits were received in return. Canada mandates official receipts for tax purposes with the charity’s registration number. The UK requires a Gift Aid declaration if the donor wants to claim tax relief. Always confirm formatting, required details, and reporting obligations to ensure compliance with local laws.