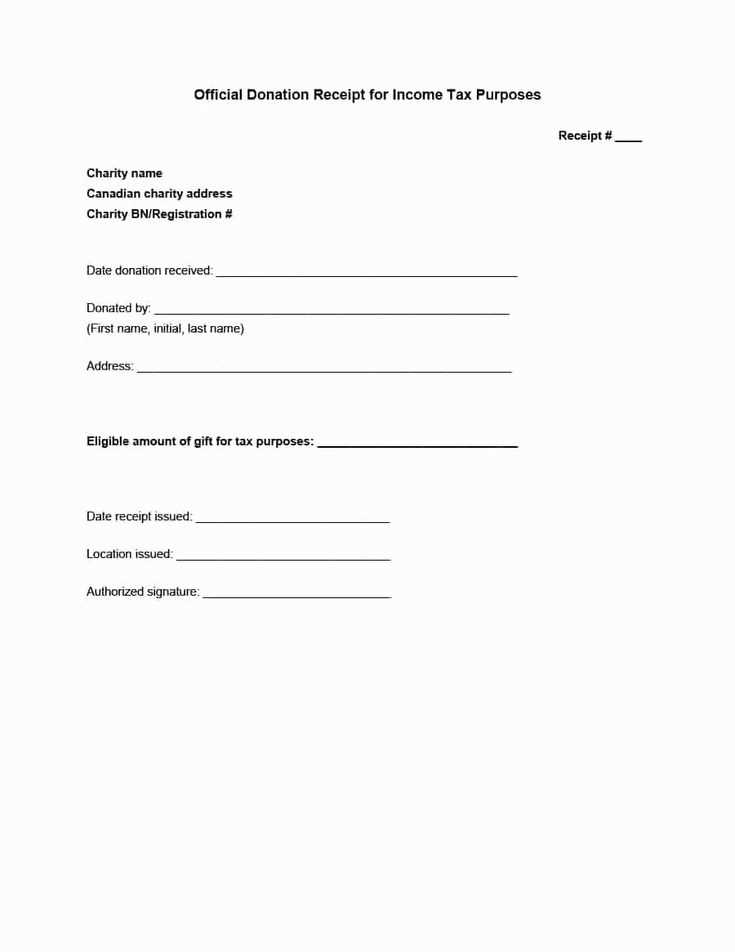

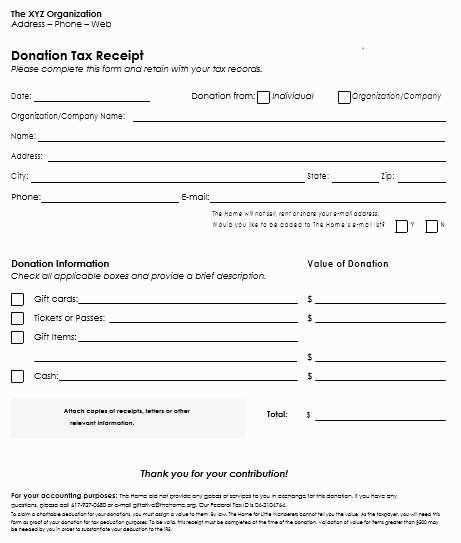

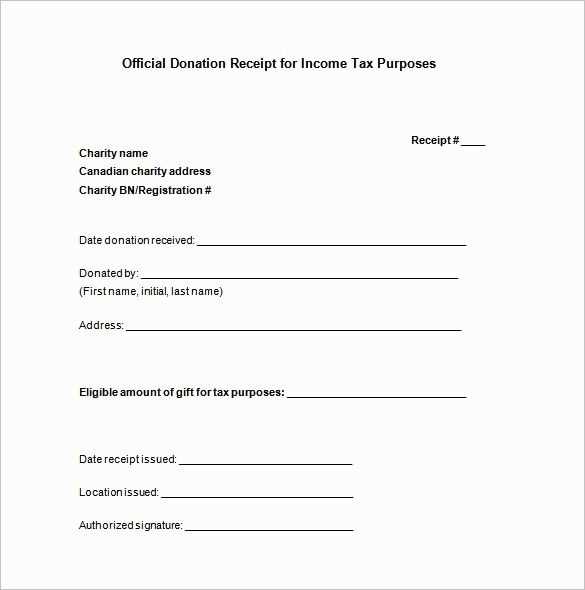

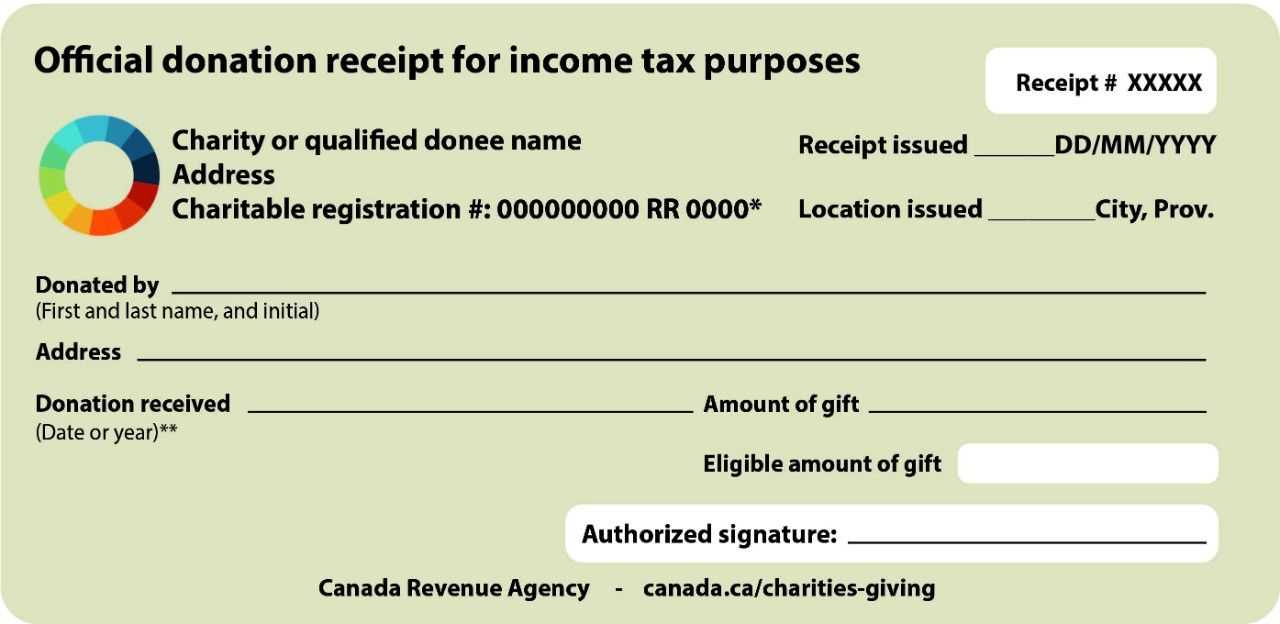

Creating a charitable receipt in Canada requires specific information to meet the Canada Revenue Agency (CRA) requirements. To ensure compliance, use the proper format and include all necessary details. This template will help you create a clear, legally valid receipt for any charitable donation.

First, make sure to include the charity’s registered business number (BN), which is mandatory for all registered charities in Canada. Without this number, the donation will not be eligible for a tax credit. Additionally, list the donor’s name, the date of the donation, and the amount or description of the donation. For non-monetary gifts, provide a clear description of the item, its estimated fair market value, and how it was valued.

Be mindful of the language used in the receipt. It must explicitly state that the donation is voluntary, with no goods or services being provided in exchange. Including a clear disclaimer like “no goods or services were provided in exchange for this gift” ensures the receipt meets CRA standards. A simple, well-organized receipt not only helps donors claim their tax credits but also reinforces transparency and trust between your charity and its supporters.

Finally, ensure that your charity’s logo or name is prominently displayed on the receipt. This adds professionalism and clarity, making it easier for donors to identify your organization. Regularly review your template to ensure it stays up to date with CRA’s regulations to avoid any potential issues during audits.

Here’s the corrected version:

To create a charitable receipt in Canada, follow these steps carefully to ensure compliance with the Canada Revenue Agency (CRA) guidelines.

Key Information to Include

- Charity’s Name and Address: Clearly state the name and address of your organization. Make sure the organization is registered with the CRA.

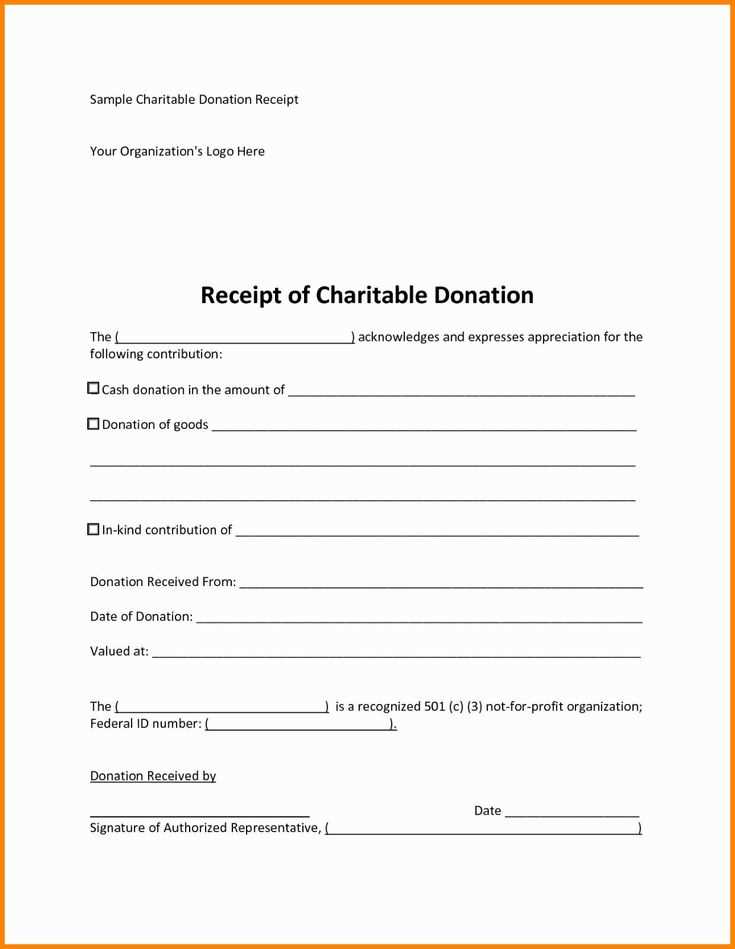

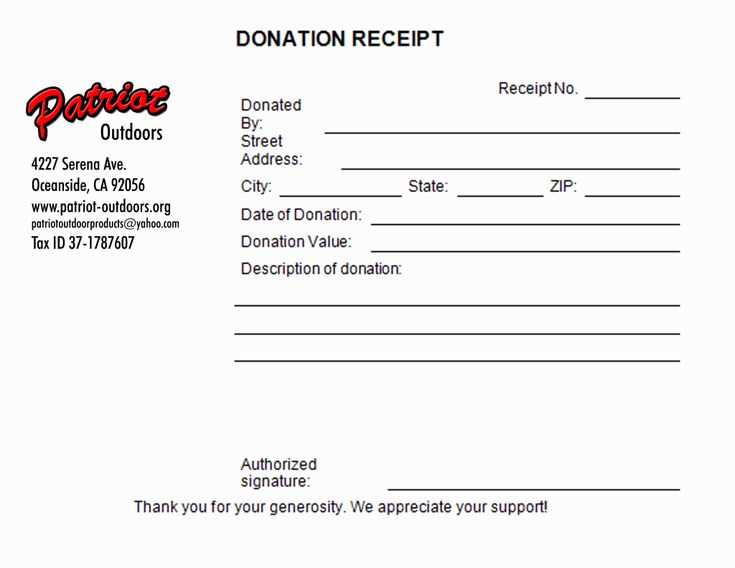

- Donor’s Name: Include the full name of the donor making the contribution. Ensure that it matches their legal records.

- Amount of Donation: State the exact amount donated. If the donation is in kind, describe the item and estimate its fair market value.

- Date of Donation: This should reflect the actual day the donation was received.

- Official Donation Receipt Number: Each receipt must have a unique, sequential number for tracking purposes.

Additional Information

- Charity’s Registration Number: Include the CRA-issued registration number. This verifies that the charity is eligible to issue receipts.

- Receipt Template: The format should be easy to understand and professional. Consider using software or templates specifically designed for charitable receipts.

- Statement of Value: For non-monetary donations, provide a statement that explains how the value of the gift was determined.

Ensure all required fields are filled out accurately. This helps your charity maintain transparency and allows donors to claim tax credits for their contributions.

- Charitable Receipt Template Canada

For a charitable receipt to be valid in Canada, it must include specific information to meet CRA (Canada Revenue Agency) requirements. Ensure your template includes the following details:

1. Organization’s Name and Address

The full legal name and complete address of the registered charity must be clearly visible on the receipt. This helps the donor identify the charity for tax purposes.

2. Charitable Registration Number

Include the charity’s official registration number issued by the CRA. This is a must-have for all charitable organizations in Canada.

3. Donor Information

Capture the donor’s full name and address, as this will be used for tax reporting and acknowledgments.

4. Date of Donation

List the exact date the donation was made. This is important for the donor to claim their tax credit for the correct tax year.

5. Donation Amount

State the amount donated, along with the type of donation (cash, property, etc.). If it’s a non-cash donation, provide an accurate description of the items and their fair market value.

6. Signature of an Authorized Representative

Ensure a representative from the charity signs the receipt to validate it. This can typically be done by someone with signing authority, such as the treasurer or director of the charity.

7. Statement of Eligibility

The receipt should also include a statement confirming that the donation is eligible for a tax credit under the Income Tax Act, which allows donors to claim charitable donations.

By following this template structure, you will provide donors with the proper documentation required to claim their tax benefits and ensure your organization stays compliant with CRA guidelines.

To properly format a charitable receipt in Canada, include these key elements:

1. Charity’s Legal Name and CRA Registration Number

Ensure the charity’s full legal name and its Canada Revenue Agency (CRA) registration number are clearly stated on the receipt. This confirms the charity’s eligibility for tax-deductible donations.

2. Donor’s Information

Provide the donor’s full name and address. This allows the donor to claim the tax deduction and ensures the receipt is personalized and legitimate.

3. Donation Date

Clearly state the exact date the donation was made. Accurate recordkeeping is essential for both the charity and donor’s tax filings.

4. Donation Amount or Description

List the amount donated, or if the donation was non-monetary, provide a detailed description along with the fair market value of the goods or services donated.

5. Value of Any Benefit Received

If the donor received a benefit (such as tickets or merchandise), subtract its value from the total donation. Only the net donation amount is eligible for a tax receipt.

6. Authorized Signature

Ensure an authorized representative from the charity signs the receipt. This validates the receipt for tax purposes.

By following these guidelines, you can create a proper charitable receipt that will meet Canada’s tax regulations and support the donor’s claims for tax deductions.

One of the most frequent mistakes when issuing charitable receipts is failing to provide a clear description of the donation. A receipt should detail the type of contribution, whether it’s money, property, or services. This ensures transparency and accuracy, making it easier for both the donor and the charity to keep track of the donation for tax purposes.

Incomplete Donor Information

Ensure all necessary donor information is included on the receipt, such as their full name, address, and contact details. Missing or incorrect information can cause delays or confusion when claiming a tax deduction. Double-check the accuracy of the donor’s details to avoid complications.

Incorrect or Missing Receipt Number

Each charitable receipt must have a unique number to ensure it’s properly tracked. Failing to assign a receipt number, or reusing numbers from previous receipts, can lead to problems during audits or when donors are filing their taxes.

Additionally, if the donation amount is not clearly stated or there are errors in the currency conversion (if applicable), it can invalidate the receipt. Keep the records accurate and consistent to avoid any future issues for the donor or your organization.

Begin by ensuring that the receipt includes your organization’s name, address, and contact information. This allows donors to easily identify the source of their donation. Add a unique receipt number for tracking purposes, ensuring that every receipt issued is distinct. This helps maintain proper records for both the organization and the donor.

Adding Key Details

Include the donor’s full name and address. This information should match the details used for tax purposes to ensure accurate reporting. Clearly state the donation amount, specifying whether it was monetary or in-kind. For in-kind donations, describe the donated items in detail, including their estimated value.

Incorporating Legal Information

Your receipt should include a statement that your organization is a registered charity, along with the official registration number. This assures the donor that their contribution is eligible for tax receipts. Also, mention that no goods or services were provided in exchange for the donation, which is a common requirement for charitable receipts in Canada.

Creating a Customizable Template

Use a template that allows easy customization for different donation types and amounts. The design should be simple and easy to update, with placeholders for all the necessary fields, such as donation date, donor information, and amounts. A clean and professional design will improve the donor’s experience and the template’s effectiveness.

| Field | Example |

|---|---|

| Organization Name | Charity ABC |

| Receipt Number | 12345 |

| Donor Name | John Doe |

| Donation Amount | $100 |

| Donation Date | February 12, 2025 |

| Charity Registration Number | 123456789 |

Review the template regularly to ensure all necessary details are included, especially during tax season, when accurate documentation is crucial. Testing different formats before finalizing the receipt template can help avoid mistakes and ensure compliance with Canada’s charity laws.

Ensure your charitable receipt clearly includes the following details:

Organization Name: Display the full legal name of the charity or nonprofit organization, as registered with the Canada Revenue Agency (CRA).

Charitable Registration Number: Include the CRA-issued registration number, which proves the organization’s status as a recognized charity.

Donor Information: List the name and address of the donor. This is critical for the donor’s tax records.

Receipt Date: The date when the donation was received is required. This helps in determining the tax year in which the donation should be claimed.

Donation Amount: Specify the exact value of the gift or donation. For non-cash donations, provide a detailed description and valuation information.

Official Signature: A signature from an authorized person within the charity organization, such as the executive director or treasurer, adds authenticity to the receipt.

Statement of Tax Credit Eligibility: Include a clear statement affirming the donor’s eligibility for tax credits according to Canadian law.

By adhering to these guidelines, you help donors maintain proper documentation for their charitable tax claims while ensuring compliance with CRA regulations.