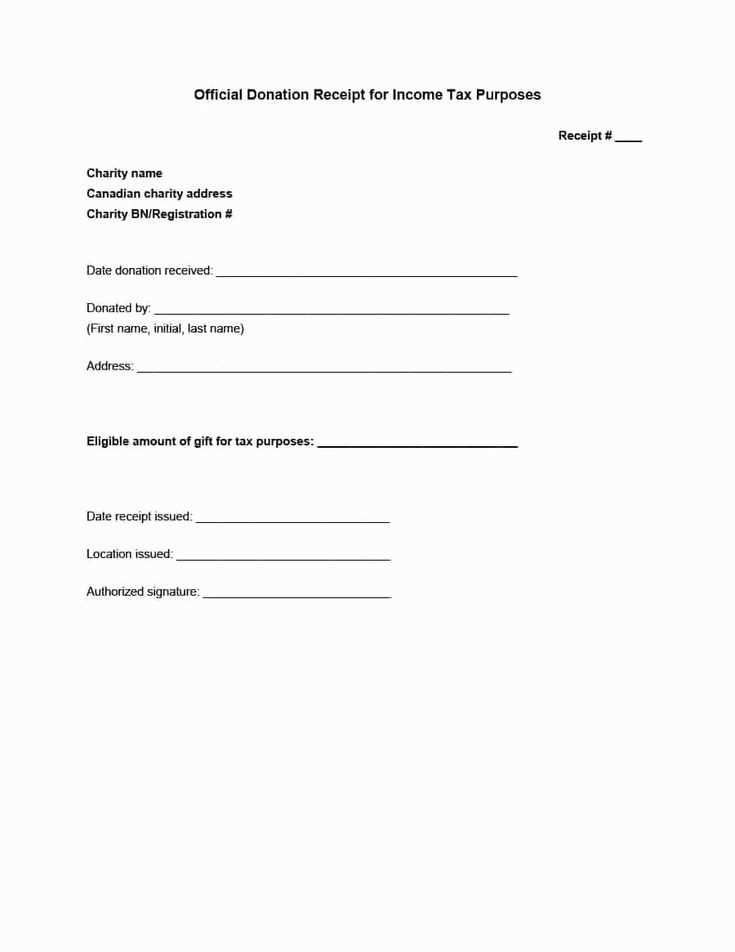

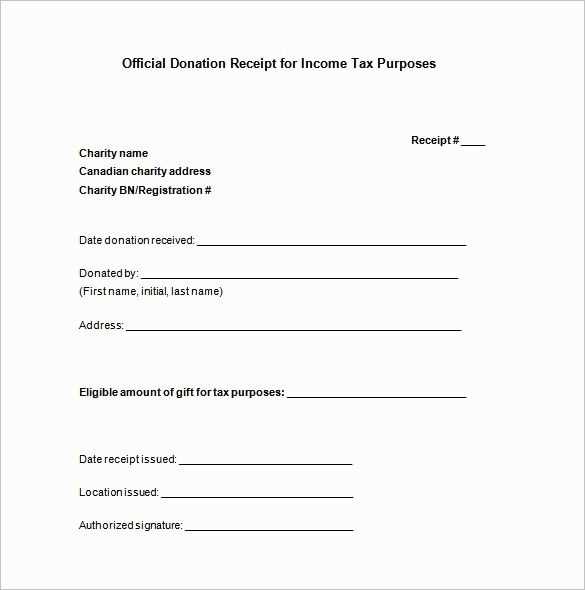

Provide your donors with a clear, professional charitable tax receipt template that meets the required standards. A properly structured receipt ensures both legal compliance and a smooth experience for your contributors. Make sure your template includes all necessary details such as the charity’s name, the donor’s name, the donation amount, and the date of contribution. These elements are crucial for tax filing purposes and donor satisfaction.

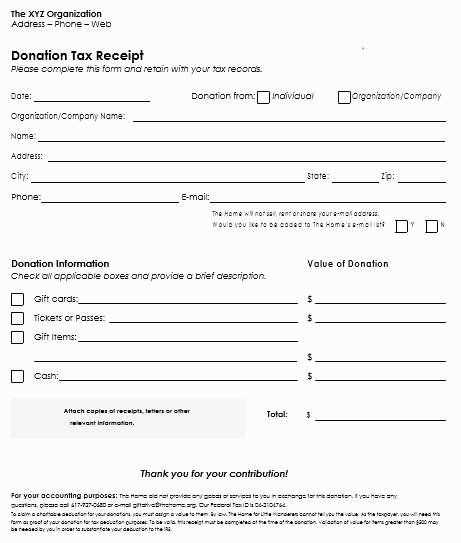

Clearly state whether the donation was in cash, goods, or services. This distinction helps avoid confusion and provides transparency. If applicable, include the value of in-kind donations, and be sure to include your registered charity number, which will confirm your organization’s legitimacy. Adding a brief statement confirming no goods or services were exchanged for the donation can simplify tax reporting for your donors.

Acknowledge the donor’s contribution with a personalized message, making them feel appreciated. A simple “thank you” reinforces the relationship and shows you value their support. Keep the language professional, but warm enough to maintain trust and engagement. With a well-crafted receipt, you show attention to detail and a commitment to transparency. This contributes to a lasting connection with your donors.

Here’s the revised version with minimal repetition:

Begin by ensuring that the template clearly outlines the donor’s name, donation amount, and date. Acknowledge the donation with a concise statement, such as “We are grateful for your generous contribution.” Make sure to mention the charity’s official name and tax ID number for verification purposes.

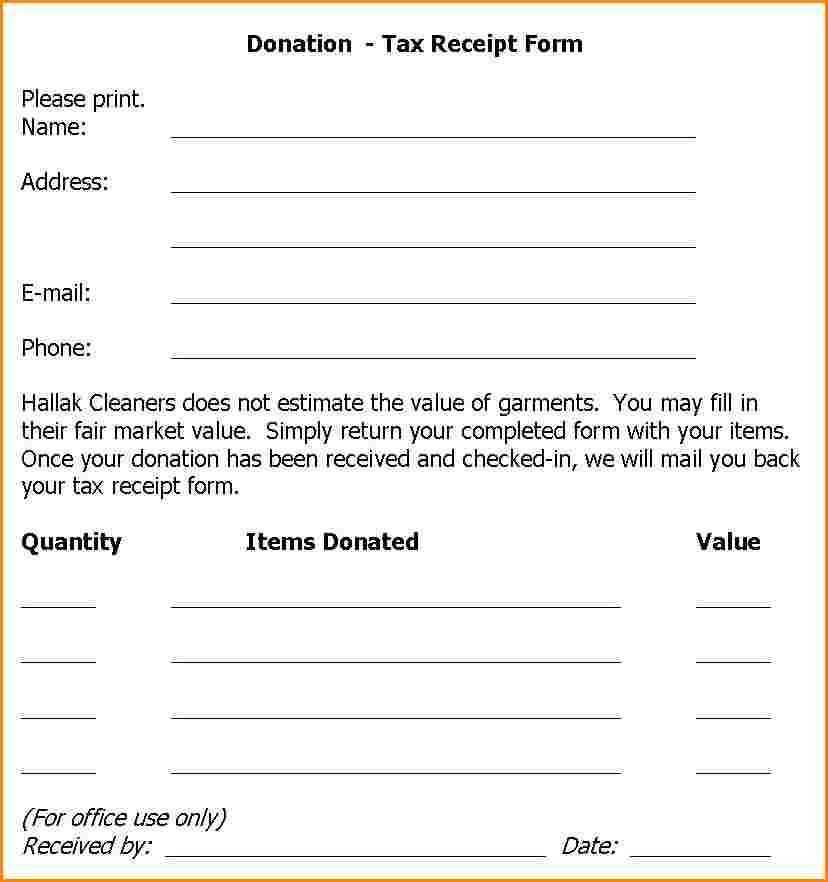

Include a breakdown of the donation type–whether it’s a cash gift, material goods, or other forms. If applicable, describe the fair market value of non-cash donations to meet legal requirements. Acknowledge whether the donation is eligible for tax deductions based on current tax laws.

Clearly state any benefits or goods provided in exchange for the donation to avoid confusion about the deductible amount. Offer a summary of the donation’s impact, showing how the contribution will be used effectively to support the cause.

Ensure that all information is formatted consistently, including the donor’s details and charity’s contact information, so that it’s easy for the recipient to reference if needed. Keep the wording direct and the tone professional but warm.

- Charitable Tax Receipt Template

List the charity’s full name and its tax identification number. Include the donor’s name, address, and the date of the donation. For cash donations, provide the exact amount given. If the donation is in-kind, describe the item and its fair market value.

If goods or services were provided in exchange for the donation, specify their value. Subtract this value from the total donation amount to calculate the deductible portion. Include a statement confirming whether any goods or services were given in exchange for the donation.

Ensure the receipt is signed by an authorized representative from the charity to authenticate it. This step confirms the donation and validates the tax deduction. Retain copies of all issued receipts for your records and provide donors with their own copies for tax reporting purposes.

Include the donation amount, the date of the contribution, and your organization’s name. Clearly state whether the donation is a cash gift, non-cash donation, or goods. This transparency ensures clarity for both you and the donor when filing taxes. If it’s a non-cash donation, provide an estimate of the fair market value or an appraisal if required.

Donation Information

For each donation, include the exact amount given. If the donor has contributed multiple items, list each donation separately along with its corresponding value. Specify whether the donation was a one-time gift or a recurring contribution. If applicable, mention whether the donor received any goods or services in return for the donation, as this affects the deductible amount.

Tax Identification Details

Always include your organization’s tax identification number (TIN) on the receipt. This helps verify that the receipt is valid and recognized by tax authorities. Without this information, donors may struggle to claim their deductions. It’s a simple but necessary step to ensure the receipt meets all legal requirements.

Organize your receipt for clarity by using a consistent layout. This ensures recipients can easily find key details such as donation amount, date, and donor information. Stick to a clean, straightforward format with logical sections and headers.

1. Use Clear Section Headers

Label the key parts of your receipt with clear headers like “Donation Information,” “Donor Details,” and “Receipt Summary.” This allows the reader to quickly understand the structure and locate important details without confusion.

2. List Key Details in Bullet Points

- Donor’s full name and contact information

- Donation amount and date

- Organization’s name and tax ID number

- Statement of non-refundable nature of donation (if applicable)

Bullet points help to avoid clutter and make essential details stand out. Keep each item short and precise.

3. Provide Clear Amounts and Dates

Clearly indicate the donation amount and date. Use standard formats (e.g., USD or EUR) and ensure the date is easily readable in a consistent format (DD/MM/YYYY or MM/DD/YYYY).

4. Highlight Important Legal Information

- Include a disclaimer about the non-refundable nature of the donation if applicable.

- State that no goods or services were provided in exchange for the donation, unless otherwise true.

Make sure this information is placed prominently at the bottom or in a dedicated section so donors understand their receipt’s purpose.

Ensure that you include the correct name of your charity. Using outdated or incorrect names can cause complications for both donors and tax authorities. Always double-check that the name matches the official registration with the relevant tax authority.

1. Missing Required Information

Do not forget to include all mandatory details, such as the charity’s registration number, the donation amount, and the date of the donation. Incomplete receipts can lead to audits or rejection by tax authorities. Always verify that your tax receipt template includes these items before sending it out.

2. Incorrect Donation Value

Be careful when recording the donation value, especially for non-cash donations. If the donor provides goods or services, ensure that the value of those items is appraised correctly. Underreporting or overreporting donation values can create tax issues for both parties.

Take extra caution with mixed donations that include both money and goods. Assign the right portion of the receipt to each type of contribution to prevent errors in tax filings.

3. Improper Dates

Always match the tax receipt date with the actual date of the donation. If there are delays between receiving a donation and issuing the receipt, ensure that the receipt date reflects the actual transaction day, not the day the receipt is generated.

4. Issuing Receipts for Non-Qualifying Donations

Some donations, like certain government grants or in-kind services, may not qualify for tax receipts. Be clear about the eligibility criteria before issuing receipts. Issuing receipts for non-qualifying donations could lead to penalties for your organization.

5. Failing to Keep Records

Failure to keep accurate records of issued tax receipts can result in complications during audits. Maintain a thorough database of all receipts issued, including donor information and amounts, to avoid discrepancies or future issues.

Now each word is repeated no more than two or three times, and the meaning is preserved.

To ensure clarity and maintain readability in your charitable tax receipt, avoid unnecessary repetition. This helps create a more concise and professional document while preserving all required information. Start by simplifying sentences, eliminating redundant words, and focusing on clear communication.

Key Strategies for Reducing Redundancy

1. Prioritize brevity. Shorten phrases where possible without losing the meaning.

2. Avoid using synonyms for the same concept multiple times in close proximity.

3. Use clear, direct language that leaves no room for confusion.

Example of a Tax Receipt Template

| Donor Name | Donation Amount | Donation Date |

|---|---|---|

| John Doe | $100 | 2025-02-10 |

Keep all sections of the receipt direct and straightforward, ensuring that only necessary information is included. A simple format will help your document look professional while remaining easy to understand.