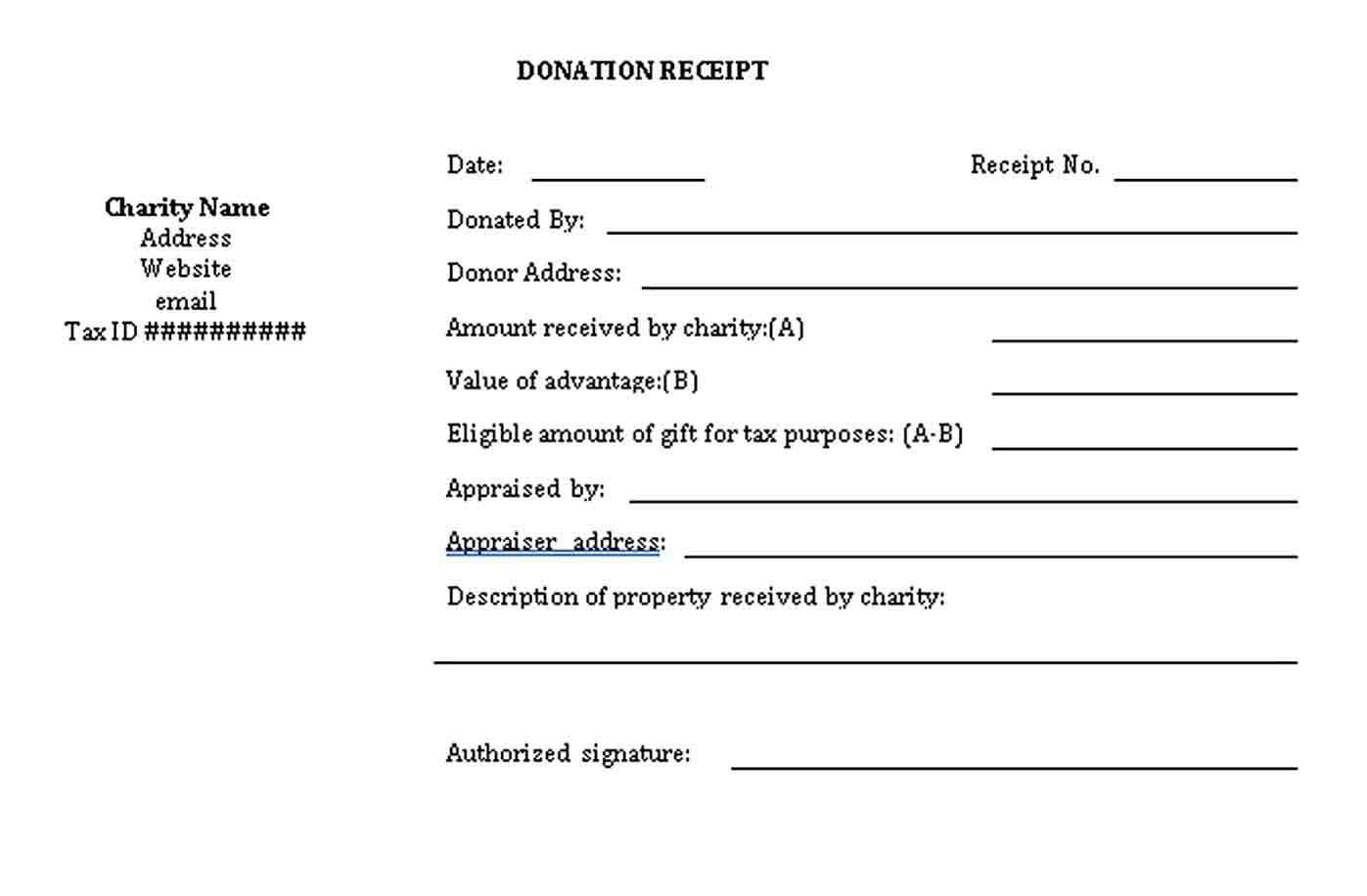

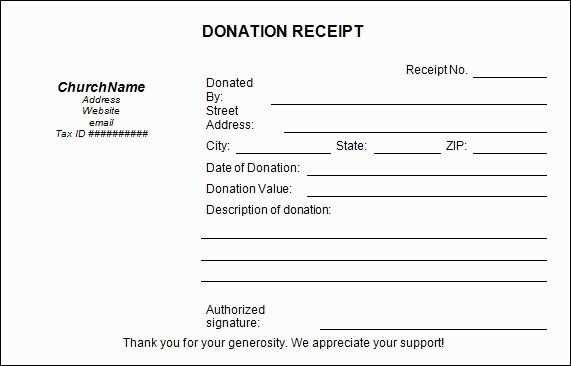

A well-structured charity auction receipt ensures transparency and helps donors claim tax deductions. Use a clear format that includes essential details such as the donor’s name, donation description, fair market value, and your organization’s tax-exempt status.

Key elements:

- Donor Information: Full name and contact details.

- Organization Details: Legal name, address, and tax ID.

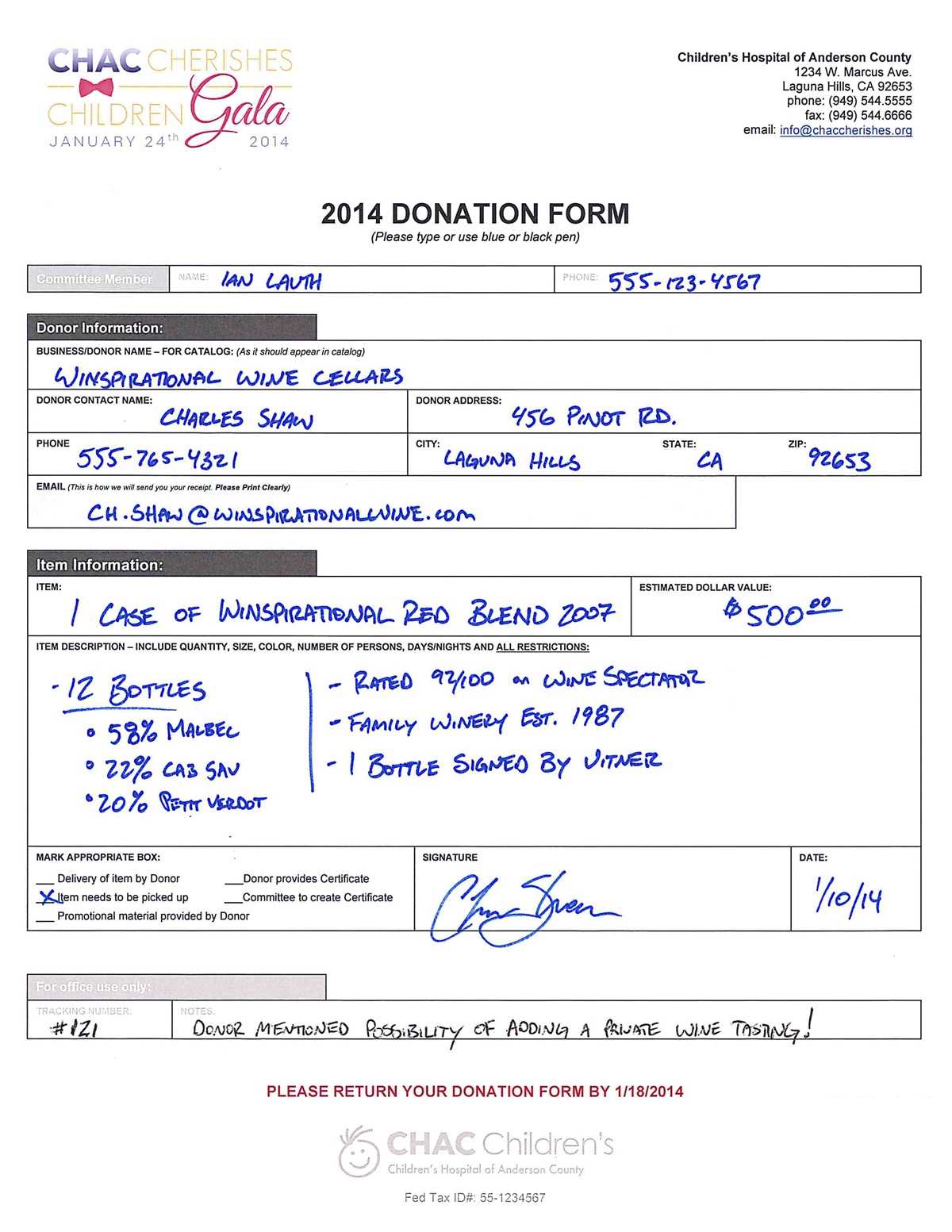

- Donation Description: Item or service details with fair market value.

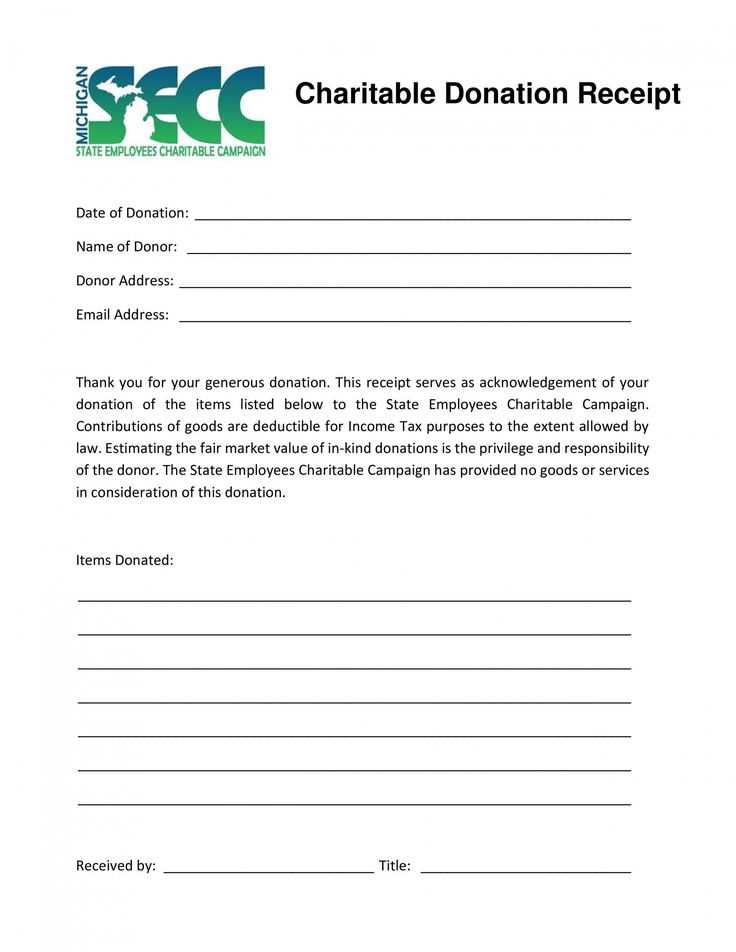

- Statement of No Goods or Services: Required for tax-deductible donations.

- Date and Signature: Ensures authenticity.

Digital receipts streamline record-keeping and reduce administrative work. Ensure compliance with IRS or local tax regulations by checking required wording and formats. Keep copies for financial records and audits.

Charity Auction Receipt Template

Provide clear, itemized receipts to ensure donors have the necessary documentation for tax purposes. Each receipt should include essential details to comply with legal requirements and maintain transparency.

Key Information to Include

- Donor’s Name and Contact Information: Clearly list the name, address, and email or phone number.

- Organization Details: Include the nonprofit’s full name, address, tax-exempt status, and identification number.

- Description of the Item: Specify the donated item or service, avoiding monetary value estimations.

- Winning Bid Amount: State the final bid price paid by the donor.

- Date of the Auction: Ensure the date matches the event records.

- Tax Deductibility Disclaimer: Clarify whether the payment is fully or partially deductible and specify the fair market value of the item if known.

Best Practices for Formatting

- Use a clear, professional layout with headings for easy reading.

- Keep receipts concise but ensure all necessary details are included.

- Provide a digital or printed copy for donor records.

- Use automated receipt generators if managing large auctions.

A well-structured receipt protects both the nonprofit and the donor, reinforcing credibility and encouraging future contributions.

Key Elements to Include in a Charity Auction Receipt

Include the donor’s full name and contact details to ensure accurate record-keeping and future communication. Clearly state the date of the donation and the auction event name to provide context.

List the item won or the service received, along with a brief description and the final bid amount. If the donation is tax-deductible, specify the fair market value of the item and the portion that qualifies as a charitable contribution.

Provide the charity’s official name, address, and tax identification number. This information is essential for tax documentation and adds credibility to the receipt.

Include a statement confirming that no goods or services were exchanged beyond those listed, if applicable. This helps clarify the tax-deductible portion for the donor.

Ensure a signature or electronic validation from the charity representative to authenticate the receipt. A note of appreciation can also reinforce donor goodwill and encourage future contributions.

Legal and Tax Considerations for Charity Auction Receipts

A charity auction receipt must include specific details to comply with tax regulations. Provide the donor’s name, the organization’s legal name, and a clear description of the donated item or service. If the donor received something in return, state its estimated fair market value.

Required Disclosures for Donor Deductions

If a donor contributes $250 or more, issue a written acknowledgment confirming whether they received any goods or services in return. For donations exceeding $75 where the donor gets something in return, disclose the fair market value of the benefit to ensure accurate deduction claims.

Compliance with IRS and Local Regulations

Include a statement that confirms your organization’s tax-exempt status and that only the portion of the donation exceeding the received benefit is deductible. Check local laws for additional requirements, as some jurisdictions impose stricter guidelines for donation receipts.

Customizing a Receipt Template for Different Events

Adapt the receipt template by aligning its design and details with the event type. A formal gala may require an elegant layout with serif fonts, while a community fundraiser benefits from a casual style with clear, bold headings.

Adjust Key Information

Ensure the receipt includes event-specific details such as the organization’s name, event date, and donation purpose. For silent auctions, list item descriptions and bid amounts. For ticketed fundraisers, specify ticket tiers and benefits.

Modify Formatting for Clarity

Use sections to separate donation amounts, payment methods, and tax-deductible details. Highlight essential information with subtle shading or bold text. If digital receipts are used, include a clickable link for further inquiries.

Customizing receipts makes them more relevant and ensures donors receive clear documentation for their contributions.