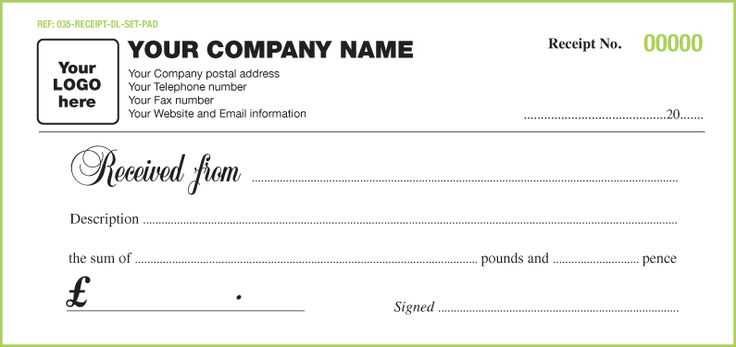

If you’re looking to create a charity receipt for donations in the UK, using a template can save you time and ensure compliance with legal standards. A charity receipt serves as proof of the donation and can be used for tax relief purposes by the donor. It must include certain details such as the donor’s name, the amount donated, the date, and confirmation that no goods or services were provided in return for the gift.

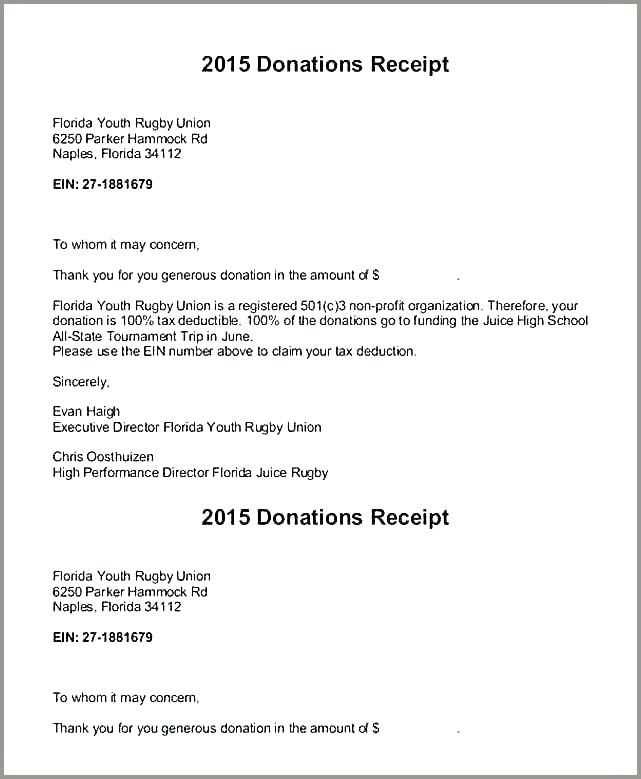

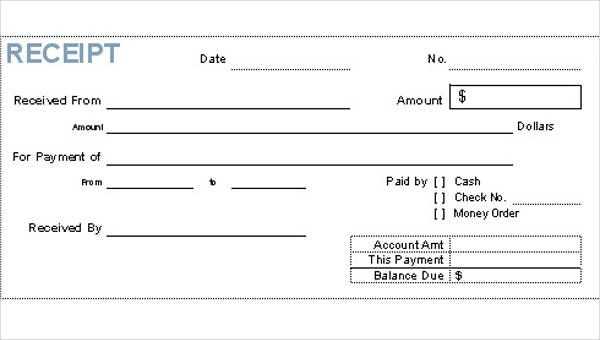

The key information to include on the receipt is straightforward. Begin by listing your charity’s full name, address, and registered charity number. Then, include the donor’s name, the donation amount, and the date the donation was made. Ensure to state clearly that the donation was made voluntarily, without expectation of goods or services in return, as this confirms eligibility for Gift Aid claims.

For charities using Gift Aid, it’s important to have a space on the receipt where donors can confirm they wish to Gift Aid their donation. This allows charities to claim back 25p for every £1 donated, significantly increasing the value of donations. Ensure your template is simple yet informative, making it easy for donors to understand the details and benefits of their contributions.

Here’s the revised version:

To create a charity receipt template for the UK, ensure the following details are included for compliance and clarity:

Key Details for the Template

The receipt should clearly state the charity’s name, address, and registration number with the Charity Commission. This is important for verifying the legitimacy of the donation. Also, make sure to list the donor’s name, the donation amount, and the date of the contribution.

Additional Information

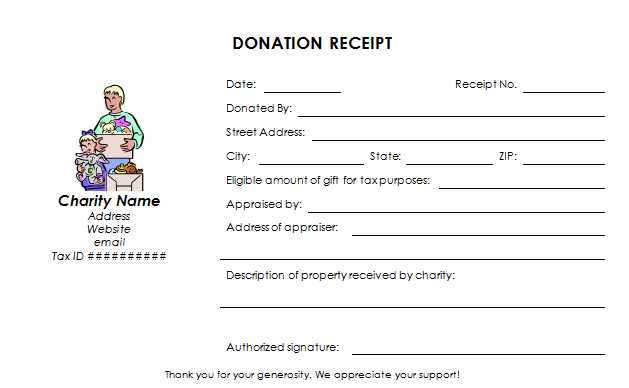

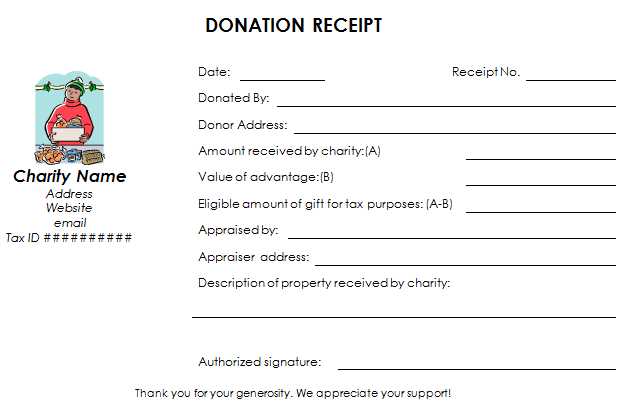

If the donation is in kind (e.g., items or services), provide a description of the donated goods or services. Also, note whether the donation was eligible for Gift Aid. If so, include a statement that confirms the donor’s consent for Gift Aid claims.

Example: “I confirm that I am a taxpayer and wish to claim Gift Aid on this donation.” This ensures transparency and makes it easy to claim Gift Aid benefits.

Make sure to include a unique reference number for each donation receipt to keep track of all contributions effectively.

- Charity Receipt Template for the UK

When creating a charity receipt in the UK, ensure it includes all necessary details for both your records and the donor’s. This template should cover the donation amount, date, donor’s details, and a brief statement confirming the charitable nature of the gift.

Here’s an outline of what should be included in the charity receipt template:

| Element | Description |

|---|---|

| Charity Name | The full name of the charity, registered with the Charity Commission or the relevant governing body. |

| Charity Number | Your charity registration number, if applicable, for identification purposes. |

| Donor’s Name | The full name of the person or organization making the donation. |

| Donation Date | The exact date on which the donation was made. |

| Donation Amount | The specific amount donated, whether in cash or goods. |

| Gift Aid Status | Confirm if Gift Aid has been claimed for the donation, and include a declaration if applicable. |

| Charity’s Address | The charity’s registered address or the location where official correspondence can be sent. |

| Receipt Number | A unique reference number for tracking the donation in your records. |

Be sure to include a statement clarifying that no goods or services were provided in exchange for the donation, which is required for tax purposes.

Using this template will help keep your records organized and meet the requirements for donation documentation in the UK.

A well-structured receipt is crucial for ensuring both the donor and charity comply with UK regulations. Follow these key guidelines:

1. Charity Name and Contact Details

Clearly state the charity’s official name, registration number, and contact information. This helps verify the authenticity of the charity. Include the charity’s address, email, and phone number for any follow-up communication.

2. Donor Information

Include the donor’s name, address, and contact details. While not mandatory, this helps if the donor requests a reissued receipt or has any queries regarding their donation.

3. Date of Donation

The receipt must list the exact date the donation was received. This is essential for both accounting and tax purposes, especially for donors claiming Gift Aid.

4. Donation Amount

Clearly state the amount donated. For non-monetary donations, include a description and estimated value. If the donation was made in kind, note the item(s) and provide an approximate value.

5. Gift Aid Declaration

If the donation is eligible for Gift Aid, ensure the receipt includes a statement confirming the donor has agreed to Gift Aid and their taxpayer status. This allows the charity to claim back tax on donations at no extra cost to the donor.

6. Statement of No Goods or Services Provided

If the donor received no goods or services in exchange for the donation, the receipt should include a statement to this effect. This helps confirm the nature of the donation for tax purposes.

7. Signature of an Authorized Charity Representative

Having the signature of an authorized representative adds credibility to the receipt. It should be a person with the authority to acknowledge donations on behalf of the charity.

By following these simple steps, you ensure your charity receipts are clear, accurate, and compliant with UK regulations. This helps both your charity and your donors maintain transparent records for tax purposes and future reference.

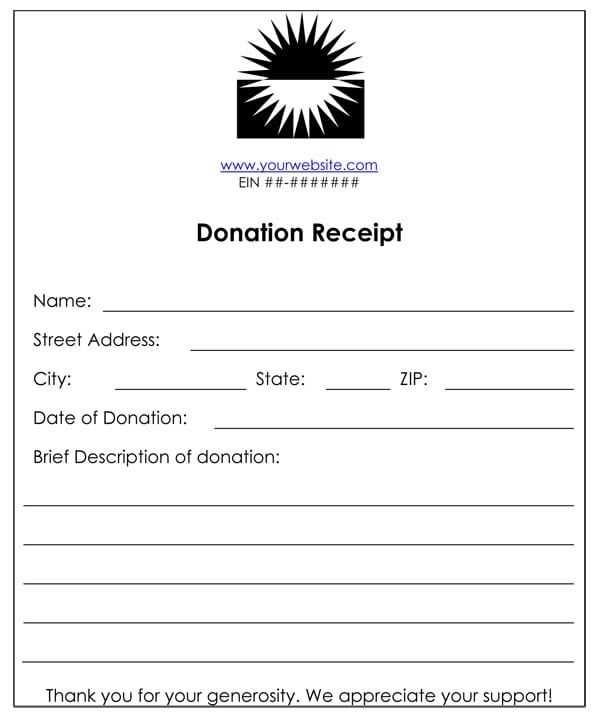

Ensure the following key details are present on your charity receipt to meet HMRC standards:

- Charity’s Name: The official name of the charity, as registered with the Charity Commission or other regulatory bodies.

- Charity Number: Include the charity’s registered number to verify its status as a recognized charity.

- Donor’s Name: Clearly state the name of the individual or organization making the donation.

- Donation Amount: Specify the exact value of the contribution, whether it’s monetary or in-kind.

- Date of Donation: Record the exact date when the donation was made to confirm the eligibility for tax relief.

- Gift Aid Declaration: If applicable, include a statement confirming the donor has agreed to Gift Aid, along with the appropriate wording for compliance.

- Receipt Number: Provide a unique receipt number for each transaction to maintain clear records.

- Charity’s Contact Information: Include a phone number, email address, or website for verification purposes and further inquiries.

Optional but Helpful Information

- Donor’s Address: For additional verification, it is recommended to include the donor’s address, though not a strict requirement.

- Payment Method: If possible, note the method by which the donation was made (cash, cheque, bank transfer, etc.).

- Use a Clear and Legible Font: Choose a simple, professional font like Arial or Times New Roman. Keep the size between 10 and 12 points to ensure readability.

- Include a Clear Heading: Label the receipt with a clear title such as “Donation Receipt” or “Charity Contribution Receipt” at the top.

- Provide Contact Information: Include your charity’s name, address, phone number, and email. This gives the donor an easy way to reach you for any follow-up inquiries.

- Donation Details: List the donation amount or the description of donated goods, including quantity and value. Specify if the donation is monetary or in-kind.

- Include Date and Receipt Number: Make sure to date the receipt and include a unique reference number for record-keeping purposes.

- Tax-Exempt Status: Mention your charity’s tax-exempt status, if applicable. This allows donors to claim their contribution on their taxes.

- Thank the Donor: Add a brief, heartfelt thank-you message. A simple “Thank you for your generous donation” adds a personal touch to the receipt.

- Double-Check the Accuracy: Ensure all details are accurate, including the donor’s name, donation amount, and your charity’s contact details.

Tailor the donation receipt template to suit the specifics of each contribution type. For one-time donations, include the donor’s name, amount, and donation date. Acknowledge the payment method used–whether it’s credit card, bank transfer, or cash. For recurring donations, provide information about the subscription frequency, start date, and total amount donated within the year. This helps track cumulative contributions over time.

For in-kind donations, list the donated items, including their estimated value based on market standards. Ensure donors know that this value may not be exact but reflects a reasonable estimate. If donations are made through events or auctions, note the event name, date, and the total amount raised. These details will give clarity about the event’s contribution to the cause.

When donations are made on behalf of others, such as in memory of someone, clearly indicate the donor’s name and the person being honored. This customization helps keep the donation’s purpose transparent for both the donor and the charity.

Always include space for special notes or messages from the donor, especially for large or significant contributions. Customizing your template in these ways not only ensures accuracy but also strengthens the relationship between the charity and the supporter.

Ensure all donations are clearly stated, including the exact amount. Avoid vague descriptions or general terms. Specify whether the donation was cash, cheque, or other types of contribution, as this can affect tax claims and verification.

Double-check that the charity’s registered name and charity number are included. Misprints or missing details can lead to complications when donors claim Gift Aid or tax deductions.

Don’t forget to include the date of the donation. Receipts without dates can create confusion and delays during auditing or when donors need proof for their tax returns.

Always issue receipts promptly. Delays in providing receipts can lead to donor dissatisfaction and may affect their ability to claim Gift Aid or tax relief within the appropriate timeframe.

Be clear about the type of donation made. If a donor provided goods or services in exchange for a donation, make sure the value of those goods/services is stated separately from the actual monetary donation, as it affects Gift Aid eligibility.

Avoid using incorrect or misleading language. For example, never label a donation as “tax-deductible” unless it is eligible under current tax laws, as this could lead to legal issues.

Don’t overlook adding a thank-you message on the receipt. It helps maintain positive relationships with donors and reinforces their generosity, which can encourage future support.

Digital receipts offer a streamlined approach to managing donations and expenses for your charity, reducing the need for physical storage and manual filing. They are easy to distribute via email or through an app, making it convenient for both donors and your team. These receipts also enable quicker access to transaction data, improving record-keeping accuracy and providing easy retrieval for future reference.

Advantages of Digital Receipts

Using digital receipts saves time and effort in managing paperwork. They reduce the administrative workload of printing and mailing physical copies, which can be costly for the charity. Additionally, digital receipts can be stored securely in cloud-based systems, minimizing the risk of loss or damage. Donors also appreciate the eco-friendly approach, aligning with modern sustainability efforts.

Advantages of Paper Receipts

Paper receipts still have their place, especially for charities that interact with donors who prefer tangible records. In some cases, paper receipts can be easier for donors to manage and keep track of, particularly in environments where internet access is limited. Additionally, some donors may appreciate the formality of a paper receipt, especially when it comes to tax records or documentation for reimbursement purposes.

For charities, the choice between digital and paper receipts depends on the donor base and the charity’s operational preferences. Digital receipts are better for cost-efficiency and ease of access, while paper receipts may still be necessary for certain donor needs. Evaluate your charity’s specific needs and resources before deciding which option works best for your operations.

Thus, each word is used no more than two or three times, and the structure remains clear and correct.

To create a well-organized charity receipt template, focus on including the key details without overcomplicating the format. List the charity’s name, the donor’s details, and the donation amount. Make sure the date of the donation is clearly marked, along with any relevant reference numbers. This keeps everything simple and professional.

Ensure that the receipt includes a clear statement that the donation is for charitable purposes. This helps maintain transparency and makes it easier for both parties to use the receipt for tax purposes. Avoid excessive wording that may distract from the main details.

Once the essential information is included, you can personalize the template with a brief thank you note or additional contact details for the charity. This creates a more engaging experience for the donor while keeping the document concise.

In summary, prioritize clarity by limiting repetition and focusing on the necessary components. A charity receipt template should be easy to read, with relevant information front and center.