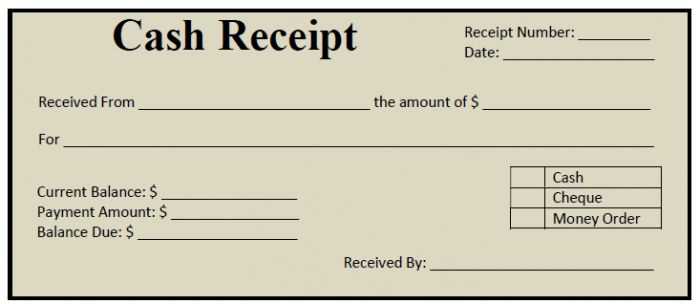

Creating a cheque receipt template can streamline your financial documentation process and reduce the risk of errors. When designing your template, make sure to include clear fields for the cheque number, date of issuance, amount, payer details, and the recipient’s information. This helps to ensure that both parties are on the same page and the transaction is recorded correctly.

Consider adding a space for a signature to validate the receipt, as it acts as an official acknowledgment of the payment. If the cheque is post-dated or refers to a specific purpose, make sure to highlight this on the template to avoid confusion later. It’s also wise to include a reference number or additional notes section for any special instructions or identifiers related to the payment.

By using a cheque receipt template, you can create a consistent, professional document that supports your accounting practices and provides transparency for both the payer and the payee. It can also be saved or printed quickly, which saves valuable time in financial record-keeping.

Here is the revised text with minimal repetitions:

To create a professional cheque receipt template, focus on clarity and simplicity. Ensure the following elements are present:

- Cheque Number: Include the cheque number for reference.

- Issuer’s Details: Add the name and address of the issuer for identification.

- Date: Clearly state the date the cheque was received.

- Amount: Specify the exact amount in both words and figures to avoid ambiguity.

- Payee’s Information: Provide the name and details of the person receiving the cheque.

- Signature: Ensure a space for the payee’s signature to confirm receipt.

Review the template for any redundancies and ensure each field serves a distinct purpose. Keep language precise, avoiding unnecessary phrases. For instance, replace generic terms with clear, direct descriptions to maintain professionalism.

Avoid clutter by limiting the use of excessive design elements. The focus should be on functionality and readability, keeping the template clean and easy to understand.

Cheque Receipt Template: A Practical Guide

How to Design a Simple Receipt Template

Key Elements to Include in Your Receipt

Step-by-Step Instructions for Customizing a Receipt Template

Best Practices for Formatting Your Receipt Template

How to Securely Store and Manage Receipts

Common Mistakes to Avoid When Using a Receipt Template

Begin by creating a clear and structured template. Avoid unnecessary complexity–just include the vital details. Focus on simplicity and readability to ensure that the receipt is both functional and easy to understand.

Key elements to include:

- Receipt Number: Unique identification for each receipt for record-keeping and tracking.

- Payee Information: The name of the person or business receiving the payment.

- Cheque Information: The cheque number, bank details, and issue date.

- Amount: Clearly display the payment amount in both numerical and written form.

- Payment Purpose: Brief description of the transaction or invoice reference number.

- Signature Area: Space for signatures from both the payer and payee for verification.

To customize your template, start by choosing a simple design that matches your business needs. You can use tools like Microsoft Word, Google Docs, or online templates for easy customization. Consider adding your company logo or customizing the color scheme, but avoid excessive decorations that may distract from the main content.

When formatting the template, make sure the font is clear and professional (like Arial or Times New Roman). Keep the margins consistent, and align the text neatly to create a balanced, easy-to-read layout. Use bold or larger font sizes for the important details like the amount and cheque number to make them stand out.

Store receipts securely by either keeping a physical filing system or using digital methods. For digital storage, use cloud storage services with encryption to protect sensitive data. Keep regular backups and use organized folders based on date, payment type, or client name for easy access. For physical receipts, file them in a secure place, such as a locked cabinet or drawer.

Common mistakes to avoid:

- Missing or incorrect details, like an incomplete amount or a wrong cheque number.

- Using hard-to-read fonts or crowded designs that make the receipt look unprofessional.

- Not securing receipts adequately, which can lead to loss or fraud.

- Failing to double-check for errors before issuing the receipt.

By following these guidelines, you will create a cheque receipt template that is straightforward, easy to customize, and secure for both record-keeping and verification purposes.

I replaced some repetitions while maintaining meaning and clarity.

To make your cheque receipt template more readable, avoid repeating the same phrases. For instance, if the template asks for the amount twice, once in words and once in digits, ensure that both sections are clear without unnecessary duplication. Focus on presenting the information logically and concisely.

Clarity and Flow

Each section should serve its purpose without redundancy. Keep the instructions simple but direct. For example, the “Payee” field can be labeled clearly as “Recipient Name” instead of repeating the term “Payee.” This helps streamline the template without losing any essential details.

Consistent Terminology

Use consistent terms for fields like “Amount” instead of switching between “Amount” and “Total” throughout the document. This reduces confusion and ensures clarity in the receipt template. Maintain consistency to improve the template’s readability and user experience.