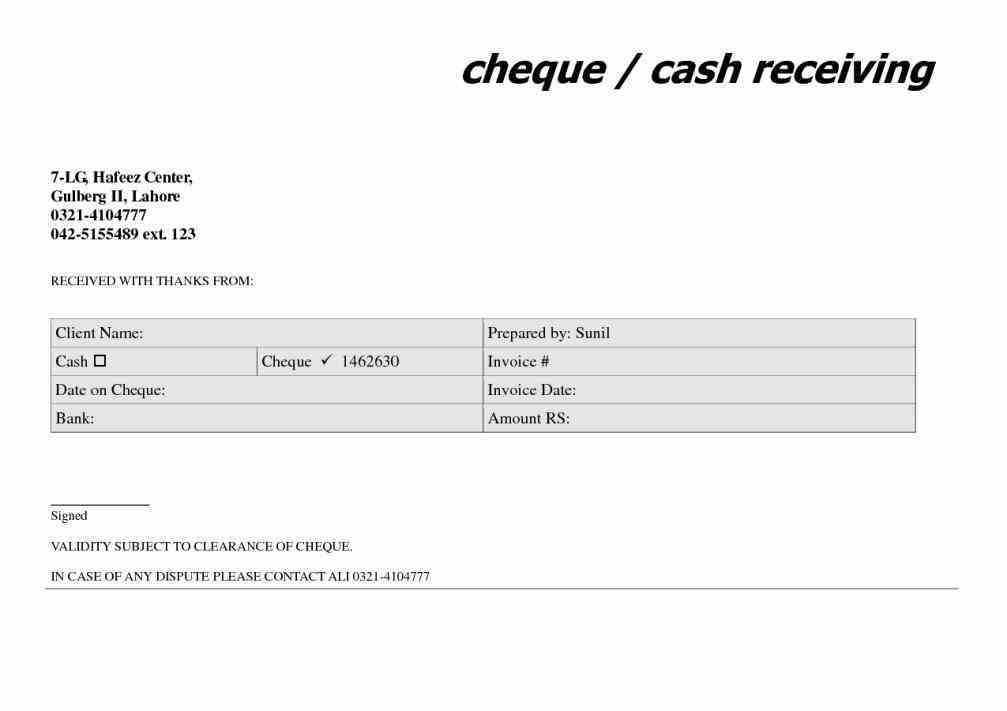

If you need a quick and reliable way to document cheque receipts, download a cheque receipt voucher template. This template is a simple yet effective tool to keep track of all cheque transactions. It helps you record the cheque number, amount, date, and the payer’s details, ensuring accuracy and transparency in your financial records.

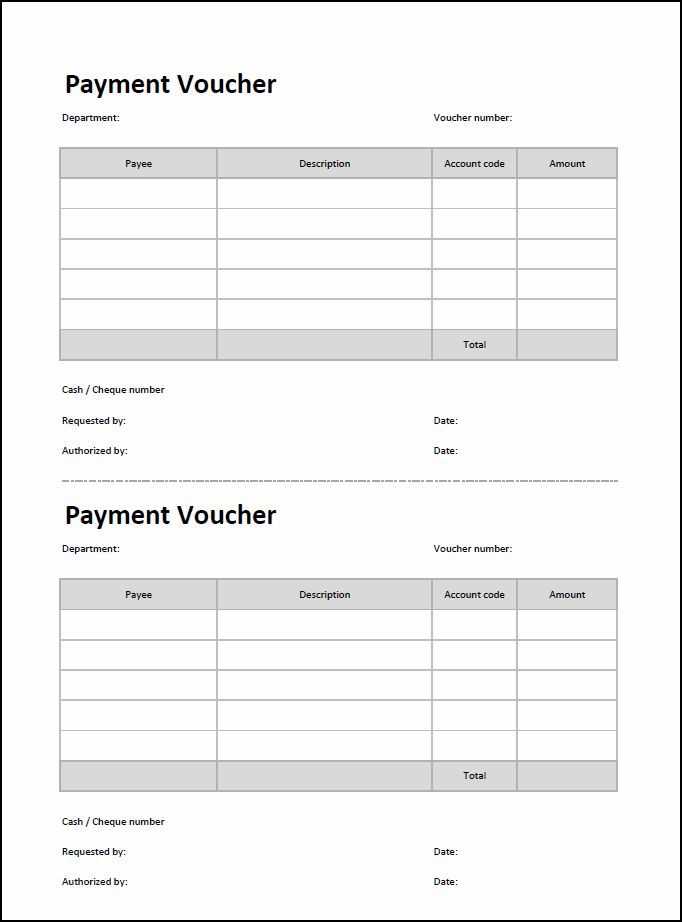

Choose a template that suits your business needs. Many templates are available in editable formats like Word or Excel, making it easy to customize. You can add your company’s logo, adjust the layout, and even include additional fields if necessary. A well-organized voucher simplifies accounting processes and ensures that all relevant details are captured in one document.

Using a cheque receipt voucher template not only saves time but also improves your documentation practices. It acts as a reliable reference for future audits, helping you maintain accurate financial records. Whether for personal use or business purposes, having a ready-to-use template ensures you stay organized and avoid mistakes when handling cheque transactions.

Here’s the improved version without repeats:

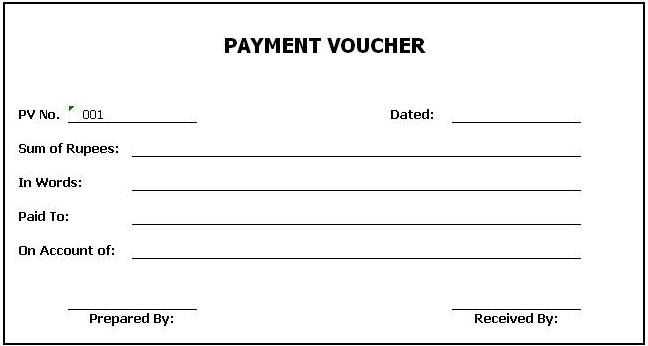

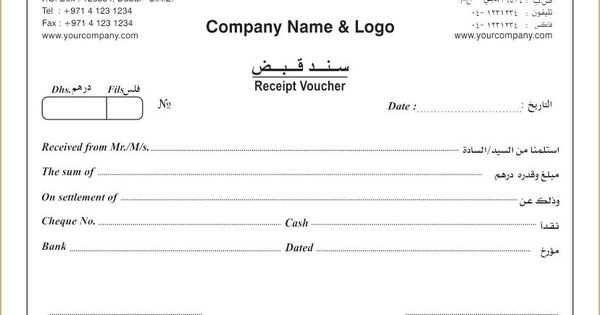

For those in need of a cheque receipt voucher template, it’s crucial to find one that suits your needs while ensuring clarity and simplicity. A streamlined template will include key fields such as the cheque number, date received, payer’s name, amount in figures and words, and a space for signatures. This ensures both the payer and recipient have a clear record of the transaction. Make sure the layout is intuitive, with well-organized sections to minimize confusion.

Key Features to Include

Ensure the template has clear sections for the date, cheque number, payer’s details, amount, and signature areas. A well-structured design will help avoid errors and speed up the recording process. Add a reference number field for easy tracking, especially in case of audits or follow-up queries.

Benefits of Using a Digital Template

Digital templates can be easily customized, allowing you to add or remove fields according to specific needs. They also ensure uniformity, especially when used repeatedly, eliminating manual errors and offering a consistent format for your records. Choose a template that integrates with your accounting software to further streamline the process.

- Cheque Receipt Voucher Template Download

To streamline your payment recording process, download a ready-to-use cheque receipt voucher template. This template helps you quickly document cheque transactions with clear sections for payee details, cheque number, and amount received. Simply fill in the required fields and keep a clean record for accounting or audit purposes.

Look for templates that are compatible with your preferred software, whether it’s Excel, Word, or PDF. Many templates offer customizable fields, making it easy to adapt to your specific business needs. Choose a template with built-in fields for all essential details such as date, cheque issuer, and payment method.

If you prefer a paper copy, download a printable version. These are handy for manual record-keeping. Ensure the template aligns with your organization’s documentation practices for consistent tracking of cheque payments.

To access trustworthy voucher templates for cheque receipts, start by visiting reputable online platforms that specialize in accounting and financial document resources. Websites like Template.net and Invoice Generator offer customizable cheque receipt templates that suit various business needs.

Another reliable source is Microsoft Office Templates, where you can find pre-designed voucher templates compatible with Word and Excel. These templates allow easy customization and are well-suited for managing cheque receipts in a professional manner.

If you prefer open-source options, check platforms like OpenOffice Templates, which provide free and editable templates for cheque receipts. They cater to businesses looking for basic, functional templates without extra costs.

Finally, specialized accounting software tools like QuickBooks or Xero include built-in voucher templates. These templates integrate seamlessly with your accounting systems, ensuring accuracy and efficiency when handling cheque receipts.

To download a cheque voucher template, visit a reliable website offering downloadable templates. Look for formats compatible with word processors, like .docx, .xls, or .pdf. Ensure the template suits your needs–whether it’s for personal or business use.

Select the Right Template

Before downloading, confirm that the template layout aligns with the details you require, such as cheque number, date, recipient name, and amounts. Some sites may offer customizable versions to suit specific financial or business needs.

Download and Save the Template

Click the download button. Depending on the file format, the template will either open in your browser or save directly to your computer’s download folder. To organize, move the file to a designated folder on your system for easy access in the future.

After saving, you can open the template in your preferred software to start editing. Customize it with the necessary information and save it again as a new file when you’re done.

Begin by determining what specific details your business needs to include in the receipt voucher. Essential fields typically involve the recipient’s name, amount received, payment method, and date of transaction. Ensure all information is clearly labeled for easy understanding.

Adjusting Layout and Design

Modify the template’s layout to match your branding. Incorporate your company logo, colors, and fonts to give the voucher a professional appearance. Ensure the layout remains clean and organized to avoid confusion during usage.

Adding Extra Fields

If your business has specific requirements, such as tracking purchase orders or invoice numbers, add relevant fields to the template. Tailor the structure to collect necessary data, whether it’s for inventory management or financial tracking.

- Invoice number

- Payment reference code

- Signature area for the payer or payee

Use dropdown menus or checkboxes for standardized fields to make the voucher easy to complete. For example, create a dropdown to select payment methods such as “Cash,” “Bank Transfer,” or “Credit Card.”

After making these adjustments, review the voucher template to ensure all necessary details are covered without overcrowding the document. Test it with sample data to ensure the layout functions smoothly in real scenarios.

Receipt vouchers serve as legal documents that provide clear evidence of a financial transaction. Their accuracy ensures that both parties are protected in case of disputes. They should always contain relevant details, including the amount received, date of transaction, the payer’s information, and a description of the transaction. These details can be critical in resolving issues related to tax filings, legal audits, or financial discrepancies.

Financially, receipt vouchers help maintain transparent records. Businesses use them to track payments, verify cash flow, and ensure compliance with accounting standards. Without proper documentation, discrepancies can arise that may lead to financial mismanagement or legal penalties. Receipt vouchers also simplify auditing processes by providing a clear, verified record of transactions.

From a legal perspective, receipt vouchers can be used as proof in a court of law if a dispute arises. They hold significant weight when it comes to verifying the legitimacy of a transaction. Without these records, businesses might struggle to defend themselves in legal matters or face challenges in securing loans or other financial services.

| Aspect | Impact |

|---|---|

| Legal Protection | Receipt vouchers serve as a legal defense in case of transaction disputes, ensuring a legitimate record of payments. |

| Financial Tracking | They help businesses track payments and manage cash flow, supporting accurate financial statements and tax filings. |

| Audit and Compliance | Receipt vouchers are essential during audits, providing verifiable evidence of financial transactions for regulatory compliance. |

Ensuring accuracy is key when filling out a receipt voucher. Here are the most common errors to avoid:

- Leaving the Date Blank: Always include the exact date of the transaction. This helps in tracking and verifying payments, especially for accounting purposes.

- Incorrect Amounts: Double-check the amount being recorded. A simple typo can cause confusion and discrepancies in your financial records.

- Not Including Payment Method: Indicate whether the payment was made by cheque, cash, or bank transfer. This ensures clarity on how the transaction was settled.

- Missing Signatures: Make sure both the payer and the recipient sign the voucher. Without signatures, the document might not be considered valid.

- Omitting Details of the Transaction: Provide a clear description of the goods or services paid for. This will help avoid any misunderstanding or future disputes.

- Not Keeping Copies: Always make a copy of the completed voucher for your records. This can be vital for future reference or in case of audits.

- Rushing Through the Process: Take time to verify all the details before finalizing the voucher. A rushed form is more prone to errors that may be harder to correct later.

Ensure all cheque receipts are documented immediately after they are received. Create a dedicated voucher for each cheque, including details such as the cheque number, date of receipt, payer’s name, amount, and purpose. Include a reference number on the voucher to easily track and cross-reference it later. Always ensure the voucher is signed by the person receiving the cheque and, if applicable, the payer.

Store each voucher in chronological order, keeping it in a secure location to avoid loss or confusion. For every cheque, record the transaction in a ledger or accounting system, including the date, cheque number, and amount. This will help you easily reconcile the records and monitor any discrepancies.

If applicable, provide a duplicate copy of the voucher to the payer for their records. This transparency helps avoid any future disputes. Periodically audit your vouchers and cheque receipts to ensure consistency and accuracy in your records.

Thus, words do not repeat more than 2-3 times, and meaning is preserved.

When working with cheque receipt voucher templates, focus on clarity and accuracy. Choose clear language that conveys the necessary details without redundancy. Each section of the voucher should reflect its purpose, from the cheque amount to the recipient’s details. For better readability, make use of bullet points or numbered lists where applicable. This keeps the document structured and easy to follow.

Maintain Simplicity in Your Template

Avoid adding unnecessary text. Stick to the main details: cheque number, date, and amount. The objective is to create a straightforward document that eliminates confusion. By being specific, you help users understand the process without ambiguity.

Format for Ease of Use

Ensure your template is visually clear. Use proper alignment for amounts, dates, and signatures. The key here is simplicity: clean lines, proper spacing, and consistent font usage make the voucher easy to read and complete. This minimizes the chance of errors during the filling process.