Prepare a clear and accurate year-end receipt template for your child care center to simplify the process of issuing receipts to parents. The template should include key details such as the child’s name, dates of attendance, and the total amount paid for the year. This ensures transparency and avoids confusion when parents need documentation for tax purposes.

Start by organizing the payment details for each child. List the services provided, including tuition fees, extracurricular activities, and any additional charges such as late fees or materials. Group payments by month or term to make it easy to track, and ensure that any discounts or credits are clearly noted.

Include a clear summary section at the bottom of the receipt, highlighting the total amount paid over the course of the year. This is especially helpful for tax purposes, as parents can easily refer to the full amount without sorting through individual payments. Make sure to use a readable font and format, keeping the information accessible and well-organized.

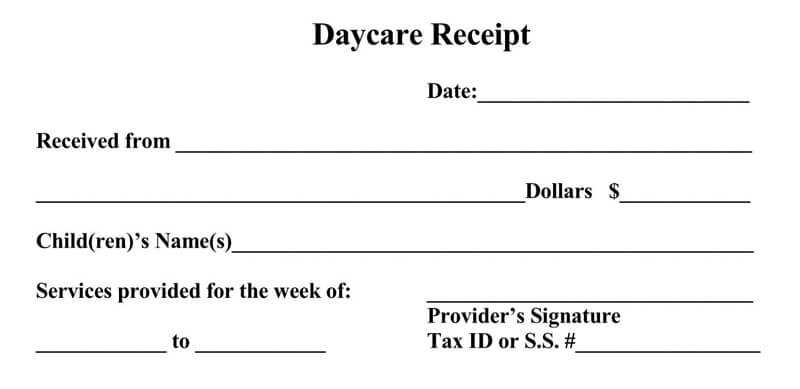

Finally, ensure all relevant contact information is included, such as the center’s name, address, and phone number. It’s also helpful to add your business’s tax identification number (TIN) for official records. This small detail will help both you and the parents keep everything in order for the year-end documentation process.

Here’s the revised version:

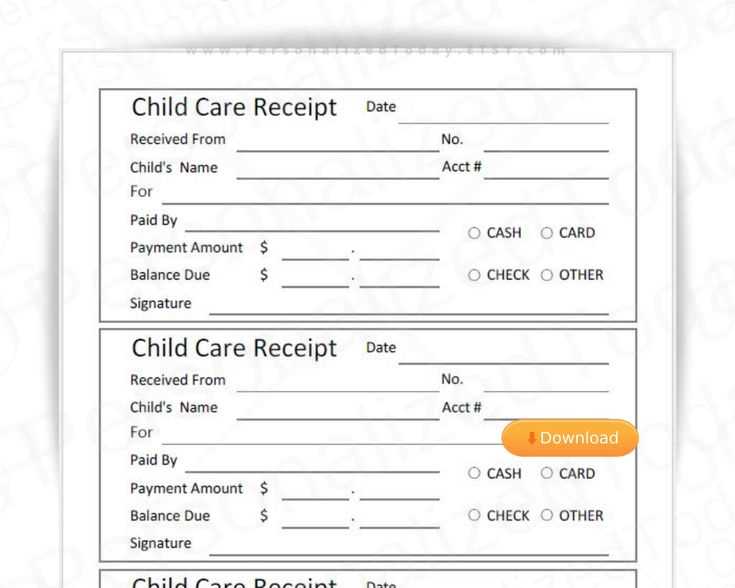

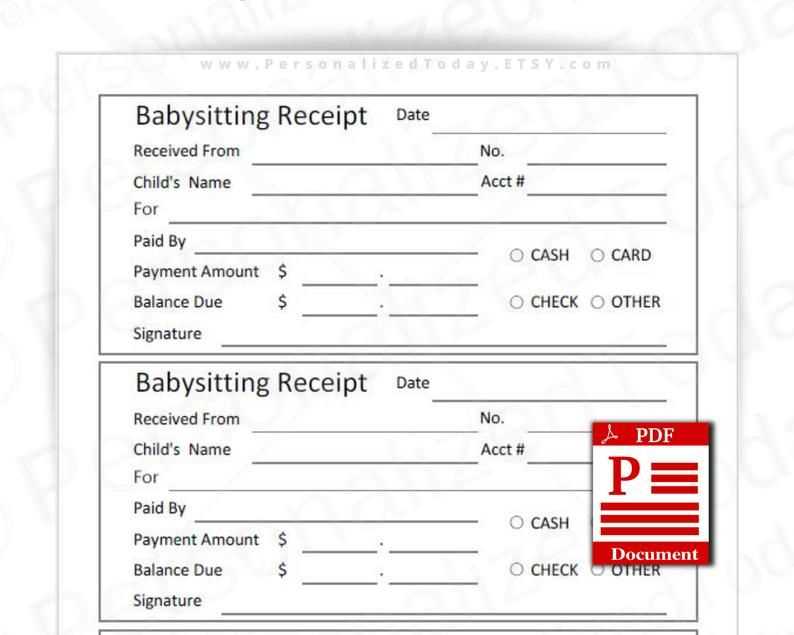

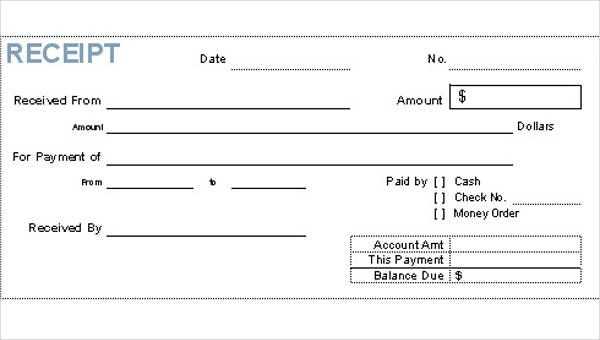

Make sure the receipt includes all necessary details for clarity and transparency. Below is a list of key elements you should consider:

- Child’s name: Clearly state the child’s full name to avoid confusion.

- Care center details: Include the name, address, and contact information of the center.

- Service period: Specify the exact dates covered by the receipt (e.g., from January 1 to December 31).

- Total amount paid: List the exact amount the parent or guardian has paid for the services during the period.

- Payment method: Indicate how the payment was made, such as by check, credit card, or cash.

- Itemized charges: Break down the costs for transparency, listing each service separately (e.g., tuition, extra activities, supplies).

- Discounts or adjustments: If applicable, include any discounts or adjustments made to the total amount due.

- Tax information: Add any relevant tax information if necessary for the parent’s tax records.

Ensure that the language used is simple and direct. Avoid unnecessary jargon to keep the receipt clear and easy to understand. Remember to keep a copy of the receipt for your records and send a copy to the parent or guardian promptly.

- Child Care Center Year-End Receipt Template

Creating a year-end receipt for parents or guardians is a simple yet crucial task for child care centers. This document serves as proof of payments made for the year, often required for tax purposes or reimbursements. A clear and accurate receipt ensures smooth communication and accountability between the center and the families. Here’s how to structure the template effectively:

| Information | Details |

|---|---|

| Child Care Center Name | Include the full name of the center. |

| Parent’s Name | List the full name of the child’s guardian. |

| Child’s Name | Provide the name of the child attending the center. |

| Receipt Number | A unique number for each receipt for easy reference. |

| Payment Period | State the beginning and end dates for the period covered by the receipt. |

| Payment Amount | Indicate the total amount paid for the period, itemized if necessary. |

| Payment Method | Note whether the payment was made by cash, credit card, or check. |

| Date of Payment | Record the exact date of the payment. |

| Authorized Signature | A signature from an authorized center representative for validation. |

Ensure that all sections are filled out accurately. Providing a well-organized receipt helps parents track payments and simplifies any necessary documentation for tax filing or reimbursement requests. A clean and professional format will also enhance trust in your child care service.

Begin by including the center’s name, address, and contact details at the top of the receipt. This makes it easy for parents to reference the information later. Ensure the receipt is clearly marked with the date the payment was made, as this will help parents track their expenses for tax purposes.

Include Parent and Child Details

List the parent’s name and the child’s name to avoid confusion. If the payment covers multiple months or services, break down the amounts for each, showing a clear total at the bottom. You may also include the payment method (e.g., cash, check, or online payment) for transparency.

State the Purpose of the Payment

Clearly indicate the service being paid for, whether it’s tuition, activity fees, or other related costs. This helps parents understand exactly what they are being charged for. Finish by summarizing the total amount paid, ensuring all calculations are accurate.

Ensure you include the total amount of fees paid by the parents throughout the year. This includes tuition fees, any additional charges for activities, or special programs. Provide a breakdown by month or term for transparency.

Clearly state the child’s enrollment dates and the number of days attended. This helps parents track the consistency of care provided during the year and ensures they can match the payment records.

Include tax identification details for both the child care center and the parents, as these are necessary for tax filing purposes. Ensure this information is updated and accurate.

List any deductions, such as discounts or subsidies, that the parents received. This prevents confusion and allows families to verify all adjustments made to their final payment statements.

Summarize the program’s services, including any changes in fees or offerings from the start to the end of the year. This gives parents a clear picture of what they’ve paid for and how services have evolved.

Provide a final balance statement, showing any outstanding payments or credits remaining at year’s end. This allows for smooth financial closure and helps prevent future discrepancies.

Use folders or files to categorize receipts by type (e.g., office supplies, meals, utilities) and date. This system simplifies the process of locating a receipt quickly when needed.

Digitize Receipts for Easy Access

Take photos or scan receipts and save them in cloud storage. Make sure to back up your files to avoid losing important documents. You can organize them into folders based on tax years or categories, making them easy to access during tax season.

Maintain a Receipt Log

Create a spreadsheet or log to track all expenses. Include details such as the date, vendor, and amount. This allows you to cross-check receipts with your records, ensuring that nothing is overlooked when filing taxes.

Keep the layout clean and organized. Ensure that each section is clearly labeled and easy to navigate. Avoid overwhelming the user with excessive text or complex formatting. Use tables to structure financial data, keeping columns and rows straightforward and readable. A simple, intuitive layout makes it easy for users to find the information they need quickly.

Clear Labeling and Grouping

Label each section with descriptive headings that reflect the content. Group related information together, such as payment summaries, fees, and deductions, to prevent confusion. Provide space for important details like the child’s name and care dates to stand out, making it easier for the user to track key details at a glance.

Accessible Data Presentation

Display the information in an easy-to-read format. Use large fonts for key figures like the total amount due or credits, and include sufficient spacing between sections. Limit the use of bold or underlined text to highlight only the most important details. This helps users process the data with minimal effort.

Check that all payment details are accurate. Double-check amounts received, payment methods, and any discounts or adjustments applied. A common mistake is overlooking a payment type, leading to discrepancies on the receipt. Ensure that you include all applicable taxes or fees so that the receipt reflects the true amount paid.

Use the correct format for dates. Often, year-end receipts are issued with incorrect dates, especially when there’s a delay in processing payments. Make sure to use the exact date of payment and avoid any confusion with transaction dates from previous months.

Verify that all required information is included. Omitting key details, like the name of the child care center or the payer’s details, can create problems. Ensure that the receipt lists the correct legal name of the center, the full name of the payer, and a description of services provided.

Avoid vague descriptions of services. Provide a clear breakdown of services received, including dates of care and specific charges. This helps prevent confusion and ensures the receipt can be used for tax or reimbursement purposes without additional clarification.

Cross-check for duplicate entries. Sometimes payments are mistakenly entered more than once, leading to incorrect totals. Before issuing receipts, verify that no duplication of charges has occurred and that each payment is correctly recorded.

Ensure your year-end receipts reflect the unique payment arrangements of each family. Tailor the receipts for different payment structures, whether they involve monthly installments, lump sum payments, or financial aid contributions. Here’s how to adjust your templates:

- Monthly Payment Plans: Break down the year’s payments into individual monthly entries. Include the payment date, amount, and remaining balance for clarity.

- Lump Sum Payments: Clearly highlight the total amount paid in one lump sum, noting the total balance paid off for the year.

- Discounts or Financial Aid: Specify any discounts, scholarships, or financial aid applied, including the exact amounts and dates for reference.

- Multiple Payment Methods: For families who use different payment methods (checks, credit cards, etc.), ensure that each payment method is listed separately with the corresponding amounts.

- Tax Information: If applicable, indicate the tax-exempt status or tax-deductible amounts. This helps families who might need it for filing their taxes.

Tailor each receipt according to the specific payment structure, ensuring families receive a clear summary of their financial history with your center.

Make sure your year-end receipt template for a child care center includes a clear breakdown of services provided. This will make tax filing easier for parents and ensure all necessary information is included. List each service (e.g., full-time care, after-school care) along with its cost and dates of service.

Itemized Details

Be specific when listing each service. For example, if the child attended for certain months only, include that information. This avoids confusion and guarantees clarity. Providing a total amount for each section helps parents keep track of their payments throughout the year.

Payment Information

Always include the payment method used (e.g., cash, credit, check) and the date payment was received. This will be helpful when parents need to reconcile their financial records.