Providing clear and organized receipts is a fundamental part of running a successful child care service. Whether you operate a home-based daycare or a larger facility, offering professional receipts to parents helps maintain accurate financial records and builds trust. A well-designed receipt template saves time and ensures consistency in documentation.

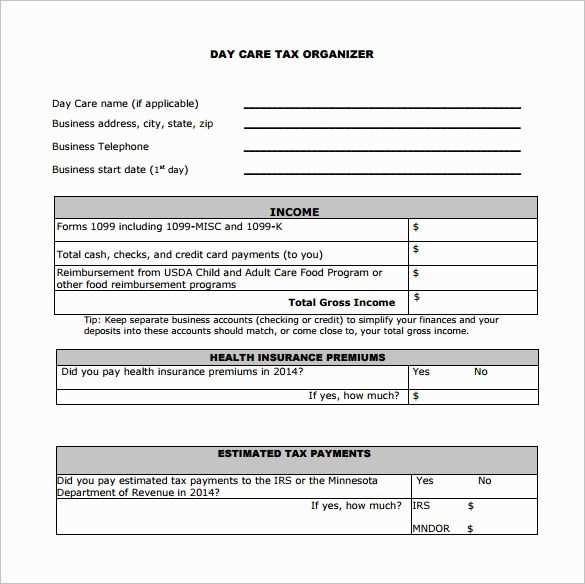

A typical child care provider receipt should include essential details such as the provider’s name, contact information, the child’s name, the service period, and a breakdown of charges. This transparency not only helps parents track payments but also proves invaluable during tax filing or reimbursement claims.

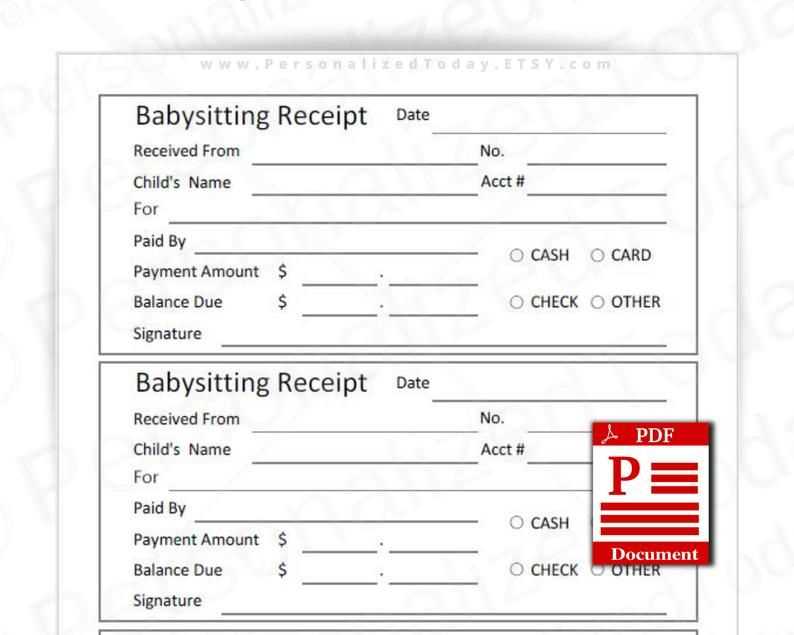

Using a pre-made template streamlines the process. Customize it with your logo and personal details to give it a professional touch. Ensure that it allows space for noting payment methods, service descriptions, and any applicable discounts or late fees. Providing a receipt at each transaction is a small step that offers long-term benefits for both you and the families you serve.

Here’s the corrected version with reduced repetitions:

To create a clear receipt for child care services, be concise and include the following key details: the provider’s name, address, phone number, and the child’s name. Specify the dates for which care was provided, the hours, and the hourly rate or total amount due. Include a unique receipt number for tracking purposes. Make sure to outline any additional fees, such as for supplies or transportation, and provide a clear breakdown of the total amount charged. Always include the method of payment, such as cash or check, and a signature line for both the provider and the client. This ensures a professional, transparent record of the transaction.

- Child Care Provider Receipt Template

A child care provider receipt should clearly list key details such as the services provided, the amount paid, and any applicable dates. This helps both parents and providers maintain accurate records for their own use. The following components are necessary for an effective receipt:

| Field | Description |

|---|---|

| Provider’s Name | The name of the child care provider or business. |

| Provider’s Contact Information | Phone number and email address of the provider. |

| Parent’s Name | The name of the parent or guardian. |

| Child’s Name | The name of the child receiving care. |

| Service Date(s) | The date(s) for which the services were provided. |

| Description of Services | A brief description of the child care services provided (e.g., full day care, after-school care). |

| Total Amount Paid | The total amount paid for the services. |

| Payment Method | How the payment was made (e.g., cash, check, or credit card). |

| Receipt Number | A unique reference number for the receipt, which can be useful for tracking purposes. |

| Provider’s Signature | The signature of the child care provider to validate the receipt. |

Using a template with these components ensures the receipt is complete and professional. You can create a custom receipt template or find pre-made ones online for easy use. Make sure to keep a copy for your records and provide the parent with their copy at the time of payment.

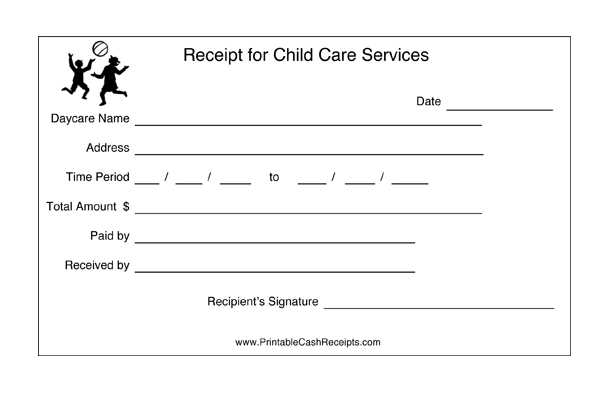

A clear structure ensures that both the provider and the parent can easily track payments and services. Begin with the name of the child care provider and their contact details. This includes the business name, address, phone number, and email. It’s important to provide this information at the top for quick identification.

Next, include the date of service. This should specify the period during which the child care was provided, such as the dates of attendance or the billing period. This helps clarify what the payment covers.

The receipt should list the child or children receiving care. This personal information ensures there’s no confusion about who the services were provided for.

Detail the specific services rendered. Include hourly rates, number of hours worked, or flat fees. Break down any additional charges like late fees or special activities, if applicable.

Finally, the total amount due must be prominently displayed. This final total should reflect any discounts, payments made in advance, or other adjustments. A clear breakdown makes it easier for parents to verify charges and for providers to keep accurate records.

Begin by including the child’s full name and the date of birth. This helps identify the child under care clearly. The caregiver’s full name, contact information, and business address should also appear. Make sure to mention the service provided, whether it’s daycare, after-school care, or another type of care, along with the specific dates for the service rendered.

Include an accurate breakdown of the payment, specifying hourly or daily rates, total time or days worked, and the final amount due. If applicable, include any discounts, taxes, or additional fees for services like transportation or meals.

Don’t forget to note the payment method (e.g., check, cash, or electronic transfer) and the payment date. If the receipt is for a deposit or partial payment, clarify the balance remaining.

The template should also feature a clear statement indicating that the care services were provided and that the receipt reflects the agreed payment. A thank-you note can also be a nice touch, expressing appreciation for the client’s business.

| Information | Details |

|---|---|

| Child’s Name | [Full Name] |

| Date of Birth | [DOB] |

| Caregiver’s Name | [Caregiver’s Full Name] |

| Service Provided | [Type of Care] |

| Service Dates | [Start Date] – [End Date] |

| Payment Breakdown | [Hourly/Flat Rate], [Total Time/Days], [Total Amount] |

| Payment Method | [Cash/Credit/Card/Check/Other] |

| Payment Date | [Date] |

| Balance Due | [Amount Remaining, if applicable] |

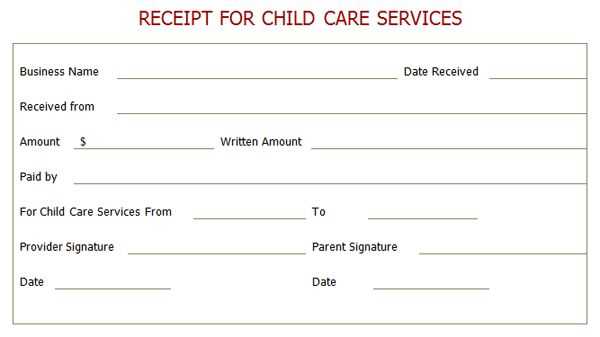

Use a clean and simple layout. The most important information should be easy to find, so prioritize readability by utilizing clear fonts and enough white space between sections. Avoid cluttering the receipt with unnecessary details.

- Heading and Logo: Place your business name or logo at the top. This establishes brand identity and gives the receipt a professional touch.

- Date and Time: Include the exact date and time of the transaction in a clear and easy-to-read format. This is crucial for record-keeping.

- Itemized List: Clearly list all services or products provided, along with their individual costs. Group similar items together for easier reference.

- Total Amount: Make the total amount bold or larger in size to ensure it stands out. This helps customers quickly locate the most important piece of information.

- Payment Method: Indicate whether the payment was made by cash, credit card, or another method. This provides a clear record for both parties.

- Contact Information: Ensure your contact details (phone number, email, or website) are visible in case the customer needs to follow up with you.

Lastly, keep the layout consistent across all receipts. A uniform format helps customers easily understand and trust the document, which can build loyalty and repeat business.

Customizing a receipt for child care services can make a big difference in clarity and professionalism. Start by adding specific fields that align with the needs of both the caregiver and the parent. Personalize each receipt to reflect the unique care provided to each child.

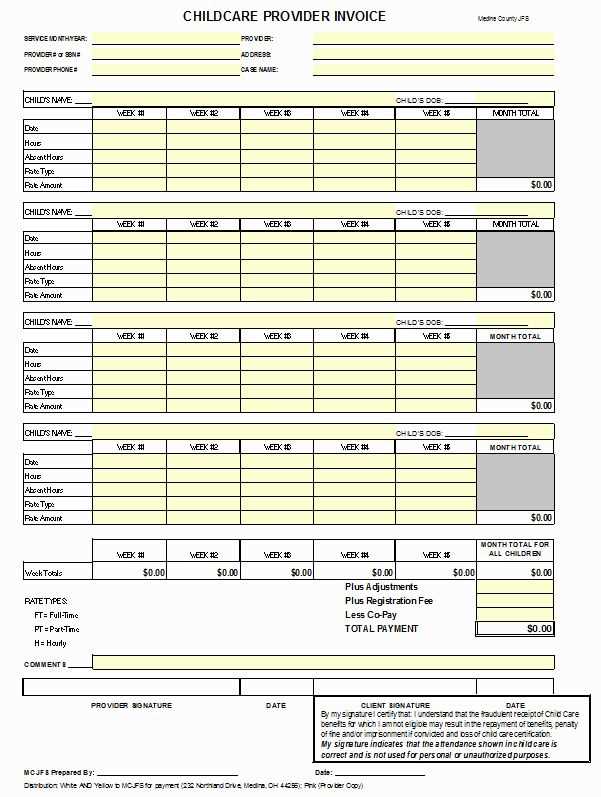

Adjusting Time and Date Information

Include accurate details for the time spent caring for the child. Customize the receipt with the start and end times of each day, including any special hours such as early drop-offs or late pick-ups. This can ensure transparency in billing for non-standard hours.

Adding Extra Services or Activities

If additional services like meals, tutoring, or outings are provided, list them separately. Include a section for extra charges and detail the nature of each service to keep everything transparent. For example, note if special events, such as field trips, were part of the care on a given day.

- Special events: field trips, holiday care, etc.

- Meals provided: breakfast, lunch, snacks

- Educational activities or additional lessons

Adjust each category to match the care arrangement. Whether it’s a one-time event or a recurring charge, clearly show what was included on the receipt.

Customizing Payment Methods

Be sure to list the payment method used (e.g., cash, check, or credit card). For repeat clients, create a space where recurring payments or discounts can be applied. This will make managing ongoing services easier for both parties.

- Payment type: credit card, bank transfer, cash

- Discounts for multiple children or extended hours

- Deposit requirements, if applicable

Tailor each receipt to reflect these details, ensuring both the caregiver and parents are on the same page regarding costs and services rendered.

Double-check all the details before finalizing a receipt. Incorrect information, such as typos in names, addresses, or payment amounts, can lead to confusion and disputes.

- Missing or incorrect dates: Always ensure the date of payment is clearly stated. If you fail to include the correct date, it could affect tax records or financial tracking.

- Omitting service details: Clearly list the services provided or items purchased. Failing to do so can leave room for misunderstandings or incomplete records.

- Forgetting payment method: Always specify how the payment was made (e.g., cash, check, credit card). This prevents potential disputes over how the transaction was completed.

- Lack of provider identification: Clearly include your name, business name, and contact details. Without this, the receipt may not be valid for future reference.

- Overlooking tax information: If taxes apply, make sure to list the exact amount and include your tax ID number if necessary. Missing tax details can lead to confusion or legal issues.

- Not providing a receipt number: Assigning a unique receipt number helps track payments and organize records. This step is especially useful for accounting and audits.

By addressing these common mistakes, you can ensure your receipts are accurate, professional, and legally compliant.

Use online platforms like Google Docs or Microsoft Word to quickly create and customize child care provider receipt templates. These tools offer pre-made templates that you can adjust to fit specific needs, such as adding payment details, services provided, and dates. With simple formatting tools, you can change fonts, colors, and layout to match your style.

Free Template Generators

There are numerous free template generators that allow you to create receipts without starting from scratch. Websites like Canva or Adobe Spark let you choose from a variety of receipt designs, and you can modify them to fit your requirements. These tools often come with drag-and-drop functionality, making it easy to add logos or personal touches.

Spreadsheet Tools

Spreadsheet software such as Google Sheets or Excel can also be used to generate child care provider receipts. Templates in these programs can automatically calculate totals, taxes, and other amounts. Use functions to streamline your workflow and create professional-looking receipts that are easy to update with new information.

If you want to add more synonyms or make the style more formal, let me know!

When crafting a receipt template for child care services, be sure to include key details such as the date of service, the provider’s name, and the amount charged. This ensures the receipt is both clear and professional. You should also outline the hours worked or the type of service provided for transparency.

Details to Include

Start with the provider’s full name, address, and contact information. List the child’s name, service type, and the corresponding date and time. The total amount due and payment method (cash, check, or card) should be clearly marked. Adding a brief note about any additional services provided, like meals or extended hours, can also help.

Optional Additions

If you want to make your receipt even more customizable, consider adding a section for feedback or next payment due dates. This can enhance communication between you and the parents, ensuring that everything is transparent and easy to follow.