Use a child care receipts template in Canada to ensure your records are clear and complete for tax purposes. A simple template allows you to keep track of payments made for child care services, which is necessary for claiming eligible expenses. By using this template, you can avoid errors when filing your taxes and ensure you meet all requirements for government benefits and credits.

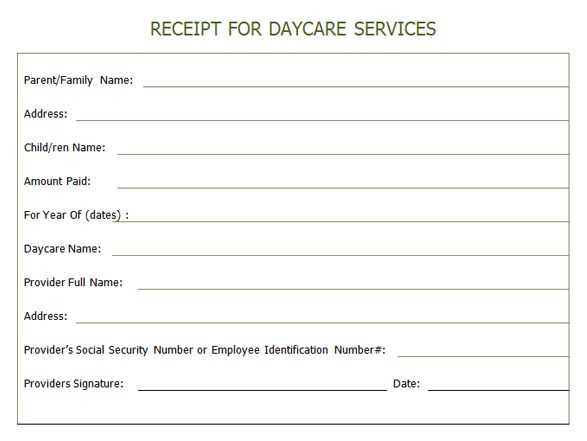

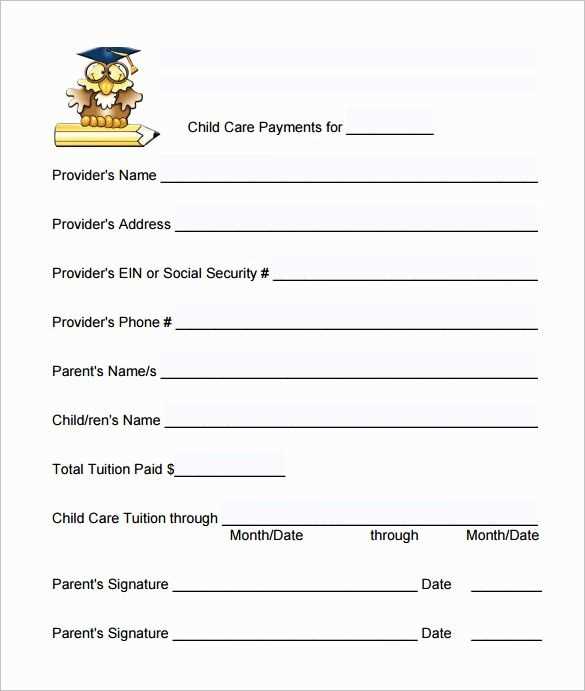

Ensure that the template includes all key information: the provider’s name, address, and business number, the total amount paid, the dates of service, and the child’s name. This information is crucial when submitting claims to the Canada Revenue Agency (CRA) or when applying for tax deductions related to child care costs.

To make sure you’re using the correct format: check with the CRA or your tax preparer for any specific guidelines related to receipts. It’s also a good idea to keep a copy of the receipt for your own records and verify that the template aligns with what is expected for reimbursement or credit purposes.

Sure! Here’s the revised version with fewer repetitions of the word “Child Care”:

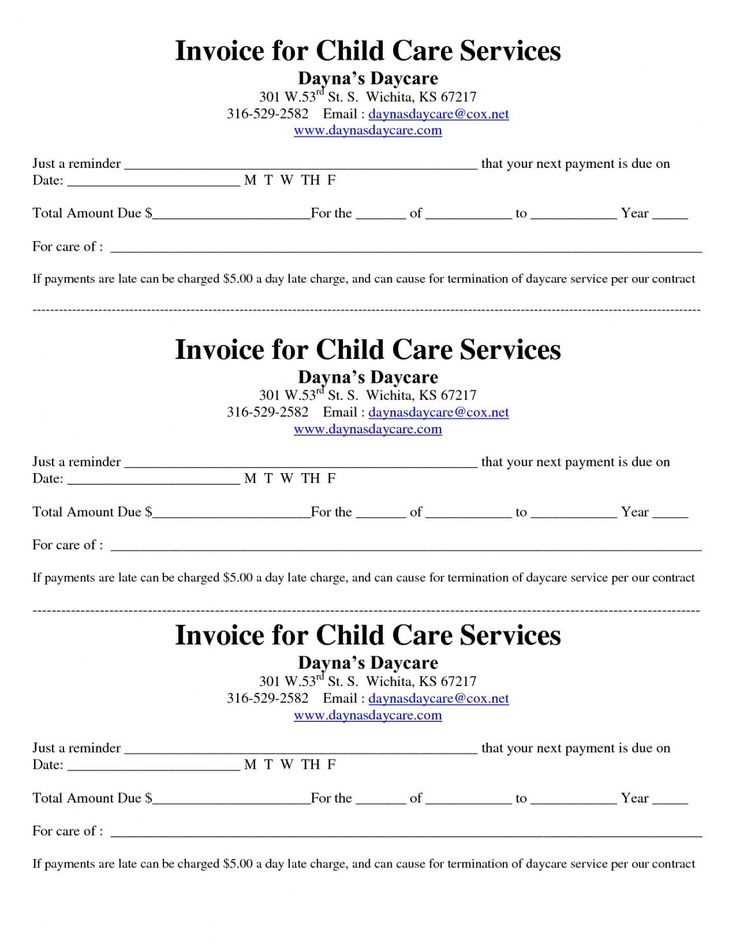

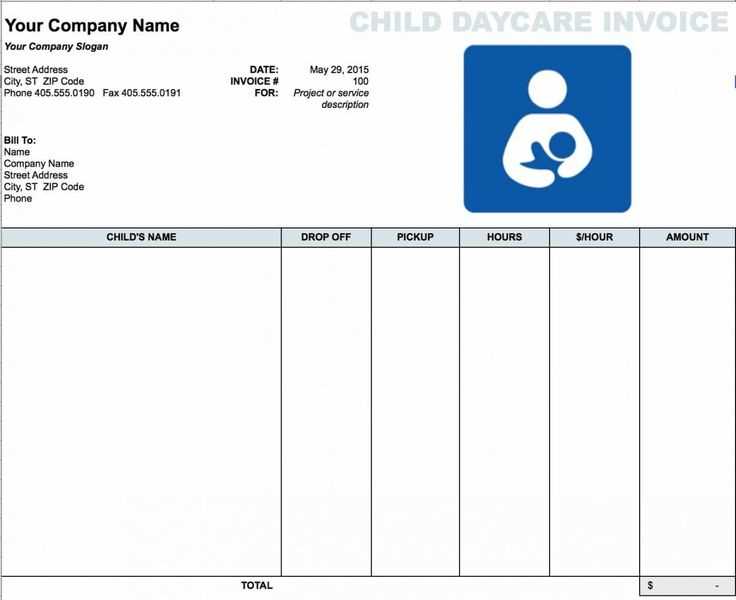

For a clear and professional receipt template, ensure you include the following details: the provider’s name, contact information, service dates, and total payment. Also, specify the type of care provided, whether it was part-time, full-time, or occasional. It’s helpful to break down the costs, such as hourly rates or fixed amounts, to enhance transparency.

Details to Include:

Use a simple layout with a clear breakdown of the hours worked, services rendered, and any applicable taxes. This ensures both parties have a detailed record of the transaction. Including a unique receipt number can help with record-keeping.

Formatting Tips:

Consider using bold headings to highlight key information, such as payment totals and the care provider’s contact details. This makes the document easier to read and helps prevent any confusion.

- Child Care Receipts Template in Canada

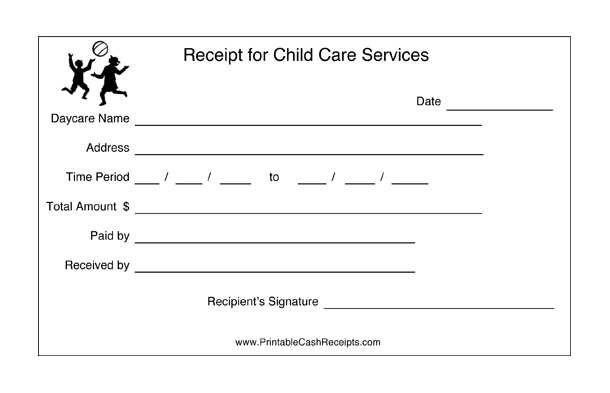

To create a child care receipt in Canada, include the provider’s name, address, and contact information. Clearly state the service dates and total amount paid. Be sure to list the child’s name and age, along with the type of care provided, such as daycare or after-school care. If applicable, add the provider’s business or registration number. This will help parents claim child care expenses on their tax returns.

For each transaction, ensure that the receipt includes the amount paid, whether it’s for a single day or a longer period. Provide a breakdown of services if the child care provider offers different rates for various activities. Include any additional charges, such as late fees, if applicable.

Make sure to provide the receipt in a clear format, with a space for both the parent and provider to sign. Keep a copy for your own records. It’s important for both parties to have accurate receipts for tax purposes, as well as for verifying expenses during audits or disputes.

Receipts for child care expenses must meet specific legal criteria to be valid for tax purposes in Canada. They should contain particular information, including the service provider’s name, address, and phone number. Additionally, the receipt must specify the dates of service, the amount paid, and the name of the child receiving care.

Required Details for Legal Compliance

| Detail | Description |

|---|---|

| Service Provider Information | Full name, address, and phone number of the child care provider. |

| Dates of Service | Exact dates when child care services were provided. |

| Amount Paid | Exact dollar amount paid for the services rendered. |

| Child’s Name | The name of the child receiving care must be included. |

Additional Considerations

If you are using a daycare or care center, make sure they provide a formal receipt. For informal care arrangements, like a nanny, a signed and dated receipt is required to ensure tax eligibility. Always verify that the receipt is complete and accurate before submitting it for claims.

To create a receipt template for tax purposes, make sure it includes specific information required by Canadian tax laws. Start by including the business name, address, and contact information at the top. Include a unique receipt number for tracking. Clearly state the date the payment was made and the service provided or goods sold.

Include Detailed Payment Information

Specify the amount paid and the method of payment (e.g., cash, credit card, bank transfer). If applicable, list any taxes collected, such as GST or HST, and the amount of tax charged. Be sure to include both the net amount and the tax amount separately.

Contact Information and Signature

At the bottom, add your business’s contact information again. Include a space for the signature of the person receiving the payment or a digital signature if applicable. Keep a copy of all receipts for tax filing purposes and ensure that they are easily retrievable in case of an audit.

How can I assist you with your current task or content creation request today?

Customize your receipt template to reflect your brand and specific needs. Begin by including your business name, logo, and contact details at the top of the template. This ensures recipients can easily identify your company. Adjust the font, color scheme, and layout to align with your branding style.

Update Payment Information

Modify the payment fields to match your service. Include the payment method, date of transaction, and any relevant reference numbers. If applicable, add tax breakdowns or discounts to make the receipt more detailed and transparent.

Add Special Notes or Terms

If you have any specific policies or notes for customers, add them at the bottom of the receipt. This could include return policies, warranty details, or special instructions. Keep it concise but clear.

Make sure all the details on your receipts are accurate and clear. Double-check the names, dates, and amounts before submitting the document. Here’s a list of common mistakes to avoid:

- Missing or Incorrect Dates: Ensure the date on the receipt matches the date of the transaction. Incorrect dates can delay reimbursement or tax claims.

- Omitting Provider Information: Always include the provider’s full name, address, and contact details. Missing information can lead to confusion or rejection of your submission.

- Incorrect Amounts: Verify that the amounts listed are correct, including taxes and any additional fees. An incorrect total can cause delays or errors in financial reporting.

- Not Including Item Descriptions: If applicable, include a description of the services or items purchased. Vague or missing descriptions may make it difficult to identify the expense.

- Unclear Payment Method: Specify the payment method used, whether cash, credit, or another method. Lack of clarity can lead to doubts about the authenticity of the transaction.

Handling Errors on Receipts

If you discover an error after submission, contact the provider to request a corrected receipt. Make sure to act quickly to avoid issues down the line.

Final Check Before Submission

Before submitting your receipts, review each one to ensure all details are correct. Taking a few extra minutes to verify the information can save you from potential problems later on.

To claim child care deductions in Canada, submit your receipts through your annual income tax return. These receipts must be filed with the Canada Revenue Agency (CRA) either online or by mail.

If filing online, use the CRA’s certified software or My Account portal. Both methods allow you to easily attach digital copies of your receipts. Alternatively, if filing by paper, include the physical receipts with your tax return form.

| Method | Details |

|---|---|

| Online via CRA My Account | Upload receipts directly through My Account or using CRA-approved software. |

| Online via Certified Tax Software | Attach digital receipts when filing taxes through CRA-certified software. |

| By Mail | Send original receipts along with your tax return form to the appropriate CRA address. |

Ensure that the receipts are clearly legible and include the required details: the caregiver’s name, address, and Social Insurance Number (SIN), as well as the total amount paid for child care services.

Submitting receipts through the proper channels will help ensure that your tax deduction claims are processed efficiently by the CRA.

Use a clear, concise child care receipt template to keep track of payments for child care services. A well-organized receipt helps ensure you have accurate records for tax purposes.

- Include the date of payment and the service period.

- Specify the child care provider’s name, address, and contact details.

- List the services provided, including hourly or daily rates.

- Note any additional charges or discounts applied.

- State the total amount paid.

- Ensure that both the payer’s and provider’s signatures are included, if applicable.

Use this structure to avoid confusion and keep accurate records for future reference or tax filings.