Use a child care tax receipt template to simplify the process of claiming child care expenses. This document is designed to meet the requirements for tax deductions and credits, ensuring accuracy and efficiency during tax season.

Start by including the provider’s name, address, and contact information. This is necessary for verification purposes. Include the dates of service and the amount paid for each session, along with a clear breakdown of any additional fees.

Make sure to specify the child’s name and age, as this information will help distinguish the care provided. Keep receipts organized and accessible, as they will be needed for tax filings and potential audits.

Remember that keeping a detailed record will support your tax filing and may lead to deductions that reduce your overall tax liability. This template can be easily adapted for different child care services.

Here is the corrected version:

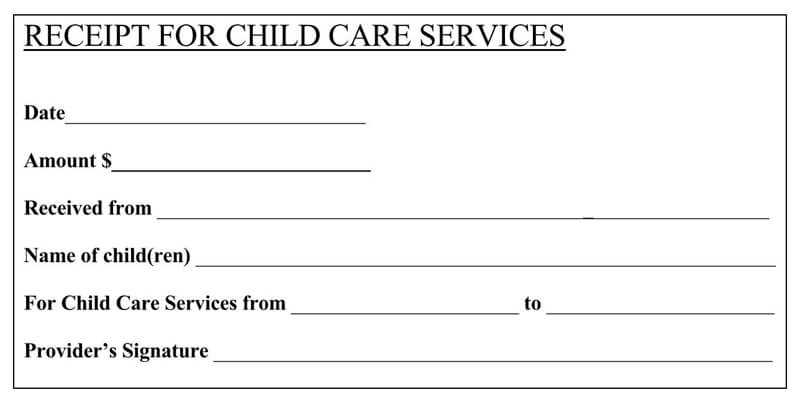

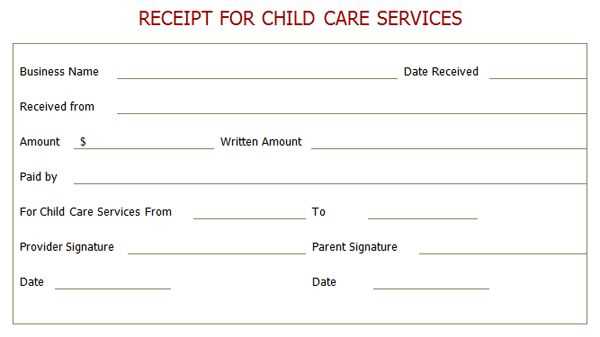

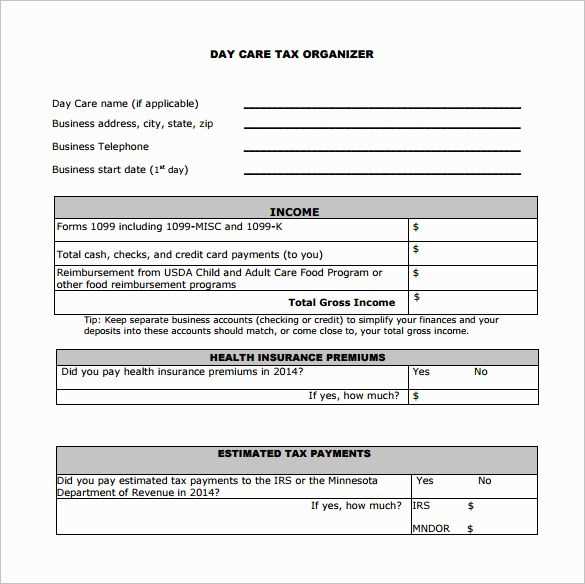

To create a child care tax receipt, use clear headings and include the necessary information for accurate reporting. Ensure that the receipt contains the name and address of the child care provider, the period of care, and the total amount paid. Below is a basic template you can use:

| Field | Details |

|---|---|

| Provider Name | Enter the name of the child care provider |

| Provider Address | Enter the address of the provider |

| Period of Care | Start and end dates of the care provided |

| Total Amount Paid | Enter the total amount you paid for the care during the period |

| Tax Identification Number (TIN) | Include the provider’s TIN, if applicable |

Make sure the receipt is signed and dated by the provider to confirm its authenticity. This ensures that you have all the required details to claim child care expenses when filing your taxes.

- Child Care Tax Receipt Template

Use the following details when filling out a child care tax receipt template to ensure accurate documentation for tax purposes:

Key Information to Include

- Child care provider’s name, address, and phone number.

- Taxpayer’s (parent’s) information and the child’s name.

- Total amount paid for child care during the tax year.

- Date(s) child care services were provided.

- Provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN).

Template Usage Tips

- Ensure the provider’s details are correct and match their tax records.

- Double-check the dates and amounts to avoid discrepancies.

- Retain a copy of the receipt for your personal records and submit it with your tax return.

To create a tax receipt for parents’ child care, start by including the provider’s full name, address, and contact information. Clearly state the child care services provided, along with the total amount paid by the parents. Specify the time period the services covered, such as weekly or monthly dates.

Include Required Legal Information

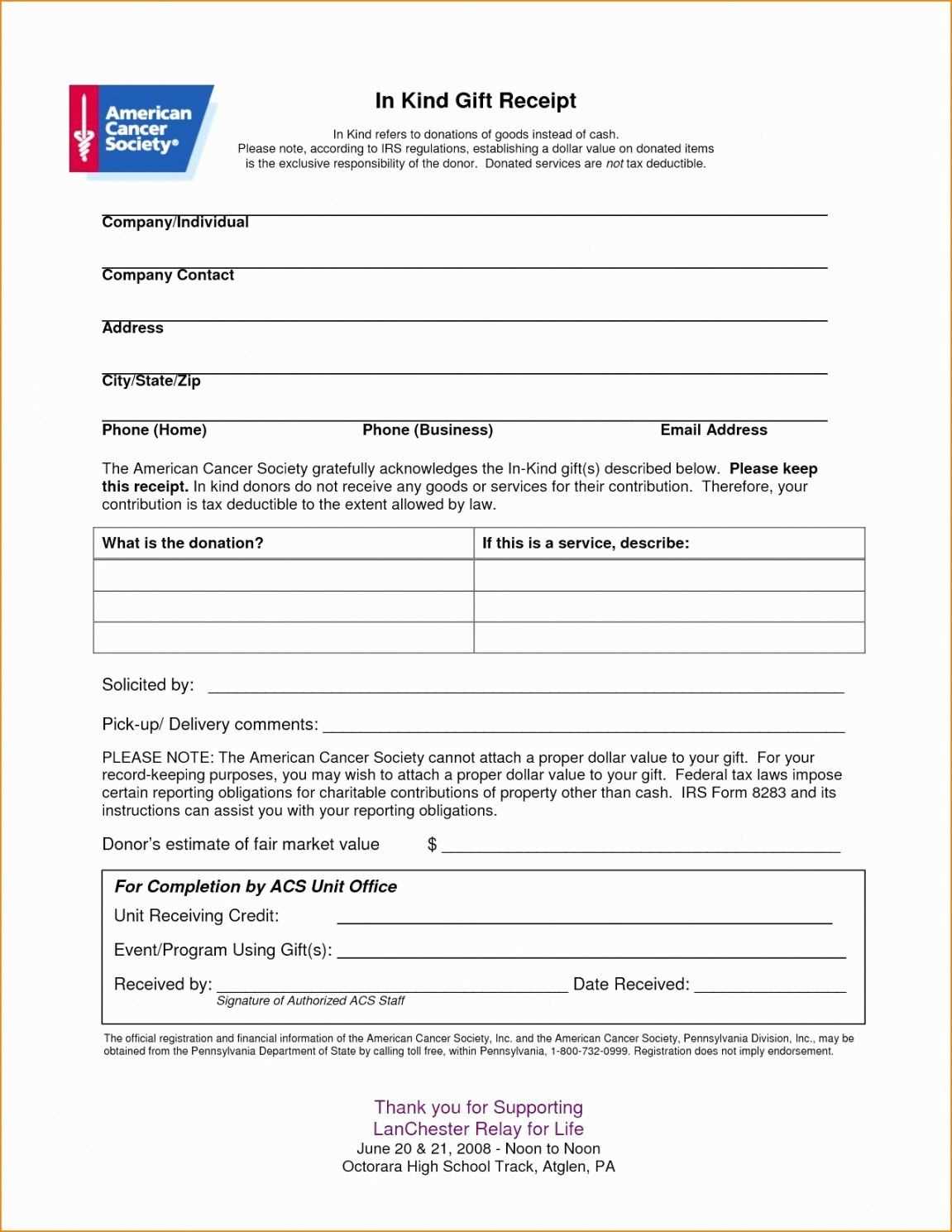

Ensure the receipt includes your business tax identification number or social security number, as required by local tax laws. Make sure to mention if the receipt is for a tax-deductible service to help parents claim their child care expenses.

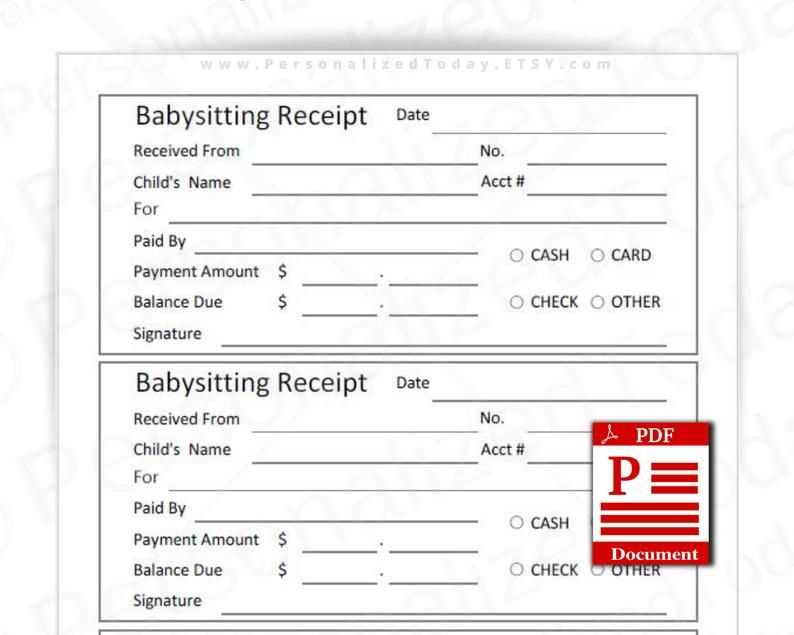

Clarify Payment Details

Break down the payments into categories, such as hourly rate, weekly rate, or any additional charges for extra services. Clearly mention if payments were made in cash, cheque, or other methods, and the date of each transaction. This helps parents verify all deductions they may be entitled to on their taxes.

Include the name, address, and phone number of the child care provider. This helps confirm the identity of the service and establishes its credibility for tax purposes. Make sure to add the provider’s business registration number or license number, as required by local tax laws.

Dates of Service

List the exact dates child care was provided. This ensures that only relevant expenses are accounted for in the tax filing period. If the child care is ongoing, include start and end dates for each period of service.

Amount Paid

Clearly state the total amount paid for the child care services during the reporting period. Include a breakdown of costs if the charges vary based on hours or services provided. This transparency helps support claims and avoid confusion.

Note any additional fees, such as late pick-up charges or extra services like meals, to ensure all costs are reflected accurately.

Lastly, include the signature of the child care provider or an authorized representative, which verifies the authenticity of the receipt.

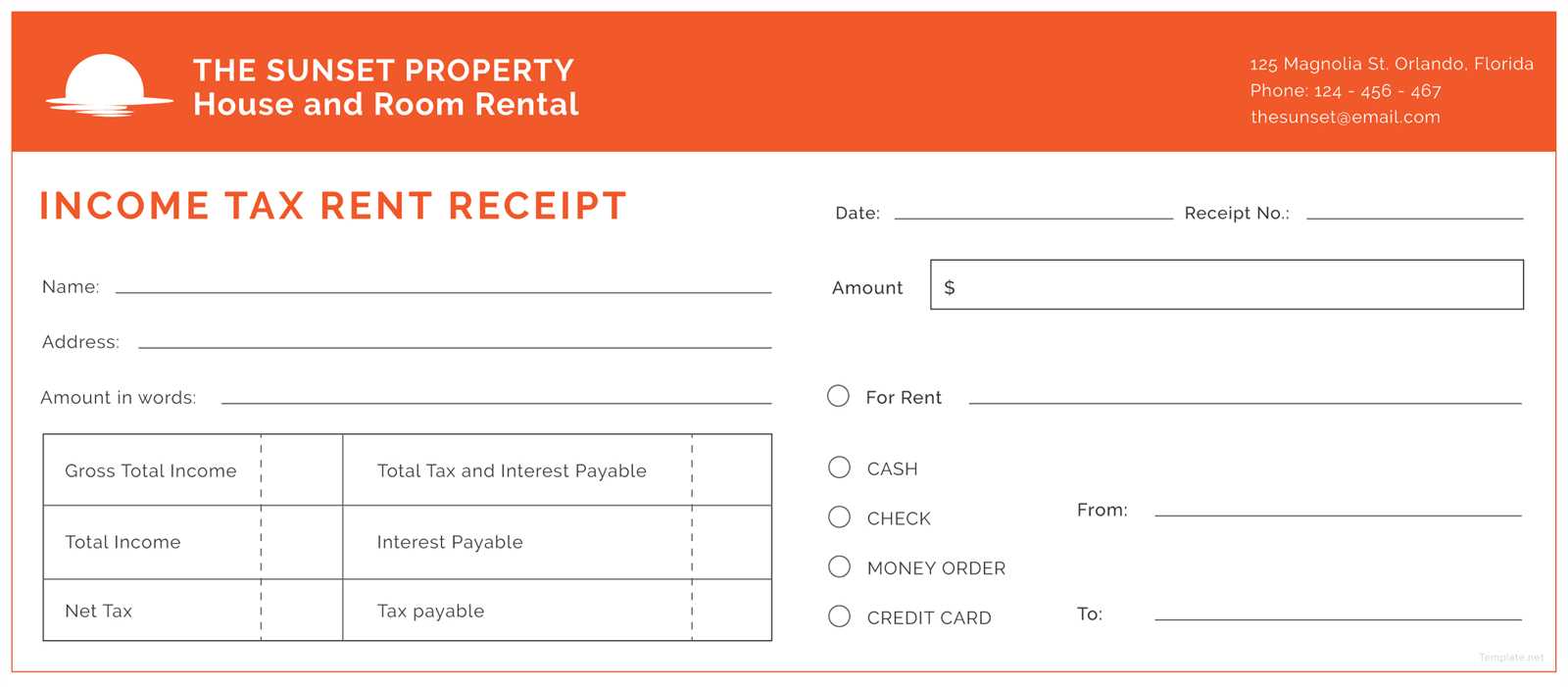

Ensure the layout of your tax receipt template is straightforward and user-friendly. Place the title, such as “Tax Receipt,” at the top in bold for immediate recognition. Below that, clearly label the receipt with a unique identifier, such as a receipt number or date.

Incorporate clear sections for the essential details: name of the child care provider, the parent’s or guardian’s name, and the child’s name. Include the total amount paid and any relevant tax information, such as tax-exempt status or tax rates. Organize these details in a clean table format for easy reading.

Next, add a space for the provider’s contact information–address, phone number, and email. It’s helpful to also include the provider’s business registration number, if applicable. At the bottom, provide space for the signature of the care provider or an authorized representative, ensuring the receipt appears formal and legitimate.

Choose a clear font that’s easy to read and ensure there’s enough white space between sections to avoid a cluttered appearance. Consider including a footer with additional details, like refund policies or legal disclaimers, but keep it concise and relevant.

Child Care Tax Receipt Template

Make sure the template clearly lists all necessary information. Start with the child care provider’s name and contact details. Follow with the child’s name, age, and the care period for which the expenses apply.

- Provider Information: Include the name, address, and phone number of the provider.

- Child Information: List the child’s full name, age, and relationship to the taxpayer.

- Dates of Service: Specify the dates of child care service provided, including start and end dates for the year.

- Total Amount Paid: Clearly state the total amount paid for services, broken down by month or week if applicable.

- Provider’s Tax Identification Number (TIN): Include the TIN or social security number of the child care provider for tax reporting purposes.

Ensure the template is signed by the provider and includes their signature, which is important for verification purposes.