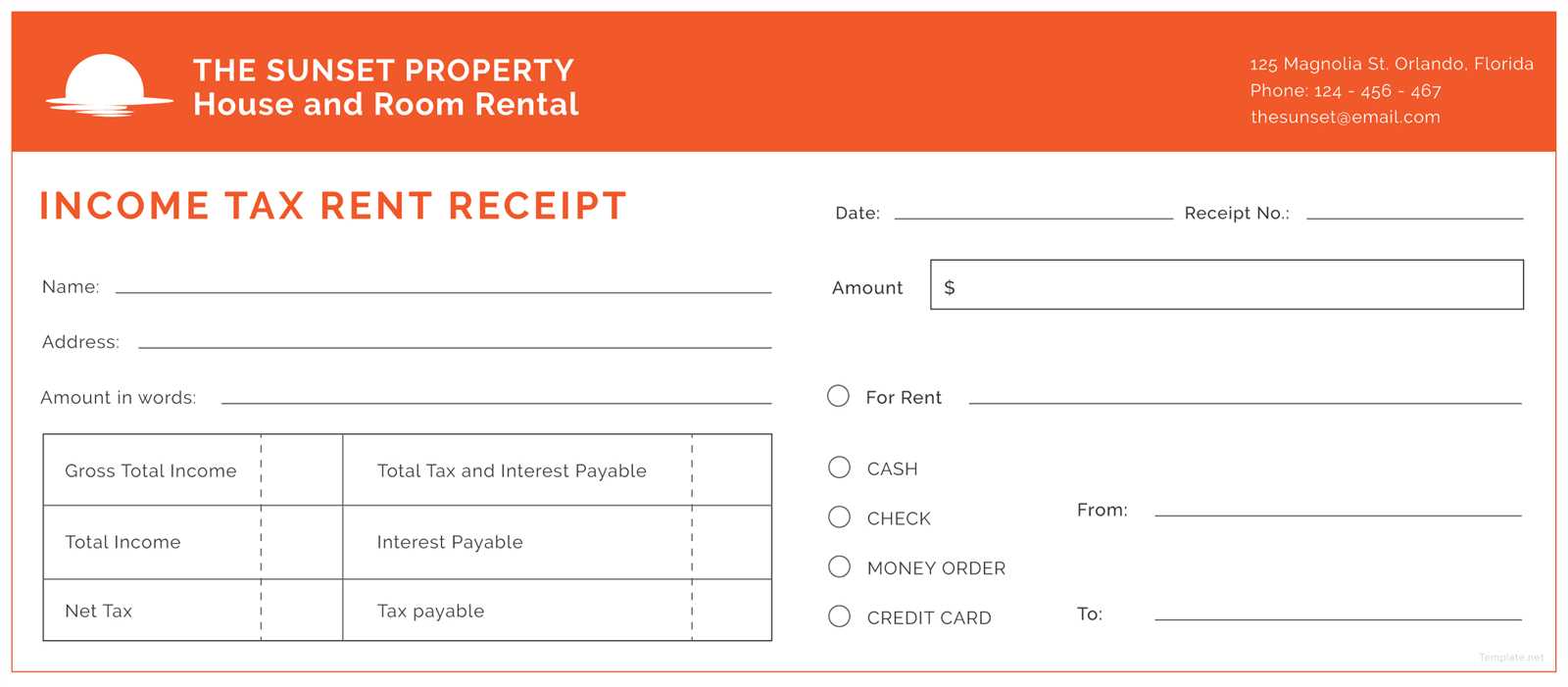

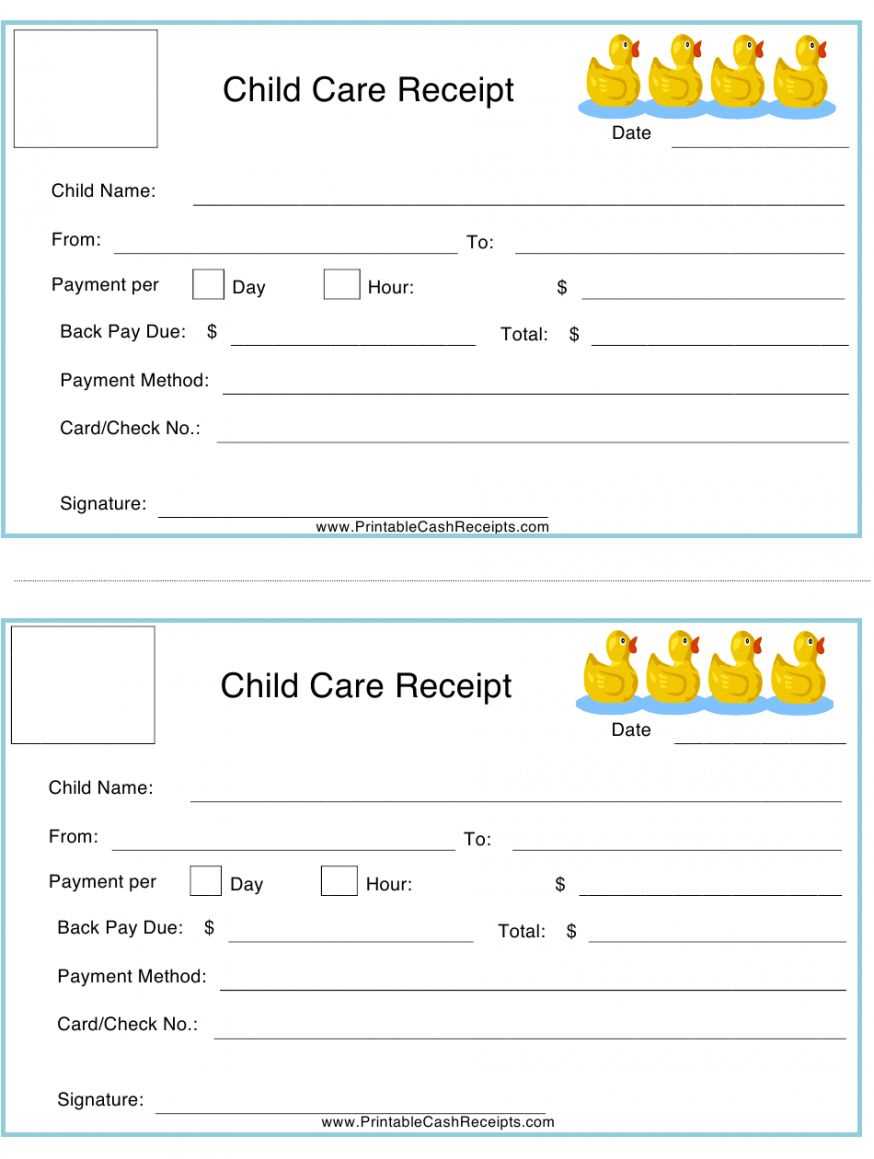

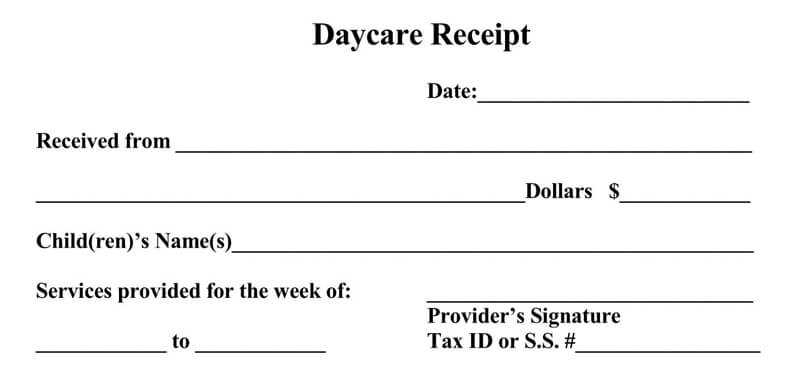

If you’re a parent in Canada who has paid for child care services, you can use a child care tax receipt to claim eligible expenses on your taxes. This receipt must include specific information to qualify for deductions or credits. Make sure your receipt shows the name of the child care provider, the dates of service, and the total amount paid. The receipt should also list the name of the child, and if applicable, their age, since certain age limits apply to some credits.

To create a child care tax receipt template, include the following details: provider’s name and contact information, the child’s name, the total amount paid, the service dates, and the signature of the provider. For parents who use multiple child care providers, ensure each provider gives you an individual receipt for their portion of the care provided. Accurate records make it easier to claim the child care expense deduction and potentially the Child Care Expense Deduction available on your tax return.

Always keep a copy of the receipt and any related documents like payment records or contracts in case the Canada Revenue Agency (CRA) requires them for verification. Using a clear and well-structured template not only helps you claim the correct amount but also ensures you meet all of the CRA’s reporting requirements. A simple and well-detailed receipt is an important tool in maximizing your tax return.

Here are the corrected lines:

Ensure that you include accurate details when creating a child care tax receipt. Each entry should reflect the precise amount paid for child care services. Include the full name and address of the child care provider, as well as their registration number. These details are crucial for tax deductions.

Key Information to Include:

Provider’s Name and Contact Information: The provider’s full name, address, and phone number should be included. This helps verify the authenticity of the receipt.

Child’s Full Name: Indicate the child’s full name for whom the care was provided. This ensures the tax deduction applies to the correct dependent.

Payment Breakdown:

Provide an itemized list showing the total amount paid for child care services during the tax year. If payments were made for different periods or services, include each amount separately. This clarity will prevent confusion during tax filing.

Ensure the receipt is signed and dated by the provider. This is a requirement for the tax authorities and will prevent any issues during your submission.

- Child Care Tax Receipt Template for Canada

To create a child care tax receipt for Canada, ensure that it includes the following key elements:

1. Provider Information: The receipt must contain the name, address, and contact information of the child care provider. If the provider is a business, include the business name and registration number if applicable.

2. Parent/Guardian Information: Include the name of the parent or guardian claiming the child care expenses. Ensure that the receipt is addressed correctly to the individual responsible for the tax return.

3. Child’s Information: Include the name and date of birth of the child for whom the care was provided. This helps link the claim to the appropriate tax filer.

4. Dates of Service: The receipt must specify the dates when the child care services were provided. This should cover the period for which you are claiming the deduction.

5. Amount Paid: Clearly state the total amount paid for child care services. If applicable, break down the amounts for different months or periods.

6. Service Details: Provide a brief description of the child care services provided, such as full-time or part-time care, before and after school care, or any special services offered.

7. Signature and Date: The receipt should be signed by the provider and dated. This adds authenticity to the document and confirms that the services were provided.

8. Tax Identification Number (if applicable): If the provider is a registered business, include their tax ID or business number to validate the transaction for tax purposes.

By ensuring that all these details are included, your child care tax receipt will meet the Canada Revenue Agency’s (CRA) requirements for claiming child care expenses.

To format a child care receipt for Canadian tax purposes, ensure it includes the following details:

- Provider’s information: Include the child care provider’s full name, address, and contact number.

- Amount paid: Clearly show the total amount paid for the service, including the dates the payments cover.

- Child’s name: List the child’s name for whom the care was provided.

- Service details: Specify the type of care provided (e.g., daycare, nanny, preschool). If applicable, break down the services into individual charges (e.g., hourly rate, extra fees).

- Provider’s tax number: Include the provider’s tax identification number (Business Number or SIN if an individual). This is necessary for both the taxpayer and the provider for reporting purposes.

- Date of service: Make sure the receipt reflects the exact dates the child care was provided.

- Provider’s signature or official stamp: For verification, a signature or stamp from the provider confirms the authenticity of the receipt.

Ensure all receipts match these requirements for them to be accepted by the Canada Revenue Agency (CRA). Properly formatted receipts allow parents to claim eligible child care expenses on their tax returns. Keep a copy of each receipt for your records as part of your tax documentation. A lack of these details may result in a claim being denied or delayed.

A tax receipt for child care must contain specific details to be valid for Canadian tax claims. These details include:

| Required Information | Description |

|---|---|

| Provider’s Name | The full name or legal business name of the child care provider. |

| Business Number (BN) | If the provider is a registered business, their CRA Business Number is required. |

| Provider’s Address | The complete address of the provider (street, city, and postal code). |

| Recipient’s Name | The name of the person receiving the child care services (usually the parent or guardian). |

| Child’s Name | The name of the child receiving care from the provider. |

| Service Dates | Exact dates or the period during which child care services were provided (e.g., January 1 – March 31, 2025). |

| Total Paid | The total amount paid for the child care services, including any taxes (HST or GST). |

| Type of Service | A description of the child care services (e.g., full-time care, part-time care, after-school care). |

| Provider’s Signature | The signature of the provider, or a statement of authenticity from the provider, confirming the receipt’s accuracy. |

Make sure all information is accurate and complete to avoid delays or complications when filing your tax return. These details are critical for claiming child care expenses on your tax forms.

To submit a child care receipt with your tax return, include the receipt information in the appropriate section of your tax form. If you’re using paper filing, attach the original or a copy of your receipt to your return. For online filing, you’ll enter the details directly into the tax software.

Make sure the receipt includes the caregiver’s name, address, and tax identification number (if applicable), along with the dates and total amount paid. If you’re claiming child care expenses for more than one child or caregiver, list each separately with corresponding details. Keep in mind that only eligible child care providers qualify for this deduction, so ensure you meet the Canada Revenue Agency (CRA) guidelines before submitting your claim.

Once you’ve filled out your tax return, review the child care expenses section to verify everything is correct before submitting. If you’re filing online, your software will typically walk you through the process, but double-checking the details will help prevent any mistakes. If you’re using a tax preparer, ensure they have all the necessary receipts and supporting documents for submission.

Tax Receipt for Child Care in Canada

Ensure that your child care provider gives you a tax receipt by the end of the year. This receipt is crucial for claiming child care expenses on your tax return. It should include the provider’s name, address, registration number (if applicable), the total amount paid, and a breakdown of services provided.

What to Include on the Receipt

The receipt must clearly state the dates and amount paid for each service. Providers must also mention the child’s name and age if possible, as this helps to match the claim to the correct family. Be sure to keep a copy for your records, as you’ll need it for filing your tax return.

How to Use the Receipt for Tax Deductions

Once you receive the tax receipt, you can use it to claim your child care expenses. Keep in mind that receipts are required for both in-home and daycare services. Each type of care has specific guidelines, so check the Canada Revenue Agency’s (CRA) website for more details on eligibility and what expenses are deductible.