Use a childcare receipt template to keep track of payments for daycare or other childcare services. This is vital for tax deductions or credits related to childcare expenses. A clear, well-organized receipt ensures that all necessary details are captured accurately. Here’s how to structure a childcare receipt template to meet tax requirements.

Key Components of a Childcare Receipt

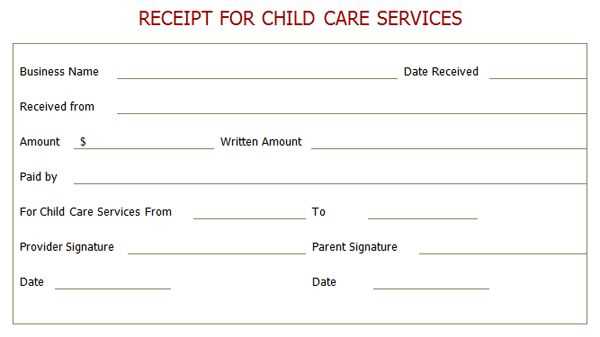

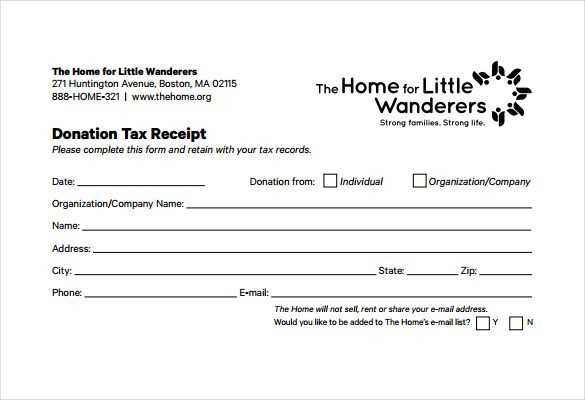

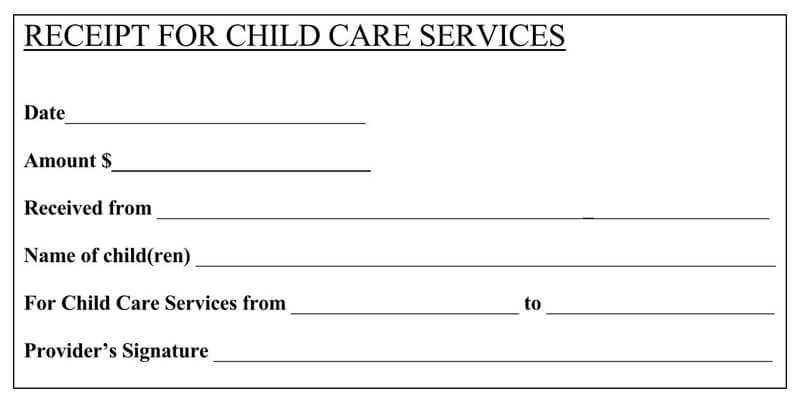

- Provider’s Information: Include the name, address, and contact details of the childcare provider.

- Parent’s Information: Include the name and address of the parent or guardian receiving the service.

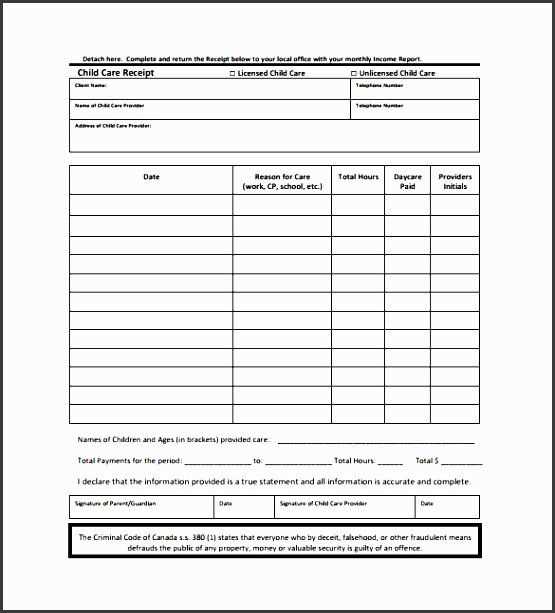

- Date(s) of Service: Clearly indicate the dates on which childcare services were provided.

- Hours of Service: List the number of hours or days that childcare services were rendered.

- Amount Paid: Specify the total payment made for the services. Include any discounts or additional charges, if applicable.

- Payment Method: State whether the payment was made by check, cash, credit card, or another method.

- Tax Identification Number (TIN): Include the provider’s TIN or Employer Identification Number (EIN) to ensure the receipt is valid for tax purposes.

How to Use the Template for Tax Filing

Keep all receipts organized and retain them for at least three years. Include the receipts with your tax documents when claiming the Child and Dependent Care Credit. The IRS requires accurate documentation of childcare expenses, so be sure that each receipt includes the provider’s details and the amount paid. You can use the template as a reference for submitting your claims or for auditing purposes.

Tips for Filling Out the Template

- Accuracy: Double-check all information before submitting the receipt to ensure that all data is correct and complete.

- Consistency: Use the same format for each receipt to avoid confusion when filing taxes.

- Keep a Copy: Always store a copy of the completed receipt for your own records.

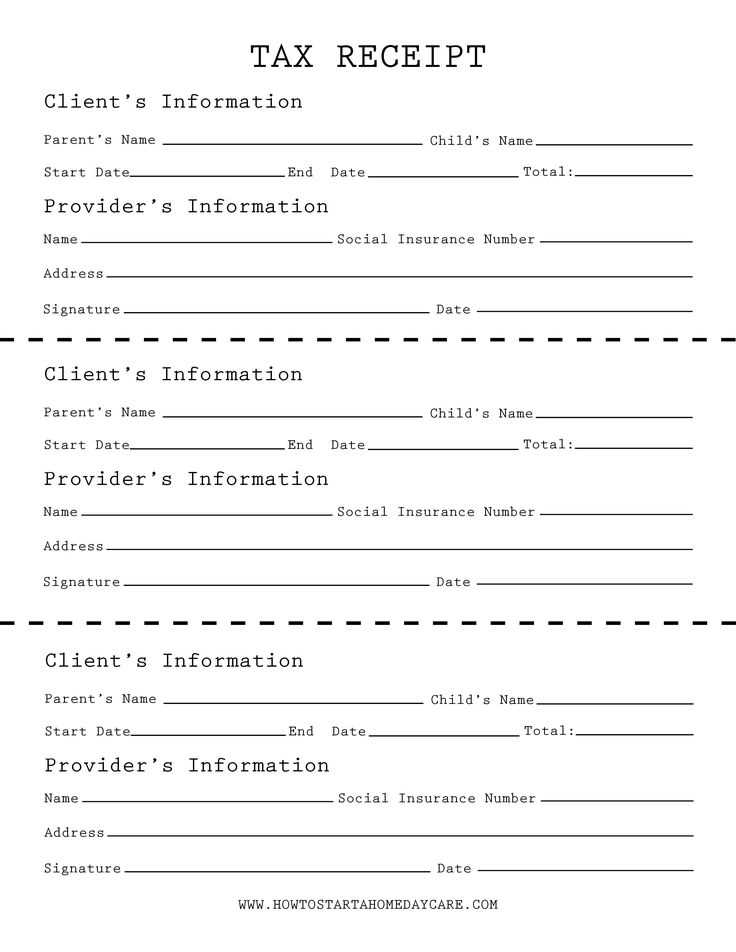

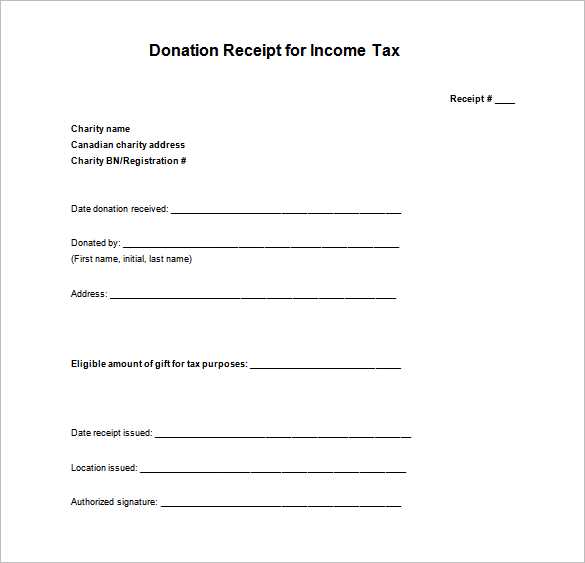

Childcare Receipt Template for Tax

To create a legally valid childcare receipt for tax purposes, ensure it includes all necessary information that tax authorities require. This will help both the payer and the recipient maintain accurate records for tax deductions or reporting. Here’s how to structure it:

How to Create a Legally Valid Receipt

Start by including the provider’s full name, address, and contact information at the top. Include the date of service, the child’s name, and the number of hours or days the care was provided. Specify the total amount paid for the childcare services and any applicable taxes. Don’t forget to list the provider’s business or tax ID number, if available. Finally, have both the provider and the parent sign the receipt to confirm the payment details. A stamped or signed document can be used for further validation.

Key Information to Include in Your Childcare Invoice

The invoice should contain the following critical details:

- Provider’s full name and business name (if applicable)

- Provider’s contact information (address, phone number, and email)

- Date of service and the duration of care provided

- Detailed breakdown of services and rates

- Total amount paid and the payment method used

- Any applicable taxes or fees

- Provider’s tax identification number (TIN) or business registration number

Common Mistakes to Avoid When Preparing a Receipt

When preparing a childcare receipt, avoid these common errors:

- Missing or incorrect provider information, such as the tax ID number or address

- Failure to include a detailed description of services and rates

- Omitting the date and duration of service

- Not having the necessary signatures or acknowledgments from both parties

By including all required information and avoiding these mistakes, you can create a receipt that is both legally valid and useful for tax filing purposes.