Providing a clear and professional receipt for donations is a simple but impactful way to show appreciation to contributors. A well-structured giving receipt template helps churches maintain accurate records and offer transparency, making tax deductions easier for donors. By incorporating key details such as donor information, donation amount, and date, you build trust and foster long-term support.

Start with a clean layout that includes space for the church’s name, address, and tax-exempt status. Donors appreciate knowing that their contributions are recognized and documented correctly for tax purposes. Add sections for the amount donated, the date, and a brief statement confirming that no goods or services were exchanged in return, as this is a requirement for tax-exempt organizations.

Ensure the receipt includes a thank-you message. A simple line expressing gratitude can go a long way in building relationships and encouraging ongoing support. Customize your template to reflect the values of your church while maintaining professionalism and clarity. With the right template, you create a valuable tool that supports both administrative functions and donor relationships.

Sure! Here’s a detailed plan with practical subheadings for the topic “Church Giving Receipt Template,” in English, without using overly general terms:htmlEditWhat is a Church Giving Receipt Template?

A Church Giving Receipt Template is a pre-designed format churches can use to acknowledge donations made by individuals or organizations. This document provides the donor with the necessary information for tax purposes, ensuring they can claim deductions on their contributions.

Key Elements of a Church Giving Receipt

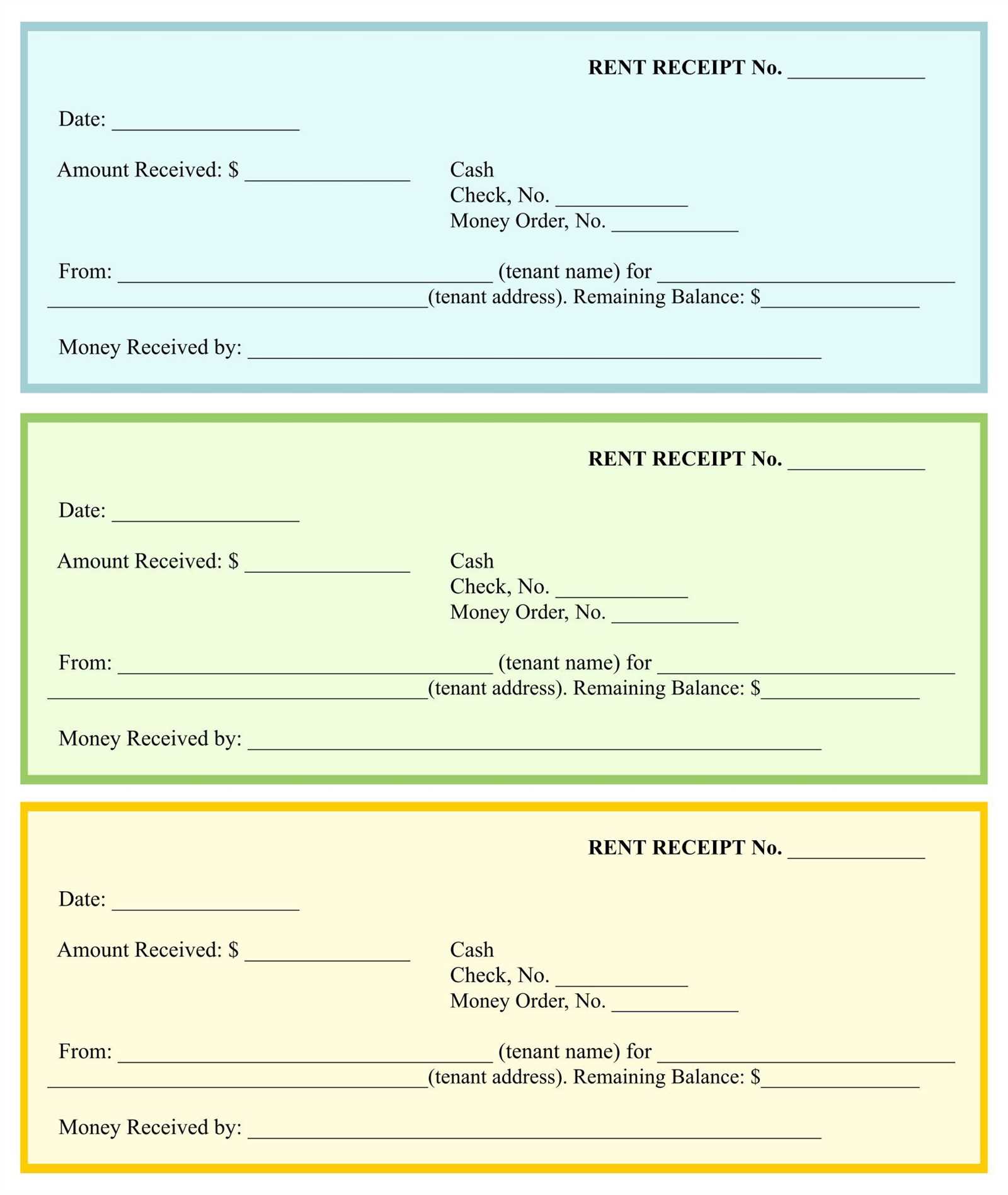

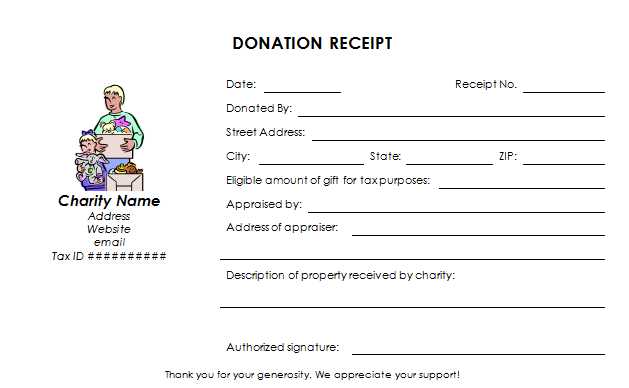

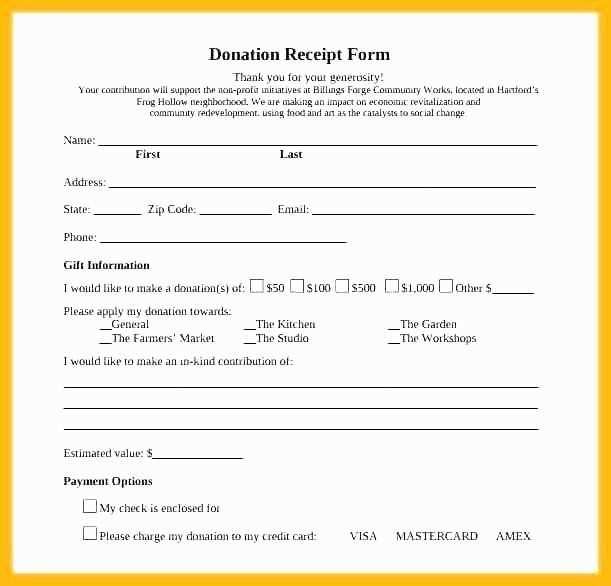

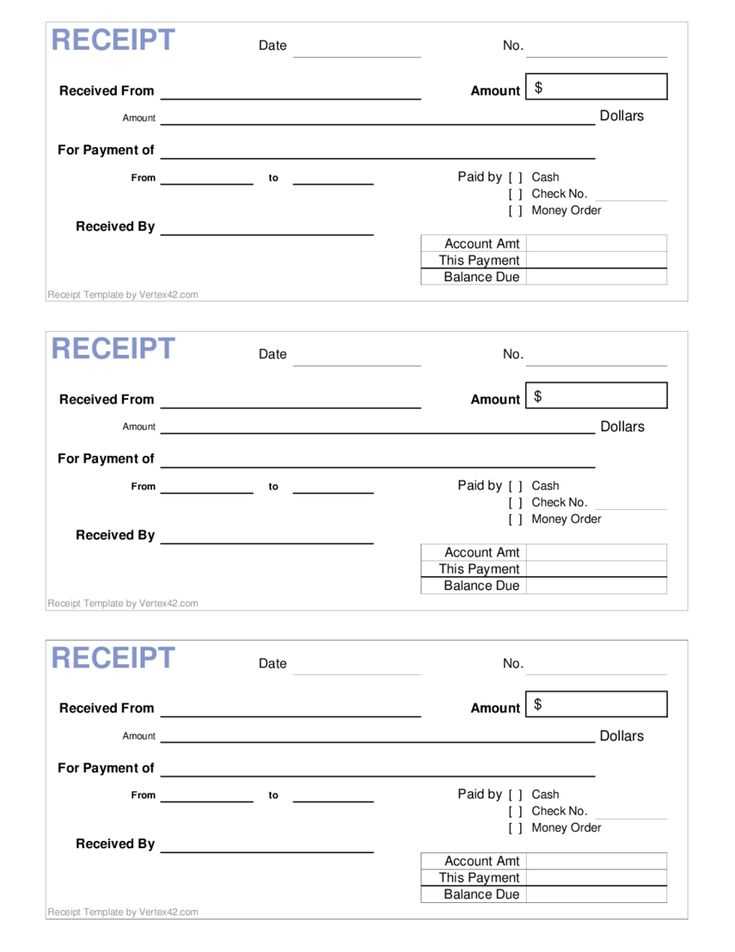

The template should include several critical pieces of information. Firstly, the church’s name and address must be clearly stated, along with the date of the donation. Next, the donor’s details, such as name and address, should appear. The receipt must specify the amount donated, the method of donation (cash, check, or online), and whether anything of value was received in return, like event tickets or goods. Additionally, if the donation is over a certain amount, a statement confirming no goods or services were provided in exchange should be included.

Customizing Your Template

While basic templates can be found online, it’s best to customize your receipt to fit the church’s specific needs. Include any legal disclaimers or tax-related notes required by local regulations. The receipt should also have a unique identification number for tracking purposes and prevent errors or misuse. Customize the design to match your church’s branding for a professional and cohesive appearance.

How to Create a Donation Receipt Template

Designing a donation receipt template starts with ensuring it includes the necessary details for both the donor and the organization. Focus on clarity and simplicity. Your template should capture the donor’s name, donation amount, and the date the donation was made.

Key Elements to Include

Include the name of the organization, its address, and contact details. Clearly state the donation amount, as well as the nature of the contribution (e.g., monetary, in-kind). If it’s a monetary donation, specify whether the donation is tax-deductible. Also, add a unique receipt number for tracking purposes.

Formatting Tips

Use clean, easy-to-read fonts. Ensure each section is clearly defined, using spacing and bold text to differentiate key areas. Keep the tone formal but accessible. A clear heading such as “Donation Receipt” can make it instantly recognizable to the recipient.

Don’t forget to provide the organization’s tax-exempt status number if applicable. This is particularly important for individuals who will use the receipt for tax purposes.

How to Use the Template for Donation Tracking

Fill in the donor’s name, address, and donation amount in the respective fields of the template. Ensure the donation date is accurately recorded for future reference. If applicable, include any specific purpose for the donation, such as event sponsorship or general funds.

Keep a copy of the receipt for your records. Update the template after each donation to maintain an accurate log. Include any necessary notes, such as recurring donations or special conditions attached to the donation.

Review the template regularly to ensure all information is complete and accurate. This allows for smoother communication with donors and ensures compliance with financial reporting standards.