Key Components to Include

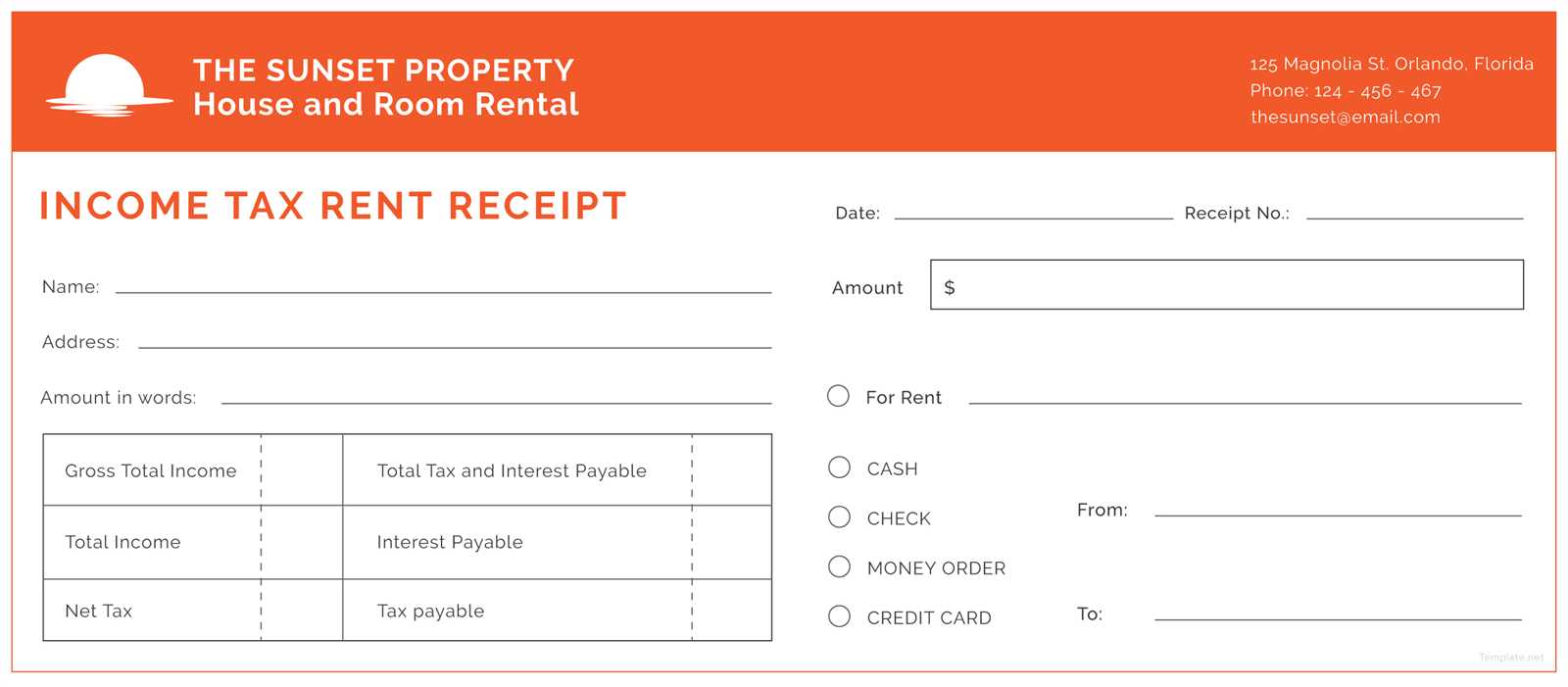

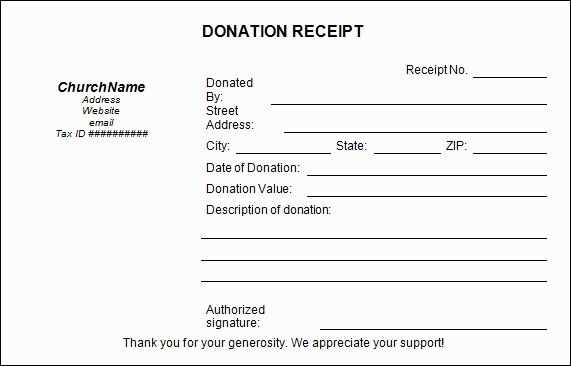

A well-structured church tax receipt should have a few critical details. These elements help ensure compliance and provide clarity for the donor. Include the following:

- Church Name and Address: Clearly state the full name of the church and its physical address. This makes it easy for the donor and tax authorities to confirm the organization’s legitimacy.

- Tax Identification Number (TIN): Include the church’s TIN or equivalent. This is crucial for the donor’s tax filing process.

- Donor’s Information: List the full name and address of the donor to ensure the receipt corresponds correctly with the donor’s records.

- Donation Amount: Clearly state the amount or description of the donation. For non-cash donations, include an estimated value.

- Donation Date: Include the exact date the donation was made.

- Statement of No Goods or Services Received: A simple declaration that no goods or services were exchanged for the donation is necessary for tax-exempt status.

Formatting Tips

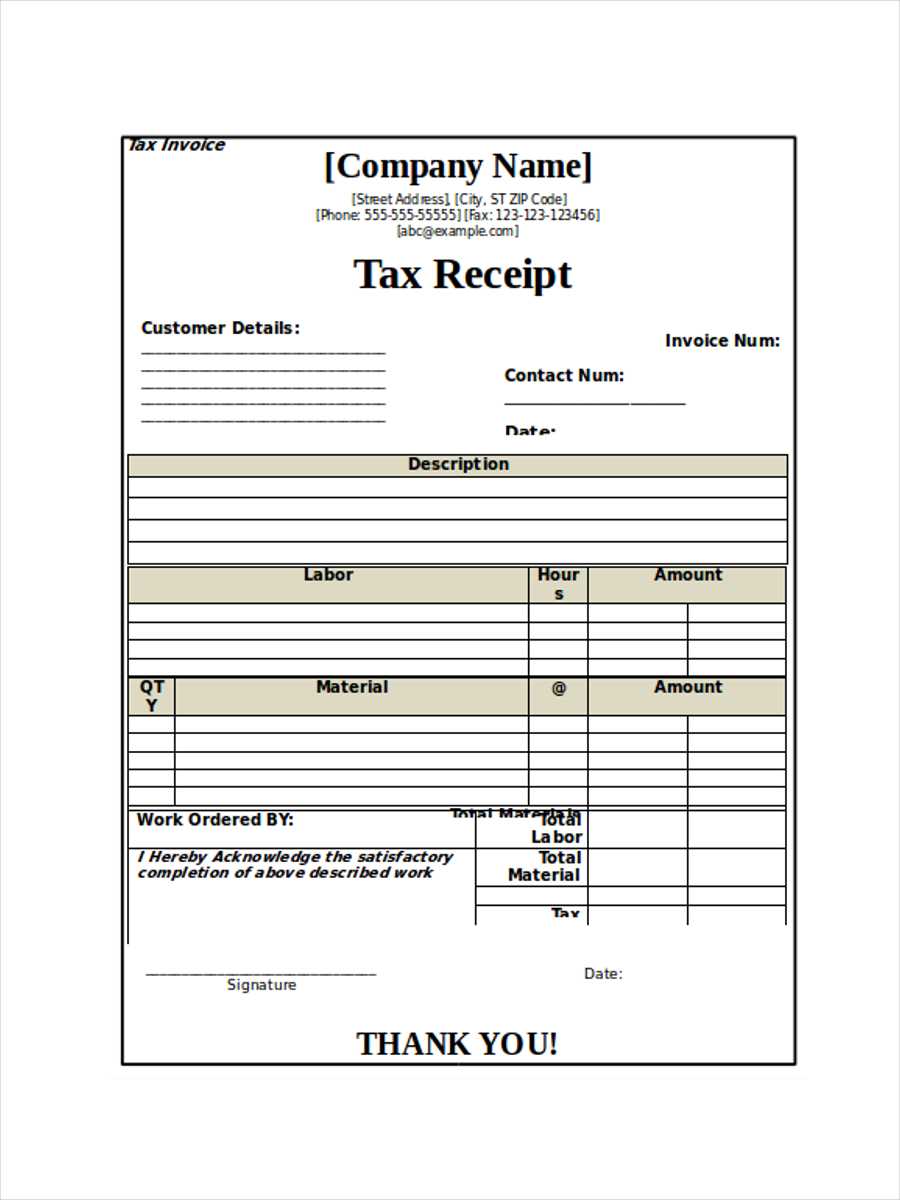

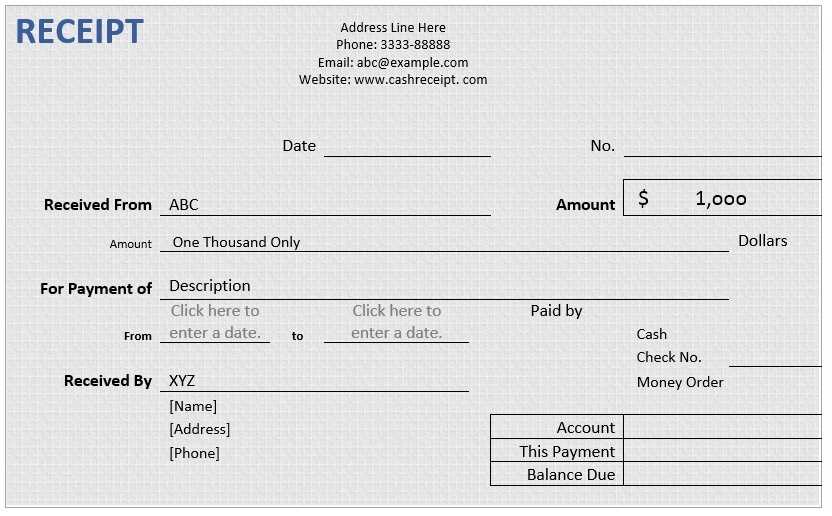

The layout of the receipt should be clean and easy to read. Here’s how you can format it:

- Use Clear Fonts: Choose legible fonts such as Arial or Times New Roman with a minimum size of 10 pt.

- Organize the Sections: Group the details logically–start with church information, followed by donor information, donation details, and then the legal declaration.

- Space for Comments: Allow a small section at the bottom for any additional remarks, such as a personalized thank-you message.

- Simple Header: Keep the title short, such as “Charitable Contribution Receipt,” to make it clear what the document represents.

Example Template

Here’s a basic example you can use as a reference:

[Church Name] [Church Address] Tax Identification Number: [TIN] Receipt for Donation Date of Donation: [Date] Donor Name: [Donor Full Name] Donor Address: [Donor Address] Donation Amount: [Amount or Description of Non-Cash Donation] No goods or services were provided in exchange for this donation. Thank you for your generosity. [Church Signature] [Date]

Keep Records and Stay Compliant

Maintaining accurate records is key. Make sure to issue these receipts regularly and store them securely. Churches should also be prepared to provide additional documentation if requested by the IRS or local tax authorities.

Got it! It sounds like you’re working on a variety of Finnish content, particularly focusing on product usage, troubleshooting, and maintenance guides. Do you need help drafting some new sections or coming up with ideas for a specific article? Let me know how I can assist you!