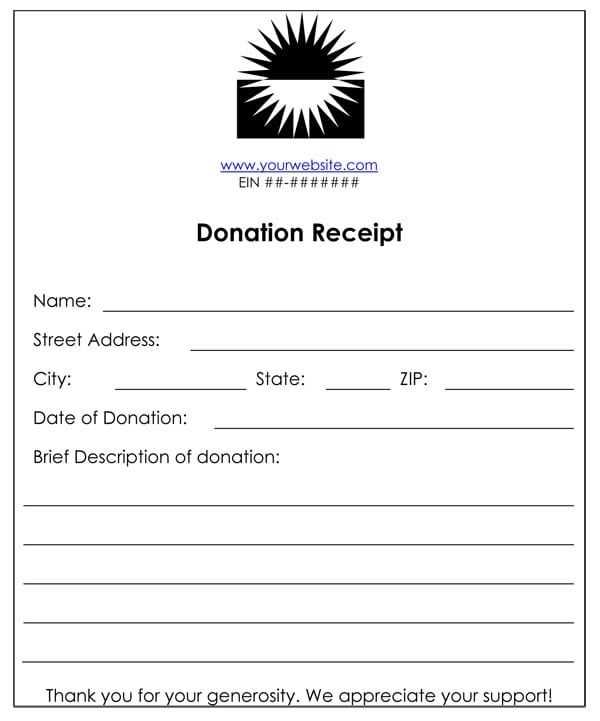

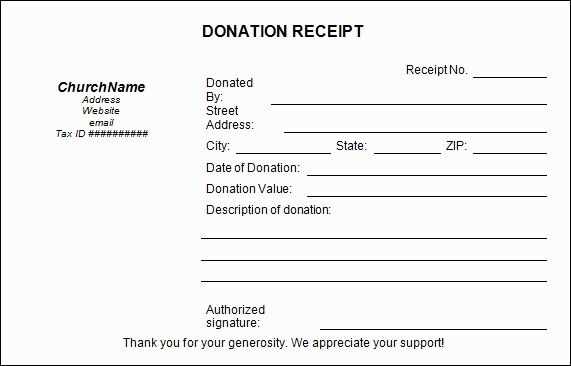

Creating a church tithing receipt template is a straightforward process that ensures transparency for both the congregation and the church administration. Start by including the name of the church, its address, and contact information at the top of the receipt. This provides a clear point of reference for the donor.

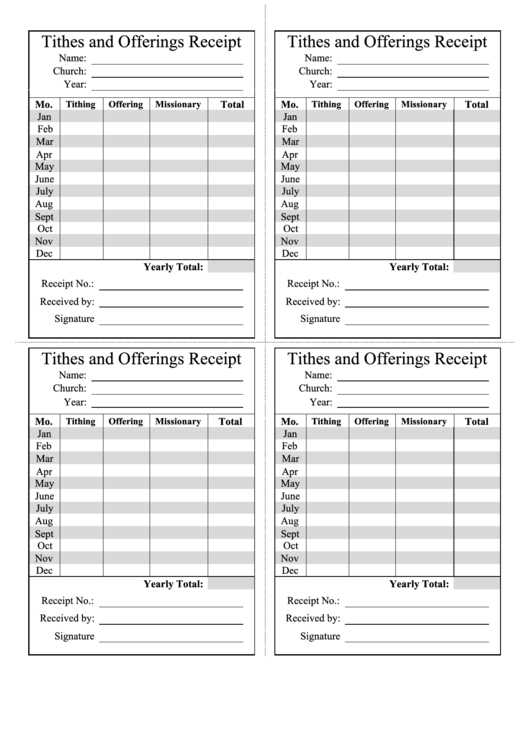

Next, include the donor’s name and the date of the donation. These details are crucial for record-keeping and allow donors to easily identify their contributions. Be sure to specify the donation amount and clearly state whether the donation is tax-deductible, if applicable. For added clarity, a brief description of the donation’s purpose–such as “General Fund” or “Building Fund”–can be included.

Conclude the receipt with a thank you message and the church’s signature or authorized representative’s name. This gesture adds a personal touch and demonstrates appreciation for the donor’s support. Keep the design simple and professional, ensuring all necessary details are present for tax purposes and record tracking.

Church Tithing Receipt Template Guide

To create a church tithing receipt template, focus on clarity and organization. The receipt should include key details such as the donor’s name, the amount donated, and the date of the contribution. Here’s how you can structure the template effectively:

Key Elements

- Church Name and Contact Information: Place this at the top for easy reference. Include the church’s address, phone number, and email.

- Donor Information: Ensure the donor’s name and address are clearly listed to confirm the contribution.

- Donation Details: Include the donation amount, the date, and the purpose (e.g., general fund, building fund, etc.).

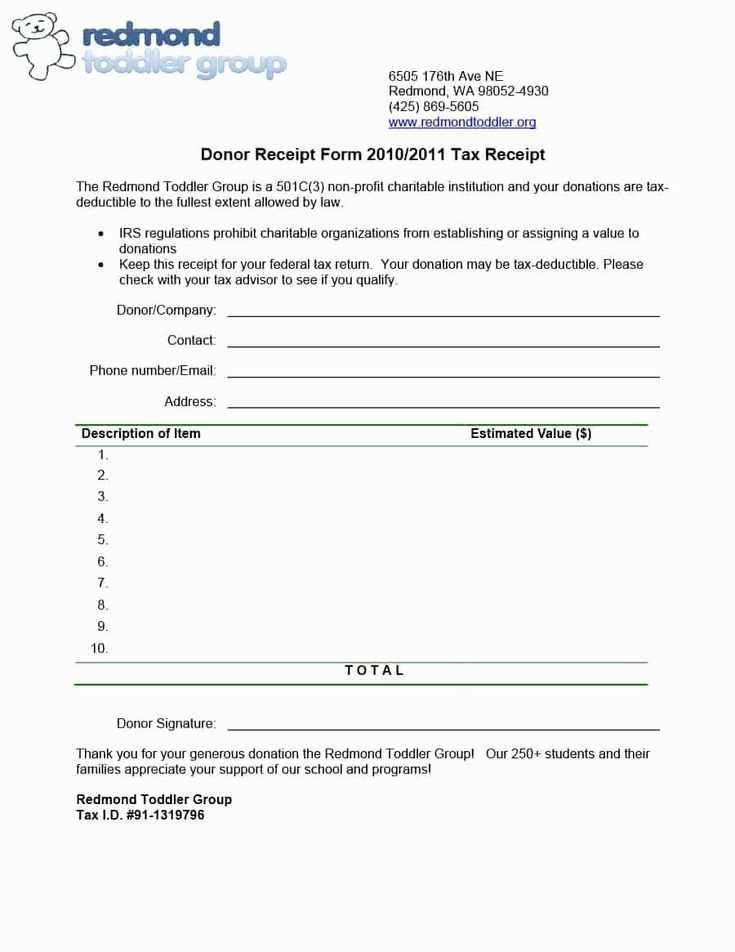

- Tax Information: Add a statement that confirms the donation is tax-deductible according to local laws. Include a tax ID number if applicable.

- Receipt Number: Assign a unique number for each receipt for proper record-keeping.

Formatting Tips

- Consistency: Use a clean, simple layout that makes the information easy to read.

- Professional Tone: Keep the language formal but friendly. Avoid unnecessary flourishes.

- Legal Requirements: Verify that your template meets any local or state requirements for donation receipts.

Using a template that covers these elements ensures that the receipts are clear, functional, and compliant with legal requirements, making it easy for both the church and its donors to keep accurate records.

How to Create a Tithing Receipt Template

Begin by organizing key elements of the tithing receipt, ensuring they cover the donor’s name, donation amount, date, and church details. You’ll also need to include a statement verifying the receipt of the donation without the value of any goods or services provided in return.

Step 1: Include Basic Donor Information

Collect the donor’s full name and address to personalize the receipt. It’s important to capture the full name for clarity and to distinguish between multiple donors in the church records. Address details may not always be required but can be included for more formal documentation purposes.

Step 2: Record the Donation Details

Clearly state the amount donated, whether it’s cash or check. For cash donations, note the estimated value if possible. You should also indicate the date the donation was made and whether it was a one-time contribution or part of a recurring pledge.

Key Elements to Include in a Tithing Receipt

A tithing receipt must clearly reflect the necessary details for both transparency and record-keeping. Begin with the church name and the full address to ensure the receipt is attributed to the correct organization.

Date of the donation is a key detail. This specifies the exact time the donation was made, which is vital for tax purposes and tracking. Include the donor’s full name as well as the donor’s address or contact information to further verify the contribution.

Clearly state the donation amount, indicating whether it was a one-time gift or part of a recurring pledge. If applicable, list any specific designation for the donation, such as funds for a particular ministry or project. This helps both the donor and the church track how contributions are being allocated.

Include a statement confirming tax-deductibility of the donation. This can be a brief statement like, “This donation is tax-deductible under IRS regulations,” provided the church is registered as a nonprofit organization.

Ensure to sign the receipt or provide the authorized signature of a church representative to validate the document. Additionally, specify whether the donation was made in cash, by check, or through an electronic payment method. This adds another layer of clarity and legitimacy to the receipt.

Customizing the Template for Church Needs

Begin by adjusting the template to include your church’s name, logo, and contact details. This creates a personalized look and ensures members can easily reach out if needed.

Include specific fields that reflect the types of donations your church receives, such as regular offerings, special funds, and event contributions. Customizing donation categories will provide transparency and help track giving more accurately.

Add a section for a donor’s address and preferred contact method. This is helpful for sending thank-you notes or receipts by mail, allowing the church to stay connected with supporters.

Ensure the template has space for a unique donation reference number or identifier. This helps to track donations efficiently and provides a clear record for both the donor and the church.

Consider including a statement of your church’s tax-exempt status. It reassures donors that their contributions are eligible for tax deductions and complies with tax regulations.

Review the font choices and overall layout to ensure they are clear and easy to read. Avoid clutter and use a design that reflects the values and culture of your church, providing a professional yet welcoming appearance.