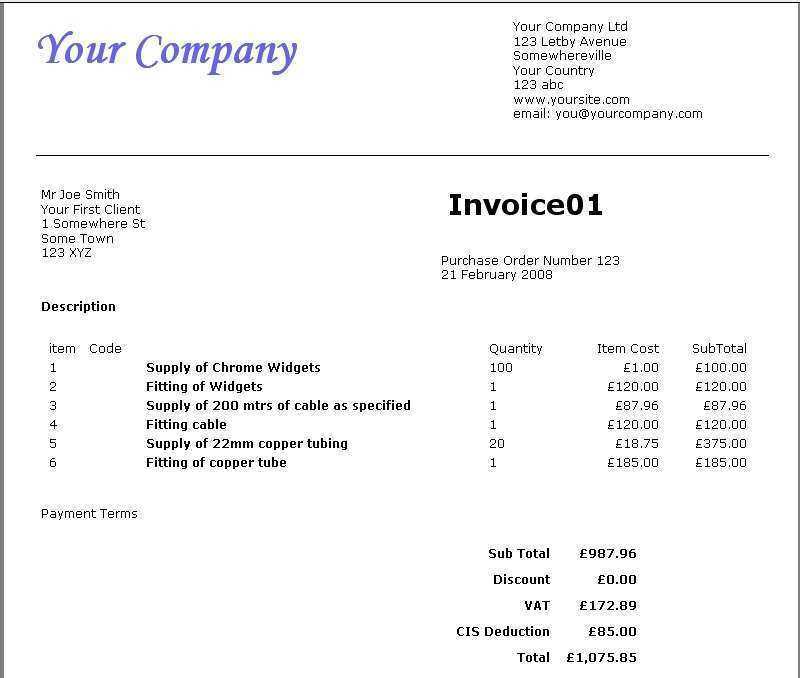

To create a CIS (Construction Industry Scheme) receipt template, ensure it clearly states the details necessary for tax reporting. Start by including the supplier’s full name, address, and the unique CIS registration number. This ensures compliance with tax laws and makes it easier for both parties during audits or reconciliations.

The next important aspect is the inclusion of the payer’s details, including the full name or business name, and the tax reference number. These elements help confirm the legitimacy of the transaction and serve as proof of the payment.

Be sure to outline the services provided, along with the dates of the work. This not only helps to clarify the nature of the transaction but also provides transparency. Include a breakdown of the amount being paid, ensuring that the CIS deductions, if applicable, are clearly listed.

Finally, keep the format simple yet professional. Use bullet points or clear sections to improve readability, ensuring all data is easy to locate. This can speed up processing and minimize mistakes during submission or review.

Here is the corrected version:

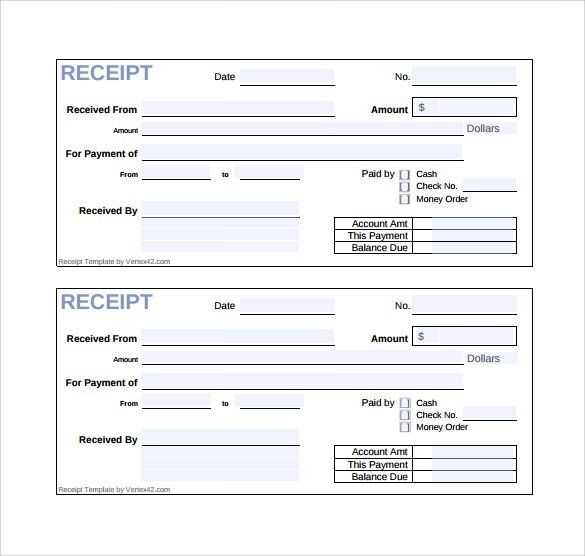

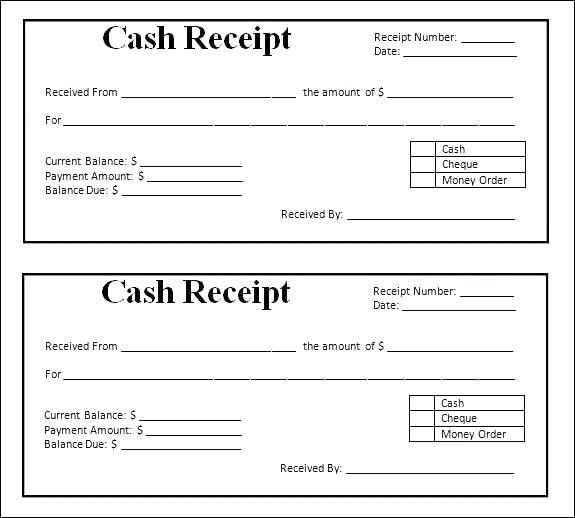

To ensure your receipt template functions properly, first focus on simplifying the layout. Make sure it has a clear structure, with appropriate sections such as the date, transaction details, and total amount. Use bold text for important information, like the total, so it stands out easily to the customer.

Key Points to Remember:

Ensure the font size is readable, and avoid cramming too much information in one area. Leave space between sections to keep it organized and easy to navigate. For date formatting, follow a consistent format, such as YYYY-MM-DD, to ensure clarity across different systems.

Formatting Tips:

Align text properly: left-align customer details and right-align monetary values. This improves readability and creates a clean look. If you need to include taxes or discounts, present them clearly and separately from the subtotal to avoid confusion.

Cis Receipt Template Guide

Creating a Basic Receipt Template

Customizing Fields for Specific Purposes

Ensuring Accurate Data Input

Formatting Tips for a Clear, Professional Layout

Integrating Tax and Payment Details

Validating the Template for Local Compliance

Start with a clear layout that includes key details such as the seller’s information, buyer’s details, transaction date, and the list of purchased items or services. Structure your receipt with a section for itemized costs and a final total. Keep it simple and user-friendly, avoiding unnecessary complexity.

Customizing Fields for Specific Purposes

Adapt your template to meet specific needs by adding or removing fields. For instance, if the receipt serves as proof of donation, include a field for donation type. If it’s for a service, add a description field for work performed. Adjusting the template ensures it is fit for purpose without overwhelming users with irrelevant information.

Ensuring Accurate Data Input

Set clear rules for data entry. Use placeholders for numerical fields like amounts or dates to guide accurate input. Implement dropdowns for repeated entries like payment methods or item categories. This minimizes errors and speeds up the process of generating receipts.

Formatting Tips for a Clear, Professional Layout

To improve readability, use ample white space between sections. Align text consistently, and ensure that all fonts are easy to read. Bold or highlight key figures, such as totals and taxes, for quick reference. Keep formatting consistent throughout, from headings to item descriptions.

Integrating Tax and Payment Details

Incorporate fields for tax breakdowns and payment methods. Make sure the tax rates and amounts are clearly displayed for transparency. Add payment details, such as the payment method and transaction ID, so that all relevant information is documented.

Validating the Template for Local Compliance

Ensure the receipt meets local tax regulations by reviewing legal requirements in your region. This could include tax rates, mandatory information, or specific formats. Adjust the template to comply with those standards before using it to issue receipts.