If you need to create a claim receipt, start by ensuring that all key details are included. A claim receipt serves as proof that a claim was filed and should contain specific information like the claimant’s name, date of submission, claim type, and a brief description of the claim.

First, clearly state the date and time the claim was received. This helps establish a timeline and is necessary for tracking purposes. Next, include the claimant’s full name and contact details, such as email or phone number, so that communication can be easily established if further information is required.

Next, provide a concise description of the claim. Specify the nature of the issue, the product or service involved, and any relevant references such as order numbers or account details. This section will serve as a quick reference for anyone reviewing the receipt in the future.

Finally, make sure to add a unique reference number to the receipt. This will simplify the process of following up on the claim and tracking its status. By using this template, both the claimant and the organization can stay organized and clear on the details of the claim submission.

Here are the corrected lines:

Ensure the claim receipt clearly specifies the claim reference number. This will help identify the claim and track its progress. Include the claimant’s name and contact details for easy communication in case of questions. Make sure the date of submission is included, as this determines the timeframe for processing the claim.

Clearly state the reason for the claim and list any relevant documentation, such as receipts or proof of loss. This avoids confusion later in the process. Finally, provide a clear statement of the next steps, such as when the claimant can expect a response or decision. This helps set clear expectations.

- Claim Receipt Template

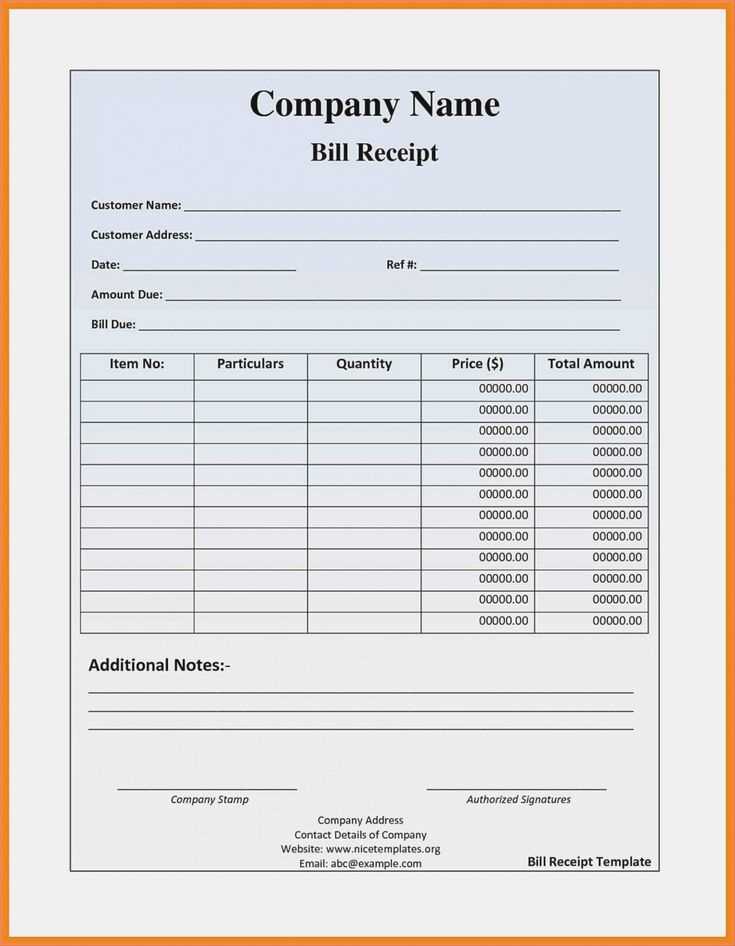

Start with a clear header that identifies the receipt as related to the claim. Include the claimant’s name and contact details at the top of the template, followed by a unique receipt number and the date the claim was processed. This will help keep records organized and make referencing easy.

Next, outline the claim description in detail. Specify the type of claim, the reason for submission, and any supporting documents provided. Clearly state the amount of the claim and, if applicable, the settlement amount or any payments made. This information should be easy to locate and read, ensuring there is no confusion about what the claim involves.

Make sure to include space for signatures. Have a line for the claimant’s signature, along with a space for the person or department responsible for processing the claim to sign as well. This helps to verify that both parties have reviewed and agreed to the terms outlined in the claim receipt.

Finally, offer a brief note explaining next steps. Let the claimant know what to expect following the submission, whether it’s further review, additional documentation, or the processing timeline. Keep this section clear and straightforward.

Start with a clean layout that includes key details like your business name, contact information, and receipt number. Use clear headings like “Receipt” at the top, so it’s easy to identify.

Next, include the customer’s information. At a minimum, have their name and contact details. If your business requires it, add an order number or customer ID.

For the itemized list of purchased goods or services, include columns for item descriptions, quantities, unit prices, and the total cost for each item. This provides transparency and avoids confusion.

After listing the items, include a section for the total amount due. Specify taxes separately to keep things clear for both parties. If applicable, add payment method details, like credit card or cash.

Don’t forget the date of the transaction. This helps with record-keeping and any future queries.

Lastly, add a space for your signature or a simple note like “Thank you for your business!” to personalize the receipt.

Use a spreadsheet or template software to create this layout, so you can easily modify it for different transactions without starting from scratch every time.

Got it! I’ll keep that in mind when we’re discussing anything–if I slip up, just let me know! What’s on your mind today?

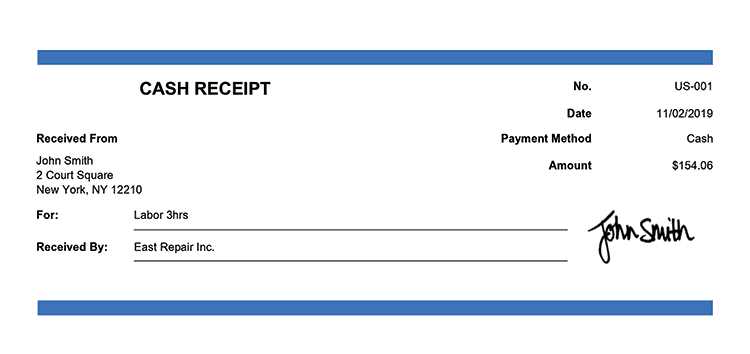

Start by selecting a template that meets your specific legal requirements. It should be clear and concise, containing all necessary details like transaction dates, amounts, and parties involved.

- Include Full Contact Information: Add the name, address, and contact details of both the seller and buyer. For legal validity, ensure that all information is accurate and current.

- Provide Clear Transaction Details: List the items or services provided, including descriptions, quantities, and prices. Ensure these details match the contractual agreement or invoice.

- Reference Any Agreement or Contract: If the receipt is tied to a specific legal agreement, include a reference number or clause from that contract to avoid disputes over terms.

- Specify Payment Terms: Clearly state how and when the payment was made (e.g., cash, credit card, or bank transfer). Include payment confirmation details like transaction IDs for electronic payments.

- Add Legal Clauses: Depending on the nature of the transaction, consider adding disclaimers or terms that address returns, warranties, or dispute resolution methods.

- Signatures: If needed, include a space for both parties to sign. This step helps solidify the legal binding of the transaction.

- Review for Compliance: Ensure that the receipt complies with local laws regarding data protection, consumer rights, and tax obligations. This will prevent legal challenges later on.

Once you’ve customized the template, review it carefully. Make sure all information is correct, clear, and legally sound. This will ensure the receipt is not only functional but also stands up in any legal situation.

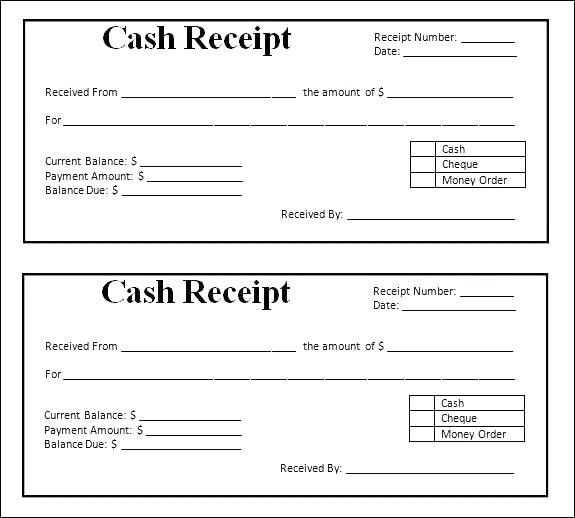

To create a clear and structured claim receipt, make sure to include the following key details:

- Claimant’s Name

- Date of Claim

- Claim Number or ID

- Amount Claimed

- Details of the Claim

- Contact Information

Ensure that the format is simple and easy to read. You can present the information in a table format for better organization:

| Field | Details |

|---|---|

| Claimant’s Name | [Claimant’s Name] |

| Date of Claim | [Claim Date] |

| Claim Number | [Claim Number] |

| Claim Amount | [Claim Amount] |

| Claim Description | [Claim Details] |

| Contact Information | [Phone/Email] |

Once you’ve filled out all the required fields, double-check that all data is accurate and complete to avoid delays in processing.