Every commercial truck transaction requires a well-structured receipt to ensure transparency and accurate record-keeping. A properly designed commercial truck receipt template includes essential details such as buyer and seller information, truck specifications, payment terms, and signatures. Without a standardized format, disputes may arise, and tax documentation can become a challenge.

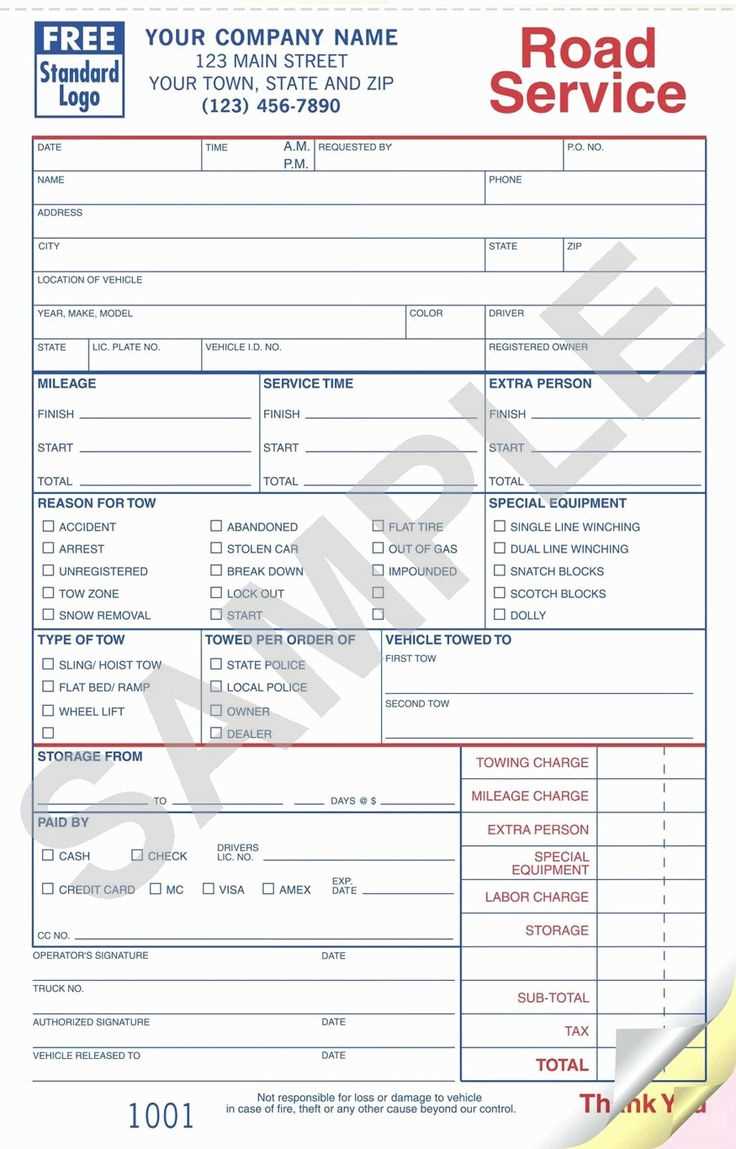

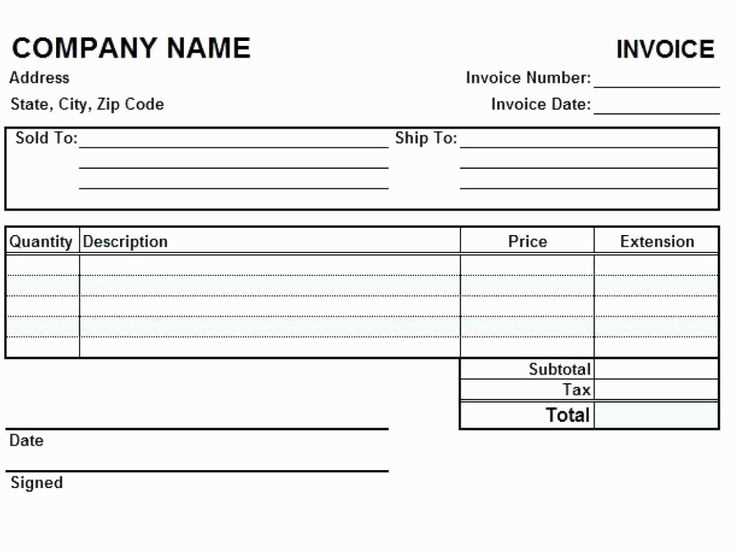

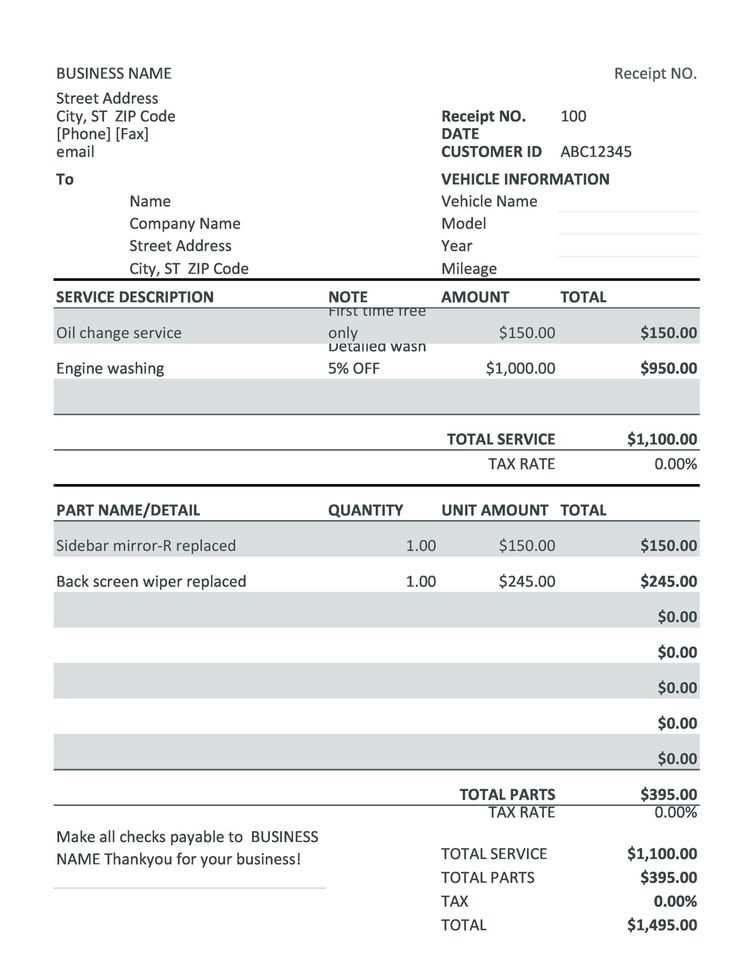

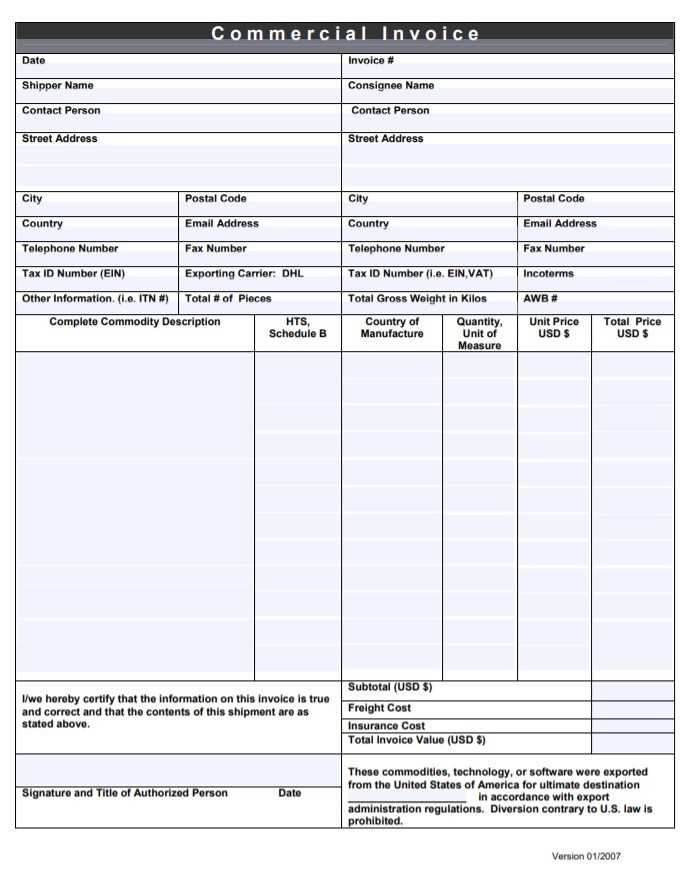

To create a clear and legally sound receipt, include the following key elements:

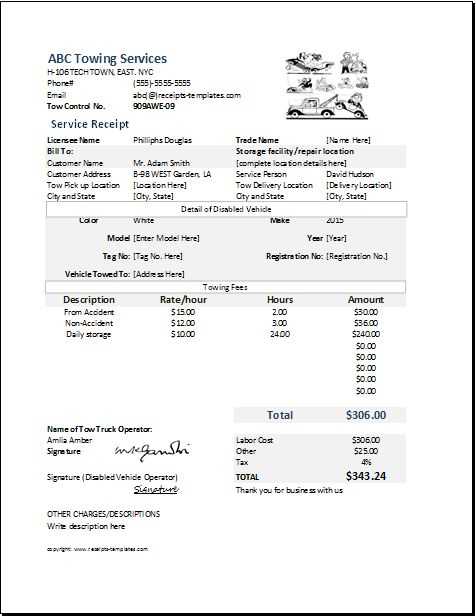

- Business Information: Name, address, and contact details of the seller.

- Buyer Details: Full name and contact information.

- Truck Specifications: Make, model, year, VIN, and mileage.

- Payment Terms: Total price, payment method, and any financing details.

- Date of Sale: The exact date when ownership is transferred.

- Signatures: Both parties should sign to confirm the agreement.

For additional protection, include a clause stating that the vehicle is sold “as-is” unless specific warranties are agreed upon. A professional template not only streamlines transactions but also minimizes legal risks. Download a customizable format or create one using spreadsheet software to maintain consistency across all sales.

Here’s a version with redundant word repetitions removed, while maintaining the meaning:

When designing a commercial truck receipt template, focus on clarity and simplicity. Begin with sections that are easy to fill out, such as vehicle information, customer details, and payment summary. Avoid overloading the template with unnecessary fields. Each section should serve a clear purpose, offering enough space for required data without clutter.

Ensure the template includes essential elements like date, time, and transaction details. Add clear labels and logical grouping to make the document user-friendly. If applicable, include terms of service or other contractual notes in a separate section to prevent distractions from the main information.

Incorporate a signature field for both the customer and driver. This adds a layer of security and accountability to the receipt. Keep the design consistent and professional, but adaptable to various business needs. The focus should be on function over form, ensuring the document is easy to read, fill, and store for future reference.

- Commercial Truck Receipt Template

A commercial truck receipt template helps simplify the process of recording and managing transactions related to truck services, sales, or rentals. Using a clear and organized template ensures accuracy and prevents misunderstandings. Here’s a structured approach to creating a commercial truck receipt:

Key Elements to Include

- Business Information: Include the company’s name, address, phone number, and email. This ensures that clients can easily contact you if needed.

- Date of Transaction: Clearly specify the date when the transaction took place. This is crucial for record-keeping and tax purposes.

- Truck Details: Include the truck’s model, license plate number, and any other identifying information. This ensures there’s no confusion about the truck involved in the transaction.

- Service Description: List the services provided, such as rental duration, maintenance work, or the type of delivery made. Be precise about the nature of the service.

- Amount Paid: Clearly state the total amount paid, including taxes, if applicable. This prevents discrepancies when clients review their payments.

- Payment Method: Indicate whether the payment was made by cash, credit card, check, or any other method. This helps keep a complete transaction record.

- Transaction Reference Number: Assign a unique reference number to each receipt. This allows for easy tracking and reference in case of follow-up inquiries.

Tips for Customization

- Make sure the receipt format aligns with your business branding, using your company logo or customized colors.

- Consider adding a section for customer feedback or comments to improve services and gather valuable insights.

- Ensure the receipt is easily readable with clear fonts and logical spacing for better usability.

Using this structured template ensures clarity in commercial truck transactions and contributes to smooth, professional interactions with clients.

A truck receipt should clearly communicate critical details about the transaction. The most important elements include:

1. Truck and Driver Information: The receipt must include the truck’s identification number, license plate, and the driver’s name. This information ensures the receipt is linked to the specific delivery or transport event.

2. Date and Time: A clear date and time of the transaction or service ensures accuracy and provides a timeline for both parties.

3. Cargo Details: The type of goods being transported should be listed, including weight, quantity, and any specific requirements such as temperature control or handling instructions.

4. Delivery Origin and Destination: Clearly stating both the pickup and drop-off locations is crucial for tracking and validating the service provided.

5. Fees and Payment Information: Break down any charges, including transportation fees, fuel surcharges, or additional service fees. It should also include the total amount paid and payment method.

6. Signatures: Both the sender and receiver should sign the receipt, confirming the details and completing the transaction.

Each of these elements adds clarity and transparency to the process, protecting both parties involved.

Ensure that all trucking receipts and documents comply with local and federal regulations. Each receipt should clearly show the necessary details, including the name and address of both the shipper and carrier, as well as any applicable tax information. This is crucial to avoid legal issues down the line and ensure transparency in business transactions.

Tax Obligations and Deductibility

Tax laws vary depending on your location, but in general, trucking businesses must keep accurate records for tax purposes. Many of the expenses associated with running a truck, such as fuel costs, repairs, and insurance, may be deductible. Ensure that receipts clearly break down these expenses to support claims for deductions during tax filing. A well-organized receipt system helps streamline your business’s tax preparation process and prevents costly errors.

Compliance with Regulatory Requirements

Trucking companies must adhere to specific industry regulations. These include maintaining proper records for freight transactions and meeting tax reporting standards set by the IRS or local tax authorities. Receipts should reflect proper documentation of the nature of the shipment, the freight charges, and any tax applied. It is also wise to consult with an accountant or tax professional to stay compliant and avoid costly penalties or audits.

A clear and readable truck receipt template is critical for smooth transactions and easy understanding. Start by choosing a simple, easy-to-read font. Sans-serif fonts like Arial or Helvetica provide clarity and are less straining on the eyes. Ensure the font size is large enough for readability, typically between 10-12 points for the main text and slightly larger for headings.

Keep Information Organized

Organize the information in sections with enough spacing between them. Group similar items together, such as truck details, delivery information, and payment terms. Use headings like “Invoice Number,” “Delivery Details,” and “Amount Due” to break up the template and guide the reader’s eye. The layout should follow a natural flow, with the most important information displayed first.

Use Bold and Italics Wisely

Bold headings and key information to make them stand out. Use italics for supplementary details, such as optional information or terms that aren’t immediately critical. This method ensures the reader focuses on the essential parts while still having access to additional details if needed.

When deciding between digital and paper receipts, businesses should weigh practical advantages and limitations based on their specific needs. Both formats offer unique benefits, but there are clear factors to consider before making a choice.

Digital Receipts: Benefits and Drawbacks

Digital receipts are becoming a popular choice due to their convenience and ease of storage. They reduce paper waste, and customers can easily access and store them on their devices. This is particularly useful for tracking purchases or returns. Furthermore, digital receipts often come with automated data entry, making it easier to manage finances and record keeping. However, customers may experience issues with email delivery or forget to save their receipts, resulting in lost records.

Paper Receipts: Benefits and Drawbacks

Paper receipts remain a staple in many industries due to their immediate and tangible nature. They provide customers with a physical record of transactions, which is useful for those who prefer not to rely on technology. Paper receipts are also easier for some customers to store and review. On the downside, they create more waste and can be lost or damaged over time. Additionally, paper receipts often require physical space to keep track of, which may become cumbersome for individuals or businesses with high volumes of transactions.

| Aspect | Digital Receipts | Paper Receipts |

|---|---|---|

| Storage | Easy to store electronically, no physical space required | Tangible but requires physical storage space |

| Waste | No paper waste | Produces paper waste |

| Accessibility | Can be accessed on any device with internet connection | Requires physical retrieval |

| Loss Risk | May be lost if email or file is deleted | Can fade or be damaged over time |

| Customer Preference | Preferred by tech-savvy customers | Preferred by customers who do not use digital tools |

Both digital and paper receipts have distinct advantages and disadvantages. Businesses should evaluate which option fits their workflow and customer preferences while considering environmental impact and storage needs.

Customizing a receipt makes your business stand out and ensures you include all necessary details for your customers. Here’s how to do it effectively:

- Include Your Business Information: Start with your company name, address, phone number, email, and website. Make sure the text is clear and easy to read, so customers can contact you if needed.

- Specify Transaction Details: List the date of the transaction, the item or service purchased, and the price for each. Be as specific as possible, especially if there are multiple items involved.

- Payment Method: Clearly state the payment method used (credit card, cash, check, etc.). This helps both you and the customer keep track of the payment method for records or disputes.

- Include Tax Information: Add applicable tax rates and amounts to ensure transparency in pricing. Make sure the tax amount is clearly labeled so customers can easily understand it.

- Return Policy: If your business has a return or exchange policy, briefly outline it on the receipt. This can prevent confusion if customers need to return items later.

- Branding Elements: Incorporate your company logo and brand colors to give the receipt a professional and cohesive look. Keep the design simple and not too overwhelming to maintain clarity.

- Additional Notes: You can add a short note like “Thank you for your purchase!” or any promotions to encourage repeat business. Ensure it doesn’t crowd the receipt and remains neat.

With these tips, your customized receipt will not only serve as a clear record for both parties but also reflect your business’s identity. Keep it straightforward and user-friendly to enhance customer experience.

Failing to record accurate vehicle maintenance details is a major mistake. Keep track of repairs, inspections, and part replacements to avoid potential fines and ensure the truck stays in safe operating condition. Missing or incomplete maintenance records can result in costly issues down the road.

Relying on outdated tracking systems causes inefficiencies. Use modern software that integrates with your accounting and dispatch systems. This allows for seamless tracking of expenses, fuel usage, and route planning, preventing mistakes that arise from manual entry or paper-based records.

Neglecting to document driver hours can lead to violations of labor laws. Ensure accurate logging of hours worked, breaks, and rest periods to avoid penalties and ensure compliance with regulations such as the HOS (Hours of Service) rule.

Overlooking detailed delivery and shipment information is a common issue. Keep precise records of deliveries, including times, dates, and recipient information. This reduces the risk of disputes and helps maintain good customer relationships.

Not tracking fuel purchases and mileage correctly can cause discrepancies in tax filings and cost analysis. Maintain consistent logs of fuel receipts and mileage to help with tax deductions and budgeting for fuel expenses.

Failing to back up your records is a critical mistake. Cloud storage or secure external drives will safeguard your data in case of technical failures or accidents. This ensures you never lose important documents that may be required for audits or legal matters.

Commercial Truck Receipt Template

Ensure your commercial truck receipt includes all necessary details to maintain clarity and avoid confusion. Start by listing the company’s name and contact information at the top. This provides clear identification for both parties involved.

Next, clearly display the date of the transaction. Include the time if it’s relevant for your records. This ensures that you have accurate time stamps for each service or delivery.

Detail the specific services rendered or goods delivered. Include the quantity, unit price, and total amount for each item or service. This breakdown helps both the client and the service provider understand what was paid for.

Don’t forget to add payment details. Specify whether the payment was made by cash, check, or credit. Including transaction IDs for electronic payments or check numbers adds an extra layer of security and transparency.

Lastly, ensure a space for both the customer and service provider’s signatures. This confirms mutual agreement on the transaction and acts as a proof of receipt for both parties.