Using a template for company receipts can significantly streamline the process of tracking transactions. A well-structured template ensures that all necessary details are included and organized, making it easier to maintain accurate records. Opt for templates that automatically calculate totals and taxes, saving time and reducing the risk of human error.

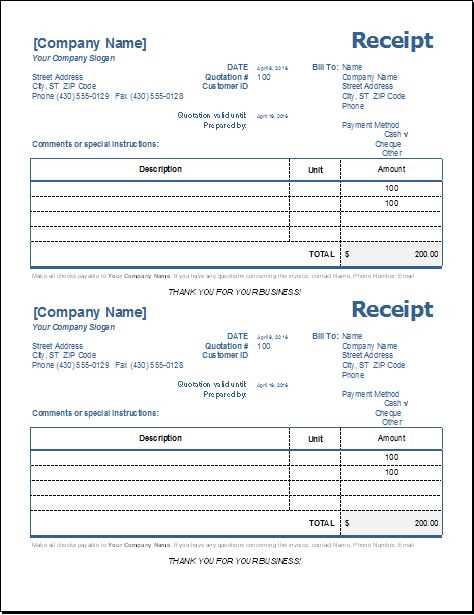

Choose a template that fits your business’s specific needs. For example, if your company provides services, include sections for hourly rates and job descriptions. If you deal with product sales, include itemized lists with product names, quantities, and prices. This customization helps ensure clarity for both your team and your clients.

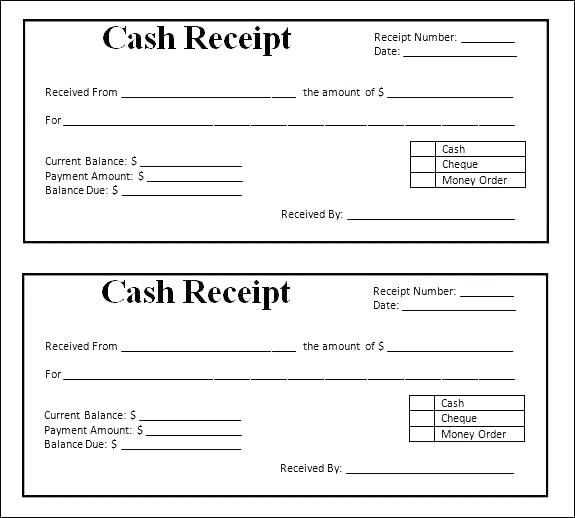

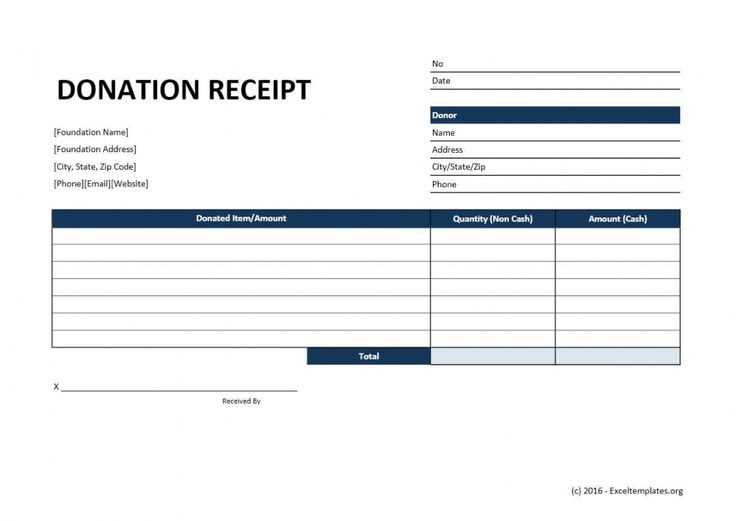

Ensure that the template includes clear sections for company name, date, transaction ID, and payment method. These details are not only useful for accounting purposes but also add professionalism to your transactions. Customizable fields allow you to include additional information that could be important to your specific industry.

For easy access, keep digital copies of your receipts in a cloud storage system, which will help you retrieve them quickly whenever necessary. Regularly updating your template based on feedback or changes in your business operations can further improve its usefulness.

Company Receipts Templates: Practical Insights

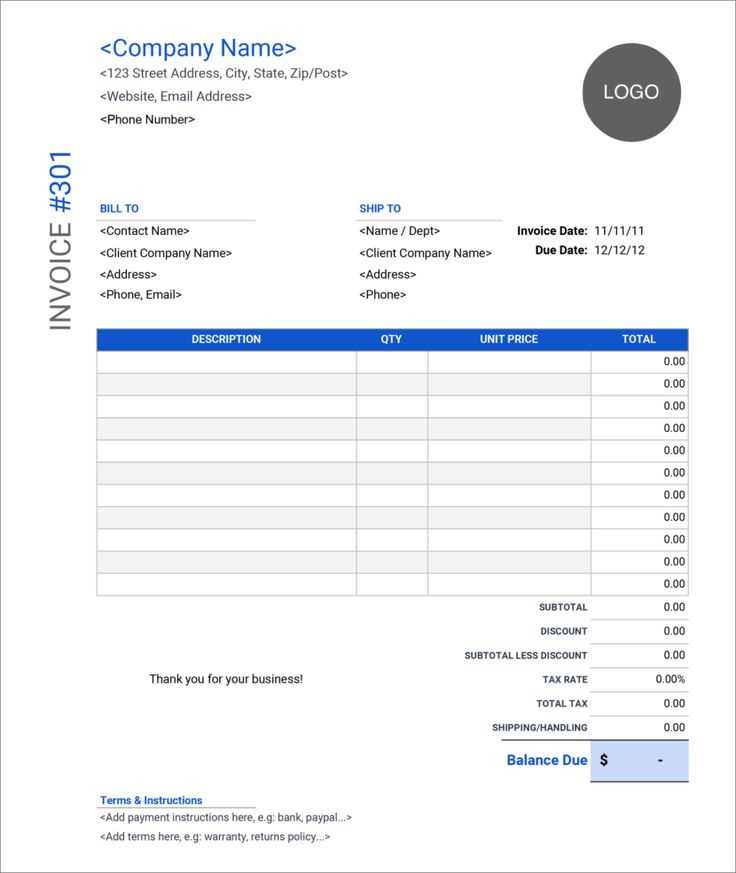

To streamline your company’s financial processes, use a customizable receipt template. A well-structured receipt not only enhances professionalism but also ensures accurate record-keeping. Focus on including the company name, date, unique receipt number, itemized details, and the total amount. Ensure your receipt format is clear and consistent, making it easier for clients to understand their purchases.

Key Elements to Include in a Receipt Template

A good receipt should have several key components. Start with the company’s contact information, including the name, address, and contact number. Clearly state the transaction date, the receipt number, and detailed descriptions of the products or services provided. Include the quantity, price, and total for each item. Finally, ensure that the total payment amount is listed prominently, along with any applicable taxes or discounts.

Design Tips for Clarity and Professionalism

Design your receipt template with simplicity in mind. Use a clear font and maintain proper spacing between sections to enhance readability. Avoid clutter and unnecessary details. A clean, easy-to-follow format will ensure your receipts are both professional and practical for everyday use.

Choosing the Right Template for Your Business

Pick a template that reflects your brand’s identity and meets your specific business needs. A well-chosen receipt template should simplify transactions while maintaining professionalism. Focus on clarity and accuracy; the template should include all necessary details such as business name, contact information, transaction date, and itemized costs. This not only streamlines the process but also builds customer trust.

Consider scalability when selecting a template. Choose one that can be easily adapted as your business grows or if you need to make updates to your pricing or branding. Avoid overly complex designs that might confuse customers or make it hard to find key information quickly.

Customization is key. The right template allows for customization without sacrificing readability. Ensure your template lets you add or remove sections as needed while keeping the layout clean and professional. Avoid overcrowding with unnecessary elements.

Look for templates that include space for both taxes and discounts, as well as the option to add personalized notes. This will give you flexibility and help maintain clear communication with your clients.

Customizing Templates for Branding and Compliance

Design your receipt templates to align with your brand and legal requirements. Customize elements such as logo, color scheme, and fonts to reflect your company’s identity, ensuring consistency across all documents.

Ensure compliance with local tax laws and industry standards by including required details. These often include:

- Tax identification number

- Business registration number

- Clear itemized lists with prices

- Proper VAT/GST breakdown

- Terms and conditions, where necessary

Regularly review your templates to ensure they meet both branding guidelines and legal updates. Adjust the layout to prioritize important information, such as payment methods or return policies, for customer clarity.

For further customizations, consider integrating automated tools that ensure your templates are updated seamlessly, allowing you to focus on running your business.

Integrating Receipts with Accounting Software

To streamline your financial management, link your receipts directly with accounting software. Start by choosing a platform that offers seamless integration with receipt capture tools. Many accounting systems now support direct upload or auto-sync options for receipts, making it simple to track expenses without manual entry.

Set up automatic categorization rules in the accounting software. By linking receipt data to expense categories, the software can categorize purchases in real time, ensuring accurate records. This minimizes human error and reduces the time spent organizing receipts at the end of the month.

Opt for accounting software that allows for receipt scanning or capturing via mobile apps. These apps automatically extract key information such as amounts, vendor details, and dates, which are then transferred to your accounting platform. This eliminates the need to enter data manually.

Ensure that your software can handle multiple receipt formats. Whether it’s paper, PDF, or digital receipts, make sure the system can interpret and store them in a format that integrates smoothly with your accounting records.

To stay compliant, choose software that supports tax reporting and can automatically apply tax rules based on receipt details. This integration helps keep your books in line with tax regulations, reducing the risk of costly mistakes during audits.

Lastly, consider setting up cloud-based syncing. This ensures that all receipt data is updated across devices, allowing you to access your records from anywhere and anytime, providing flexibility and ease of access for real-time financial management.