A conditional receipt serves as a temporary acknowledgment of a transaction, specifying conditions that must be met for full validation. When creating one, clearly outline the key terms, such as payment status, pending approvals, or return policies. This ensures transparency and protects all parties involved.

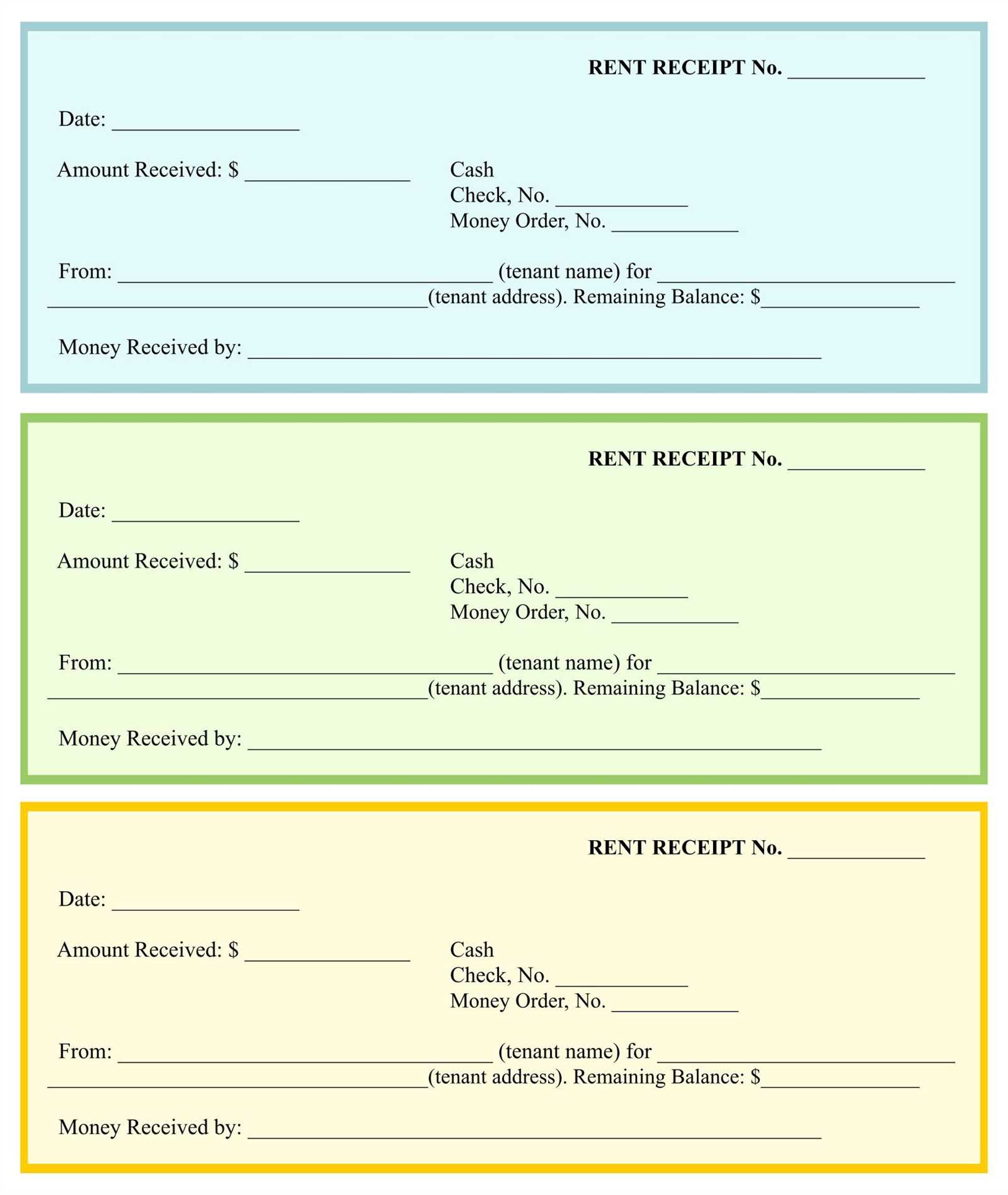

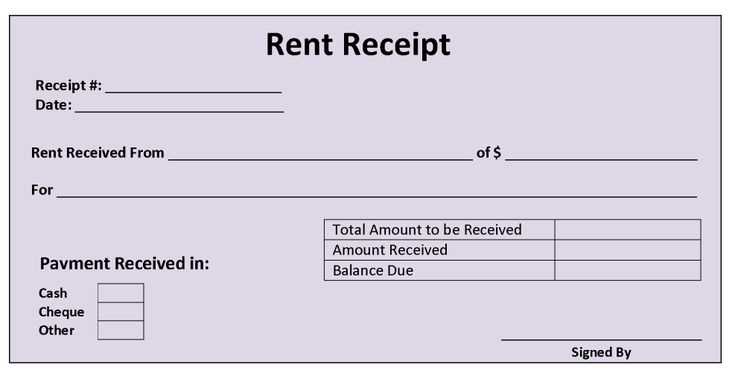

Essential Elements: Include the payer’s and recipient’s details, transaction date, amount, and a clear statement of conditions. For example, “This receipt is valid only upon final payment clearance” explicitly defines its conditional nature. If the receipt is related to a refundable deposit, specify the return criteria.

Formatting Tips: Use structured sections for clarity. A bold heading for “Conditions” ensures visibility. If the document is digital, consider an automated validation system to mark conditions as fulfilled.

Precision is key. Ambiguous language can lead to disputes. Keep statements direct, legally sound, and aligned with the agreement. For added security, require signatures or digital verification where applicable.

Here’s the corrected version without unnecessary repetitions:

Ensure that the template is clear and concise. Remove any redundant phrases that do not add meaning or clarity. Focus on the core information, such as the recipient’s details, payment terms, and specific conditions.

- Start with a clear introduction of the receipt’s purpose and the involved parties.

- Provide a brief summary of the transaction, including the amount and date of the transaction.

- State the conditions that apply to the receipt, making sure to avoid repetitive legal jargon.

Keep the language direct and avoid over-explaining. The goal is to ensure the recipient can quickly grasp the terms without confusion. Be specific when detailing conditions, but omit unnecessary qualifiers.

- For each condition, mention what action is required and the deadline for compliance.

- If applicable, provide contact details for follow-up or questions.

Wrap up by confirming the agreement and signing fields. Keep the conclusion short and professional, confirming the receipt and outlining next steps if necessary.

- Conditional Receipt Template: A Practical Guide

Creating a conditional receipt template requires clarity and precision. Begin by outlining the conditions tied to the receipt, ensuring they are simple and specific. This should include details like whether the receipt is contingent on future actions or obligations, and the exact nature of these actions. Each condition must be easily understandable to avoid confusion.

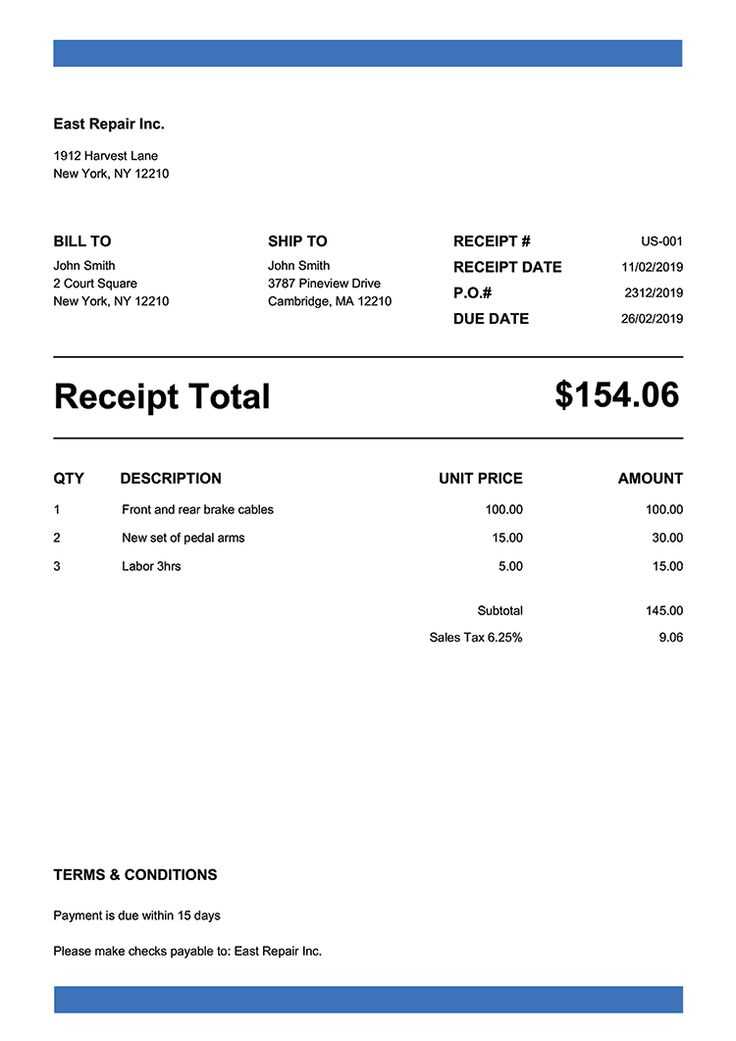

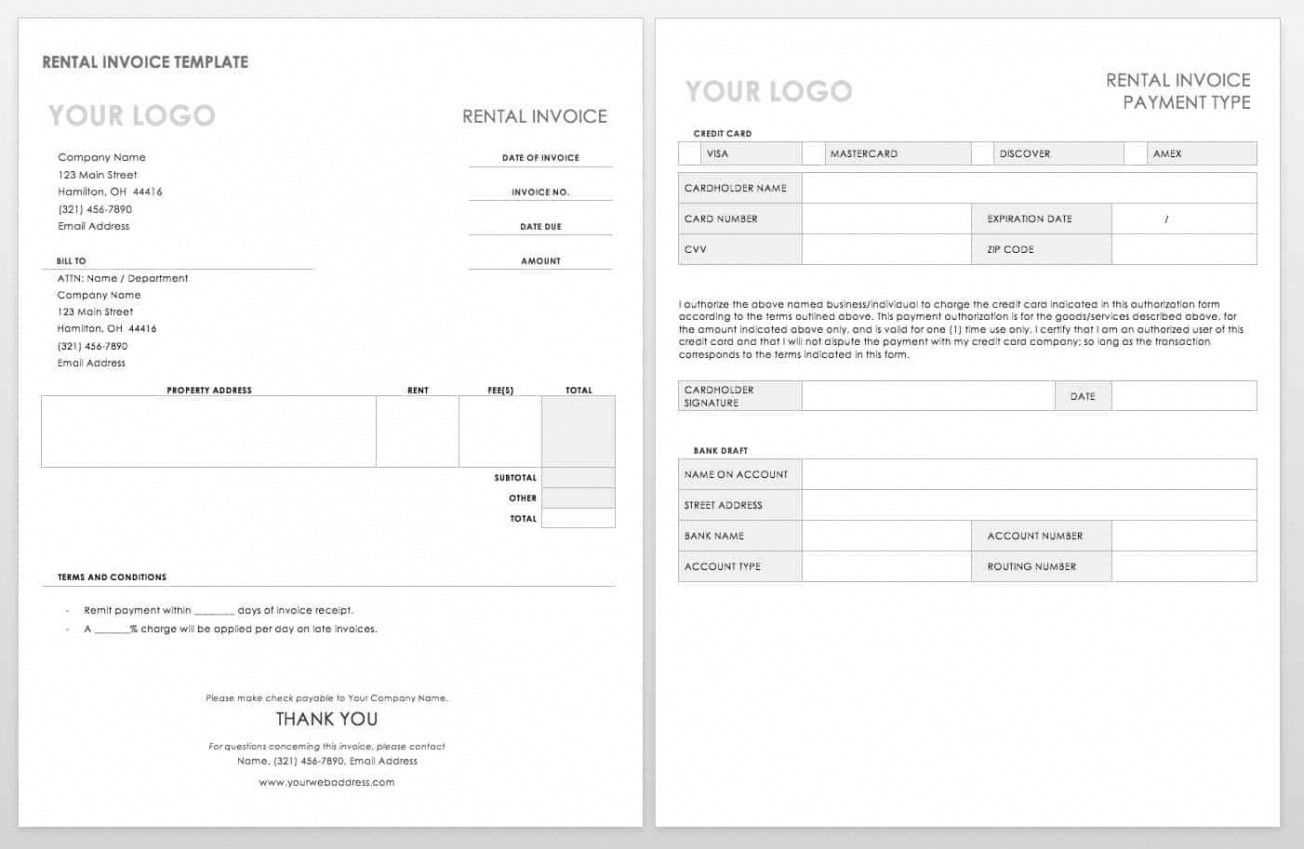

Design the template with space for essential information: recipient’s name, amount received, purpose of the payment, and any conditions attached. It’s vital that these details are presented clearly to reflect the transaction accurately.

Keep the tone professional but straightforward. Include a disclaimer or note that outlines the conditions that must be fulfilled for the receipt to be valid. For instance, you could state, “This receipt is valid only upon completion of the specified conditions, including but not limited to the following:…”

Finally, ensure the template includes a section for signatures. This validates the agreement and assures both parties that the terms of the receipt are understood and accepted.

Clearly define the purpose of the receipt. Include a statement identifying the type of transaction (e.g., payment, deposit, donation). Specify the involved parties: the payer and the recipient, with their contact details where applicable.

Clearly state the date of the transaction and any relevant deadlines or timeframes, such as payment due dates or delivery periods. Specify the exact amount involved, breaking it down by categories if necessary.

Indicate any terms or conditions that apply to the receipt. This can include refund policies, limitations on the service provided, or any special circumstances that affect the validity of the receipt.

Provide space for signatures or initials from both parties to confirm the agreement. Ensure these sections are easily identifiable to avoid confusion.

Include a reference number or unique identifier for tracking purposes. This helps with record-keeping and makes it easier to resolve disputes or verify transactions.

Draft your conditional receipt template with clear and precise language. Start by defining the terms and conditions without ambiguity. Each section should have a focused purpose and should not overlap with other clauses.

1. Define Key Terms

Provide a section for defining key terms used throughout the document. This ensures that both parties understand the terms uniformly and avoid misinterpretations. Clearly explain phrases such as “conditional receipt,” “payment,” or “delivery,” making sure they align with their specific legal implications.

2. Organize Content Logically

Structure the document into logical sections, each dedicated to a specific subject. Begin with an introduction that explains the nature of the agreement and its conditions. Follow this with separate sections for each condition, outlining the responsibilities and actions required for each party. Include a conclusion summarizing the agreement and next steps.

3. Use Numbered or Bullet Points for Clarity

- Condition 1: Detail the initial requirement, such as the receipt of goods or services.

- Condition 2: Specify any action needed to fulfill the condition, like making a payment or completing a task.

- Condition 3: Include timelines and deadlines for each action and requirement.

This clear, point-by-point format makes it easier for all parties to understand the specific terms they must follow, reducing the risk of confusion or disputes.

4. Avoid Ambiguity in Legal Terminology

Use precise legal language that leaves no room for different interpretations. Avoid vague phrases like “reasonable time” or “as soon as possible.” Instead, set exact timeframes or clearly define terms with specific meaning, such as “within 10 business days” or “upon receipt of payment.” This approach ensures there is no room for uncertainty regarding deadlines or actions.

5. Implement Conditional Clauses Clearly

When drafting conditional clauses, use simple and direct phrasing to express what happens if certain conditions are not met. For instance, “If the payment is not received within 10 days, the receipt will be void,” establishes the direct consequence of a failure to comply with the condition.

Conditional receipts are commonly used in industries where transactions or exchanges are contingent on certain conditions being met. For example, in e-commerce, a conditional receipt can be issued when a customer places an order but the item is out of stock. The receipt acknowledges the purchase while stipulating that the order will be fulfilled once inventory is replenished.

In real estate transactions, a conditional receipt may be used when a buyer makes an offer on a property, with the condition that the offer is subject to inspection results. This type of receipt clearly outlines the terms, helping to avoid misunderstandings between parties.

Another common use is in the automotive industry, where dealers issue conditional receipts when a customer places a deposit on a vehicle that is not yet available. The receipt confirms the transaction but specifies that the final sale is contingent on the arrival of the vehicle.

These receipts also play a role in warranty agreements. When a product is repaired or replaced, a conditional receipt might be provided, indicating that the warranty covers the service only under specific terms, such as the repair meeting certain standards or the product being returned within a defined time frame.

In all these cases, the conditional receipt serves to provide clarity about expectations, terms, and conditions, protecting both the issuer and the recipient by establishing clear documentation of the agreement.

Conditional receipts can serve as legally binding documents, but their enforceability depends on clear terms and mutual consent. Both parties must understand the conditions under which the receipt is issued. Without clarity, the terms may be deemed ambiguous, rendering them unenforceable in a legal context.

Key factors for ensuring enforceability include defining specific conditions and stipulations that trigger the receipt’s validity. A vague or poorly worded condition can lead to disputes, as the courts might interpret the terms differently than the parties intended.

For a conditional receipt to be upheld in court, it must be explicit in its language, indicating the specific obligations of both parties. The document should avoid general or subjective terms and outline any necessary actions or timelines. A failure to meet these conditions can result in the receipt being disregarded legally.

Consent is another crucial element in ensuring enforceability. Both parties must agree to the terms before the receipt becomes effective. A lack of consent, such as when one party does not understand or has not been properly informed of the terms, can invalidate the receipt.

Courts will also consider whether the receipt reflects the intent of both parties. A well-drafted document that clearly reflects the parties’ mutual agreement is more likely to be enforced. In contrast, a receipt lacking specificity may be interpreted in favor of the party who did not draft it.

Finally, when creating conditional receipts, seek legal counsel to ensure that terms are not only clear but also comply with relevant laws. This helps prevent legal challenges that could arise from unclear or unenforceable conditions.

Adjust your receipt template based on the type of transaction to ensure it meets specific needs. For a product sale, include product details, such as name, quantity, and price. If the transaction involves a service, emphasize the service description and duration. For refunds or exchanges, clearly state the previous transaction reference and adjustment amount.

For international transactions, consider adding currency information and exchange rates. When handling donations, include a section for tax-exempt status and a thank-you note. For online orders, provide a shipping address and estimated delivery date.

Always adapt your receipt to reflect the unique details of each transaction type. This not only ensures accuracy but also improves customer experience and reduces confusion.

Begin drafting the conditional receipt by addressing the key parties involved. Specify the names and roles of the buyer and seller, ensuring accuracy in their legal designations. Be clear about the purpose of the receipt, focusing on the transfer or receipt of goods, services, or funds, with a brief statement of the conditions attached.

Next, outline the transaction details. Include the date of the agreement, the amount or value of the transaction, and a description of the items or services being exchanged. Ensure that each item is precisely identified to avoid ambiguity. This section must also state the terms under which the receipt is conditional, such as subject to verification or pending approval.

Clearly define any contingencies. Specify the conditions that must be met for the receipt to become valid, such as payment verification or product inspection. Use concise, unambiguous language to outline these terms. Make sure all deadlines or timeframes are mentioned, so all parties are aware of their obligations.

Indicate the rights and responsibilities of each party. For example, who will bear the cost if any item is returned or found to be defective? Are there specific responsibilities for both the buyer and seller in case the conditions aren’t met? Address these details to avoid future disputes.

Conclude by including signatures or authorization lines. These must be completed by all parties involved in the transaction. The signed receipt confirms that all conditions were understood and agreed upon. Be sure to include space for dates and any necessary witness information, if applicable.

| Step | Action |

|---|---|

| 1 | Identify the parties and transaction purpose. |

| 2 | Outline transaction details (date, amount, description). |

| 3 | Define conditions that must be met for receipt to be valid. |

| 4 | Clarify rights and responsibilities of each party. |

| 5 | Include signatures and authorization lines. |

Ensure clarity in your conditional receipt template by including specific terms that define the conditions for receipt acceptance. Focus on outlining key information such as the purpose of the transaction, the date of receipt, and any requirements for fulfillment. Make sure the conditions are clear and concise, avoiding ambiguity that could lead to confusion or disputes later.

Key Elements to Include

Start with a clear description of what is being received, whether it’s goods, services, or documentation. Add a section that specifies what conditions must be met for the receipt to be considered valid. If necessary, state any deadlines or performance criteria tied to the receipt.

Formatting and Presentation

Use bullet points or numbered lists for the conditions to improve readability. Keep the language simple and direct, using active voice for greater impact. Additionally, leave space for signatures or acknowledgment at the bottom to confirm agreement to the conditions outlined in the receipt.