Key Elements of a Construction Work Receipt

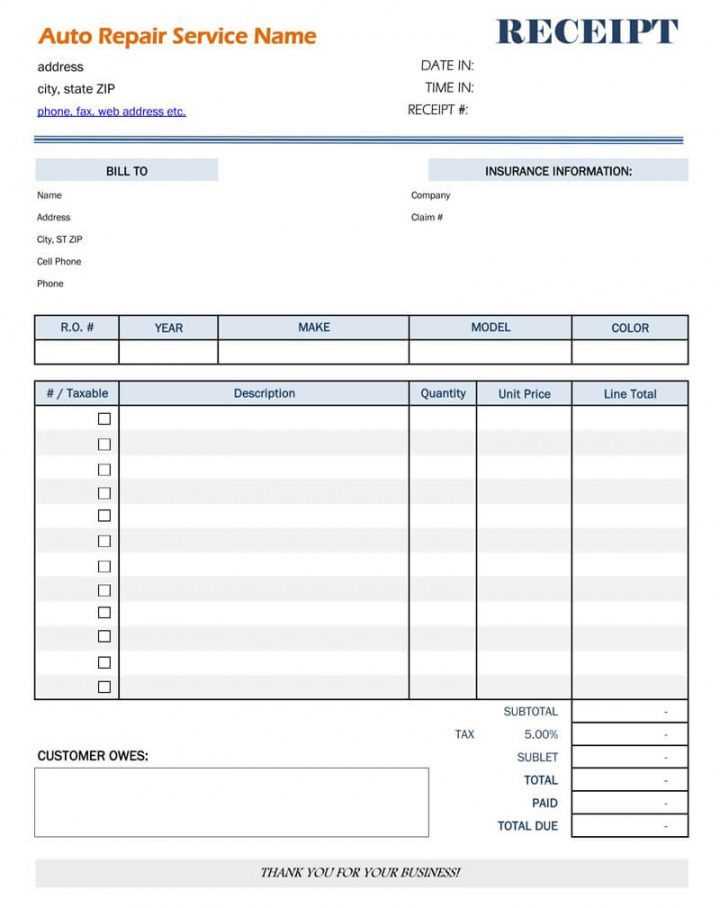

A construction work receipt must clearly outline the details of the services provided. Ensure the following components are included:

- Receipt Number: Assign a unique identifier for easy reference.

- Date: Record the exact date of the transaction.

- Contractor Information: Include the contractor’s name, address, and contact details.

- Client Information: Mention the name and contact details of the client receiving the work.

- Description of Services: Outline the tasks completed, including quantities, types of work, and materials used.

- Amount Charged: Clearly state the total cost, including breakdowns for materials, labor, and any additional fees.

- Payment Terms: Indicate when payment is due and any accepted payment methods.

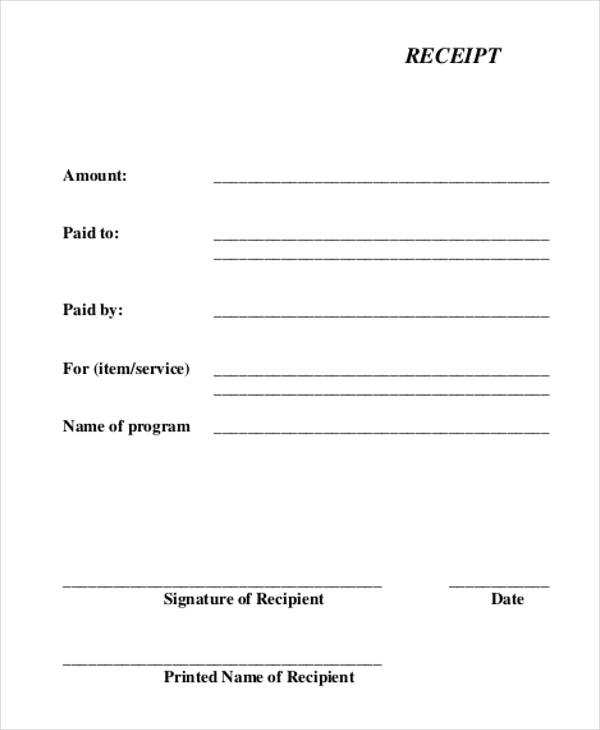

- Signatures: Include spaces for both the contractor’s and client’s signatures to confirm the completion and acceptance of the work.

Template Example

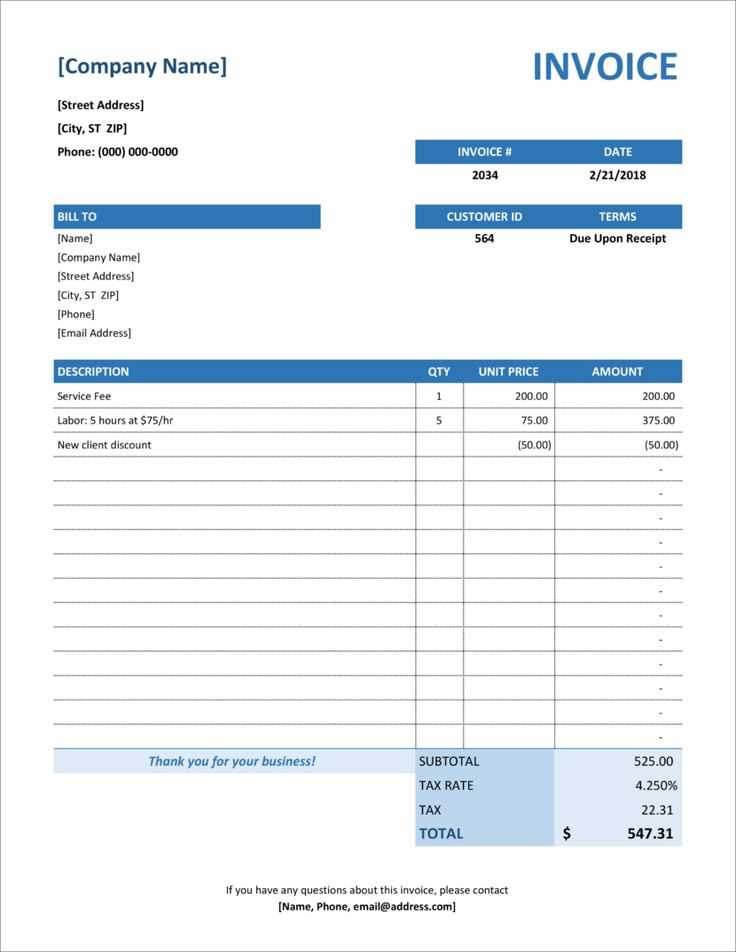

Here’s a simple example of a construction work receipt:

Receipt Number: 00123 Date: February 10, 2025 Contractor: John Doe Construction Address: 123 Main St, Cityville Phone: (123) 456-7890 Email: [email protected] Client: Jane Smith Address: 456 Oak Rd, Townsville Phone: (987) 654-3210 Email: [email protected] Description of Services: - Demolition of old structure: 20 hours at $25/hr - Concrete foundation: 150 sq. ft. at $15/sq. ft. - Materials (cement, steel bars): $500 Amount Charged: Labor: $500 Materials: $500 Total: $1000 Payment Terms: Due by: February 15, 2025 Accepted Payment Methods: Cash, Check, Bank Transfer Contractor’s Signature: ________________________ Client’s Signature: _____________________________

Additional Tips

Ensure the receipt is easy to read and free of errors. If the work involved multiple stages, consider breaking down the charges for each part. This helps prevent misunderstandings and provides transparency for both parties.

For businesses, using software to generate receipts can save time and reduce mistakes, offering a professional touch while maintaining accuracy in the transaction details.

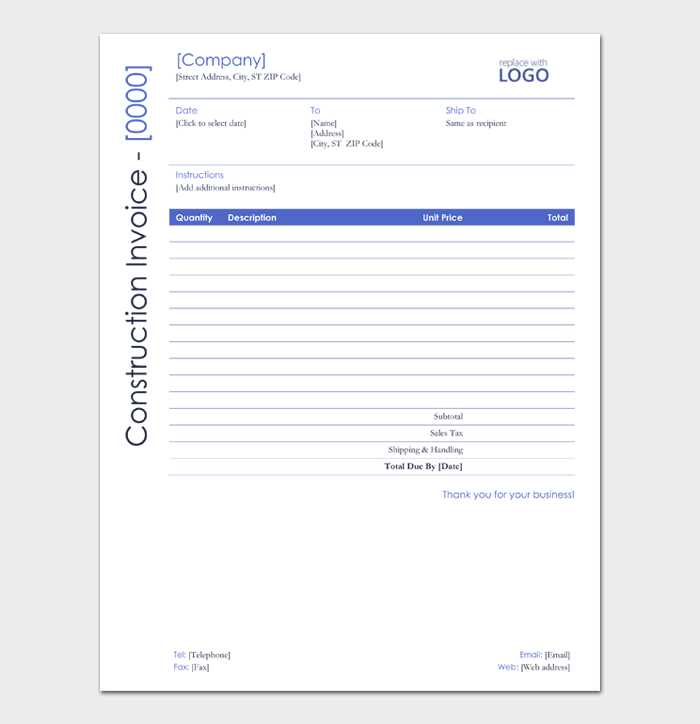

Construction Work Receipt Template

Key Elements of a Work Receipt

Legal and Tax Aspects of Formatting

Adapting a Template for Various Projects

Digital vs. Paper: Advantages and Drawbacks

Frequent Errors in Creating Receipts

Storing and Organizing Receipts

A construction work receipt should include the project details, payment amount, payment method, and date of payment. Clear identification of both the contractor and client, along with the project’s scope and specific work done, ensures transparency. List of materials used, hourly rates, and additional charges (if any) must be accurately detailed. Incorporate terms for warranty or additional services, if applicable. All amounts should be correctly calculated, and tax details must comply with the local tax code.

Legal and Tax Aspects of Formatting

Receipts must align with tax regulations to avoid complications during audits. Make sure to include the contractor’s business identification number and any applicable tax numbers, especially for larger projects. Ensure tax rates are applied correctly to labor and materials. Keep accurate records for tax deduction purposes, as tax authorities may require receipts for verifying expenses or income.

Adapting a Template for Various Projects

Modify your template to reflect the specific needs of each project. For residential work, emphasize material costs and labor hours, while commercial projects may require more detailed terms related to compliance and insurance. Templates should be flexible, allowing you to include unique payment arrangements, warranties, or service contracts where relevant.

Digital receipts offer convenience and easy sharing, but paper receipts are often required for compliance in some areas. Both formats should maintain clarity and include all necessary details for proper record-keeping. Choose the format that aligns with the project’s needs and client expectations.

Common errors include incomplete information, like missing dates or amounts, incorrect tax calculations, or omitting necessary project details. Always double-check calculations, and make sure every field is filled correctly before issuing the receipt.

Organizing receipts is key for easy access during tax season or future project disputes. Keep digital records backed up securely and store paper copies in a dedicated filing system, sorted by project and date.