Choosing the Right Template for Your Business

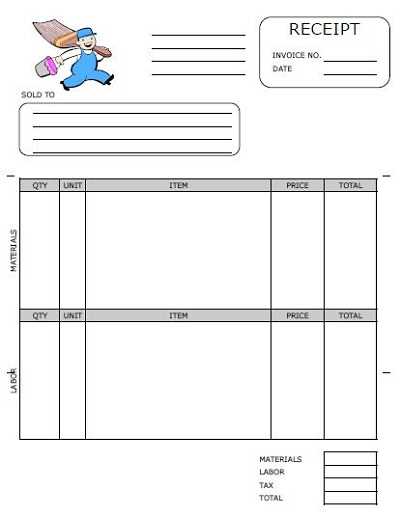

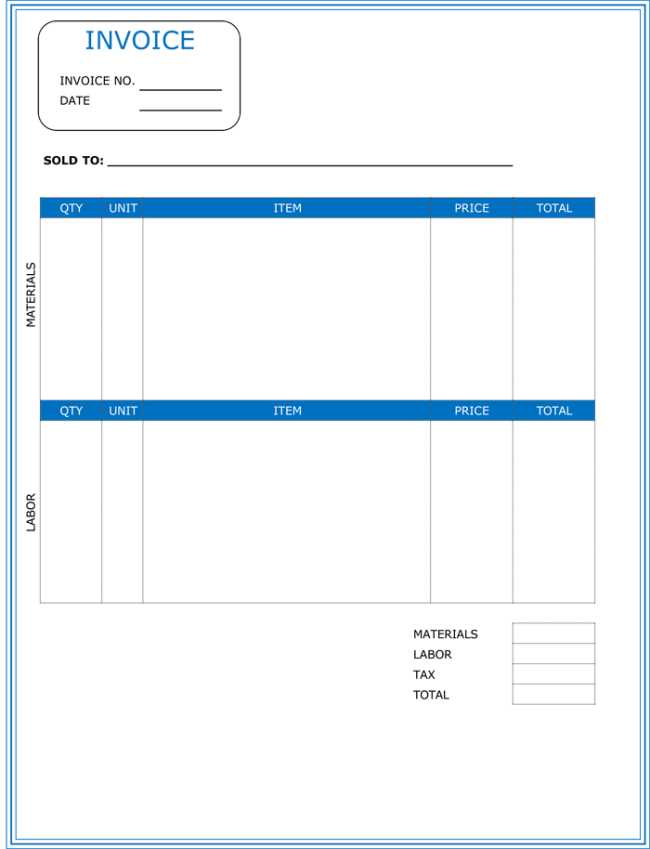

Contractor receipts serve as proof of transaction, detailing the work completed and the agreed-upon price. Selecting the correct template can streamline this process and ensure clarity. Look for a receipt template that includes the following key elements:

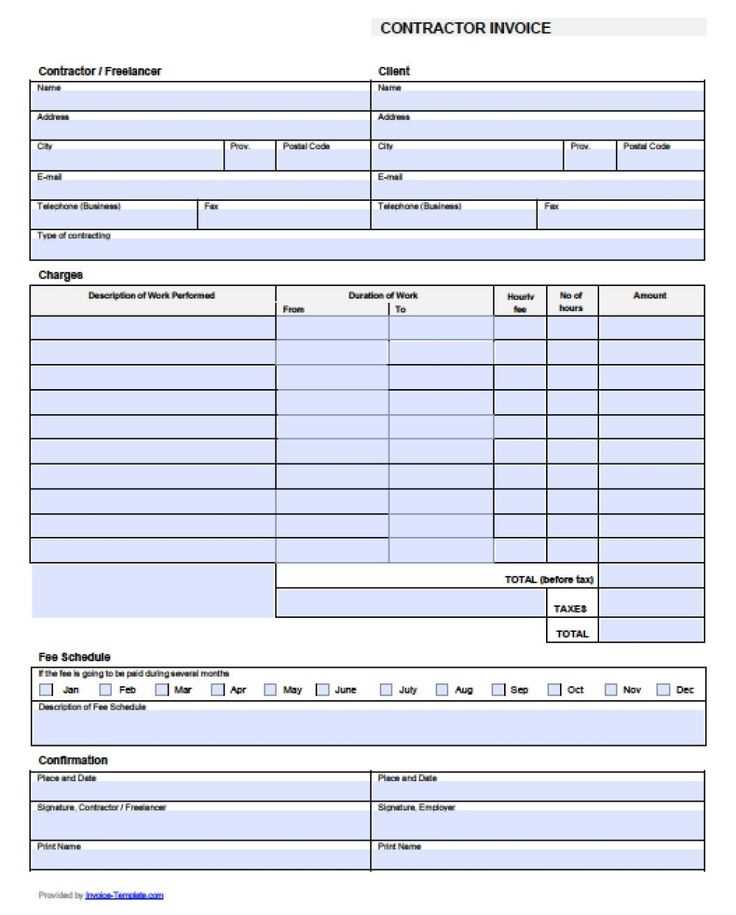

- Contractor Information: Name, address, and contact details of the contractor.

- Client Details: Information about the client receiving the services.

- Service Description: Detailed description of the work completed.

- Total Cost: Clear itemization of charges, including labor and materials.

- Payment Terms: Due dates, payment method, and any relevant discounts or taxes.

- Signature Line: Space for both the contractor and client signatures to confirm the transaction.

Where to Find Templates

Many online resources offer free contractor receipt templates. Websites like Canva, Microsoft Word, and Google Docs provide customizable templates that can be tailored to your business needs. Choose a platform that aligns with your workflow, whether it’s digital or printed receipts.

Customizing Your Template

Modify your receipt template to reflect your brand by adding a logo or customizing fonts. This can help clients recognize your receipts and provide a more professional appearance. If you frequently work on projects of different scopes, ensure that the template can handle varied payment structures or additional line items.

Key Tips for Using Templates Effectively

- Stay Organized: Use a consistent naming convention for your receipts, such as project name or invoice number, for easy tracking.

- Double-Check Details: Ensure the amounts and terms are accurate before submitting the receipt to clients.

- Keep Records: Store copies of all receipts for tax and business tracking purposes.

- Consistency: Use the same format for every transaction to maintain professionalism.

Final Thoughts

Choosing and customizing the right contractor receipt template helps maintain organization and professionalism in your business. With a few simple tweaks, a basic template can effectively capture the details of each transaction and provide clear communication with clients. Whether for small repairs or large projects, contractor receipts are an important part of building trust and keeping accurate records.

Contractor Receipt Templates

How to Customize Receipts for Various Services

Key Elements to Include in a Receipt Template

Tips for Ensuring Clarity and Accuracy in Details

Common Mistakes to Avoid When Creating Receipts

How to Adapt Receipts for Digital Use

Legal Considerations When Issuing Receipts

For different services, adjust receipt templates to reflect the specific nature of the work performed. For example, for construction services, include detailed breakdowns of labor and materials, while for consulting services, focus on the hours worked and the hourly rate. Adapt descriptions based on the industry, and make sure the service rendered is clear to avoid confusion.

Key elements in any receipt template include the contractor’s name and contact information, client details, a description of the services rendered, the total amount charged, the payment method, and the date of the transaction. Adding unique identifiers such as receipt numbers or job references ensures traceability for both the client and contractor.

Clarity is crucial–use plain language and avoid jargon. Break down complex services into digestible sections. For accuracy, double-check numbers and ensure the total aligns with the individual items listed. If applicable, include taxes or discounts and show them separately to avoid ambiguity.

Common mistakes include leaving out critical information like payment terms or providing incomplete descriptions of the services. Additionally, avoid using vague language that could lead to misunderstandings about the scope of work completed. Always ensure the receipt matches the agreed-upon terms.

For digital receipts, use software or templates that automatically generate the necessary details. This can simplify adjustments and ensure uniformity across multiple transactions. Digital receipts should include the same key elements as physical ones and must be formatted for easy viewing on screens of all sizes.

Legal considerations involve ensuring that receipts comply with tax laws, including the correct display of taxes or deductions. Be aware of any industry-specific regulations regarding documentation, and keep records of all issued receipts for potential audits. Maintain a consistent format to streamline compliance and prevent errors.