To make managing healthcare expenses easier, create a detailed copay or deductible receipt template. This template should include key information such as the patient’s name, the date of service, the medical provider’s name, and the amount paid. Include a breakdown of services, showing how the payment applies to the deductible or copay amount.

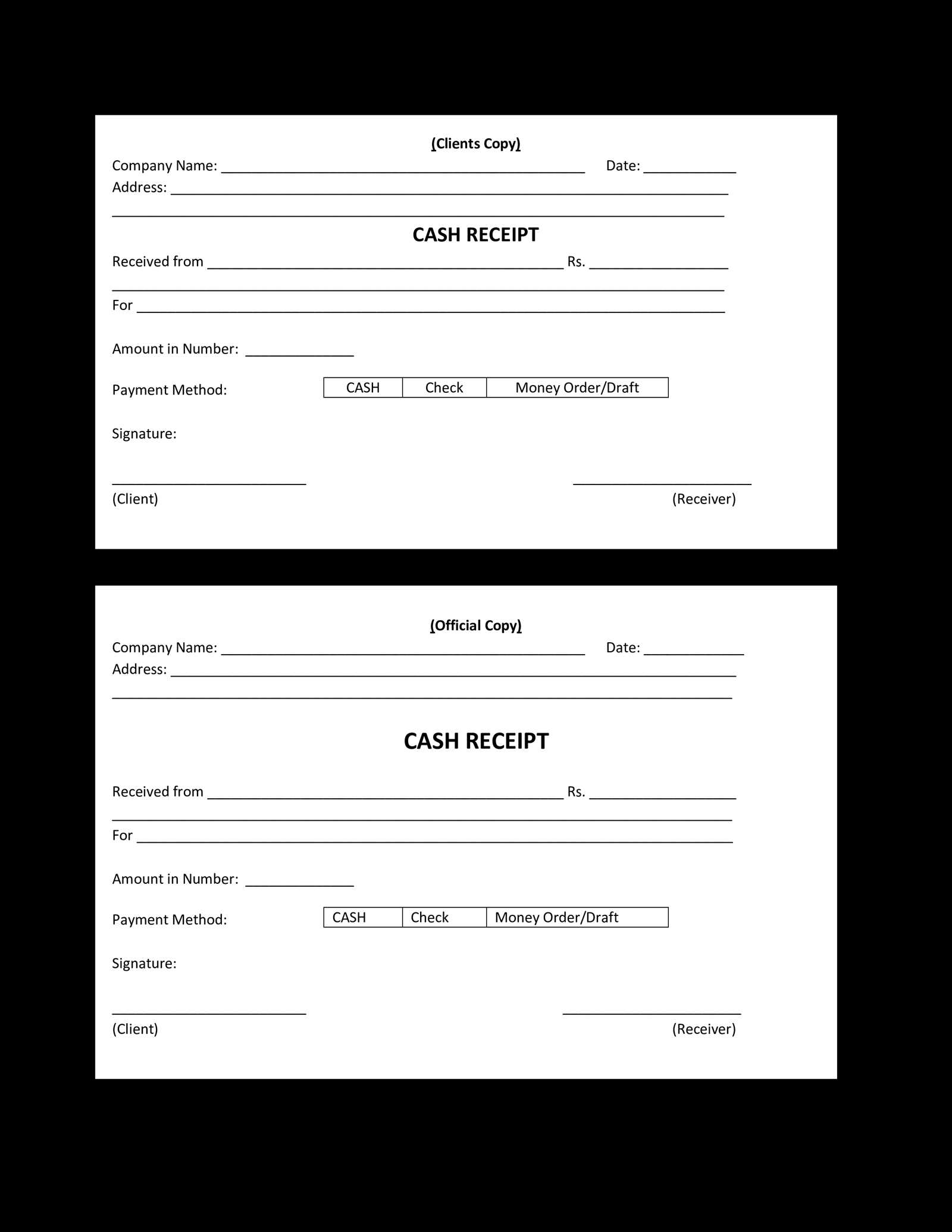

Use a simple format that is easy to understand for both the patient and insurance company. This ensures no confusion when submitting for reimbursement or tracking medical expenses. Clearly state the total amount paid and highlight the copay or deductible portion.

For accuracy, ensure all required fields are filled out correctly, including the payment method and transaction ID. Keep the receipts organized for future reference and tax purposes. By using this template consistently, you can streamline the process of managing out-of-pocket medical costs and avoid errors when seeking reimbursement.

Here are the improved lines:

Ensure the receipt clearly separates the copay amount and deductible. This makes it easier for you to identify which part of the payment applies to each category. The following template highlights this separation:

| Description | Amount |

|---|---|

| Copay Amount | $25.00 |

| Deductible Amount | $50.00 |

| Total Paid | $75.00 |

Clearly label “Copay” and “Deductible” in the receipt, with distinct rows for each. This setup simplifies tracking your healthcare expenses, especially when comparing with insurance statements or filing taxes.

- Copay or Deductible Receipt Template

To create a reliable receipt for copay or deductible payments, include the following details:

Key Information to Include

Ensure that the receipt contains the payer’s full name, the provider’s name, and the date of the transaction. Also, specify the amount paid, identifying whether it is for a copay or deductible. Including a description of the service or treatment rendered adds clarity.

Additional Tips

For added transparency, consider adding a breakdown of the charges. This helps both parties clearly understand what the payment is for. Keep the formatting simple and professional, ensuring it is easy to read and understand at a glance.

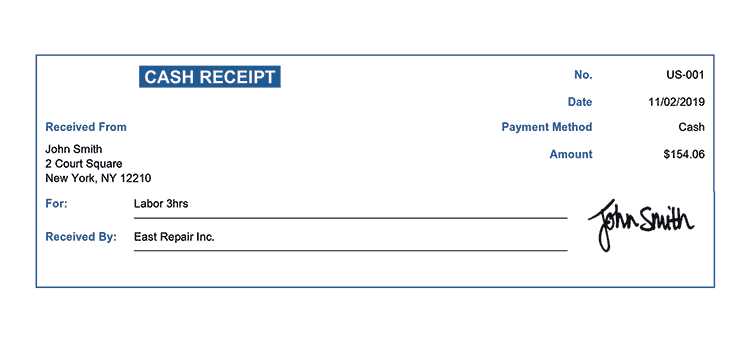

Begin by including the patient’s details at the top of the invoice, such as their full name, address, and insurance information. This ensures that the invoice is tied directly to the individual receiving treatment.

Include a Clear Date of Service

Clearly state the date the services were provided. This helps the patient verify when the charge occurred and can avoid confusion if multiple services are listed.

Itemize the Services

List each service or procedure separately with corresponding charges. Be transparent about the cost of each item to avoid any questions later. For example, include diagnostic procedures, office visits, and medications if applicable.

Next, provide details of the copay or deductible amount that applies to each service. Indicate how the amount is calculated based on the insurance policy, and specify any payment the patient has already made.

Finally, include the total amount due, and mention payment instructions. This might involve specifying whether the payment should be made online or by check, and if there are any deadlines for payment.

Ensure your receipt clearly states the following details: the name of the healthcare provider, the date of service, the total amount charged, the amount of the copay or deductible paid, and any remaining balance. Verify that the insurance provider’s information is included as well, if applicable. This helps in accurate reimbursement or tax filing.

Receipt Format

The receipt should have a breakdown of the service costs, with the copay or deductible clearly marked. Look for a separate line item indicating the amount paid and its application to the copay or deductible. Avoid receipts without this level of detail, as they may not be acceptable for reimbursement or tax claims.

Additional Notes

Check whether the receipt includes a patient ID or case number, which may be needed for documentation. If you made partial payments, ensure they are listed individually. Always keep a copy for your records, especially if you need to submit it to your insurance provider or for tax purposes.

Ensure the payment amount is clearly stated, matching the agreed-upon sum. Double-check calculations to prevent discrepancies. Inaccurate amounts can lead to confusion and delays in processing payments.

Do not omit crucial information such as payer details, payment method, or transaction date. These elements help both parties reference and verify the transaction efficiently.

1. Missing or Incorrect Dates

- Always include the correct transaction date. If this is missing or incorrect, it may cause misunderstandings about the payment’s timeliness.

- Verify that the date format matches the expected standards of your region or business practice.

2. Lack of Clear Itemization

- If the payment is for a service or product, break it down by line items. This transparency prevents disputes about what was paid for.

- Include a brief description of each item or service, along with its corresponding cost.

Double-check that the receipt is legible and all entries are easy to understand. Avoid using jargon or abbreviations that may be unclear to the recipient.

Finally, ensure that the receipt includes both the payer’s and payee’s contact information, ensuring that any issues can be resolved quickly without confusion.

To ensure smooth processing of your medical expenses, always request a detailed copay or deductible receipt. This document is vital for tracking payments and insurance claims. Here’s how to create a clear, easy-to-understand receipt:

Receipt Components

- Provider Name and Contact Information: Include the name, address, and contact details of the healthcare provider.

- Patient’s Information: Add the patient’s name, date of service, and any relevant insurance identification number.

- Itemized List: Break down the services provided, showing individual costs and copay amounts for each item or service.

- Total Paid: Clearly list the total amount paid by the patient, including the copay or deductible portion.

- Insurance Information: Include the amount covered by insurance and the remaining balance, if applicable.

Why it’s Important

Having a clear copay or deductible receipt simplifies reimbursement from insurance or tax purposes. It also helps track payments and avoids discrepancies in future claims. Always keep a copy for your records and verify that all details are accurate before finalizing payments.