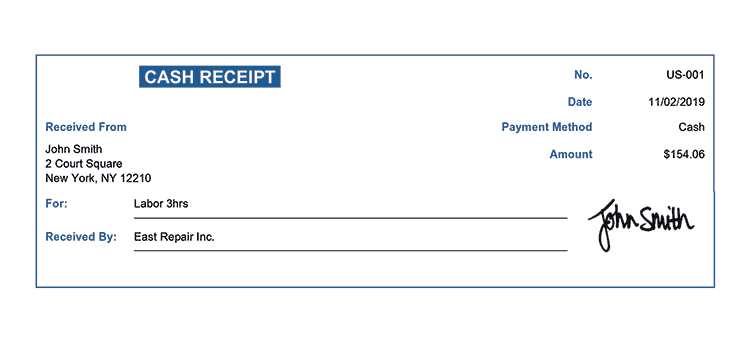

A well-structured receipt provides clarity for both the client and the service provider. Ensure that each document includes the session date, the counsellor’s name, and a unique receipt number for accurate record-keeping. Adding a detailed service description prevents misunderstandings and simplifies financial tracking.

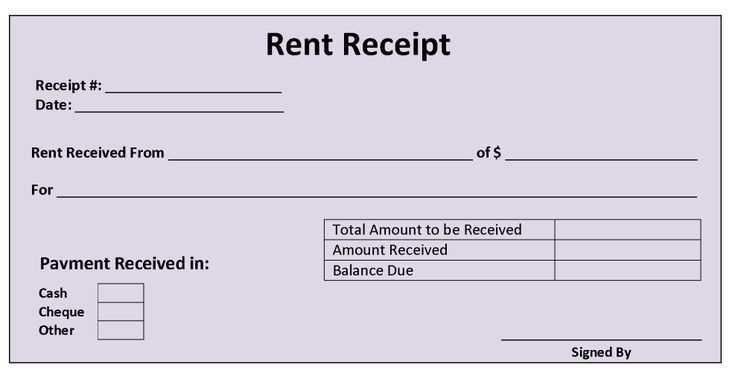

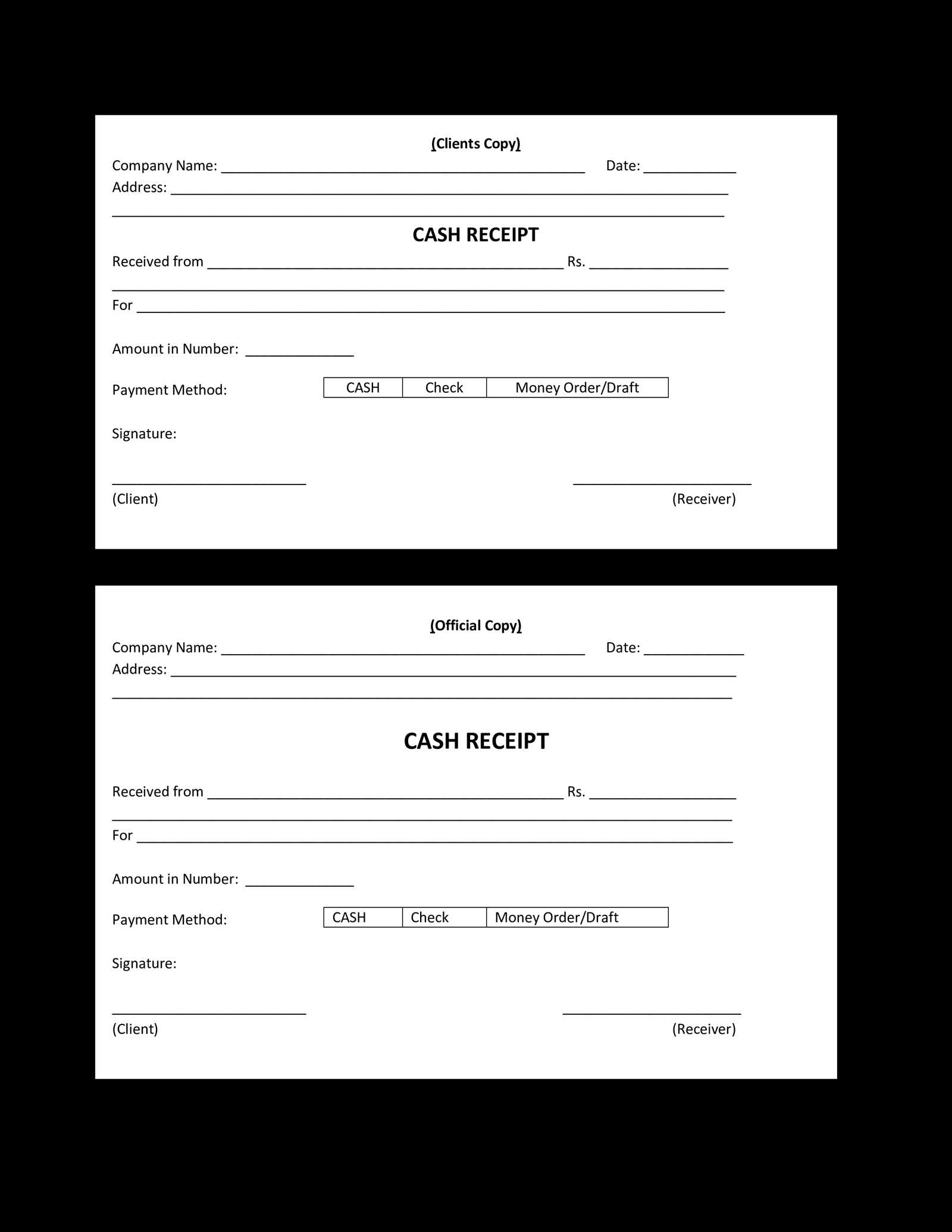

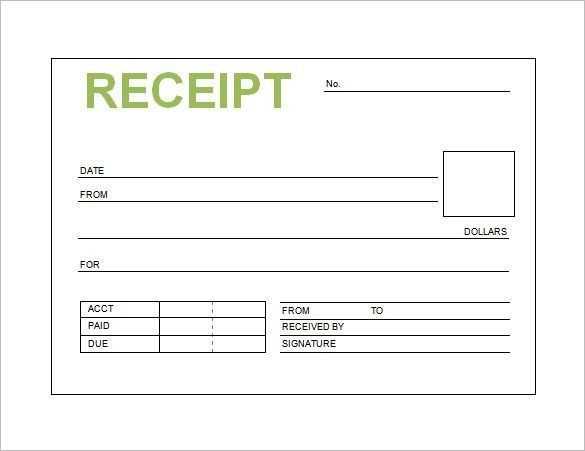

Essential components include the client’s name, payment amount, and method. Clearly state whether the fee was paid in full or if an outstanding balance remains. If applicable, include tax details and any reimbursement instructions for insurance claims.

Formatting matters. Use a simple layout with distinct sections for quick reference. Digital receipts should be easy to print and store, while handwritten ones must be legible and professionally structured. A concise footer with the provider’s contact information adds credibility.

Standardizing your receipts improves financial management and enhances client trust. Whether using a template or a custom design, consistency ensures transparency and simplifies future audits.

Counselling Receipt Template

Ensure each receipt includes key details to maintain clear records and meet financial and legal requirements. A well-structured template provides transparency for both parties.

Essential Information to Include

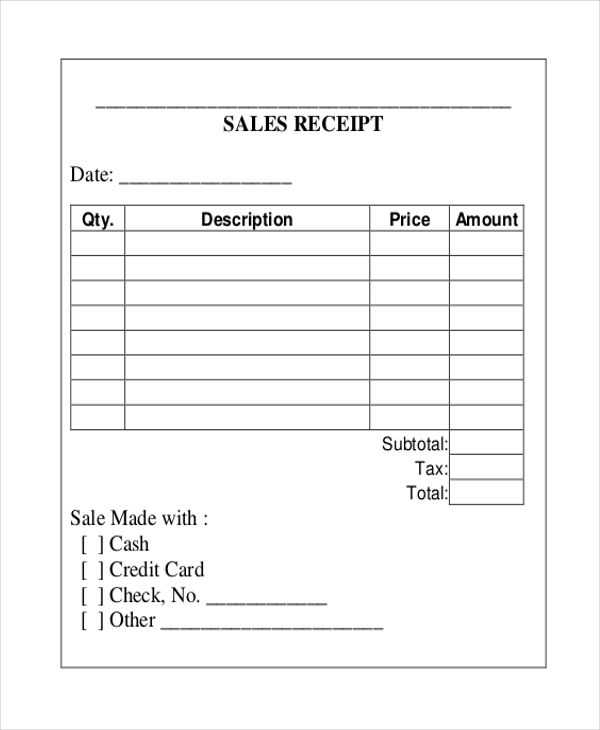

- Date of Service: Specify the exact session date.

- Client Information: Include the full name and contact details.

- Service Description: Clearly outline the type of consultation.

- Fee Breakdown: List charges, taxes, and total cost.

- Payment Method: Indicate whether payment was made via cash, card, or transfer.

- Receipt Number: Assign a unique identifier for tracking.

- Provider Details: Include the counselor’s name, credentials, and business contact.

Structuring the Receipt

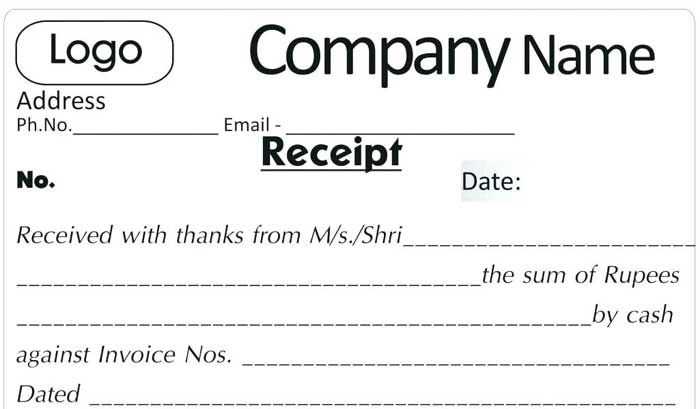

- Use a professional layout with a clear header containing the business name and logo.

- Organize sections logically, separating client details, service description, and payment summary.

- Ensure readability with consistent font size and spacing.

- Include a disclaimer if required for reimbursement or insurance claims.

- Provide both digital and printed copies for record-keeping.

Standardizing the format simplifies bookkeeping and ensures compliance with financial policies.

Key Elements to Include in a Receipt

Date and Time: Always include the exact date and time of the transaction. This helps with record-keeping and future reference.

Service Details: Clearly state the type of counselling provided. Specify whether it was an individual session, a group consultation, or another format.

Client Information: Include the full name of the client and any relevant identification details. This ensures accurate documentation.

Payment Breakdown: List the total amount paid, along with a breakdown of charges, taxes, and any applicable discounts.

Payment Method: Indicate whether the payment was made in cash, by card, or through another method. This avoids confusion in financial records.

Provider Information: Add the name, contact details, and official credentials of the counsellor or organization issuing the receipt.

Unique Receipt Number: Assign a distinct reference number for tracking purposes. This simplifies bookkeeping and prevents duplication.

Cancellation or Refund Policy: If applicable, include a brief statement on refund eligibility and any conditions for rescheduling.

Signature or Stamp: If required, add a signature or an official stamp to validate the receipt.

Formatting and Layout Best Practices

Align text and numerical details for clarity. Use a left-aligned layout for descriptions and right-align amounts to improve readability. Maintain consistent spacing between sections to separate key details.

Keep fonts legible by choosing sans-serif typefaces. Set a minimum font size of 12px for body text and 16px for headings to enhance accessibility. Avoid excessive bold or italic styles that may clutter the design.

Use clear section labels such as Client Information, Service Details, and Total Amount. Separate these with subtle lines or spacing to prevent visual overload.

Ensure proper margins by leaving at least 0.5 inches of space around the content. This prevents elements from appearing too cramped while allowing room for signatures or additional notes.

Format monetary values consistently by placing currency symbols before amounts and aligning decimals. Use a two-decimal format (e.g., $50.00) for precision.

Limit color usage to neutral tones with one highlight color for key figures, such as the total cost. Avoid unnecessary background patterns that may distract from the content.

Structure information in a logical flow, moving from client details to service descriptions and payment specifics. Use bullet points for multiple service items to enhance clarity.

Ensuring Compliance with Legal Standards

Issue detailed receipts to meet regulatory requirements. Include the client’s name, session date, amount paid, and a brief description of services provided. Add your business details, including tax identification if applicable.

Secure and Accurate Record-Keeping

Maintain digital and physical copies of receipts for the required retention period. Use encrypted storage for electronic records to protect client confidentiality. Regularly audit records to prevent discrepancies.

Adhere to Tax and Privacy Regulations

Verify local tax laws to determine whether receipts must include sales tax or other levies. Follow data protection guidelines by limiting access to financial records. If using third-party invoicing software, ensure it complies with industry security standards.

Review legal updates regularly to stay compliant with changes in financial and privacy regulations. Consult a legal professional for guidance specific to your jurisdiction.