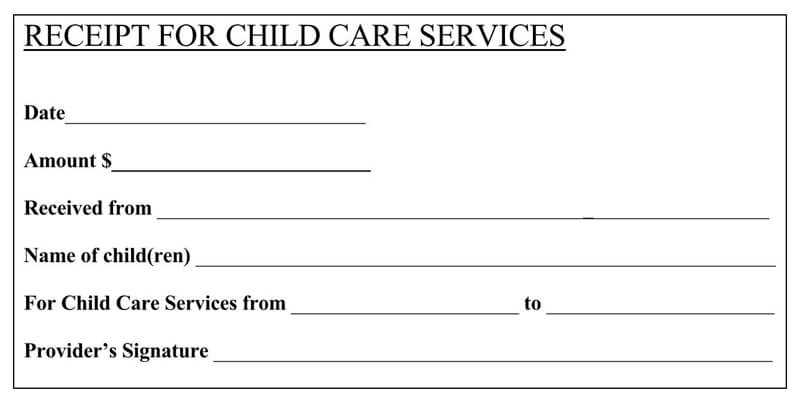

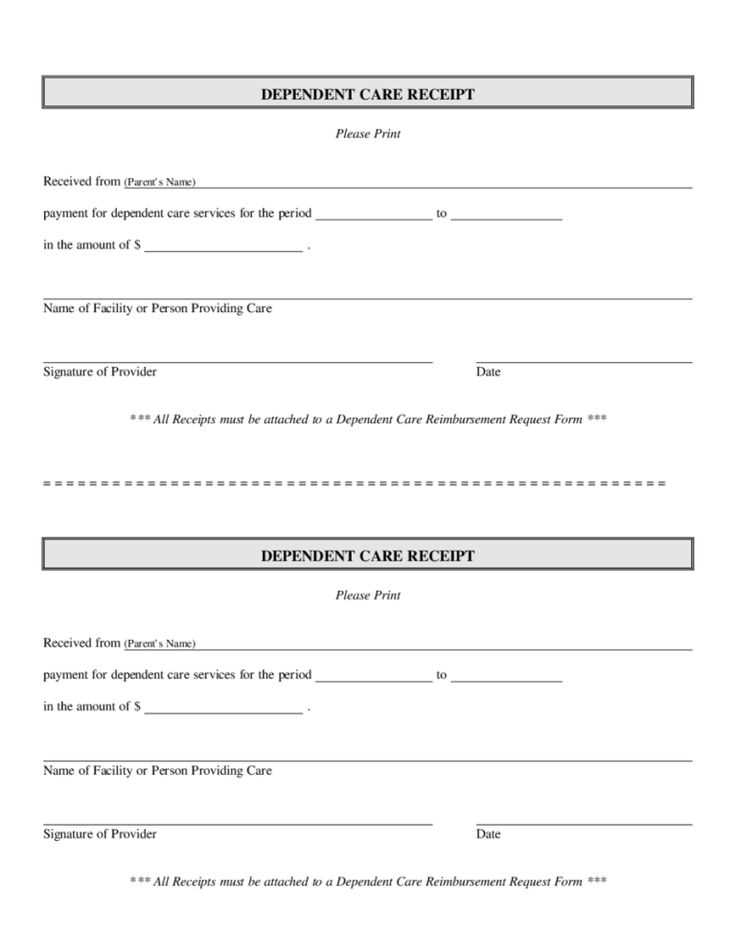

To claim child care expenses with the Canada Revenue Agency (CRA), it’s essential to have the proper documentation. The CRA child care receipt template helps ensure you provide all necessary information to support your claim. Make sure that the receipt clearly includes the name of the child care provider, their address, the dates services were provided, and the total amount paid.

Using a standard template simplifies the process and reduces the risk of errors. You can easily create a receipt or request one from your provider by ensuring it contains specific details: your child’s name, the type of care, and any applicable tax numbers for the provider. Double-check the formatting to ensure it matches the CRA’s requirements.

Keep this receipt in a safe place, as the CRA may request it when reviewing your tax return. Accurate documentation not only supports your claims but also prevents delays in processing. By using the correct format, you streamline the submission and avoid unnecessary complications down the line.

Here are the revised lines with minimal repetition, keeping the meaning intact:

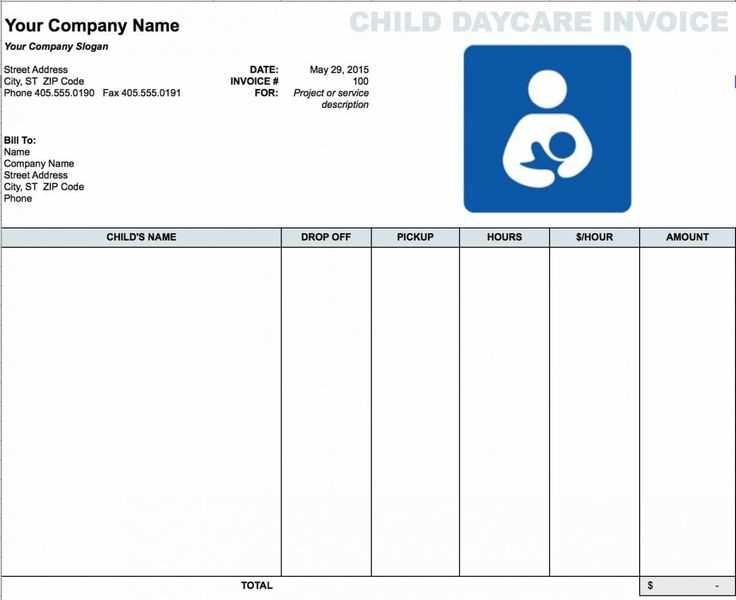

Provide a detailed description of the services rendered, including dates, hours, and the caregiver’s name. Ensure accuracy in the total amount paid, matching the amounts shown on receipts or invoices.

Use clear, concise language to describe the childcare service, avoiding unnecessary details that might clutter the receipt. Specify the exact number of hours worked, including any additional charges, such as for late nights or weekends.

Clearly state the payment method used, whether by cash, check, or electronic transfer. Include any relevant reference numbers or transaction IDs for electronic payments.

Make sure that the child’s name, along with the caregiver’s contact details, are included. This helps to maintain transparency and accountability for both parties.

Finally, ensure that the receipt is signed by both the caregiver and the parent or guardian, confirming that the information is accurate and agreed upon by both parties.

CRA Child Care Receipt Template Guide

To claim child care expenses with the Canada Revenue Agency (CRA), you need to submit a proper receipt. The CRA child care receipt template includes the required information to ensure your claim is processed smoothly. Make sure your receipt has all of the following elements:

Key Information Required

1. Provider’s Name and Address: The receipt must clearly state the name, address, and contact details of the child care provider.

2. Date and Time of Service: The receipt should specify the dates and hours of child care services provided. This helps to confirm the exact duration of care.

3. Amount Paid: The total amount paid for services must be clearly indicated, including any applicable taxes. Ensure this matches the payment records you have on file.

4. Child’s Name: For your claim to be valid, the receipt must list the name(s) of the child or children for whom the care was provided.

Additional Details

5. Tax Identification Number (TIN): The provider’s TIN, or business number, must appear on the receipt. This confirms the legitimacy of the child care provider.

6. Signature or Stamped Verification: A signature or a stamp from the child care provider is often necessary to confirm the authenticity of the receipt. If the provider uses an electronic receipt system, an automated confirmation might be sufficient.

Ensure you keep all receipts organized and accurate. Incomplete or inaccurate information can delay your refund or lead to a rejected claim. By following these guidelines, you’ll ensure that your child care expenses are correctly reported and accepted by the CRA.

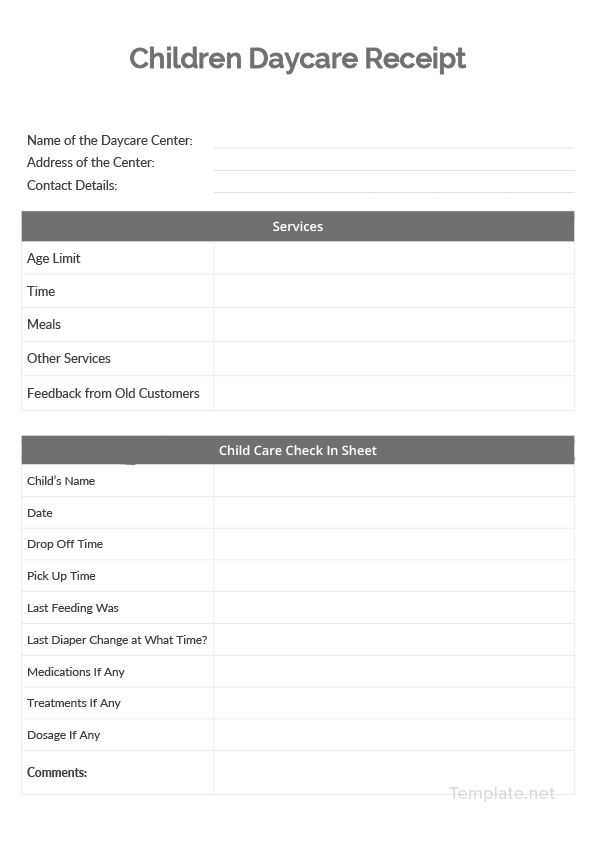

Customizing your CRA Child Care Receipt Template ensures that all required information is included for accurate tax filing. Follow these steps to make the process seamless.

Include Provider Details

Start by entering the child care provider’s full name, business address, and contact details. This ensures you have all the necessary information for your records. Make sure the provider’s CRA business number or registration number is listed if applicable. If your provider is a licensed daycare, this number should be included.

Accurate Dates and Payment Information

Ensure you accurately record the start and end dates for the services provided. For each period, list the total amount paid. Break down payments by date, if necessary, to avoid any confusion during tax filing.

Correct Child Information

Clearly mention the child’s name and their age at the time of service. This helps identify the eligible expenses tied to that child’s care. If you have multiple children, make sure to separate the costs accordingly.

Detailed Breakdown of Child Care Services

List the specific services provided, such as full-time care, part-time care, or before/after school care. It’s essential to specify which services apply to your tax deduction, as certain types may be eligible for a higher refund.

Formatting and Section Organization

Use a clean, readable layout. Ensure each section is clearly labeled–provider, child information, payment details, and services provided. Avoid clutter and make sure that there’s enough space to include all relevant information.

Double-Check for Compliance

Before finalizing your template, review CRA guidelines for child care receipts. Ensure that your template aligns with the current tax laws and includes all required information to avoid delays in processing your claim.

CRA Child Care Receipt Template Example

| Provider Name | Address | Payment Dates | Total Paid | Child’s Name | Service Description |

|---|---|---|---|---|---|

| ABC Daycare | 123 Main St, City, AB | January 1 – January 31 | $600 | John Doe | Full-time care |

| XYZ Child Care | 456 Oak Rd, City, AB | February 1 – February 28 | $500 | Jane Doe | After-school care |

By following these steps and filling in the necessary information, your CRA Child Care Receipt Template will be ready for smooth tax filing. Keep a digital copy for easy access when submitting your claim.

Include the following details in your child care receipt to ensure it’s accurate and complete:

- Provider’s Information: Include the full name, address, and contact details of the child care provider. If the provider is a business, include the company name and any relevant business identification numbers.

- Parent’s Information: List the name of the parent or guardian who is receiving the care, along with their contact information if necessary.

- Child’s Information: Specify the name of the child receiving care and their age or birthdate. This helps confirm the service being provided is for the correct individual.

- Dates of Service: Clearly indicate the start and end dates for each period of care. Include the times when care was provided, if applicable.

- Description of Services: Provide a brief description of the care services rendered, such as hourly or daily rates, and any special activities or services provided (e.g., meals, field trips).

- Amount Charged: List the total amount charged for the service. Break it down if there are multiple services or fees, such as late fees or special charges.

- Payment Details: Include the payment method used (e.g., cash, credit card, check) and any transaction numbers or references for tracking payments.

- Tax Information: If applicable, include any taxes that were charged, such as sales tax or local service fees, along with the tax rate used.

- Signature or Acknowledgment: Consider including a section where the provider or parent can sign or acknowledge receipt of payment, verifying that the information is correct.

By including these key details, you help ensure that your child care receipt is both accurate and useful for tax purposes or future reference.

Incorrectly filling out or misunderstanding a child care receipt template can lead to errors in tax deductions or reimbursement claims. Here are a few things to watch out for:

1. Missing or Incorrect Information

Always double-check the child care provider’s name, address, and contact details. Mistakes in these fields can delay processing. Ensure the child’s name, dates of service, and the total amount paid are also accurate. Missing details will make the receipt invalid for tax purposes or reimbursements.

2. Incorrect Formatting or Template Use

Many templates have specific fields that need to be filled out in a certain format. Pay attention to these instructions to avoid confusion or rejection. Use the template as it is provided without adding unnecessary information or altering it. This ensures the receipt is legally sound.

3. Failing to Include Required Dates

Always list the exact dates the services were provided. General timeframes, like “monthly” or “weekly,” won’t suffice. Each receipt should specify the start and end dates of the care period.

4. Overstating the Amount Paid

Be accurate with the total amounts. Overstating the payment can lead to tax penalties or problems with future claims. Ensure the amount matches what was actually paid to the provider.

5. Ignoring Tax Information

If the child care provider is required to report taxes, ensure their tax identification number (TIN) is on the receipt. Leaving this out may cause issues when submitting the receipt for tax purposes or reimbursement.

Avoid these mistakes to make sure your child care receipts are accurate and compliant. Double-check each field to ensure a smooth and trouble-free process.

CRA Child Care Receipt Template

Ensure that your child care receipts meet CRA requirements by using a well-structured template. Include the following key details:

- Provider Information: List the full name, address, and CRA business number of the child care provider.

- Parent/Guardian Information: Include the name of the parent or guardian claiming the child care expenses.

- Child’s Information: Record the name and age of the child who received care.

- Service Dates: Specify the period during which child care services were provided. Be precise with start and end dates.

- Amount Paid: Clearly state the total amount paid for child care, broken down by individual charges if applicable.

- Payment Method: Mention whether payment was made by cheque, cash, or other methods.

- Receipt Number: Assign a unique receipt number for tracking purposes.

Using this template will help ensure that your claim process goes smoothly, avoiding delays or issues with the CRA.