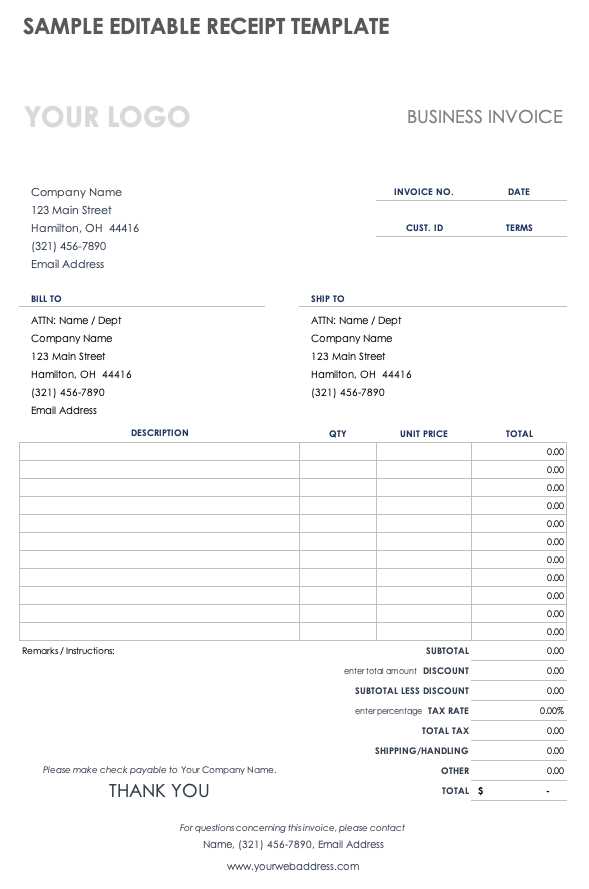

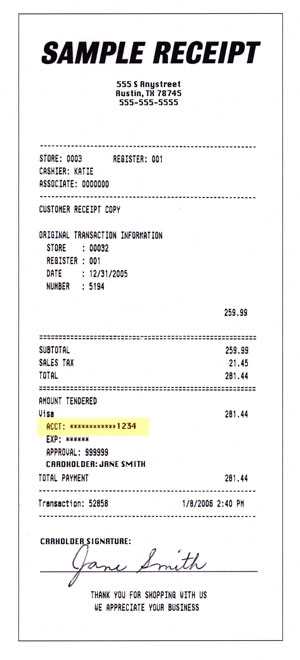

Using a clear and organized credit card receipt template helps both customers and businesses track transactions easily. A well-designed template includes all the necessary fields, such as the transaction amount, date, merchant name, and credit card details. Ensure your receipt contains the business name, address, and contact information for future reference.

The layout should be straightforward, with legible fonts and properly aligned sections. Include a space for a payment method, which could be a credit card number (last four digits), and the total amount charged. You can also add a signature line for verification purposes. By keeping this information concise and accurate, it reduces errors and simplifies bookkeeping.

If you’re creating your own template, use standard software like Word or Excel for ease of editing. Consider using templates available online to save time and effort. With these tools, you can customize the format to suit your business and make sure the design is clean and professional.

Sure! Here’s the updated version:

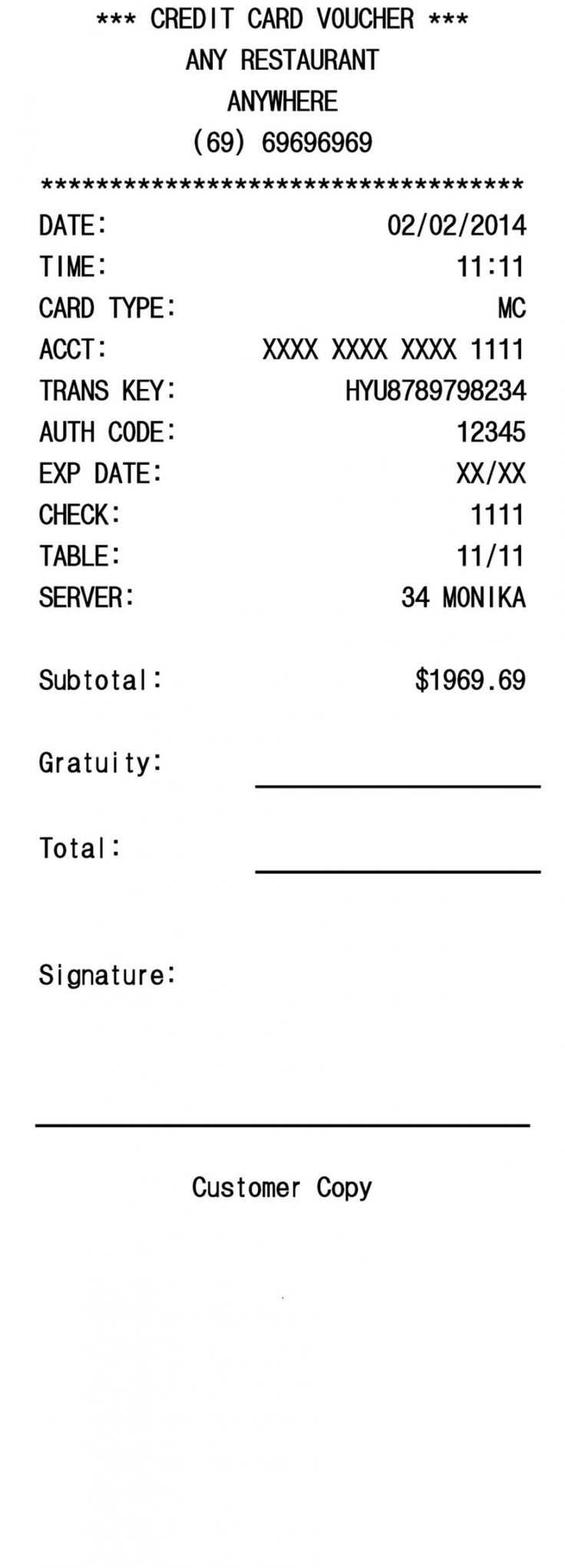

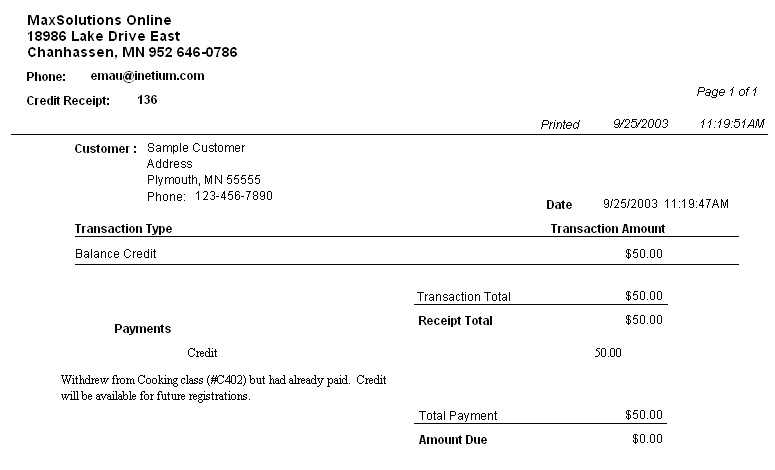

To create a clear and concise credit card receipt template, start by including the basic details of the transaction: the merchant’s name, address, and contact information. Add the date and time of the transaction, followed by the cardholder’s name and a unique transaction ID. Specify the total amount charged, including any taxes or fees applied. It’s also a good practice to clearly list the payment method used, including the last four digits of the card number for security purposes.

Key Sections to Include

The template should have sections for both the merchant and customer, ensuring that both parties have the relevant transaction details. Include a payment breakdown to show any discounts, additional fees, or gratuities. For clarity, each section should be clearly separated with a label. A final statement, such as “Thank you for your purchase,” adds a personal touch and helps close the transaction smoothly.

Design Tips for Legibility

Keep the text legible with a simple font and appropriate sizing. Use bold for important information like the total amount or transaction ID to make it stand out. Ensure there’s enough space between sections to avoid a cluttered look. If possible, offer a digital version that customers can store for reference, keeping the format consistent with your paper receipts.

Credit Card Receipt Template: A Practical Guide

How to Create a Simple Receipt Template for Personal Use

Customizing Your Receipt Template for Different Payment Methods

Best Practices for Organizing and Storing Receipts Electronically

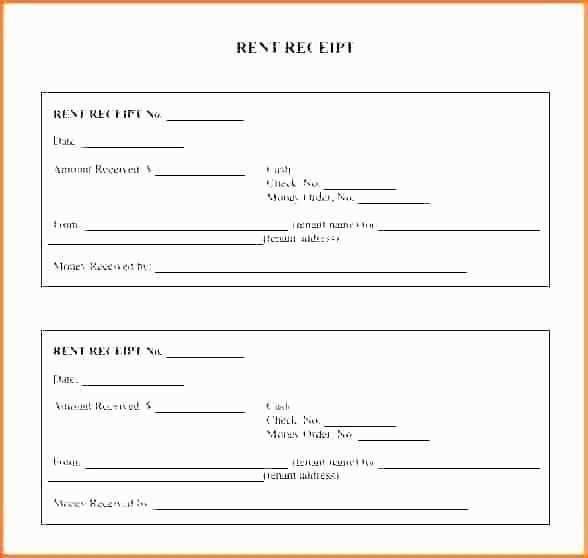

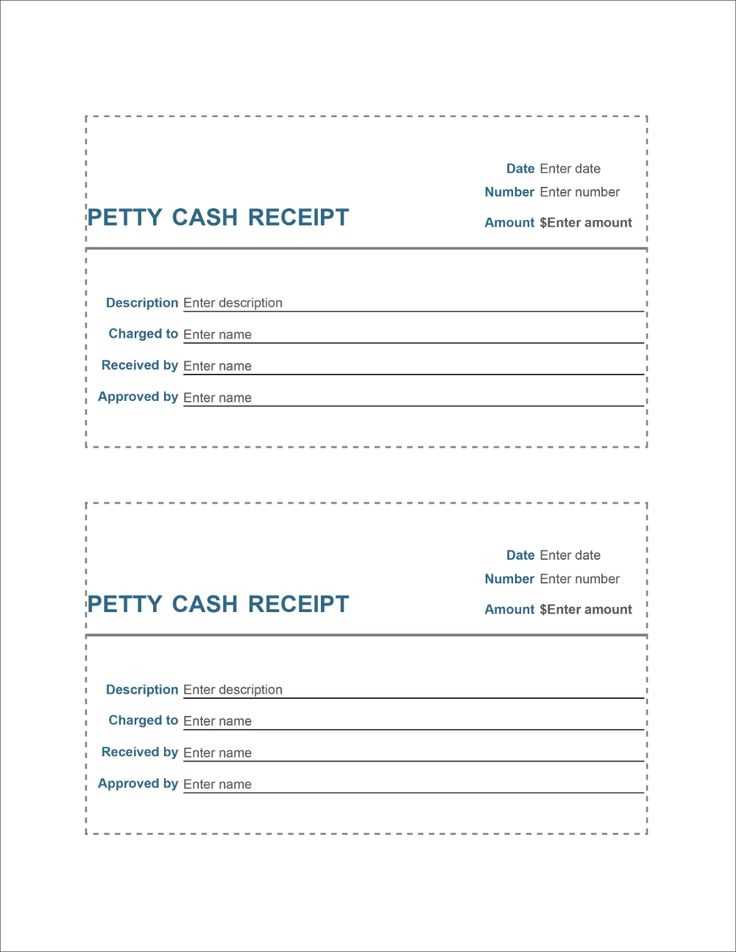

To create a simple credit card receipt template, include the basic elements: business name, contact information, receipt number, date of transaction, amount charged, payment method, and card details (last four digits). You can use a spreadsheet or a text editor to structure this information clearly. Keep it concise and easy to read, with well-defined sections for each detail. Include a space for the customer’s signature if necessary. This ensures both the merchant and the customer have a record of the transaction.

When customizing your template for various payment methods, adjust the “Payment Method” section. For credit card payments, list the card type (e.g., Visa, MasterCard) and the last four digits. For mobile payments or digital wallets, include the transaction reference number or method (e.g., Apple Pay, PayPal). If the payment is split across different methods, note each one separately to avoid confusion.

To manage receipts electronically, use cloud storage to keep them organized and accessible. Create folders based on months or types of expenses to categorize receipts. If possible, add searchable tags to each receipt file (such as “office supplies” or “travel expenses”) to streamline the search process later. Store all receipts in PDF format to preserve formatting and prevent loss of data, ensuring easy access for future reference or audits.