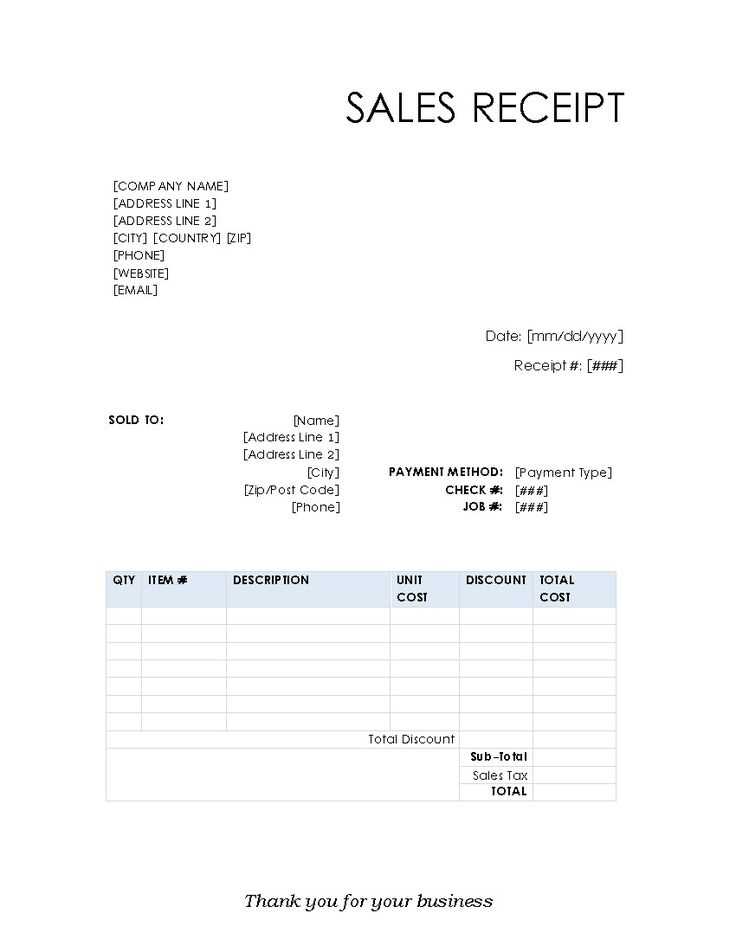

For smooth transaction management, create a clear and simple credit card receipt template. It should include the transaction date, merchant information, itemized purchases, tax details, and the total amount. A well-structured receipt ensures transparency and helps avoid any disputes in the future.

Tip: Include a transaction ID and payment method for easier reference, especially for online purchases. This provides both the customer and merchant with a quick way to track the payment in case of any discrepancies.

When designing your template, keep the layout clean and organized. Make sure the font is easy to read, and use bold headings for sections like “Total” and “Payment Method.” This makes it easier for customers to quickly identify key details.

Pro Tip: Allow space for both the cardholder’s signature and the merchant’s signature. This adds a layer of confirmation and can be useful for record-keeping purposes.

Here is the corrected version without word repetitions:

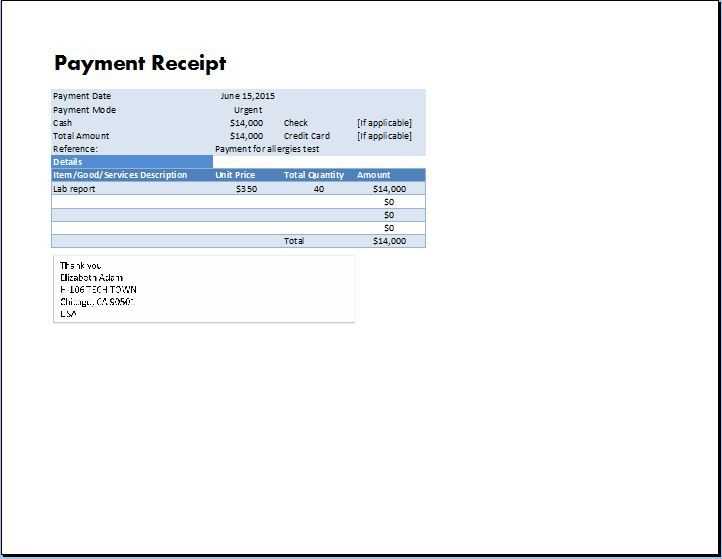

To create a clear and functional credit card receipt template, include the following key details:

- Date and time: Always show the exact moment of the transaction for accuracy.

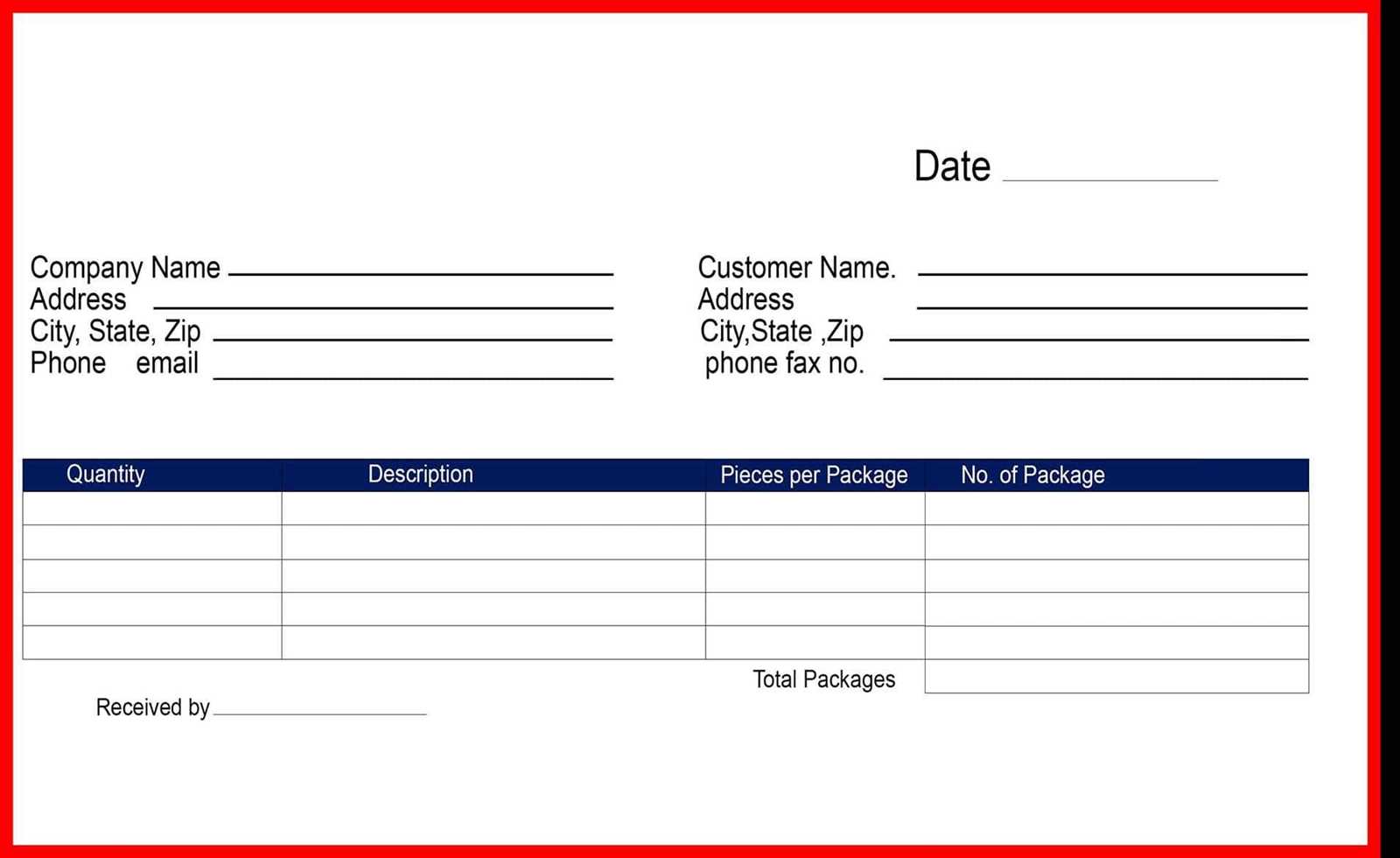

- Merchant details: Provide the name, address, and contact information of the business involved.

- Itemized list: Include every product or service purchased with its corresponding price.

- Total amount: Clearly state the total sum, including taxes and additional charges.

- Payment method: Indicate whether the payment was made via credit card, debit card, or other methods.

- Transaction ID: A unique reference number for tracking purposes is crucial.

- Signature or confirmation: If applicable, include space for a signature or digital confirmation.

Make sure all fields are aligned, easy to read, and formatted logically. Each section should be clear and concise, with no overlapping information.

Keep the design simple and avoid unnecessary elements. Limit the use of colors to maintain focus on important details.

- Credit Card Receipt Template with Tips

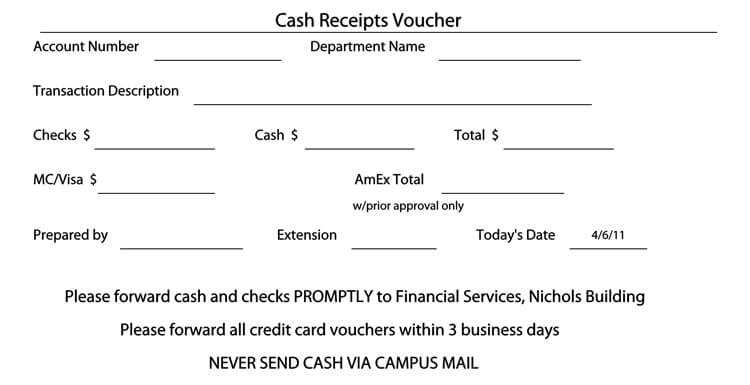

To create a clear and functional credit card receipt, include the following key elements:

- Merchant Information: Clearly list the business name, address, phone number, and email. This helps customers easily contact you if necessary.

- Transaction Details: Specify the date and time of the transaction. Include the unique receipt number for reference.

- Amount Charged: Clearly display the total amount, broken down into the subtotal, taxes, and any additional fees. Make it easy for customers to see what they are paying for.

- Payment Method: Indicate whether the payment was made using a credit card, debit card, or another method. Include the last four digits of the credit card number for verification purposes.

- Authorization Code: Provide the approval or authorization code generated by the payment processor. This adds an extra layer of security and transparency.

- Refund/Return Policy: Include a brief note on your return and refund policy. This helps set clear expectations for customers post-purchase.

Tips for Better Credit Card Receipts

- Keep it concise: Ensure the receipt is easy to read. Avoid unnecessary information that could confuse customers.

- Customize for your business: Add a personal touch, like a thank-you message or a loyalty program reminder.

- Consider digital receipts: Offering electronic versions can reduce paper waste and provide customers with a convenient way to track purchases.

Final Touches

- Double-check details: Ensure that the amounts, dates, and payment methods are accurate before issuing the receipt.

- Save a copy: Keep records of all issued receipts for accounting and auditing purposes.

Use clean, simple design elements to create a professional receipt. Start with a clear header that includes the business name, address, and contact information. This ensures the customer can quickly identify the source of the transaction. Include a section for the receipt date, transaction ID, and total amount charged, ensuring the numbers are easy to read. Opt for bold text for the total amount to highlight it.

Incorporate itemized lists showing what the customer purchased. Each line should display the item name, quantity, and price, with a subtotal at the bottom. This transparency increases trust with the customer. Be sure to separate the payment method section, where you’ll list the card type, last four digits of the card, and payment confirmation number for clarity.

Consider adding a footer with a thank-you message or additional details, such as return policies or contact information for customer service. Keep the layout clean, using white space effectively to avoid clutter. A professional-looking receipt ensures clarity and fosters confidence in the transaction.

Include the transaction date and time. This helps both the customer and the merchant track the purchase timeline. The amount paid should be clearly displayed, breaking down the total, including any taxes or additional fees. Provide the merchant’s business name and contact information for customer support. Make sure the method of payment is visible, whether it’s a credit card, debit card, or another form. Include a unique transaction number for easy reference, as this helps in case of disputes or returns. If applicable, also show the authorization code from the payment processor to confirm the payment was approved.

Modify your credit card receipt template to match your business’s brand and specific needs. Start by incorporating your logo at the top, ensuring it’s clear and professional. Use colors that align with your brand to make the receipt feel connected to your business identity.

Key Information to Include

- Customer’s name and contact details

- Date and time of the transaction

- Transaction details like the amount and payment method used

- Business’s address and contact information

- Receipt number for easy tracking

Adding Useful Features

- Include a thank-you message or reminder of loyalty programs

- Provide a space for transaction notes or instructions, if necessary

- Ensure that payment method icons or labels are clearly visible

Ensure the text is legible with a simple font and well-organized layout. Avoid clutter and prioritize important information. Lastly, save your template as a reusable format to streamline future transactions.

Make sure to include all necessary information that your local regulations require for receipts. This typically includes the business name, address, phone number, and VAT identification number if applicable. Check with local authorities to confirm what data must be visible on your receipts to comply with the law.

Include Tax Information Correctly

Tax compliance is crucial. Ensure that the receipt clearly states the applicable tax rate and the total amount of tax charged. If multiple tax rates apply to different items, list them separately for clarity.

Ensure Privacy and Data Protection

Do not include sensitive customer data on the receipt, such as their full credit card number or personal address. Make sure to comply with privacy laws such as GDPR, which may restrict what customer details can be included on the receipt.

| Required Information | Description |

|---|---|

| Business Name and Address | Must be visible and include both the business’s legal name and location. |

| Tax Identification Number | Required in many jurisdictions, especially for VAT reporting. |

| Itemized Purchases | List each item with the price, and include the total amount with taxes applied. |

| Transaction Date and Time | Include the date and time of the transaction for auditing purposes. |

Sort receipts immediately after purchase. Group them by category–such as groceries, utilities, and entertainment–for easier access. Use an accordion file or a similar system with labeled folders to separate different categories. If you’re dealing with large volumes, a binder with clear plastic sleeves is helpful to store receipts in a uniform way. This method helps to prevent receipts from piling up and allows you to locate them quickly when needed.

Use a receipt scanning app to digitize physical receipts. Store these digital copies in a cloud service with clear naming conventions, such as the date of purchase and the vendor’s name. This ensures that you can access your receipts anytime without worrying about losing paper copies.

Regularly review and discard receipts that are no longer needed. For instance, most utility bills can be shredded after a year, while receipts for major purchases should be kept for warranty purposes. Set a routine, like monthly or quarterly, to go through your receipts and clear out the clutter. This keeps your system organized and prevents unnecessary buildup.

For business expenses, track receipts using accounting software that allows you to upload photos or scan documents directly into your financial records. This eliminates the risk of losing important receipts and saves time on manual entry.

One common mistake is failing to include all necessary transaction details, such as the merchant’s name, transaction date, and total amount. Omitting any of these details can create confusion or inaccuracies when reviewing the document later.

Incomplete Information

Ensure the document contains a clear breakdown of the transaction. This includes taxes, tips, or any other additional charges. Missing out on these elements could cause discrepancies in your financial records.

Incorrect Formatting

Pay attention to consistency in the formatting of the credit card receipt. Use a standard template to avoid confusion, and always double-check for any errors in dates, amounts, or transaction types.

| Field | Correct Example | Incorrect Example |

|---|---|---|

| Transaction Date | February 4, 2025 | 02/04/25 |

| Amount | $50.75 | $50,75 |

| Merchant Name | John’s Electronics | John’s |

Avoid using shorthand or abbreviations for details like the merchant’s name, as it may lead to misunderstandings or difficulties in identification later. Always opt for full, clear entries to maintain accuracy.

Credit Card Receipt Template: Tips for a Clear and Professional Layout

Organize all necessary details in a structured format. Start by including the transaction date, amount, and vendor name clearly at the top of the receipt. Use bold font for these elements to draw attention to key information.

Break Down the Payment Information

Display the payment method and last four digits of the credit card number below the transaction details. This allows the cardholder to easily reference the payment method used, while keeping sensitive information secure.

Additional Tips for User-Friendly Receipts

Make sure to include a clear total amount, including taxes and any tips. Use bullet points or simple lines to separate different sections, making it easy to skim through the information. Lastly, always ensure that the receipt is formatted correctly for printing, with all details aligned neatly to avoid confusion.