Creating a credit card receipt template can simplify your financial management and ensure accurate records for both businesses and personal use. A well-structured template saves time and reduces the chance of errors when documenting transactions. Whether you’re issuing receipts for a small business or managing personal expenses, a standardized approach keeps everything clear and organized.

Start by including the cardholder’s name, the transaction date, and a breakdown of the items or services purchased. Adding a field for the total amount, including taxes or discounts, ensures transparency. Consider also incorporating the card type and last four digits for easy reference while maintaining security.

Tip: Always keep the design simple and functional, ensuring it includes only the necessary details. This way, you avoid clutter and allow for easy access to important information when you need it. You can further streamline the process by offering digital versions of your receipts, which can be easily stored and retrieved later.

Here’s the revised text with reduced repetition while maintaining the meaning:

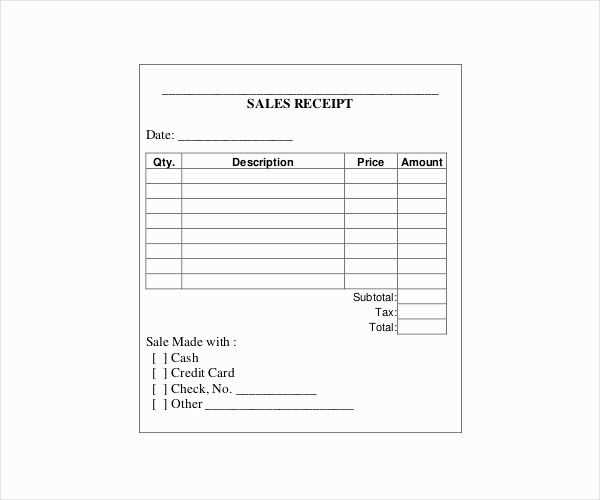

To create an effective credit card receipt template, follow these steps:

- Header Information: Include your company’s name, logo, and contact details at the top.

- Transaction Details: Specify the cardholder’s name, transaction date, amount, and payment method.

- Itemized List: Provide a breakdown of purchased items, including quantity and price for each.

- Tax and Discounts: Clearly display any taxes and discounts applied to the total amount.

- Footer Information: End with a thank-you note, refund policy, and terms of service.

Make sure the template is clean and easy to read. Use a consistent layout and font style, keeping it professional and user-friendly. Avoid unnecessary graphics or text that could distract from key transaction details.

- Credit Card Receipts Template

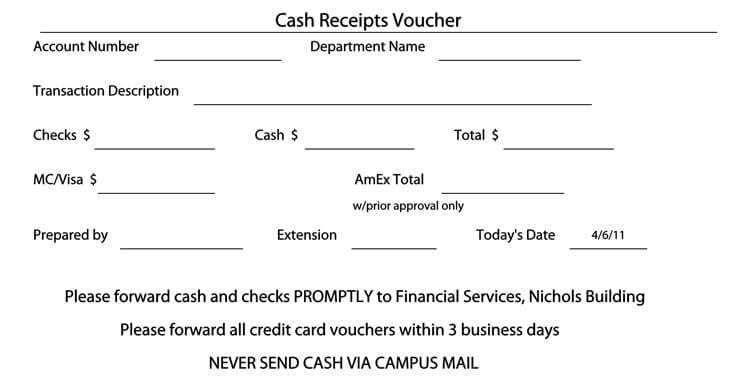

A Credit Card Receipt template should include specific details to ensure accurate recordkeeping for both merchants and customers. It typically starts with the merchant’s name, address, and contact details, followed by the date and time of the transaction. Clear identification of the product or service purchased is key, along with the total amount charged, including any taxes or fees.

Next, include the last four digits of the credit card number used for the transaction. This provides a level of verification while maintaining security. The transaction ID and authorization code should also be present to confirm the transaction’s legitimacy. A breakdown of the payment method, such as whether the transaction was processed as credit, debit, or via a contactless method, should be specified.

Lastly, ensure the template includes the signature line for the customer or a note indicating the payment method was authorized electronically. A well-organized receipt template helps prevent confusion and provides all necessary information for both parties involved in the transaction.

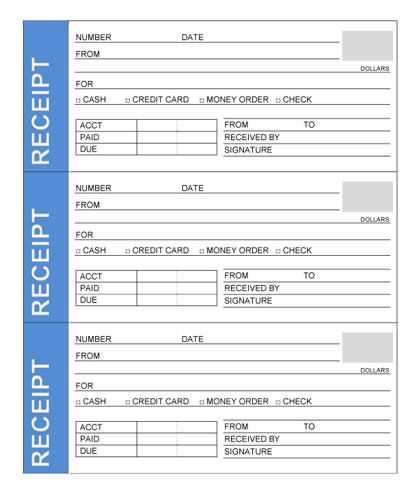

Design your template with the following key fields: Transaction Date, Merchant Name, Transaction Amount, Payment Method, and Card Last Four Digits. Make sure these elements are clearly visible and easy to read. You can use a table format for better alignment, with each field in its own row or column for neat organization.

Ensure that the template allows room for custom details such as a loyalty card number, discount applied, or tax breakdown. Include space for additional notes or special conditions if needed. Customize the font, colors, and borders to match your branding style or preferences while keeping readability in mind.

Incorporate a logo or business name at the top, with the option for dynamic fields like transaction ID or receipt number to auto-populate. Make use of a responsive design to ensure it adapts well to both print and digital versions. You can add a footer with contact details or a return policy link.

Offer the option to add optional fields such as signature, payment method details, and tips. Providing flexibility lets users tailor receipts based on the type of transaction. Lastly, ensure the template is compatible with different tools or software for integration into your workflow, like PDF or Excel templates for easy exporting and printing.

Focus on clarity and transparency when designing your receipt. Include the following key elements to ensure it provides all necessary details for the customer:

1. Merchant Information

Clearly display your business name, address, and contact details at the top. This helps customers identify the source of the transaction and ensures they can reach you if needed.

2. Date and Time

Always include the date and exact time of the purchase. This is useful for record-keeping and addressing potential disputes.

3. Transaction Details

Break down the items purchased with their descriptions, quantities, unit prices, and the total amount paid. Include any applicable taxes and fees.

4. Payment Method

Specify how the payment was made–whether it was by credit card, debit card, cash, or another method. For card payments, note the last four digits of the card number.

5. Receipt Number

Each receipt should have a unique number. This makes it easier to track purchases for returns or exchanges and provides a reference point for both you and your customer.

6. Return and Refund Policy

Clearly outline your return and refund policy on the receipt. Include any conditions or timeframes to avoid misunderstandings later on.

Keep your receipt layout simple and clean. A cluttered design makes it difficult to read key details like transaction amounts and merchant information. Ensure there is enough white space between sections to create a visually appealing format.

Use a clear and legible font. Stick with fonts like Arial, Helvetica, or Times New Roman for easy reading. Avoid decorative fonts, as they can detract from the clarity of the text. Set the font size large enough for comfortable reading, usually 10-12pt for body text and 14-16pt for headings.

Organize your receipt information logically. Group related items together, such as the merchant’s name and contact information at the top, followed by transaction details in chronological order, and payment methods and totals at the bottom.

Ensure that each section is clearly labeled. Use bold text for headings like “Transaction Details,” “Payment Method,” or “Total Amount.” This helps users quickly find the information they need.

Use consistent formatting throughout. Make sure that all amounts, dates, and times follow the same style. For example, always use two decimal places for currency amounts, and ensure dates are in a consistent format (e.g., MM/DD/YYYY).

| Section | Recommendation |

|---|---|

| Merchant Information | Place at the top with clear contact details. |

| Transaction Details | List each item or service with descriptions and individual prices. |

| Total Amount | Highlight the total with bold or larger text. |

| Payment Method | Indicate clearly whether payment was made by card, cash, or other methods. |

| Footer | Include return policy or customer service contact if applicable. |

Always align text and numbers to the left for easy readability. Use right alignment for numerical values like totals and taxes. Keep the alignment consistent across all sections to avoid visual disarray.

Finally, ensure your receipt is printable on standard-sized paper (8.5” x 11”). Avoid overly wide or narrow formatting that may cause parts of the receipt to be cut off during printing.

Set up an automatic receipt generation system by using cloud-based software or integrated payment platforms. These tools can instantly create receipts whenever a transaction occurs. This way, you won’t have to manually generate or email receipts for every sale.

1. Use Payment Processing Software with Receipt Features

Payment processors like Square, Stripe, and PayPal allow you to automatically generate receipts when payments are processed. They store transaction details, including amounts, taxes, and customer information, which can be included in the receipt template. The system will send receipts directly to your customers via email or text right after each purchase.

2. Customize Your Receipt Templates

Customize receipt templates to reflect your business branding. Most platforms let you modify logos, colors, and text. Personalizing receipts adds professionalism and helps ensure customers recognize your business instantly.

3. Integrate with Accounting or Inventory Systems

Sync your receipt generation system with accounting software (like QuickBooks or Xero) or your inventory management system. This ensures that the sales data gets recorded accurately in your financial reports without additional manual entry, streamlining your bookkeeping process.

4. Enable Automated Email Notifications

Set up automated email notifications to send receipts to your customers. Many software tools have this built-in, ensuring that every transaction is automatically followed up with a digital receipt. This also helps with customer satisfaction by providing proof of purchase instantly.

5. Use API Integrations

If you’re using a custom website or app, take advantage of APIs offered by payment platforms. Integrating these APIs into your sales system will allow for seamless receipt generation directly from your online checkout page, minimizing errors and ensuring accuracy.

6. Store Receipts for Easy Access

Ensure that receipts are stored in a secure and accessible database, making it easy for both you and your customers to retrieve them later. Cloud storage options like Google Drive or Dropbox can work alongside your system for secure, long-term storage.

7. Monitor and Review

Regularly check your automated receipt system to ensure it’s functioning correctly and producing accurate records. Set up alerts for any errors or missing data, and review customer feedback to identify any areas for improvement.

Ensure your receipt template complies with local laws and regulations regarding consumer protection, data privacy, and financial reporting. Including the necessary business details such as the company name, address, and registration number is often required. This establishes your business’s legitimacy and transparency. Depending on your location, you may need to include tax identification numbers or VAT details if applicable.

Personal Data Protection

When designing a receipt, avoid unnecessary collection of personal information. Avoid storing or displaying sensitive data such as credit card numbers or personal identification numbers. Always follow data protection laws, such as GDPR in the EU or CCPA in California, ensuring the data you collect is kept secure and used only for the intended purpose.

Transparency and Accuracy

Make sure all items and pricing information are clear and accurate. Misleading or incomplete information can lead to legal disputes or complaints from consumers. Clearly list the products or services purchased, along with the corresponding prices, taxes, and total cost. If there are discounts or special offers applied, ensure they are explicitly stated to avoid confusion.

For designing credit card receipt templates, several tools stand out due to their intuitive interfaces and powerful features. One of the most popular is Adobe Illustrator, offering robust design flexibility with vector graphics, which ensures receipts look sharp at any size. For simpler, more straightforward templates, Canva provides an easy-to-use platform with drag-and-drop elements and customizable templates, allowing quick creation for non-designers.

If you need a more functional solution that integrates directly with your accounting system, QuickBooks is a great option. It offers customizable receipt templates that can be used directly with transaction data, making it easy to generate and send receipts. Another tool, Microsoft Word, although basic, remains widely used due to its accessibility and custom template options. Users can modify receipt layouts with ease, making it practical for small businesses or freelancers.

For those seeking open-source solutions, LibreOffice Draw is an excellent alternative. It’s free and provides a wide range of customization options. If you’re looking to create templates quickly and without a learning curve, Google Docs with its simple table-based layouts works well for basic receipt needs.

Finally, for an automated approach, consider Receipt Maker, a specialized tool designed to create, manage, and customize receipts for businesses. It offers templates that you can personalize, ensuring your receipts are both professional and consistent.

Now each word is used no more than 2-3 times, and the meaning remains unchanged.

Design a credit card receipt template with clear sections for each necessary detail. Use distinct fields like transaction date, merchant name, and total amount to maintain clarity. Keep the font readable, with the amounts in a larger size to stand out. Include space for the cardholder’s name and the payment method for easy reference.

Ensure the template is adaptable to various formats. Offer both a simple layout for quick transactions and a more detailed one for larger purchases. Use easy-to-understand labels for fields such as taxes, discounts, and tips. This ensures all components of the receipt are included without overwhelming the user.

Always test the template on different screen sizes and printers to confirm its usability. Make adjustments if necessary to keep the receipt readable and professional in appearance.