Key Elements of a Credit Receipt

A well-structured credit receipt ensures clarity and accuracy in financial transactions. Every receipt should include the following:

- Receipt Number: A unique identifier for tracking.

- Date: The exact date of the transaction.

- Payer Information: Name and contact details of the person or entity making the payment.

- Payee Information: Name and details of the recipient.

- Payment Amount: The credited sum in both numerical and written formats.

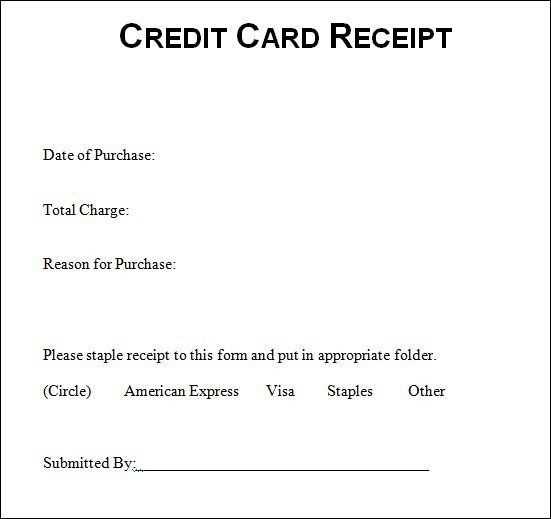

- Payment Method: Cash, card, bank transfer, or other means.

- Reason for Payment: A brief description of the transaction.

- Signature: Signature of the issuer for verification.

Sample Credit Receipt Format

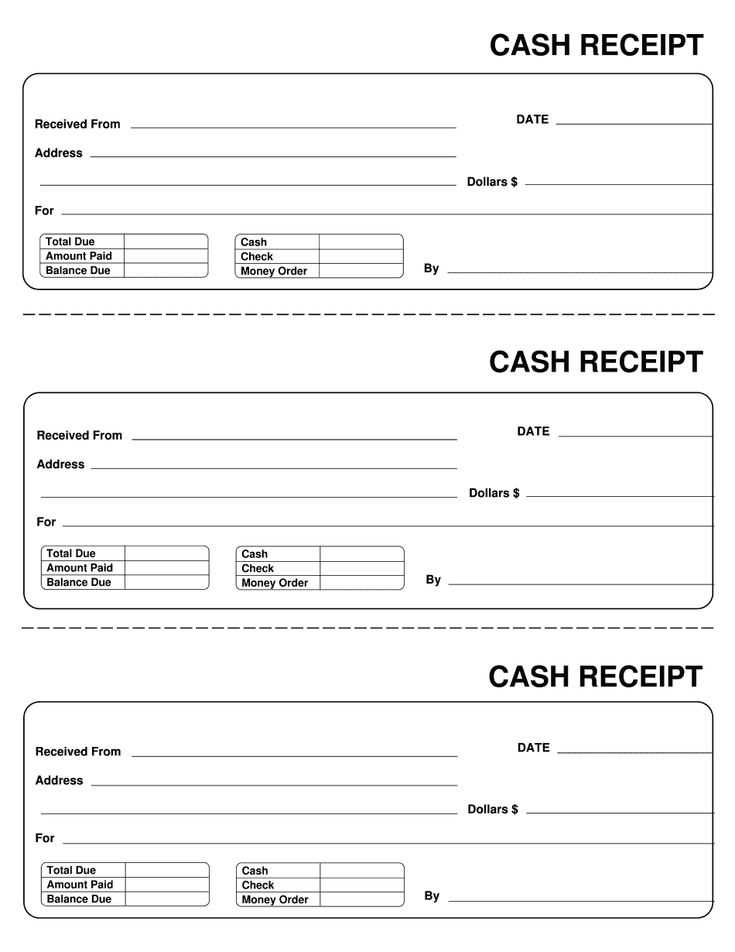

Using a standardized layout improves consistency and readability. Below is a structured format:

--------------------------------------------------- CREDIT RECEIPT Receipt No.: [Unique Number] Date: [MM/DD/YYYY] --------------------------------------------------- Received from: [Payer Name] Contact: [Payer Contact Information] Amount: $[Amount] ([Amount in Words]) Payment Method: [Cash/Card/Bank Transfer] Reason: [Brief Description] --------------------------------------------------- Received by: [Payee Name] Signature: ________________

Best Practices for Issuing Credit Receipts

- Use pre-numbered receipts to maintain order.

- Ensure all details are legible and error-free.

- Keep digital and physical copies for records.

- Provide a duplicate to the payer for reference.

Following these guidelines guarantees transparency and professionalism in financial documentation.

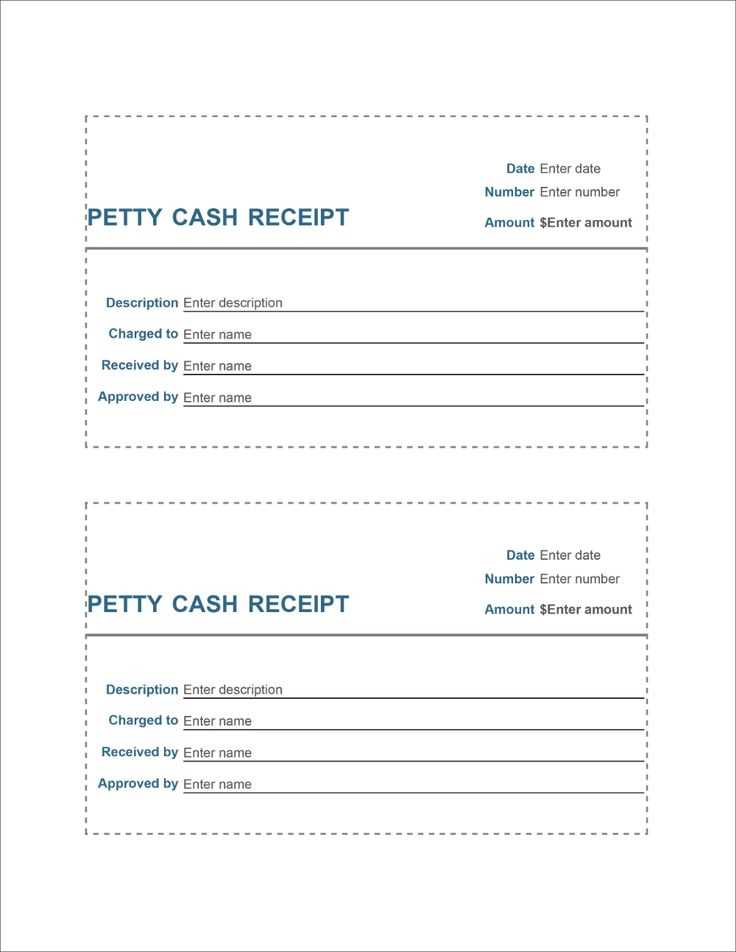

Credit Receipt Template

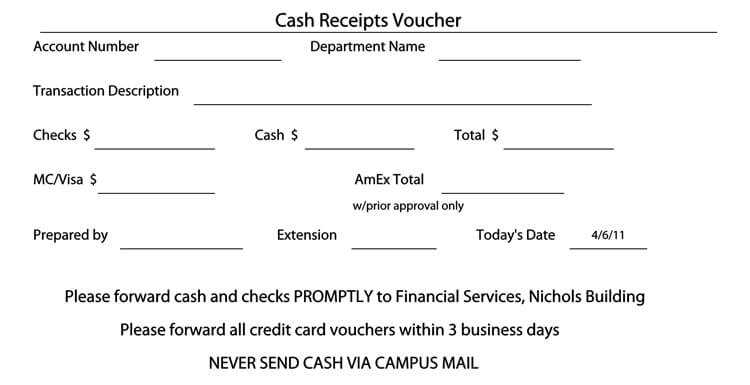

Mandatory Fields in a Payment Receipt

Formatting Guidelines for Clear Records

Legal Aspects and Compliance Standards

Customizing Receipts for Various Transactions

Digital vs. Printed Versions: Pros and Cons

Frequent Mistakes and Ways to Prevent Them

Mandatory Fields in a Payment Receipt

Include the transaction date, payer and payee details, unique receipt number, amount paid, payment method, and a breakdown of any applicable taxes. If relevant, add terms of service or refund policies.

Formatting Guidelines for Clear Records

Use a structured layout with consistent spacing and alignment. Clearly label each section, ensuring the total amount stands out. Choose legible fonts and avoid excessive styling. If using digital formats, ensure compatibility with accounting software.

For legal compliance, verify that all required details align with tax regulations. Customization helps tailor receipts for different transactions, whether for retail sales, service payments, or installment plans.

Printed versions offer physical proof but require secure storage. Digital formats improve accessibility and reduce paperwork but should be protected with encryption. Avoid common errors like incorrect amounts, missing fields, or duplicate numbers by automating receipt generation.