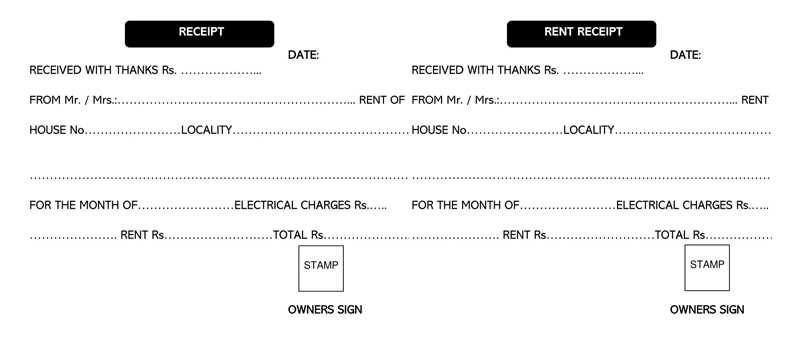

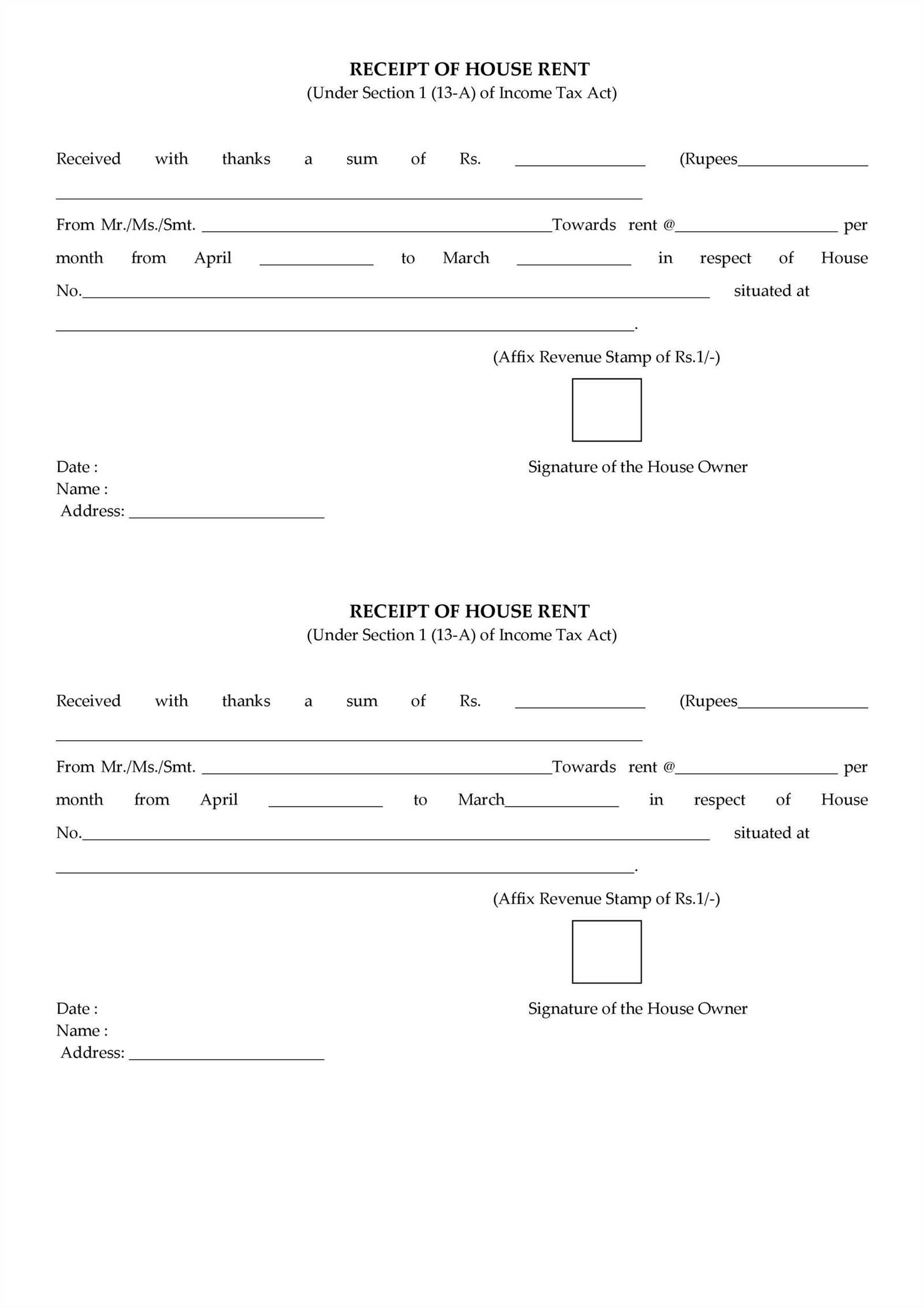

Key Elements of a Stamp Duty Receipt

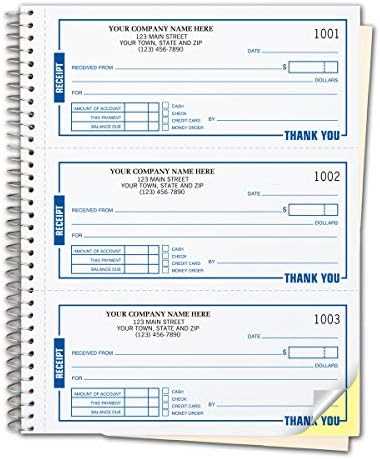

A well-structured stamp duty receipt should include specific details to ensure validity and compliance. The following elements are essential:

- Date of Issue: Clearly state when the receipt was generated.

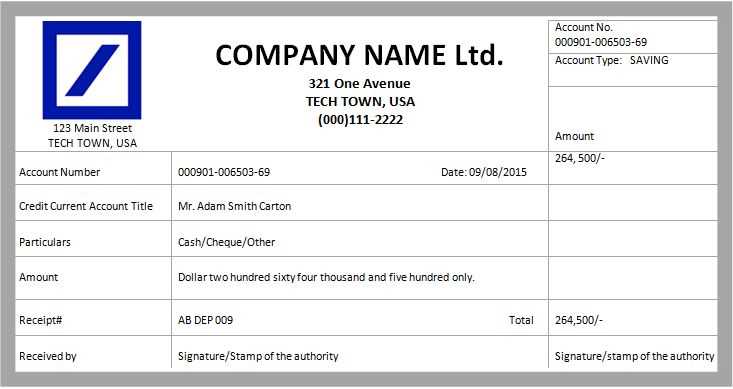

- Payer Details: Include the name, address, and identification of the person or entity making the payment.

- Transaction Description: Specify the type of transaction requiring stamp duty.

- Stamp Duty Amount: Indicate the exact amount paid.

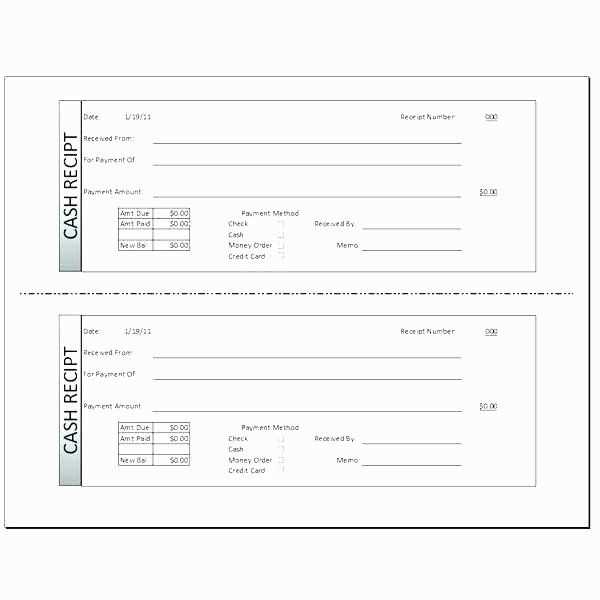

- Payment Method: Mention whether the payment was made via bank transfer, check, or another method.

- Authorized Signature: Ensure a signature or official stamp is present.

Creating a Custom Template

Using a Word Processor

Word processing software offers flexibility for designing a professional receipt. Use tables to structure the document and placeholders for variable information. Save the template as a reusable file.

Spreadsheet-Based Templates

Spreadsheets allow automated calculations and easy formatting. Use predefined formulas to calculate totals and taxes. Export the final version as a PDF for official use.

Online Generators

Several platforms provide customizable templates. Input necessary details, select formatting options, and download the completed receipt. This method is quick and convenient for frequent transactions.

Ensure the final template aligns with local tax regulations before issuing receipts.

Custom Stamp Duty Receipt Templates

Key Elements to Include in Such Receipts

How to Customize Them for Various Transactions

Legal Considerations When Designing These Documents

Clearly define the transaction details. Include the full names of both parties, a precise description of the transaction, and the exact amount of duty paid. Ensure the date and location are accurate.

Use standardized numbering. Assign a unique receipt number to facilitate tracking and verification. This helps prevent duplication and fraud.

Include an authorized signature or stamp. A receipt without proper authentication may be challenged. Ensure the issuer’s name, designation, and signature (or an official stamp) are present.

Ensure legibility and compliance. Use a professional font and structured layout. Verify that the receipt format adheres to relevant tax and financial regulations to avoid disputes.

Adapt for specific transactions. Customize sections based on use cases. For property sales, detail the location and valuation. For business agreements, specify contract terms and parties involved.

Retain copies for record-keeping. Digital and printed copies should be stored securely for audits or legal reference. Specify the retention period based on local laws.