To streamline your daycare tax reporting, a clear and concise income tax receipt is key. Start by including the name of your daycare, its address, and contact information. Ensure you also list the child’s name, the dates of service, and the total amount paid for the year.

Include a breakdown of payments for easy reference, particularly if the daycare provides different services or age group pricing. Be specific about the service periods–weekly, monthly, or yearly–along with the associated costs. This will help both parties ensure the correct figures are reported for tax purposes.

Make sure to add your daycare’s registration or tax identification number, which is often required by tax authorities. A signature or official stamp can also be beneficial for verification, ensuring that your receipts meet all necessary legal requirements.

Lastly, keep copies of all receipts organized and easily accessible. This will simplify your annual tax filing and avoid any last-minute rush to gather paperwork.

Here’s the corrected text:

When creating a daycare income tax receipt, ensure the document includes all the necessary information for tax reporting. Start by listing the daycare provider’s name, address, and phone number at the top. Clearly state the child’s name, the dates of service, and the total amount paid during the year. It’s crucial to note the amount of payments received for childcare services, excluding any extras like meals or transportation, unless those are part of the agreed-upon service.

Include Specific Payment Details

Each receipt should outline the payments made, categorized by month or session. This ensures that the tax filer can track exact payments, avoiding confusion during tax filing. Be clear on the service period and include any additional details, such as discounts or late fees applied to the payments.

Keep It Simple and Clear

Tax receipts should be straightforward. Avoid unnecessary jargon and make sure the figures match the services provided. A clean and simple template will make it easier for both the provider and parent to stay organized.

Lastly, be sure the daycare provider’s business information is present in the footer along with any necessary tax identification numbers if applicable. This ensures the receipt is both legally valid and easy to reference in case of an audit or tax-related query.

Daycare Income Tax Receipt Template: A Complete Guide

What Key Information Should Be Included in a Daycare Tax Receipt?

How to Format a Daycare Income Tax Receipt for Tax Purposes

What Are the Legal Requirements for Daycare Providers Issuing Tax Receipts?

Common Mistakes to Avoid When Issuing Daycare Tax Receipts

How to Track Daycare Payments for Accurate Tax Receipts

How to Customize a Daycare Tax Receipt Template for Your Business

Key Information for a Daycare Tax Receipt

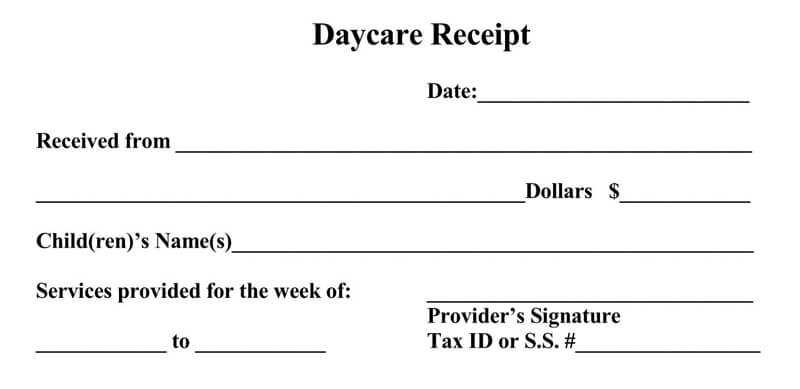

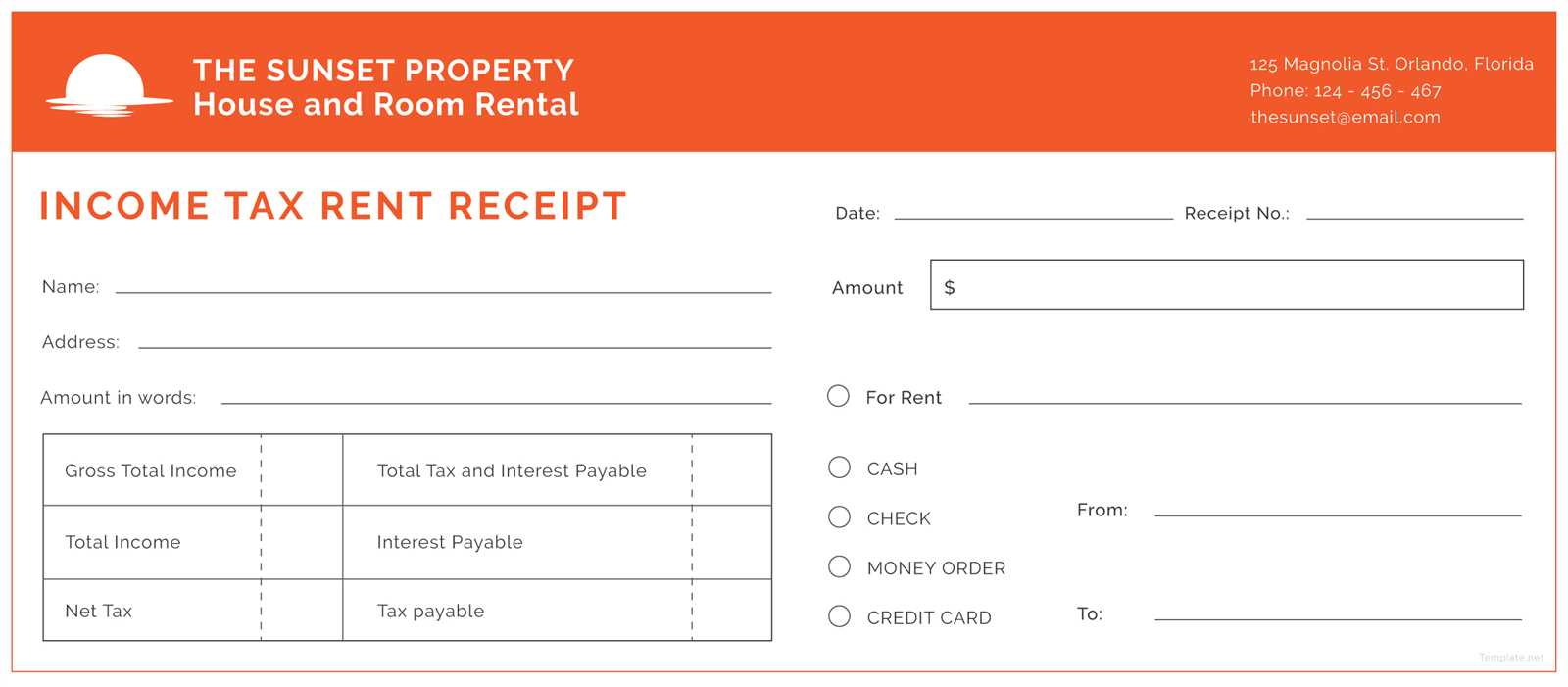

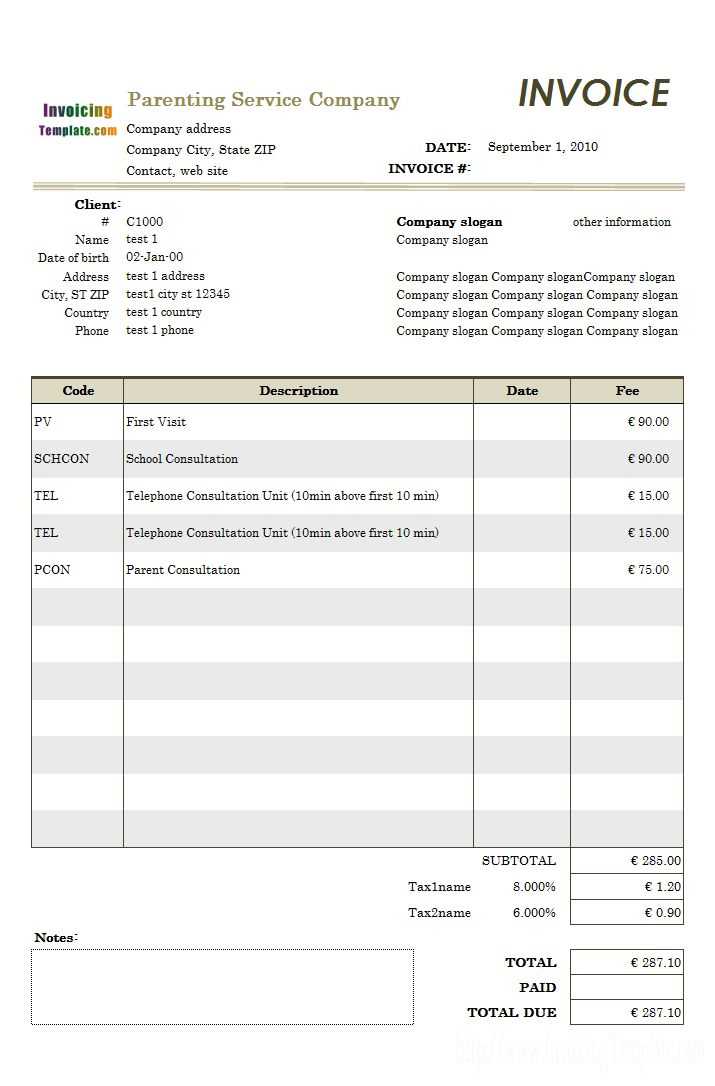

A daycare tax receipt should clearly display the following details: the daycare provider’s business name, contact information, and tax identification number (TIN). Include the parent’s name, the child’s name, the dates of service, the amount paid, and the payment method. You must specify whether the receipt is for a single payment or a series of payments, and it should mention any applicable taxes. The total amount paid should be clearly marked, and it’s helpful to include a breakdown of charges if different services were provided.

How to Format a Daycare Tax Receipt for Tax Purposes

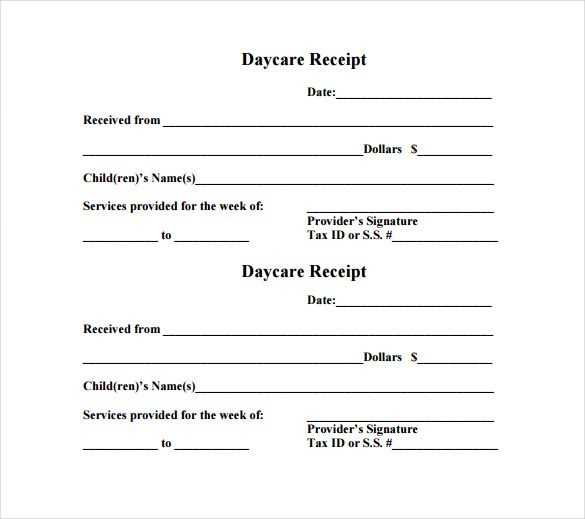

Format your daycare tax receipt professionally. Start with your business name and contact details at the top. Beneath that, include the receipt title, such as “Daycare Payment Receipt.” List the customer’s information, followed by the details of the payment. Include the date of the payment, service description, and total amount. If the payment is for multiple periods, clearly indicate the start and end dates. Ensure all amounts are itemized and that the tax rate is shown, if applicable. At the bottom, include a statement confirming that the receipt is accurate, followed by your signature or a digital signature.

Legal Requirements for Daycare Providers Issuing Tax Receipts

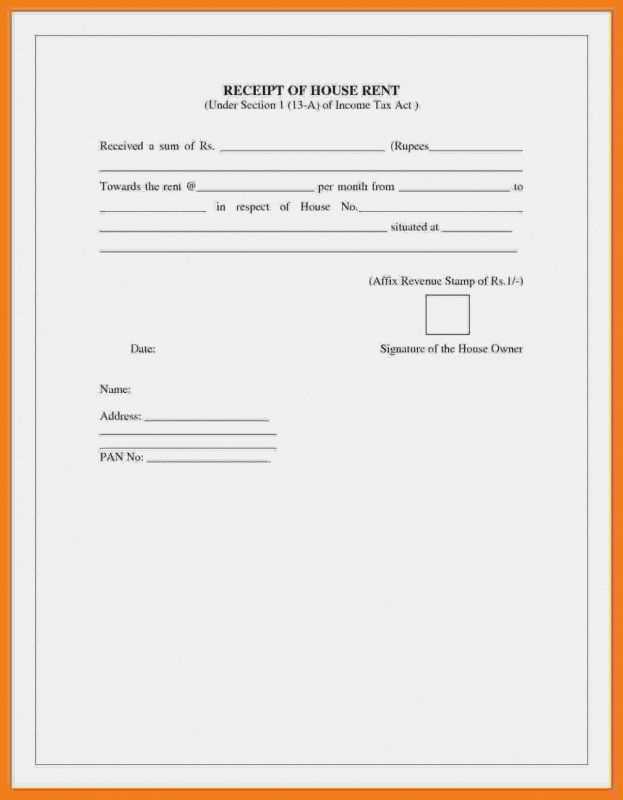

Daycare providers must comply with local regulations when issuing receipts. This typically includes providing receipts for payments over a certain amount and maintaining accurate records for tax reporting. Depending on your jurisdiction, you may need to provide a receipt for every payment or only upon request. It’s also important to ensure that the receipts comply with income reporting requirements, including the accurate reflection of taxes collected. Keep a copy of each receipt for your own records to facilitate tax filing and any potential audits.

Common Mistakes to Avoid When Issuing Daycare Tax Receipts

Avoid issuing receipts with missing or incorrect information. Ensure that all names, dates, and amounts are accurate. Double-check that the payment method is correctly recorded. Also, don’t forget to provide receipts in a timely manner–delaying receipts can create confusion for clients come tax season. Lastly, don’t use vague descriptions; the receipt should clearly reflect the services rendered. Any unclear entries can lead to misunderstandings and potential tax issues.

How to Track Daycare Payments for Accurate Tax Receipts

Track all payments using a reliable accounting system or software. Record each payment immediately, along with details such as the payer’s name, the amount, and the payment method. Organize payments by date, and ensure they are classified correctly–whether as regular fees, late fees, or additional services. This will make issuing accurate receipts much easier and ensure you’re prepared for tax filing or audits. Periodically review your records to avoid discrepancies and ensure you’re not missing any payments.

Customizing a Daycare Tax Receipt Template for Your Business

Create a tax receipt template that suits your business’s needs. If you operate multiple daycare locations or offer various services, include customizable fields for these details. You may want to add sections for discounts or promotional credits, if applicable. Ensure the template is user-friendly for both you and your clients. If you issue receipts electronically, consider providing an option for digital receipts to streamline your process. Personalize your template with your logo and business information for a professional touch.

Tax Receipt Template for Daycare Services

Ensure your daycare income tax receipt includes all necessary details to meet requirements. The receipt should clearly list the provider’s name, address, and contact information. Include the child’s name, the dates of care provided, and the total amount paid for services. If applicable, specify any government subsidies or tax credits received.

Key Information to Include:

Start with the daycare provider’s legal name and full address. Include the registration or business number, if applicable, for easy verification. List the child’s full name and the exact dates of the care provided, such as the start and end dates for each period of service. Clearly state the total amount paid for the care, with breakdowns if necessary (e.g., weekly or monthly fees).

Additional Considerations:

For tax purposes, it may be useful to also include a breakdown of any deposits made or special rates. Ensure the receipt is signed or includes a statement verifying the authenticity of the information. Double-check the accuracy of the amounts listed to avoid complications during tax filing.