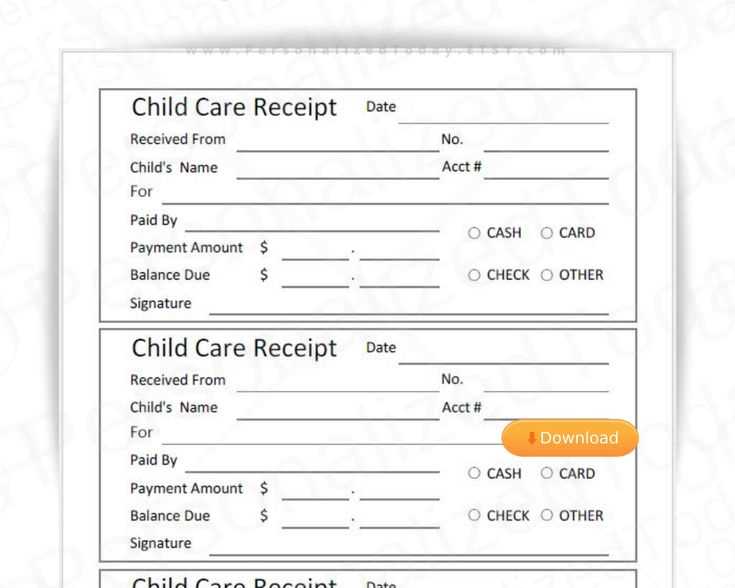

If you’re looking to submit a daycare receipt for your FSA, creating a well-structured template can save time and avoid mistakes. A properly formatted receipt ensures smooth processing and helps maintain accurate records. Here’s how to structure your daycare receipt template effectively.

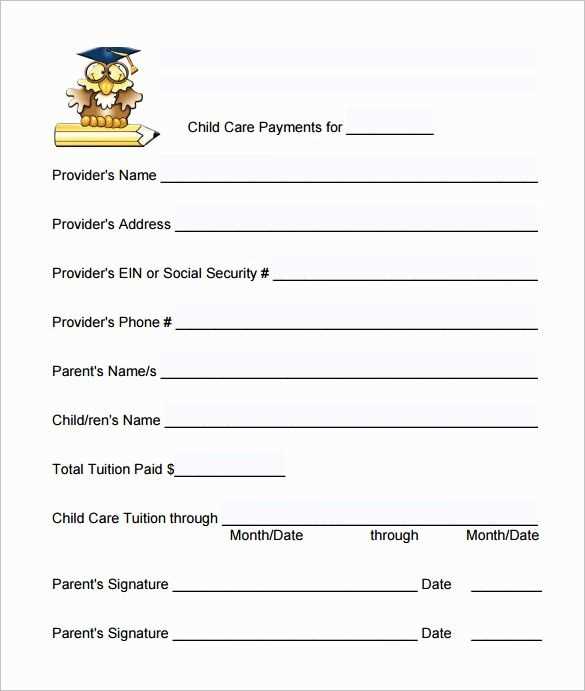

Start by including provider information, such as the name of the daycare center, address, and contact details. This establishes the source of the care provided and is required for FSA claims. Next, make sure the date(s) of service are clearly listed. This helps confirm the period during which the service was rendered, aligning with the dates on your payment receipts.

Don’t forget to add the child’s name and the amount paid for each service, as these details are crucial for documentation. For example, list the total amount for a month of daycare or the cost for specific days if payments are broken down. The final section should include a provider’s signature or official stamp, validating the receipt for FSA submission.

By following these steps, you’ll have a clear, easy-to-read daycare receipt template that will make your FSA reimbursement process smooth and straightforward.

Here’s a version of the sentences with minimal repetition:

Use a clear, simple format for daycare receipts submitted to your FSA. Begin with the daycare provider’s name, address, and contact details. Include the child’s name, dates of service, and a detailed description of services provided. Be sure to list the total amount charged, highlighting any amounts covered by FSA. If applicable, add the provider’s tax ID number. Ensure the receipt is dated to match the payment period for your FSA claim. Keep a copy of the receipt for your records in case additional documentation is requested. Double-check that all required information is present before submitting the receipt to avoid delays in processing your claim.

- Daycare Receipt for FSA Template

For a daycare receipt to be eligible for FSA claims, ensure it includes the following details:

- Provider’s Information: Include the daycare’s name, address, and phone number.

- Child’s Name: Clearly state the name of the child receiving care.

- Care Dates: List the specific dates when the daycare services were provided.

- Amount Paid: Provide the total amount paid for the services, including any extra fees.

- Tax Identification Number (TIN): The daycare center must provide their EIN or TIN for verification purposes.

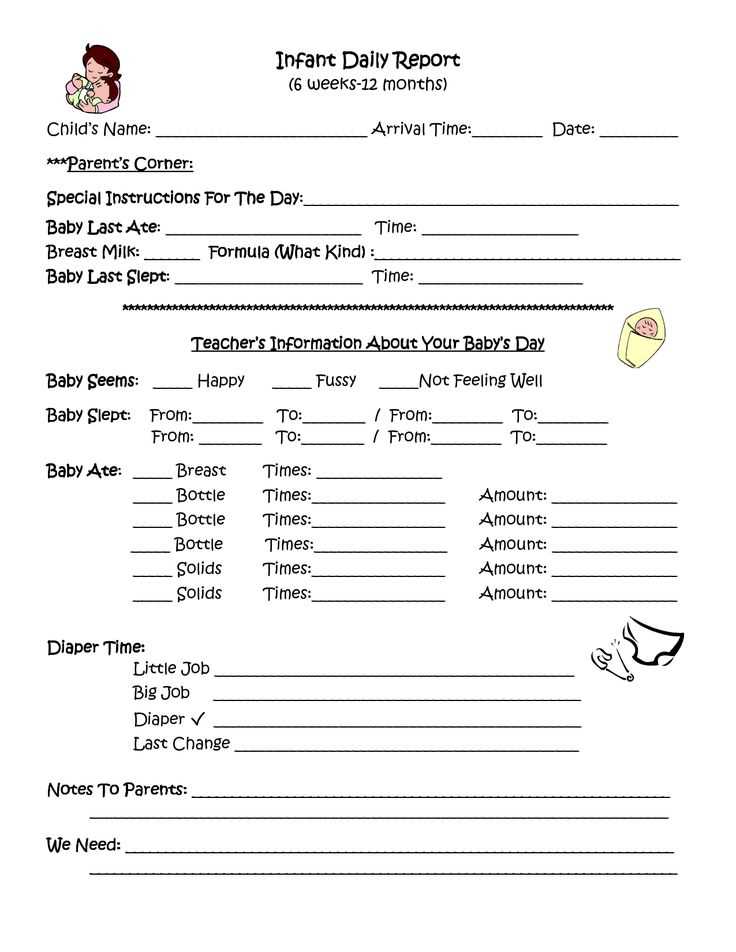

- Care Type: Specify the type of care received, such as full-time, part-time, or after-school care.

Make sure all these details are present on the receipt. Missing or incorrect information may result in claim delays. If in doubt, contact your daycare provider to verify the accuracy of the receipt before submission.

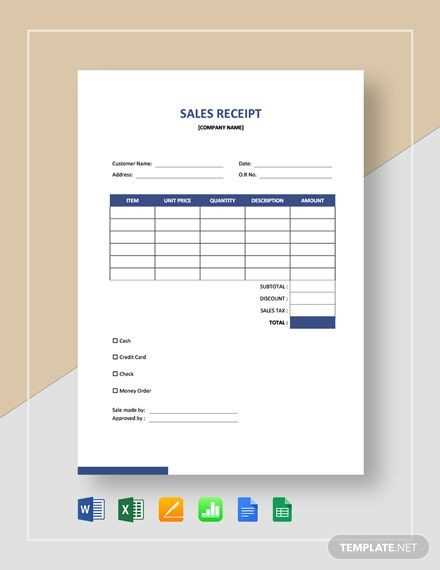

Ensure your daycare receipt includes the necessary details to process FSA reimbursements smoothly. Start with the provider’s name and address, which should be clearly visible. The receipt must also include the date of service and the total amount paid. Break down the charges, listing each day or session separately. This can help avoid confusion, especially if the daycare provides multiple services or has varying rates.

For the reimbursement process, ensure the receipt contains the child’s name and age. This verifies the eligibility of the service. Include the type of service provided, such as “child care” or “after-school care,” to clarify the purpose of the charges. If applicable, specify the dates of care, especially if the daycare operates on a weekly or monthly schedule.

If your daycare charges taxes, list them separately to make it easier for FSA administrators to verify total eligible expenses. Additionally, always request a receipt with the daycare provider’s signature or official stamp, which adds authenticity to the documentation.

| Required Information | Example |

|---|---|

| Provider’s Name and Address | ABC Daycare, 123 Main St, City, State, ZIP |

| Child’s Name and Age | John Doe, Age 4 |

| Date of Service | January 15, 2025 |

| Amount Paid | $250.00 |

| Breakdown of Charges | Child Care (January 15, 2025) – $250.00 |

| Taxes (if applicable) | Sales Tax – $10.00 |

Keep the receipt clear, organized, and legible to avoid delays in processing. Review all information for accuracy before submission, as missing or incorrect details could result in reimbursement delays or denials.

Ensure that the date on your daycare receipt matches the date of service. Any discrepancy can lead to delays or rejection of your claim. Double-check to verify that the service dates listed are clear and correspond with your child’s attendance.

Incorrect or Missing Provider Information

Make sure the daycare provider’s name, address, and contact details are included on the receipt. If any of this information is missing or incorrect, your submission could be flagged for further review or denied. Always verify that this information is legible and up to date.

Incorrect or Unclear Payment Details

Receipt amounts should match the charges listed in your payment records. Any confusion around partial payments, discounts, or additional charges might raise questions. Avoid submitting receipts that aren’t fully itemized, as this could result in the need for resubmission or rejection.

To ensure smooth processing of your FSA claim, the receipt must contain specific details. First, include the provider’s name or the daycare center’s business name. This helps confirm the legitimacy of the service provider. Next, list the dates of service clearly; this should reflect the exact time your child attended daycare. Without this information, your claim may face delays.

Include a breakdown of charges for each service provided. This ensures transparency and helps validate the expenses. Also, ensure the total amount paid is clearly stated, along with any taxes or additional fees. It’s important to have a clear itemized list to avoid confusion during reimbursement processing.

If applicable, include the child’s name to specify the individual benefiting from the service. This helps confirm that the daycare service aligns with the FSA’s eligible expenses. Lastly, the receipt should be dated to indicate the payment was made in the correct period, ensuring it aligns with the FSA guidelines.

Daycare Receipt for FSA Template

Ensure your daycare receipt includes all necessary information for FSA claims. Each receipt should have the daycare provider’s name, address, and phone number. Clearly state the child’s name and age, the dates of service, and the total amount paid. If applicable, list any specific services provided, such as full-day care or after-school programs.

Detailed Information to Include

For accuracy, include your child’s first and last name, along with the provider’s details. The receipt should show both the total charges and any payments made (if applicable). Make sure to mention the period of service covered by the receipt to avoid delays or confusion. Receipts that break down costs by days or weeks help FSA administrators process claims more efficiently.

Format for Submitting

When submitting your daycare receipt, keep it clear and legible. Ensure the provider’s signature or other verification is included if required. Submit the receipt alongside the necessary claim form from your FSA plan. If you need further clarification, contact your FSA administrator to confirm submission guidelines.