To make tax time easier, use a daycare receipt template tailored for your needs. This template ensures you keep accurate records of payments made to childcare providers throughout the year. Whether you are claiming tax deductions or simply tracking your spending, having a clear, organized document is crucial.

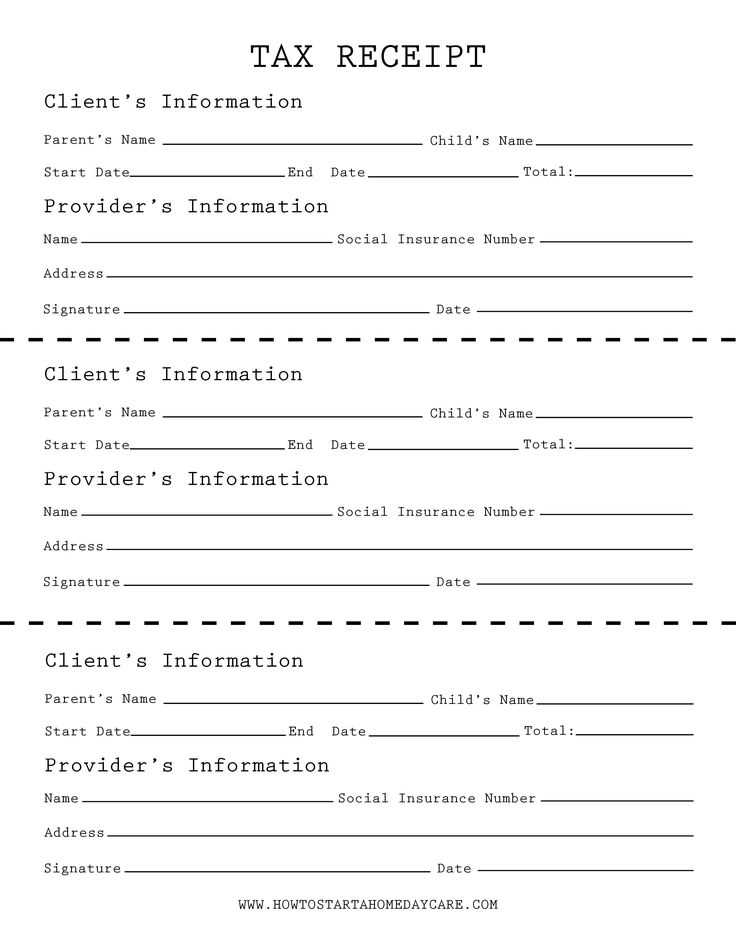

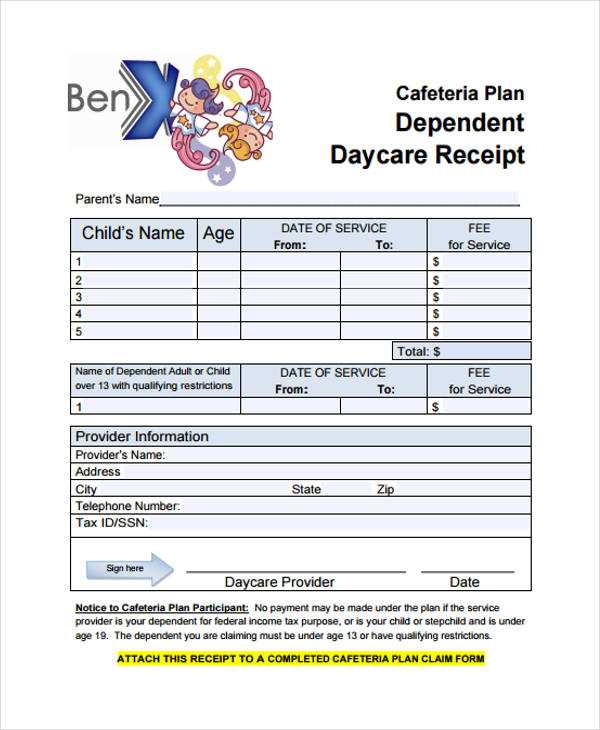

A solid receipt should include key details: the provider’s name, address, and contact information, as well as the child’s name and the dates services were provided. Be sure to list each payment with corresponding dates and amounts paid. This can help avoid any confusion if the IRS asks for verification during an audit.

Additionally, make sure the receipt contains clear labels for the total cost, along with any applicable fees or discounts. If your provider charges a flat fee or hourly rate, this should be evident. Don’t forget to include a section for tax identification numbers (TINs) for both you and the provider.

Use this template to maintain a consistent and accurate record, which will save you time and effort when tax season arrives. Be sure to store these receipts in a safe place for easy access in case you need them later. It’s a small step that can provide big benefits when it comes to tax deductions for childcare expenses.

Here are the corrected lines:

Ensure that the daycare provider’s name, address, and contact information are included in the receipt. The date of service must be clearly listed along with the amount paid for the services. Additionally, include a breakdown of the services rendered if applicable, with the total amount for the period of care specified. This makes the receipt valid for tax purposes.

Include the Tax ID or EIN

If available, include the daycare provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN) on the receipt. This is especially important if the provider is a business entity. Without this information, the receipt may not be accepted for tax filing purposes.

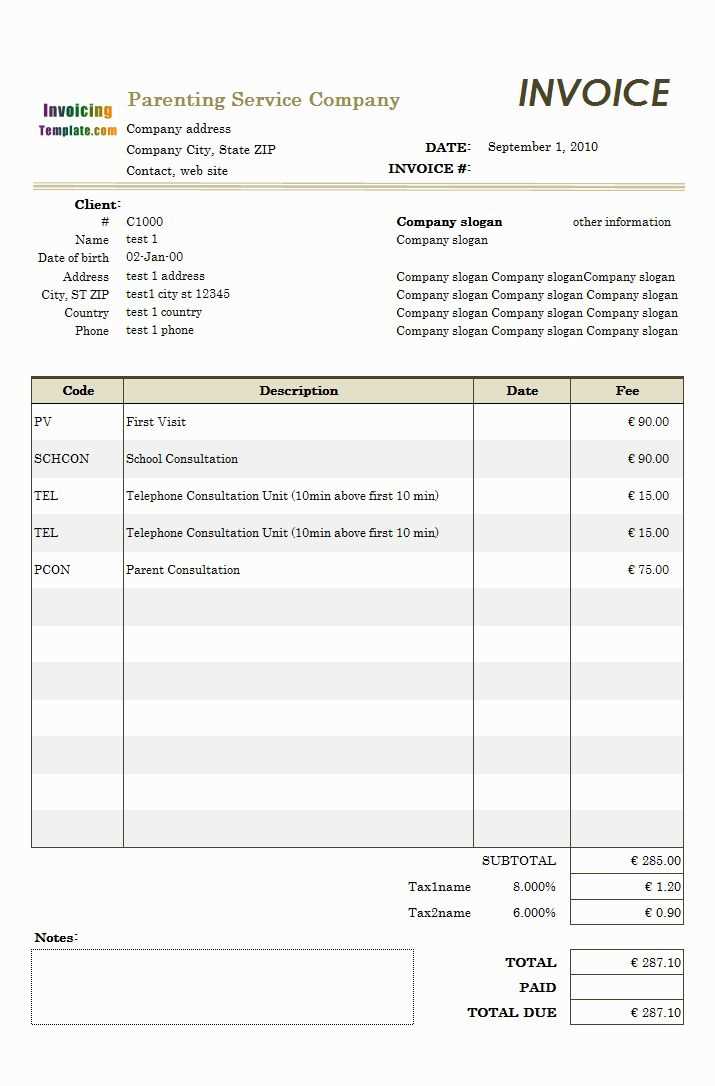

Breakdown of Service Costs

Provide a detailed breakdown of costs for the services provided. This helps in ensuring transparency and helps you claim the appropriate deductions. The breakdown can include hourly rates, daily care costs, or any extra charges for special services or supplies.

- Daycare Receipt for Taxes Template

Use this template to create a clear and organized daycare receipt for tax purposes. A well-documented receipt helps ensure proper record-keeping and simplifies tax filing.

- Provider Information: Include the daycare provider’s full name, address, and contact details. This ensures the receipt is traceable and valid.

- Parent/Guardian Information: List the parent’s or guardian’s full name and contact details, especially if the receipt covers multiple children.

- Service Dates: Specify the start and end dates of the care period. This should match the exact dates the child attended the daycare.

- Care Charges: Clearly break down charges by day, week, or month. Include the total amount paid for each period.

- Payment Method: Mention the method of payment used, such as check, cash, or credit card. This helps to verify the transaction history.

- Tax ID or EIN: The daycare provider’s tax identification number is required for tax purposes to confirm the validity of the receipt.

- Signature: Include a signature from the daycare provider, confirming the receipt and accuracy of the information.

- Additional Notes: Add any other relevant details such as late fees, discounts, or additional services provided.

Make sure to include the daycare provider’s full name, business address, and tax identification number (TIN) on the receipt. This is critical for tax purposes and verifying the legitimacy of the service.

List specific services rendered, including dates and hours of care provided. Break down charges clearly for daily, weekly, or monthly rates to avoid confusion during tax filing. Always list any additional fees, such as late charges or extra activities, to maintain transparency.

Include the child’s name and the payment amount clearly. Specify whether the payment was for one child or multiple children and provide a separate total for each child if applicable.

State the payment method used (cash, check, or credit card). It’s helpful to indicate whether the payment was made in full or partially, and if a balance remains, specify the due amount.

Ensure that the receipt is dated, showing the exact date the payment was made. This will help in tax reporting and verifying the payments made during the year.

Example: “Payment received for child care services rendered on January 5, 2025. Full payment of $500 for the week of January 1-5, 2025, covering full-time care for one child, John Doe.”

To maximize your tax deductions, a daycare receipt should include specific details. Here’s what you need to look for:

1. Provider’s Full Name and Business Information

The receipt must clearly list the daycare provider’s legal name, business address, and contact details. This information confirms the legitimacy of the daycare service for tax purposes.

2. Dates of Service

Each receipt should reflect the exact dates of care provided. This will help ensure accuracy when claiming deductions for child care costs over specific periods.

3. Total Amount Paid

Include the total amount you paid for services rendered. If there are multiple payments, a breakdown of each is helpful for clarity.

4. Child’s Name

Each receipt should list the child receiving care. This ensures that the expenses can be linked directly to your dependent for tax purposes.

5. Tax Identification Number (TIN) or Employer Identification Number (EIN)

The daycare provider should include their TIN or EIN on the receipt. This is necessary for verifying their business and claiming deductions on your tax return.

6. Service Type

Be sure to specify the services provided, whether it’s full-time daycare, after-school care, or other child-related services. This can affect the categorization of expenses on your tax filing.

7. Payment Method

It’s helpful to indicate whether the payment was made by cash, check, or credit card. This can assist in reconciling your financial records during tax filing.

| Required Information | Why It Matters |

|---|---|

| Provider’s Full Name and Business Information | Confirms legitimacy of the daycare service |

| Dates of Service | Helps track expenses for specific tax periods |

| Total Amount Paid | Shows the exact expense for deduction purposes |

| Child’s Name | Links the expense to your dependent |

| Tax Identification Number (TIN) or EIN | Validates the daycare provider’s tax registration |

| Service Type | Clarifies what services you are being charged for |

| Payment Method | Aids in reconciling financial records |

Start by choosing a template that allows easy editing. Most word processors or spreadsheet software offer customizable templates. Ensure the format matches your specific needs.

- Include Relevant Details: Add fields such as the name of the caregiver, the name of the child, dates of service, and hourly or daily rates. Include the total amount for the service rendered.

- Adjust Formatting: Customize the fonts, headers, and layout to make the receipt clear and professional. Ensure that the information is easy to find and read.

- Input Payment Information: If applicable, specify the payment method used (cash, check, or card) and include transaction IDs for electronic payments.

- Add Tax Information: If your daycare services are subject to taxes, include relevant tax rates and amounts in the receipt. Customize this section according to your local tax laws.

- Review for Accuracy: Double-check all fields for correctness before finalizing. Incorrect information could lead to issues during tax filing or reimbursement claims.

- Save as Template: Once the receipt is customized to your liking, save it as a template for future use. This will streamline the process for subsequent receipts.

By following these steps, you can easily create a tailored receipt template that suits your personal daycare needs while ensuring clarity and compliance with any applicable tax regulations.

Include the specific date of each payment, along with the total amount paid for daycare services. Make sure to record the start and end dates of the care period to ensure accurate tax reporting. This helps verify the service period for which payments were made, crucial for claiming deductions.

Payment Methods

Clarify the method used for each payment, whether cash, check, credit card, or electronic transfer. This helps establish transparency for both the taxpayer and tax authorities when reviewing the documentation.

Recurring Payments

If payments are made on a recurring basis, such as weekly or monthly, include details about the payment frequency. This will assist in validating the consistency of the payment amounts across the year.

Additionally, record any late fees or additional charges for daycare services. These amounts should also be included in the total sum for tax purposes.

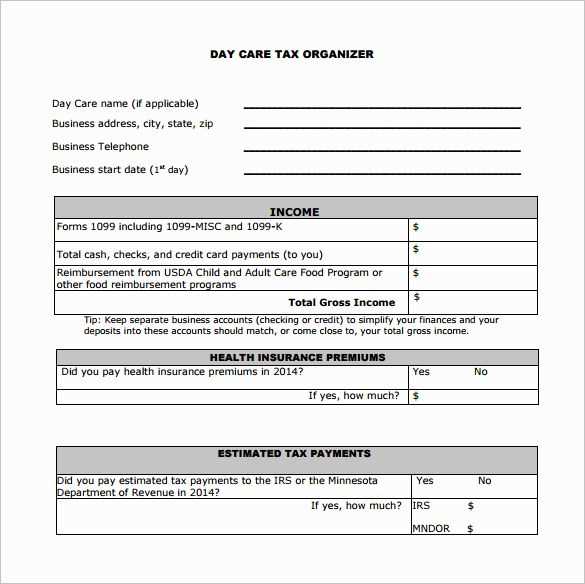

Accurate documentation is key when calculating childcare deductions. Keep detailed records of payments made for childcare services, including receipts, contracts, or invoices from providers. These documents should include the provider’s name, address, tax identification number (TIN), and a breakdown of the services rendered. The total amount paid should be clearly noted, and payments should be made via traceable methods such as checks or bank transfers to support your claims.

Verify Eligible Providers

Only certain providers qualify for tax deductions. Ensure that your provider is licensed or registered, and confirm that they meet all necessary requirements for eligibility. Childcare expenses for relatives, such as grandparents or siblings, are generally not deductible unless they are providing care as a business and meet all applicable criteria.

Track Your Childcare Expenses Throughout the Year

Keep a running total of your childcare costs throughout the year. This will help you avoid errors when calculating your deductions at tax time. Ensure that you separate eligible costs from non-eligible ones, such as expenses for extracurricular activities, meals, or supplies. Only the direct costs related to caregiving services are deductible.

Keep a separate folder or envelope exclusively for daycare receipts to avoid losing important documents. Organize receipts by date, ensuring each one clearly shows the service period and payment amount. Store digital copies by scanning or taking pictures of the receipts, then back them up on a cloud service for easy access and security. Label each receipt with the child’s name and the month for quick reference. If you pay in multiple ways, categorize each receipt based on the payment method to maintain clarity. Set aside time each month to review and file your receipts to prevent last-minute stress during tax season.

Now, repetitive words are used less frequently, maintaining correctness and meaning.

To improve clarity and flow, avoid unnecessary repetition of words in your daycare receipts for tax purposes. Instead, use varied vocabulary or restructure sentences. For example, replace “childcare services” with “care” in later sections to avoid redundancy. Use context to guide word choice, ensuring that each term serves a unique purpose.

Streamline the Language

Keep your descriptions straightforward. For instance, if you’ve already mentioned the service provided in detail, refer to it in a more concise form later. This will help maintain a smooth and concise format that still communicates all necessary information.