Creating a debit card receipt template is a straightforward task that helps streamline your financial record-keeping. With a well-structured template, you can easily track your transactions, ensuring clarity and accuracy for both personal and business needs.

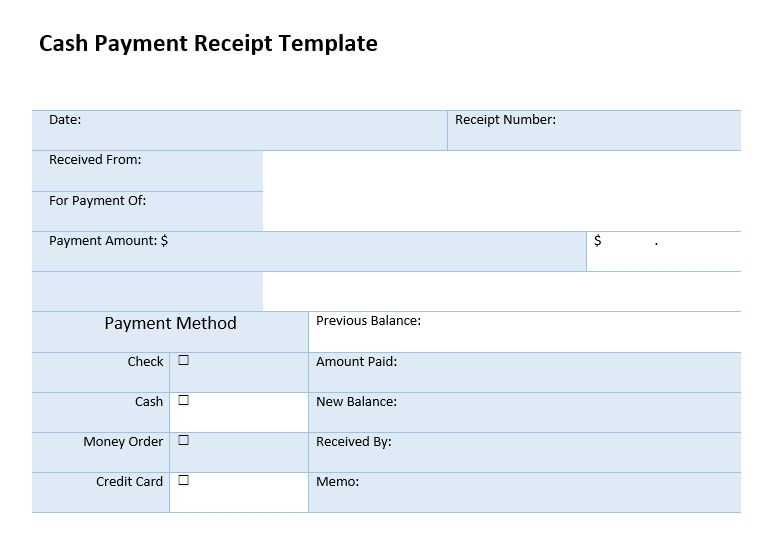

Start with including the most important details: transaction date, merchant name, purchase amount, and the last four digits of the debit card used. This ensures transparency and makes it easy to reference any purchase in the future.

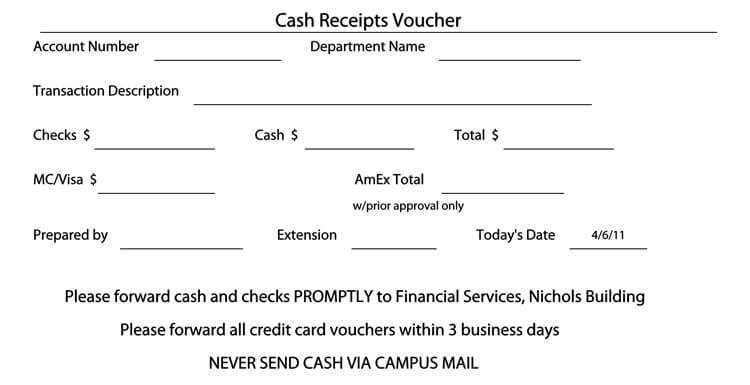

Next, consider adding fields for transaction types (e.g., debit, credit, refund), which helps in distinguishing between different types of charges. A simple and user-friendly layout promotes easy understanding and quick identification of any discrepancies.

To complete your template, include space for a unique receipt number. This adds an extra layer of organization, making it easier to file and retrieve receipts when needed. Adjust the template’s design to suit your specific requirements and preferences, whether it’s for personal use or for your business records.

Here’s the corrected text, where word repetitions are removed:

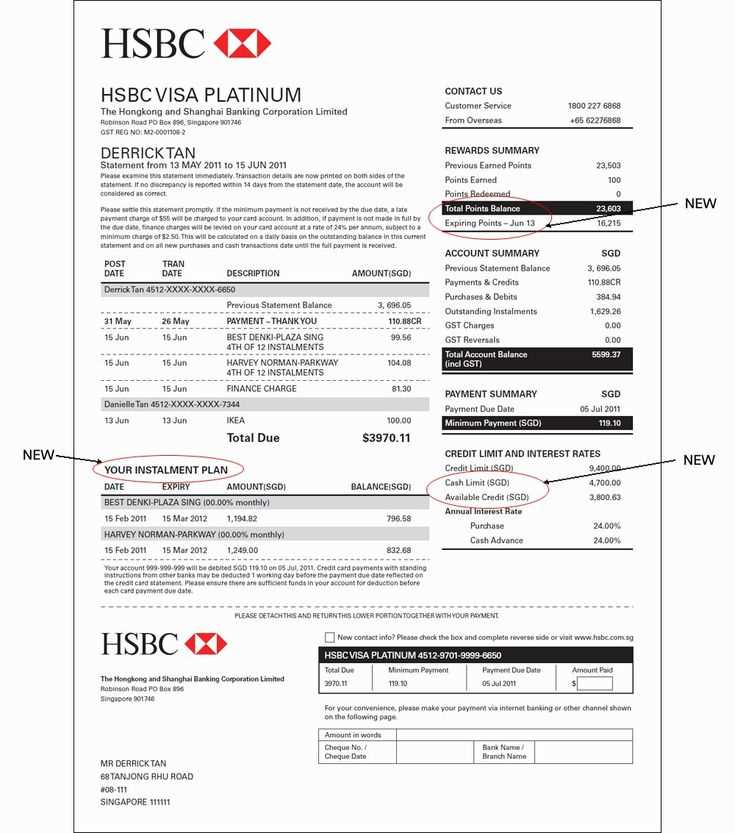

The receipt template for debit card transactions must include key details. Include the transaction date, merchant name, amount spent, and the last four digits of the debit card. Additionally, it’s helpful to provide the cardholder’s name and the transaction ID for easy reference.

Ensure the formatting is clear and user-friendly. Avoid unnecessary jargon or complex terms that may confuse the customer. The layout should prioritize readability, with each section distinctly separated and labeled.

Make sure to include a contact option for any disputes or inquiries. A clear summary of the total amount and any fees applied should follow immediately after the transaction details.

Provide an easy-to-read breakdown of the items purchased or services rendered. This helps customers verify their charges and understand the transaction fully.

- Debit Card Receipt Template

To create a debit card receipt template, include essential details that reflect the transaction. Start with the merchant’s name and contact information at the top. This ensures customers know exactly where the purchase was made.

Transaction Information

Next, provide the transaction date, time, and unique receipt number. This helps to track and verify the purchase. Clearly display the debit card number (last four digits) for security, alongside the transaction amount, including any taxes or fees.

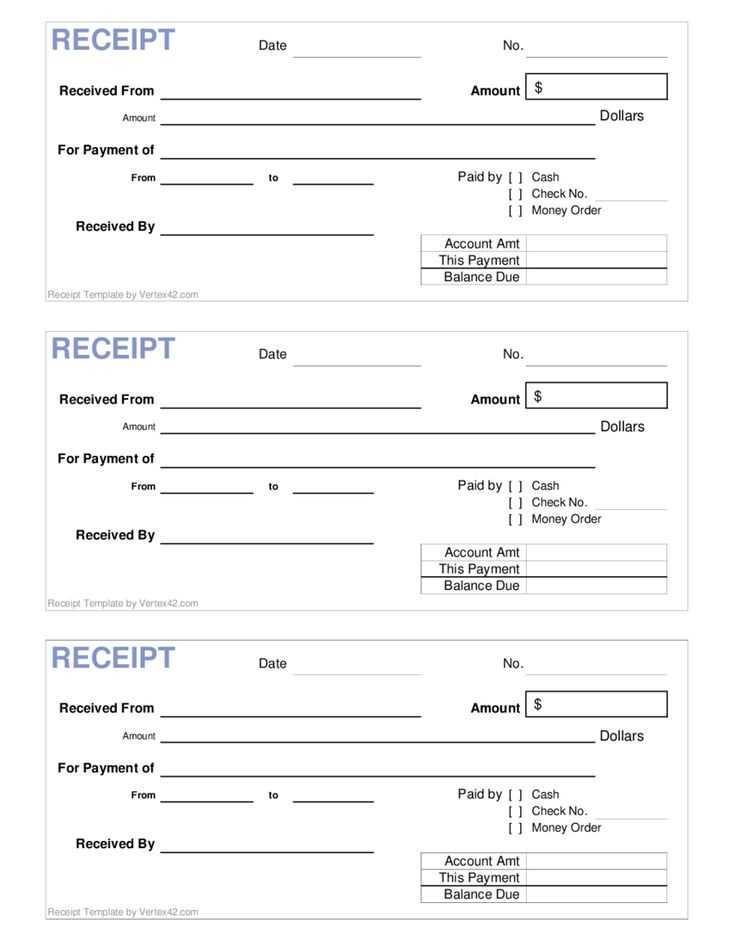

Payment Method

List the payment method as “Debit Card” and include a brief note that the transaction was completed via debit card. Include a section that acknowledges the successful authorization of the payment.

For clarity, break down the itemized list of goods or services purchased with corresponding prices, if applicable. Finally, place a thank you message and return policy or contact information at the bottom of the receipt to assist customers with potential inquiries.

To create a simple debit card receipt for personal use, you need to include essential transaction details. These details provide an accurate record of the payment, which is useful for budgeting or tax purposes.

Include the Key Information

- Transaction Date: Specify the exact date of the purchase.

- Merchant Name: Clearly list the business or individual from whom the product or service was purchased.

- Amount Spent: State the total amount, including taxes and fees.

- Debit Card Number (last four digits): For security, only include the last four digits of the card number.

- Transaction ID: If available, include any unique identifier for the transaction.

Format the Receipt

Use a simple layout with clear headings and bullet points for easy readability. Include the merchant’s logo at the top, followed by transaction details. Make sure the text is aligned for quick reference and clarity.

Once you’ve gathered the necessary information and formatted the receipt, you can save it digitally or print it for your records. This will help you track spending and maintain a simple but organized financial history.

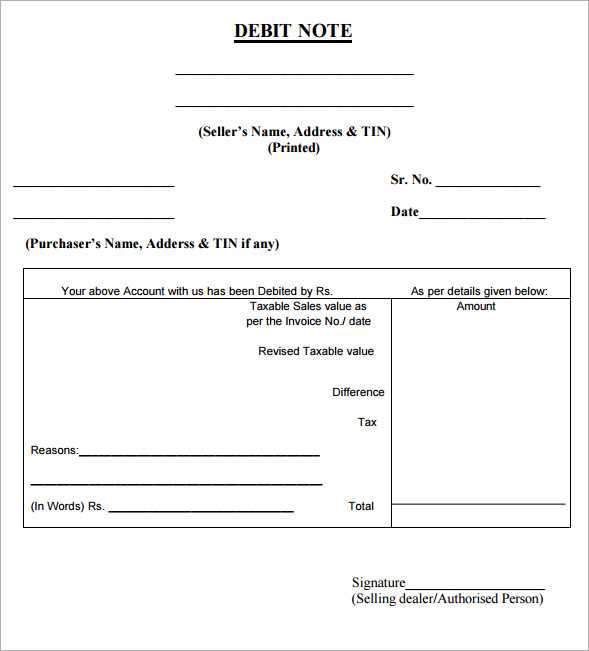

Ensure your receipt template covers these key elements: the business name and contact information, a unique transaction or receipt number, date and time of the transaction, and the items or services purchased. Include the total amount paid, including taxes and discounts, and specify the payment method used (e.g., debit card). A clear breakdown of each item’s price and applicable tax should be provided. If applicable, include return or exchange policies to inform customers. Finally, add any additional notes or terms related to the transaction that may be relevant to the customer. These details provide transparency and build trust between the business and its customers.

For each transaction type, customize your receipt by adjusting the details to match the nature of the purchase. For example, when a payment is made for goods or services, include a clear description of the item or service, the price, and any applicable taxes. This helps the customer verify their purchase and provides a record for future reference.

For cash withdrawals, the receipt should highlight the amount withdrawn, the transaction fee (if applicable), and the current balance after the withdrawal. This will give the customer a full picture of their account status and ensure transparency.

In the case of transfers, make sure to include the recipient’s details, transfer amount, and any transaction fees. Additionally, specify the date and time of the transfer, as well as the balance in the account after the transaction.

For refunds or reversals, show both the original purchase amount and the refund amount. This helps maintain clarity in tracking any adjustments made to the account. Include information on the transaction that initiated the refund for easy reference.

Customizing receipts based on transaction types not only provides transparency but also enhances the customer’s experience by keeping records precise and clear. Make sure each transaction type is handled with the appropriate level of detail for accuracy and convenience.

Ensure the clarity of the debit card receipt by following a consistent format. Use a clear font and organize all details logically. This not only makes the document user-friendly but also helps avoid confusion when referencing past transactions.

Here’s an effective structure to follow:

| Field | Details |

|---|---|

| Transaction ID | Unique identifier for the transaction. |

| Date and Time | Exact date and time the transaction occurred. |

| Merchant Name | Where the transaction took place. |

| Amount | The total sum charged or credited. |

| Payment Method | Specify debit card or other payment methods used. |

| Card Number (Last 4 Digits) | Only display the last four digits for security purposes. |

| Merchant Contact Info | Provide contact details for inquiries. |

| Transaction Type | Indicate whether it is a purchase, refund, or transfer. |

By keeping this template simple and organized, you create a receipt that is both functional and easy to read. Avoid cluttering it with unnecessary information, ensuring that each field serves a clear purpose.