A debt receipt template should be clear, concise, and legally sound. It is a document that confirms the acknowledgment of a debt repayment, ensuring both parties understand the amount and the terms involved. Using a template ensures that all relevant information is included and prevents confusion down the line.

Ensure your template includes key details such as the debtor’s full name, the amount owed, the payment method, and the date of the transaction. It’s crucial to state the remaining balance if the debt is not fully paid. Additionally, include the signatures of both parties to make the receipt legally binding. A receipt without this verification may not hold up in a legal dispute.

For added clarity, consider adding a section outlining the terms of the debt, including interest rates, payment deadlines, and any other conditions agreed upon by both parties. This level of detail helps protect both the lender and the borrower in case of any discrepancies in the future.

Here’s the corrected text with redundancies removed:

Focus on clarity and brevity. Avoid using the same words or phrases repeatedly. If the meaning is already clear, eliminate unnecessary reiterations. Tighten your sentences to make them more concise without losing meaning.

Key Tips for Reducing Repetitions:

- Review your text for repetitive phrases or words.

- Use synonyms where appropriate to maintain flow without redundancy.

- Avoid over-explaining the same concept multiple times.

- Ensure each sentence adds unique value to the content.

By following these guidelines, your text will become more readable and engaging. Eliminating repetition makes your message clearer and helps maintain the reader’s attention.

- Debt Receipt Template Guide

A debt receipt template helps document the acknowledgment of a debt payment or agreement. Using a well-structured template protects both parties by clearly defining the terms of the transaction. This guide will walk you through the key sections that should be included in a debt receipt template to ensure it is both clear and legally binding.

Key Components of a Debt Receipt

When drafting a debt receipt, include the following details to ensure clarity:

- Parties Involved: Identify both the lender and borrower. Include full names, addresses, and contact information.

- Debt Amount: Specify the exact amount of money owed, including the currency.

- Payment Terms: Describe how and when the debt is being paid, including any agreed-upon schedule for payments.

- Signature and Date: Both parties should sign and date the receipt to acknowledge agreement.

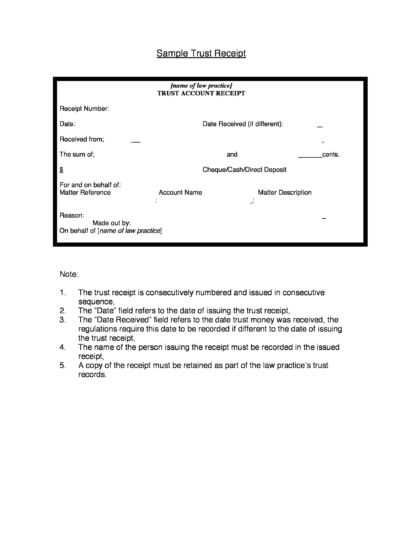

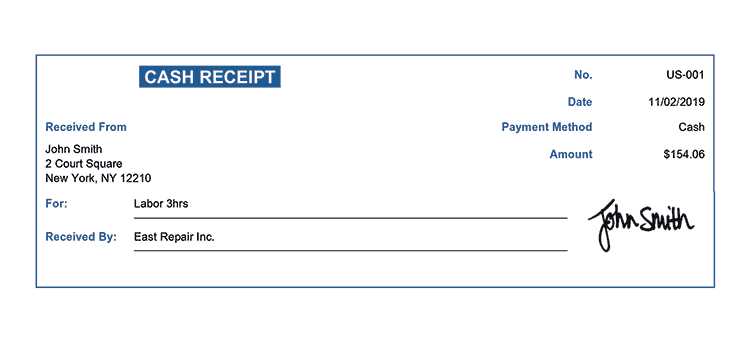

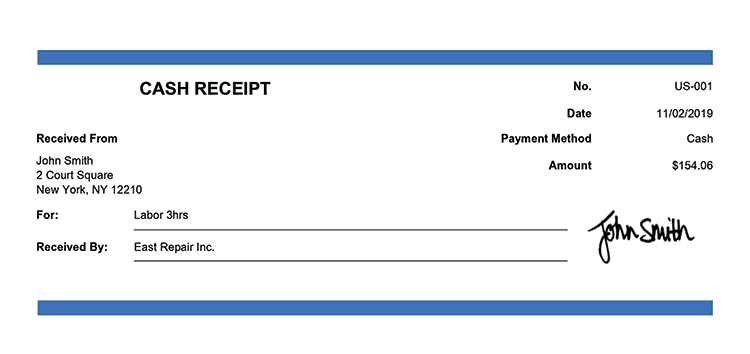

Template Example

Here’s a simple example of a debt receipt template:

| Details | Information |

|---|---|

| Lender’s Name | [Lender’s Full Name] |

| Borrower’s Name | [Borrower’s Full Name] |

| Debt Amount | $[Amount] |

| Payment Date | [Date of Payment] |

| Payment Method | [Cash/Bank Transfer/Cheque] |

| Lender’s Signature | [Lender’s Signature] |

| Borrower’s Signature | [Borrower’s Signature] |

| Date | [Date of Agreement] |

With all sections properly filled out, this receipt can serve as proof of payment or agreement and can be referred to in the future if any disputes arise.

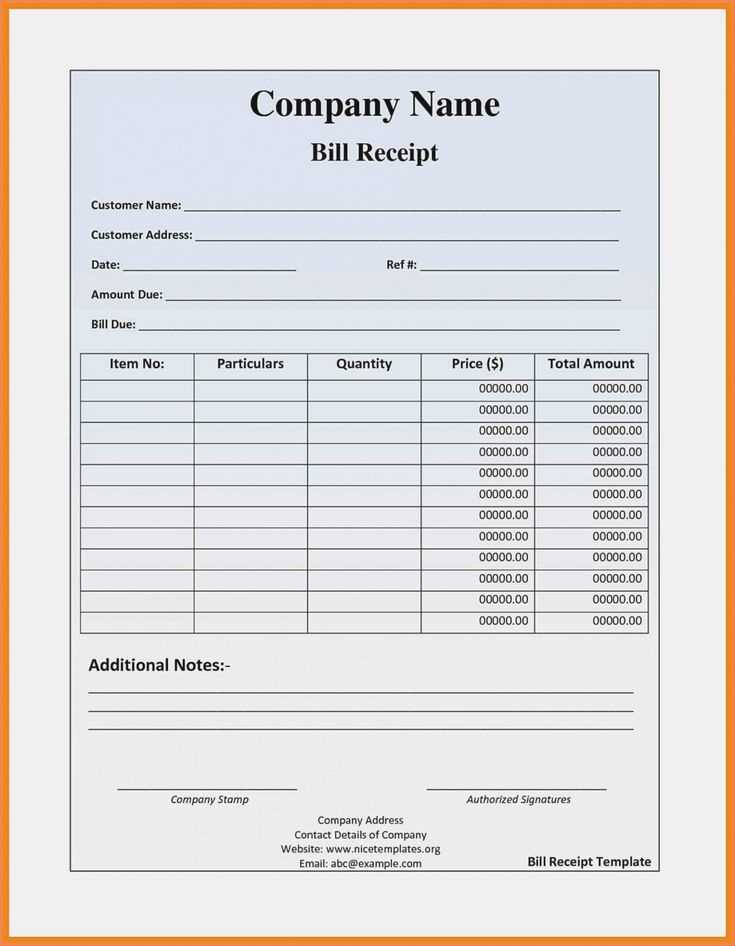

A debt receipt document should be clear and precise. To ensure both parties understand the agreement, include the following key elements:

1. Debtor and Creditor Details: Clearly identify the individuals or entities involved. Include full names, addresses, and contact information for both parties.

2. Amount of Debt: State the exact amount owed, specifying the currency and whether it includes any interest or additional fees.

3. Date of Debt Receipt: Mention the exact date on which the debt is acknowledged. If the amount is paid in installments, include the payment schedule and amounts due.

4. Payment Terms: Specify the agreed payment method (e.g., bank transfer, cash, check) and any applicable due dates. If the debt is interest-bearing, include the interest rate and calculation method.

5. Acknowledgment of Debt: A clear statement that the debtor acknowledges the debt and is responsible for repayment under the agreed terms.

6. Signatures: Both the debtor and creditor should sign the document, with each party keeping a copy. If applicable, include a witness signature for added authenticity.

| Section | Details |

|---|---|

| Debtor Information | Name, address, contact information |

| Creditor Information | Name, address, contact information |

| Amount Owed | Specific amount, currency, interest (if any) |

| Payment Terms | Method, schedule, interest rate (if any) |

| Acknowledgment | Statement of debt acceptance |

| Signatures | Debtor, creditor, and witness (if necessary) |

By structuring the debt receipt with these components, both parties can avoid misunderstandings and ensure the terms are legally binding.

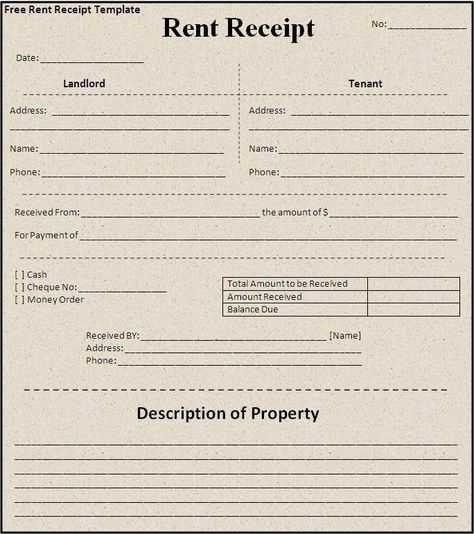

Clearly state the amount of money received, specifying both the numerical value and the currency. This helps avoid any confusion regarding the payment made. Add the date of the transaction, ensuring it matches the day the payment was processed.

Include the name of the payer and the payee. If applicable, include their contact information or business details. This ensures both parties can be easily reached if there are questions about the payment.

Describe the purpose of the payment. Whether it’s for a service rendered, product purchased, or a loan repayment, this helps clarify the nature of the transaction.

Note the method of payment (cash, check, bank transfer, etc.) so there’s a record of how the transaction was completed.

If applicable, provide an invoice or reference number. This creates a connection to any prior agreements or documents related to the transaction, adding transparency and organization.

Finally, ensure both parties sign the receipt. This confirms mutual agreement on the details of the transaction.

Debt documents typically include a variety of legal clauses that provide structure and clarity to the terms of repayment. Key clauses ensure both parties are protected in the event of a dispute or default. These clauses should be carefully reviewed for accuracy and fairness.

1. Payment Terms

Clearly define the amount due, the payment schedule, and acceptable methods of payment. The payment clause should state whether payments are fixed or variable and outline any grace periods or late fees. This protects the creditor’s right to receive payments on time while giving the borrower clear guidelines.

2. Default Clause

The default clause outlines what happens if the borrower fails to meet payment obligations. It typically includes provisions for the lender to demand full repayment or charge additional fees, such as penalties or interest. This clause is critical for lenders to enforce the terms of the agreement if a borrower defaults.

3. Governing Law

Specify the jurisdiction and laws that will govern the agreement. The governing law clause ensures that both parties understand which legal framework will apply in the event of a dispute. This is especially important in cross-border agreements to prevent confusion over legal proceedings.

4. Security Interest

In cases where the loan is secured, the document should outline the collateral being pledged. This clause provides the lender with the right to claim the collateral if the borrower defaults, creating a safeguard for repayment.

5. Waiver of Claims

A waiver of claims clause can limit the borrower’s ability to assert certain defenses or claims against the lender once the contract is signed. This can help avoid lengthy disputes over the terms once an agreement is in place.

Each clause in a debt document should be tailored to reflect the specific terms agreed upon by both parties, offering clear, actionable steps should issues arise during the repayment process.

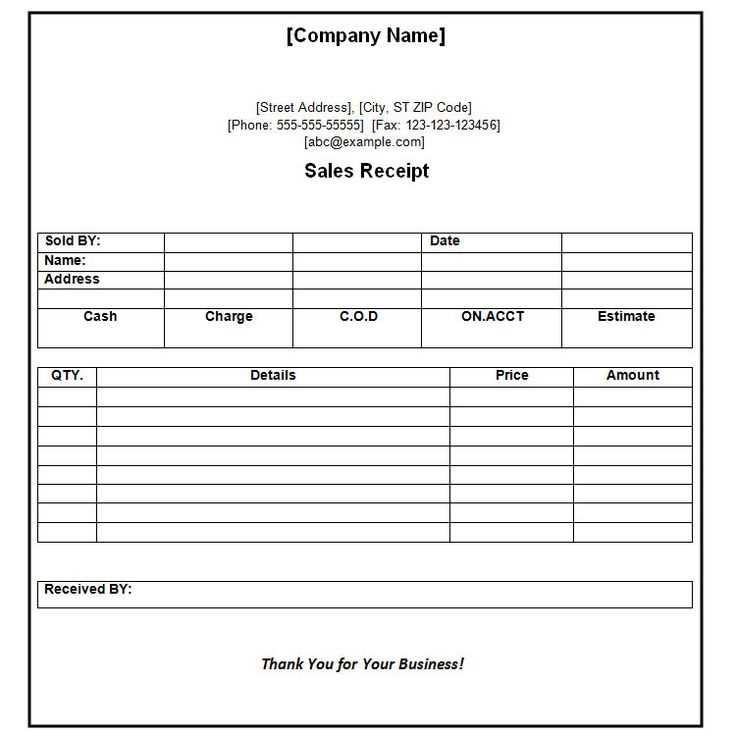

Adjust the template to fit your needs by modifying the fields to reflect the specific details relevant to your situation. Personalizing a template helps you maintain consistency and professionalism, whether it’s for a single transaction or ongoing business correspondence.

- Update the Header: Include your logo, business name, or personal contact information. This adds a professional touch and makes the document easily recognizable.

- Modify the Terms and Conditions: If the template includes predefined terms, adapt them to match your agreements or legal requirements. Ensure the payment terms, deadlines, and interest rates align with your practice or industry standards.

- Adjust the Layout: Templates are often designed to be flexible. Feel free to rearrange sections to prioritize the information you want to emphasize. You may also add additional fields such as payment options, delivery details, or other specifics that are unique to your situation.

- Personalize the Language: If the template uses formal language, you may prefer a more casual tone if it suits your business style or personal preferences. Adjust the wording to make sure the document feels authentic to your voice.

- Include Specific Identifiers: Add customer or client IDs, invoice numbers, or order references to make the document easier to track and manage.

- Design for Clarity: Ensure that the most important information stands out. Use bullet points for clarity, and ensure your contact information is visible. A well-structured document improves readability and reduces confusion.

For business use, ensure compliance with any legal or industry-specific guidelines. Check the document for accuracy before sending it out. Personal use templates can be less formal, but ensure all critical details are still included for clarity.

To verify repayment, the receipt must clearly include the payment details. Follow these steps:

- Record Payment Amount: The receipt should state the exact amount paid. Double-check for any discrepancies between the amount written and the actual payment.

- Include Date of Payment: The date on the receipt confirms when the payment was made. This helps prevent confusion about whether the debt was repaid on time.

- Payment Method: Ensure the receipt specifies how the payment was made (e.g., cash, check, bank transfer). This adds transparency and helps track payment methods.

- Signature or Acknowledgement: The person accepting the payment should sign or mark the receipt as proof of payment. This provides a formal acknowledgment of the transaction.

- Outstanding Balance: If applicable, the receipt should indicate whether there is still an outstanding balance. This confirms the partial or full repayment status.

- Reference Number: A reference number or transaction ID linked to the payment can be useful for cross-referencing with financial records.

By ensuring these details are present on the receipt, both parties have clear proof of repayment, reducing the chance of misunderstandings.

Organize receipts by category to simplify storage and retrieval. Use clear labels for physical or digital files, such as “Business Expenses,” “Personal Purchases,” or “Taxes.” This will help you quickly find what you need without sifting through a pile of unrelated documents.

Scan physical receipts to create a digital backup. Paper receipts fade over time, so having a clear, digital copy can prevent loss. Use a scanner or a high-quality photo to store receipts in cloud storage or on an external drive with strong encryption.

Use secure cloud storage for digital receipts. Ensure your cloud storage provider offers encryption, so your data remains private. Opt for services that require two-factor authentication for added protection.

Shred physical receipts once they are scanned and stored. This reduces clutter and protects sensitive information. Use a cross-cut shredder to ensure receipts are unreadable.

Keep receipts for the right amount of time. For tax or warranty purposes, store receipts for several years. For others, set a reminder to discard them after a certain period to avoid keeping unnecessary records.

Use receipt management apps to streamline the process. Many apps allow you to take pictures of receipts, categorize them, and store them securely. Some even integrate with accounting software for seamless expense tracking.

Backup your data regularly to avoid losing important receipts. Create scheduled backups to external drives or cloud services, ensuring your documents are safe even if your primary device fails.

To create a debt receipt, make sure to clearly include the borrower’s name, the exact amount of money owed, the payment terms, and the due date. This will make the agreement legally binding and prevent misunderstandings. Be specific about how payments will be made–whether in installments or as a lump sum–and include any interest rates if applicable.

Key Elements of a Debt Receipt

Start with a clear title like “Debt Receipt” to indicate the document’s purpose. Next, list both the lender’s and borrower’s full names and contact information. Include the exact amount of debt, any collateral involved, and the payment schedule. If there are late fees or penalties, make sure to mention them to avoid confusion later.

Signature and Acknowledgment

Both parties should sign and date the document, acknowledging the terms. It’s recommended to have a witness present, especially for larger amounts. Make sure each party receives a copy for their records, which may prove useful in case of any disputes down the line.