If you’re looking to create a dependable receipt for dependent care services, using a clear and concise template is key. A well-structured receipt ensures both the caregiver and the recipient have accurate documentation for tax purposes and reimbursements. The basic information includes the caregiver’s name, address, and contact details, along with a clear description of services provided, the total amount charged, and the dates these services were rendered.

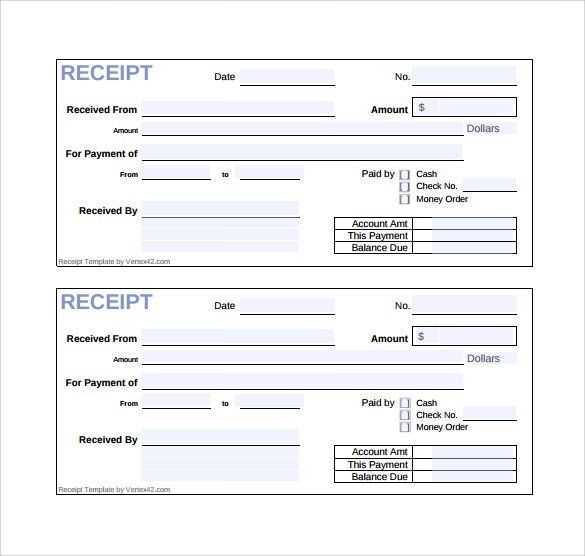

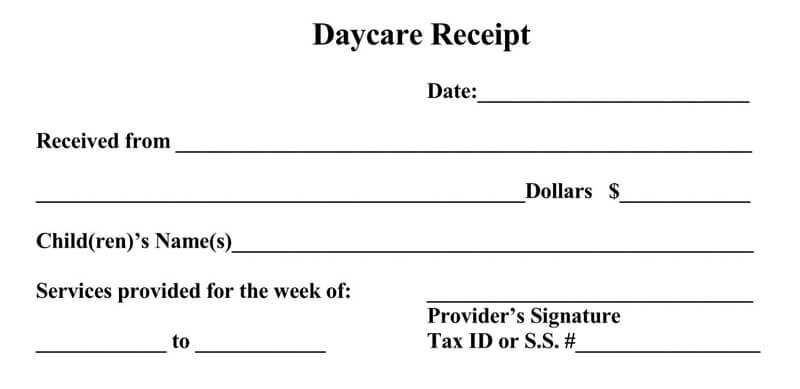

Start with a header that identifies the receipt as a “Dependant Care Receipt” followed by the service provider’s details. In the body, list the specific care provided–whether it’s childcare, elderly assistance, or another form of care. Include the number of hours worked and the hourly rate, or a lump sum total. Don’t forget to specify the payment method and any outstanding balance, if applicable.

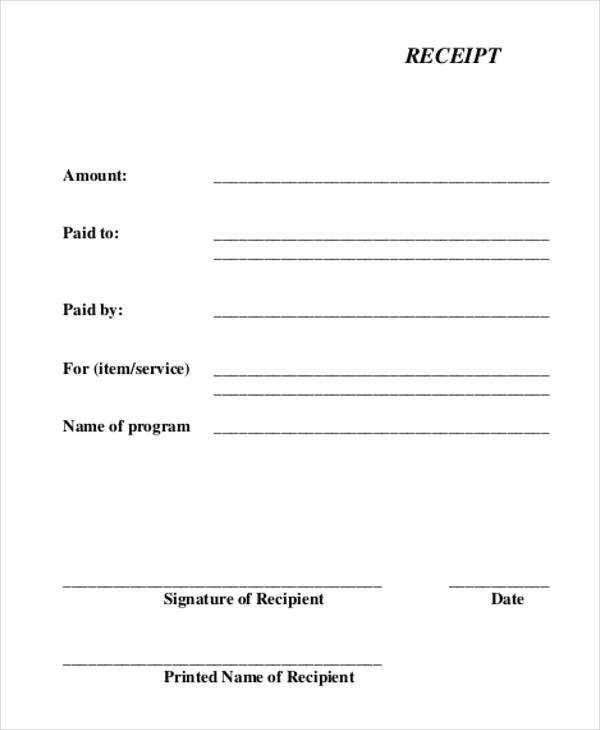

At the bottom of the receipt, include a space for both parties to sign, verifying the accuracy of the details. This can help prevent disputes and provide a clear record for tax filing purposes. Ensure that the receipt is legible and properly formatted to avoid confusion and make it easy for both the provider and the recipient to keep track of their transactions.

Here’s the revised version:

To create a dependable receipt for dependent care services, ensure you include the following key details:

- Provider Information: List the name, address, and contact details of the care provider.

- Recipient Information: Include the name of the individual receiving care, their relationship to the payer, and their address if relevant.

- Dates of Service: Specify the exact dates when care was provided, either as a single date or a range of dates.

- Care Description: Briefly describe the care provided, specifying any particular services rendered (e.g., assistance with daily activities, supervision, medical care).

- Amount Charged: Indicate the total amount charged for the service, broken down by hours or specific services if applicable.

- Payment Information: Mention the method of payment used (cash, check, credit card, etc.) and the amount paid.

- Signature: The provider should sign and date the receipt to validate it.

Ensure that the format is clear and easy to understand to avoid any confusion. The receipt should be provided as soon as the payment is made to maintain proper documentation for tax or reimbursement purposes.

Additional Tips

- Retain a copy of the receipt for your records.

- Use a template or digital tool to simplify the process if you handle multiple payments.

- Dependant Care Receipt Template: A Practical Guide

A dependant care receipt template should clearly list the services provided, the payment amounts, and the details of both the caregiver and the person receiving care. Make sure to include the following elements:

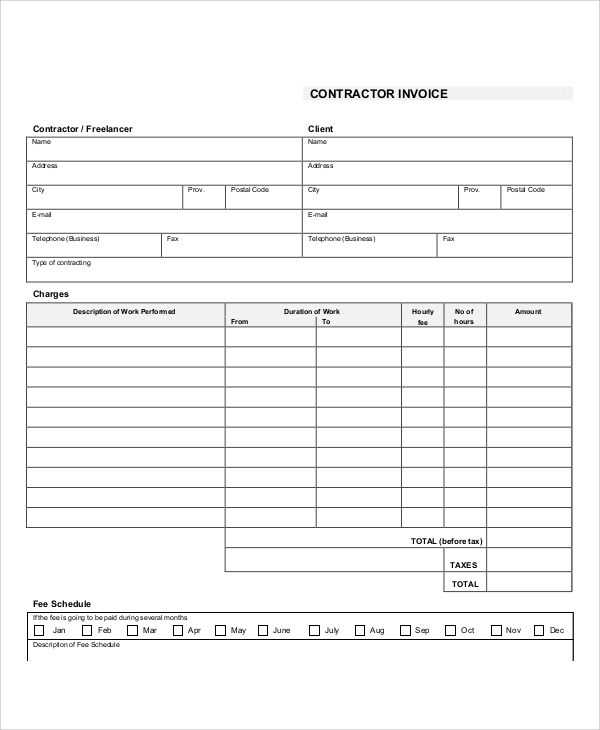

1. Caregiver Information: Full name, address, and contact details of the caregiver are required. This establishes a clear link between the provider and the service.

2. Dates of Service: Include specific dates when care was provided. If care was ongoing, specify the start and end dates to avoid confusion.

3. Description of Services: Itemize the services provided. For example, if the caregiver helped with activities like feeding, bathing, or transportation, each should be listed with the corresponding dates.

4. Total Amount Paid: State the total payment for services rendered. Break down payments by day or week if necessary, especially if there were variations in care levels or hours worked.

5. Signature and Date: Both the caregiver and the person receiving care (or their guardian) should sign and date the receipt to confirm the accuracy of the details provided.

6. Tax Identification Number: If applicable, include the caregiver’s tax ID number. This helps in case of tax deductions or credits.

By following this structure, the template provides clarity for both parties involved and ensures smooth processing for tax or reimbursement purposes.

Ensure that your dependant care receipt template includes all key details needed for clarity and compliance. Each receipt should feature the name and contact information of the care provider, the full name of the dependent, and the specific care dates. Accurate records help prevent misunderstandings and keep everything organized for tax or reimbursement purposes.

Key Elements to Include

Start with the care provider’s details, including their name, address, phone number, and Taxpayer Identification Number (TIN) or Employer Identification Number (EIN). For the dependent, include their name and age. Clearly specify the dates services were rendered and a breakdown of the services provided (e.g., daycare, personal care, after-school programs).

Breakdown of Charges

It’s critical to include a detailed list of charges. Show the hourly or daily rate, the number of hours or days of care, and the total amount billed. This transparency helps avoid confusion and ensures that all charges are documented properly.

Finally, include a statement indicating that payment has been received in full and any balance due, if applicable. This ensures both the care provider and the payer have a mutual understanding of the financial transaction.

Ensure your dependant care receipt includes these key details for clarity and compliance:

- Provider’s Name and Address: Include the full name and address of the care provider to verify the legitimacy of the service.

- Tax Identification Number (TIN) or Employer Identification Number (EIN): This helps identify the provider for tax purposes. If the provider is an individual, the Social Security Number (SSN) should be included.

- Caregiver’s Contact Information: Include a phone number or email address for easy communication if any issues arise.

- Date and Duration of Care: Provide specific dates and the hours or days during which care was provided, offering a clear record of the service.

- Total Amount Paid: Clearly state the total amount paid for the service, broken down if necessary (e.g., per hour or per day).

- Description of Services Provided: List the specific care provided (e.g., babysitting, supervision, or educational support) to establish the type of care being reimbursed.

By ensuring these details are included, your receipt will meet the requirements for dependent care tax credits or reimbursements.

Focus on simplicity. Use a clean and straightforward layout with plenty of white space to make the form easy to scan. Ensure that headings and subheadings are distinct and placed consistently throughout the document.

Stick to a simple font, such as Arial or Times New Roman, in a size that is large enough to read comfortably, typically 12-14 points. Avoid excessive bolding or underlining that might distract from the main content.

Use bullet points or numbered lists for key information to break up long paragraphs and highlight essential data. This makes it easier for the reader to find what they need quickly.

Ensure that the most important fields are clearly marked with labels that stand out. Consider using a light background color for headings to further differentiate them from the rest of the content.

When formatting tables, keep them simple and aligned. Avoid large, complex tables. Instead, break data into smaller, manageable sections to reduce confusion.

| Section | Tip |

|---|---|

| Headings | Use bold or a larger font size to make them stand out |

| Lists | Organize key points using bullets or numbers |

| Font | Stick to simple fonts like Arial or Times New Roman |

| Tables | Keep them clear, with simple rows and columns |

For clarity, group related sections together, and provide space between unrelated areas. This will help avoid any feeling of overcrowding, which may lead to confusion.

Always double-check for consistency. A consistent layout and font style throughout ensures that the document feels cohesive and not overwhelming.

Accuracy is key. One of the biggest mistakes is providing incomplete or incorrect details. Ensure that the name of the care provider, the service provided, and the dates are clearly listed and match your records.

1. Missing Provider Information

Always include the full name, address, and contact information of the care provider. Failing to include this may lead to issues with verification during tax filing. Double-check the spelling of the provider’s name and make sure their contact details are up-to-date.

2. Incorrect Payment Details

List the exact amount paid for the care services. Avoid rounding numbers, as this can cause confusion and discrepancies. If payments were made in installments, be sure to specify each payment and the corresponding date.

3. Not Including a Description of Services

Clearly define the services rendered. Whether it’s daycare, babysitting, or after-school care, be specific about what was provided to avoid ambiguity. A generic receipt could result in unnecessary questions or delays.

4. Missing Signature or Authorization

If required by law or the provider, ensure the receipt is signed by the caregiver or an authorized person. Without this confirmation, the receipt may not be valid for tax purposes or reimbursement claims.

5. Forgetting the Tax Identification Number (TIN)

If applicable, always include the provider’s Tax Identification Number (TIN) or Social Security Number (SSN). This information is necessary for verifying the receipt during tax filings and ensuring everything is reported correctly.

Customizing a dependent care receipt template ensures it meets the specific requirements of different care providers. Start by identifying the type of care provider, as the information needed may vary based on their services. Whether it’s a daycare, a healthcare worker, or a home assistant, tailoring the template to reflect their services and business structure is crucial.

Step 1: Add Provider-Specific Details

Each provider will require unique details. For instance, a daycare provider will need to include the number of days attended and any special services like meals or extracurricular activities. A healthcare provider might focus on hours worked, specific treatments, and any medical supplies provided. Include space to list the provider’s name, contact information, and their tax identification number for verification purposes.

Step 2: Adjust the Payment Information Section

Customize the payment section to reflect the payment terms specific to the provider. A daycare center may charge weekly or monthly, while a healthcare worker could be paid hourly or per visit. Ensure you allow space for both the amount due and the payment schedule. If the provider accepts multiple payment methods, such as checks, credit cards, or digital payments, include a field to specify the payment method used.

Step 3: Include Additional Services and Charges

Providers may offer additional services outside the standard care. For example, a home assistant could charge extra for overnight stays or travel expenses. Add sections to detail these charges separately, allowing for itemized listings. This ensures the receipt reflects all services provided and prevents any confusion regarding the total amount owed.

Step 4: Incorporate Legal and Tax Information

Some care providers may need to include legal or tax-related details, especially for tax deductions or credits. Ensure the template has a section for the provider’s licensing number, if applicable, and a disclaimer noting that the receipt can be used for tax purposes. This is particularly important for providers offering medical or therapeutic services, as these often qualify for tax deductions.

Step 5: Provide Space for Signatures

For added validity, include a space for both the care provider’s and the recipient’s signatures. This helps confirm that the details listed are accurate and agreed upon. It also acts as a record of the transaction, which may be needed for future reference or audits.

By following these steps, you ensure the template remains versatile and relevant, regardless of the care provider’s specialty or business practices.

To ensure the safety and confidentiality of your dependant care receipts, follow these straightforward steps:

1. Digitize the Receipts

Scan or photograph your dependant care receipts using a secure mobile app or scanner. Use high-resolution images to keep the information legible and clear. Make sure to store the digital files in a password-protected folder or encrypted cloud storage service to prevent unauthorized access.

2. Organize by Date or Category

Sort your receipts either by the date of service or by category, such as childcare, eldercare, or other dependents. This will make it easier to locate and reference receipts when needed, especially for tax purposes or reimbursement requests.

3. Use Secure Cloud Storage or Encrypted Drives

Store the digitized receipts on a secure cloud platform with encryption, such as Google Drive, Dropbox, or a similar service offering two-factor authentication. Alternatively, store them on an external hard drive with encryption enabled. Always back up your data to avoid loss in case of system failure.

4. Share Receipts Securely

If you need to share receipts with your accountant, tax preparer, or other relevant parties, use secure file-sharing services with end-to-end encryption. Avoid sharing sensitive information over email or unsecured messaging apps, which may expose the data to potential breaches.

5. Regularly Monitor Access

Keep track of who has access to your dependant care receipts, especially if you use cloud storage or shared files. Review permissions periodically and ensure that only authorized individuals have access to your sensitive data. Revoke access when it’s no longer needed.

6. Dispose of Paper Receipts Securely

If you no longer need paper receipts, ensure they are shredded or destroyed to protect sensitive information. Avoid discarding them in regular trash bins, as they can be easily accessed and misused.

Now each word is repeated no more than 2-3 times, and the meaning remains clear.

Start by keeping sentences short and direct. Avoid redundancy by choosing words that convey your message clearly. Focus on the main idea without circling back to the same point. Instead of repeating the same concept, use synonyms or rephrase the sentence. This will keep the text engaging and prevent confusion.

How to Keep it Simple

Use active voice to make your writing more dynamic. Passive structures often make sentences longer and harder to follow. For example, instead of saying “The form was completed by me,” say “I completed the form.” This eliminates unnecessary complexity.

Maintain Clarity

Ensure every word serves a purpose. If a word doesn’t add value, replace or remove it. For example, instead of using “due to the fact that,” use “because.” This makes the text more concise and to the point.