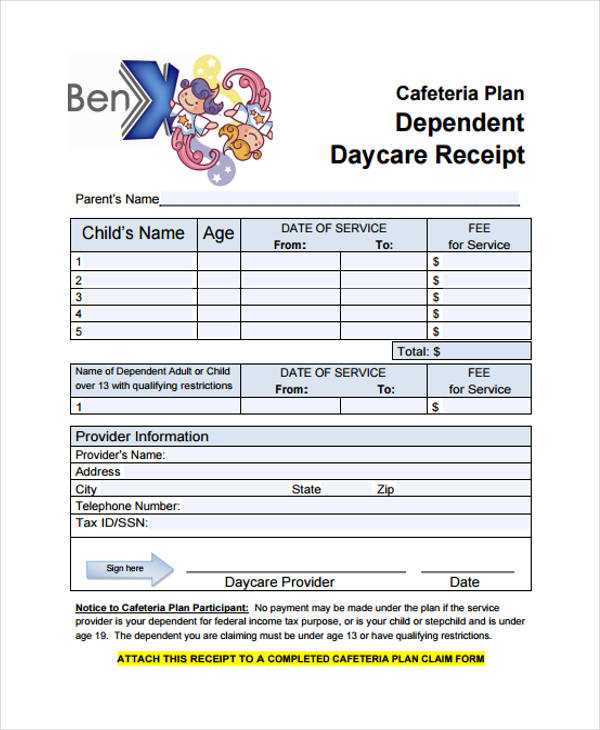

If you’re submitting claims for dependent care expenses through a Flexible Spending Account (FSA), it’s important to ensure you provide the right documentation. A clear and accurate receipt template will help streamline the reimbursement process and avoid unnecessary delays. The template should include all necessary details about the services provided and the costs incurred.

Your receipt template should list the service provider’s name, address, and tax identification number (TIN) to confirm the legitimacy of the service. Additionally, you must include the date(s) the service was provided, a detailed description of the care provided, and the total amount charged. If the care was for more than one dependent, specify the name(s) of the individual(s) receiving care.

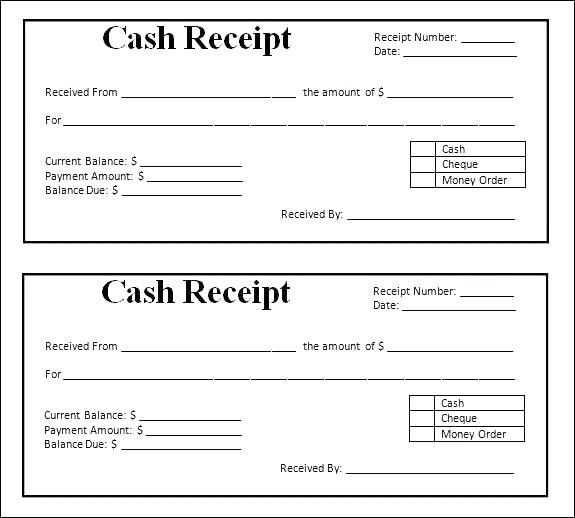

Make sure that the template includes any payment details, such as the method of payment (e.g., credit card, check, or direct payment) and the amount paid for each transaction. This ensures that the amount being reimbursed aligns with your actual out-of-pocket expenses. Without this information, your submission may be rejected or delayed.

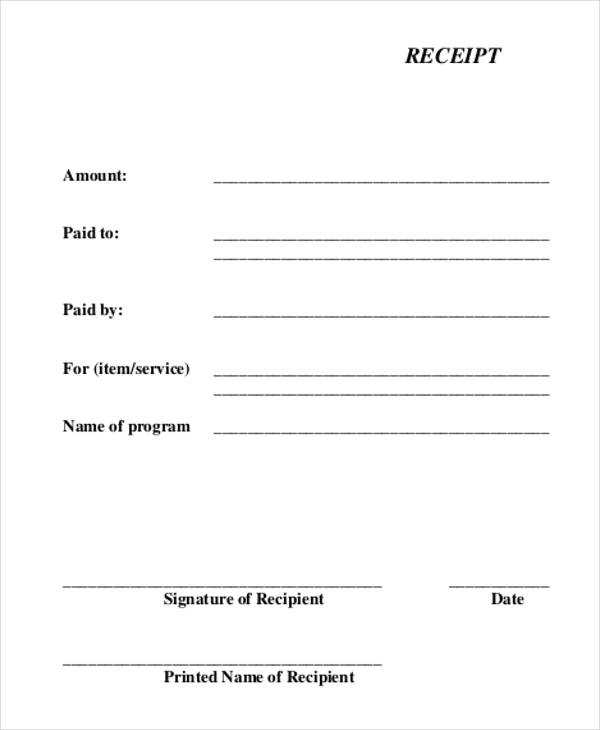

It’s also helpful to ensure the template has clear formatting, making it easy for your FSA administrator to verify the information. Keep a copy of each receipt you submit, as you may need to provide them if the FSA provider requires further clarification or verification.

Here’s the corrected version:

Ensure that your dependent care FSA receipt includes all necessary details for approval. A valid receipt should clearly show the name and address of the service provider, the dates services were provided, and a description of the services. The total amount paid must be listed, and if any payment was made through another source, such as insurance, it should be noted.

Key Elements for a Valid Dependent Care FSA Receipt

1. Provider Information: Include the full name, address, and tax identification number or employer ID of the provider.

2. Service Dates: Specify the exact dates when the care was provided, not just the billing period.

3. Service Description: List the specific care services rendered (e.g., daycare, after-school care).

4. Payment Amount: The total amount you paid for the services should be shown clearly.

5. Additional Payments: Note if any amount was covered by other sources such as insurance.

Common Mistakes to Avoid

Missing provider details, unclear service descriptions, or incorrect dates can delay reimbursement. Ensure all required information is legible and complete before submitting the receipt for processing. Double-check the amounts to avoid discrepancies.

Dependent Care FSA Receipt Template

To submit a claim for reimbursement from your Dependent Care FSA, ensure that your receipt includes the following details:

- Provider Name and Address: Full name and address of the daycare provider or facility.

- Dates of Service: Clear start and end dates for each day of care provided.

- Description of Service: Specific details of the care services, such as “childcare” or “elder care” services.

- Amount Paid: The total cost for the services rendered during the billing period.

- Provider Tax Identification Number (TIN) or Employer Identification Number (EIN): A unique identifier for the provider.

- Proof of Payment: Indication of how payment was made (e.g., credit card, check, or cash). If available, include a transaction reference number.

Ensure that each receipt is clear, complete, and legible to avoid delays in the reimbursement process. Use the following template for organizing your claims:

Receipt Template Example

Provider Name: [Provider's Full Name] Provider Address: [Provider's Address] Provider TIN: [Provider's Tax Identification Number] Date of Service: [Start Date] to [End Date] Description of Service: [Childcare/Elder Care] Total Amount Paid: $[Amount] Payment Method: [Cash/Credit Card/Check] Payment Reference Number: [Transaction ID, if applicable]

Additional Tips

- Keep copies of all receipts for your personal records.

- If you are unsure about any details, contact your FSA administrator for clarification.

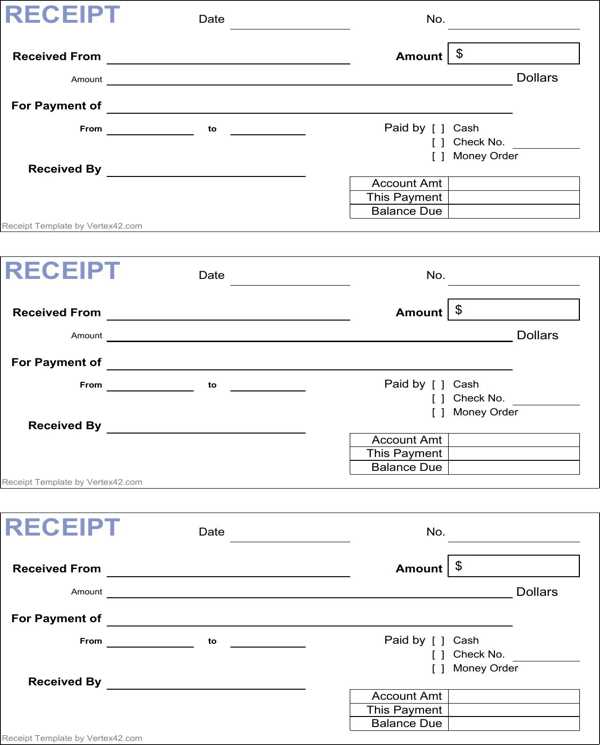

To create a valid receipt for Dependent Care FSA claims, include the following key elements:

- Provider’s Name and Address: The receipt must clearly list the care provider’s full name and their address, including city and zip code.

- Date(s) of Service: Indicate the exact dates when services were provided. If the service was ongoing, provide a range of dates.

- Amount Paid: Show the total amount you paid for dependent care services during the specified period.

- Nature of Services: Include a brief description of the services provided (e.g., daycare, after-school care, or eldercare).

- Dependent’s Name: List the name(s) of the dependent(s) who received care, along with their age, if required.

- Provider’s Tax Identification Number (TIN): The receipt must include the care provider’s TIN or Social Security number for verification purposes.

Make sure the receipt is issued by the care provider directly and is not a handwritten note or informal document. If your care provider offers invoices, these often serve as the most accurate and acceptable form of proof for your FSA claim.

Keep copies of receipts and other related documents for your records in case your FSA administrator requests them for verification.

Submit a receipt that meets FSA requirements by including these details:

Provider’s Information

Include the full name, business address, and contact number of the caregiver or daycare facility. If the provider is an individual, list their Social Security Number (SSN) or Employer Identification Number (EIN).

Service Details

Specify the exact dates of care, not just the payment date. The receipt should list the type of care provided, such as daycare, after-school care, or babysitting services.

Dependent’s Information

State the full name of the child or dependent receiving care. Ensure that the dependent is under the age limit specified in the plan.

Payment Confirmation

Document the total amount paid and the payment method. The provider must verify the charges, either with an official receipt or a signature on an invoice.

Submitting a clear and detailed receipt reduces processing delays and helps secure reimbursement without additional requests for documentation.

Incorrect or Missing Provider Information

Ensure the provider’s name, address, and Tax ID or Social Security Number are correctly listed. Missing or incorrect details lead to automatic rejections. Double-check the information against invoices or provider documentation before submission.

Using an Ineligible Expense

Only expenses directly related to dependent care qualify. Non-eligible costs, such as food, supplies, or private school tuition, will not be reimbursed. Review IRS guidelines or your employer’s plan document for a clear list of covered services.

| Common Error | Consequence | How to Avoid It |

|---|---|---|

| Submitting without receipts | Claim denial | Attach itemized receipts with provider details |

| Filing for expenses outside plan dates | Reimbursement refusal | Check plan year and grace period rules |

| Exceeding the contribution limit | Tax penalties | Track total contributions against IRS limits |

Reviewing your form for these errors before submission reduces processing delays and improves approval chances.

Creating a Dependent Care FSA Receipt Template

To ensure your dependent care expenses are processed smoothly, a clear and accurate receipt is key. Your template should include specific details to match the IRS requirements for reimbursement claims. First, make sure the receipt lists the name and address of the service provider. This is critical for verifying the legitimacy of the expense.

Next, include the date(s) of service provided. If the service spans multiple days, break it down by each date and corresponding amount. Be specific about the total charges and indicate whether the cost was paid in full or partially covered by other means (e.g., insurance). This transparency will avoid any delays in processing.

Include the name(s) of the dependent(s) receiving care and ensure they match the names listed on your FSA records. The provider’s signature or an official stamp adds credibility to the receipt and confirms the accuracy of the details provided.

If applicable, note any additional fees such as late charges or extra services. These should be separately itemized to prevent confusion. A clear, easy-to-read format can speed up the reimbursement process, avoiding potential issues with documentation review.