Creating a clear and accurate diesel receipt is crucial for businesses and individuals keeping track of fuel expenses. A simple template ensures all necessary details are included, avoiding confusion and simplifying financial reporting.

Key Elements of a Diesel Receipt

- Date: Clearly state the date of purchase.

- Location: Include the address of the fuel station or company.

- Fuel Type: Specify “diesel” to differentiate it from other fuels.

- Quantity: Indicate the amount of diesel purchased in liters or gallons.

- Unit Price: List the price per liter or gallon.

- Total Price: Calculate and display the total cost of the diesel purchased.

- Payment Method: Mention whether the payment was made via card, cash, or another method.

- Vendor Information: Include the name, contact details, and any identification numbers of the fuel supplier.

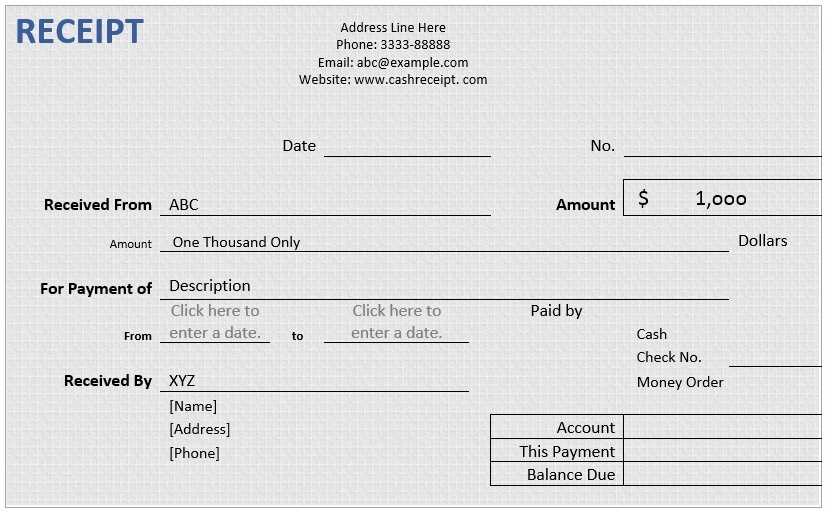

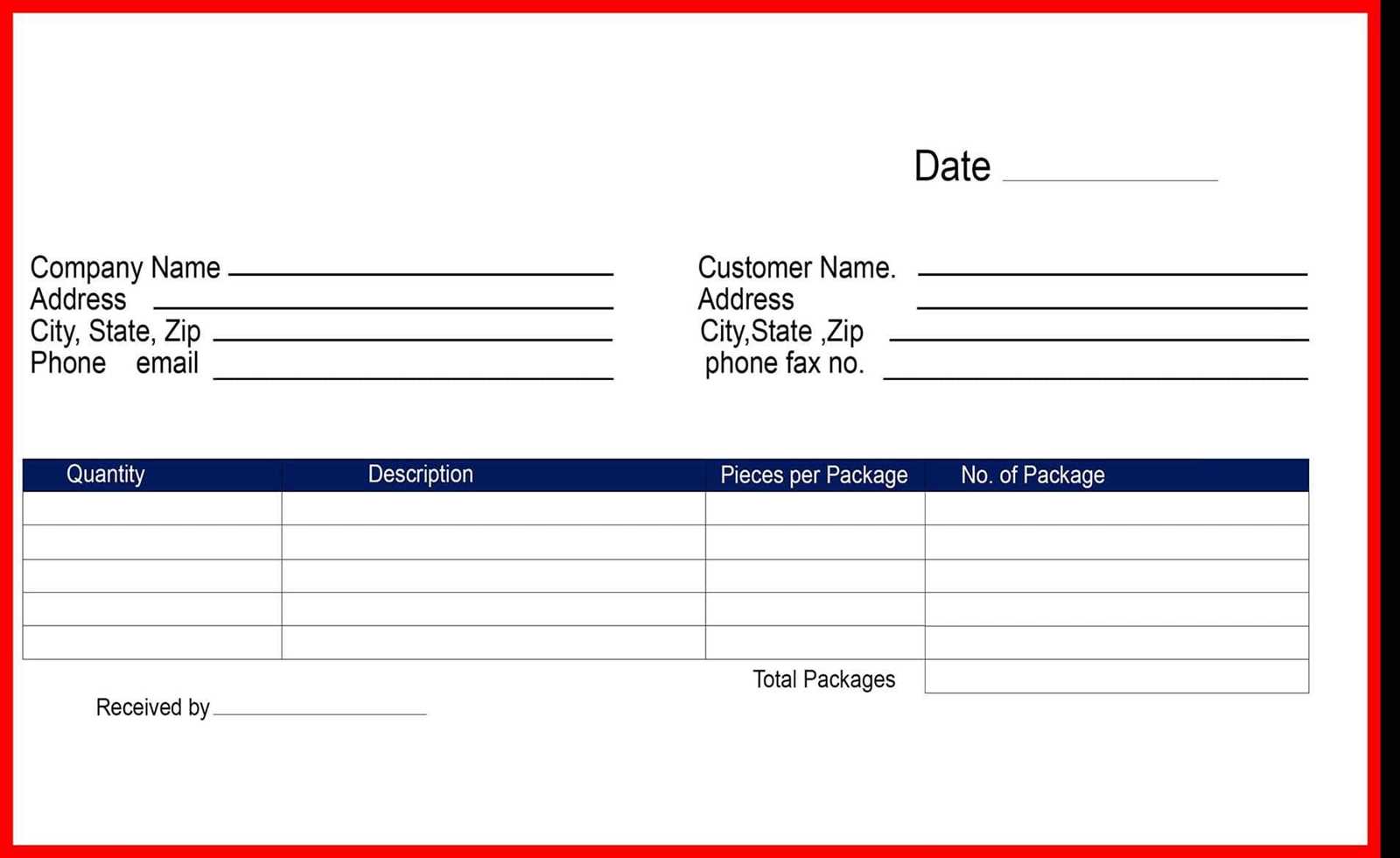

Sample Diesel Receipt Template

Here’s an example of how the receipt might look:

---------------------------------------------- Diesel Receipt ---------------------------------------------- Date: 09/02/2025 Location: ABC Fuel Station, 123 Main St. Fuel Type: Diesel Quantity: 50 liters Unit Price: $1.50 per liter Total Price: $75.00 Payment Method: Credit Card Vendor: ABC Fuel Station, Phone: (123) 456-7890 ----------------------------------------------

How to Customize Your Diesel Receipt Template

Adapt the template according to your specific needs. You can add or remove fields like discounts, VAT, or any company-specific terms. Ensure the details remain clear and easy to read, helping avoid any potential issues with reimbursement or accounting.

Why Use a Diesel Receipt Template?

Using a pre-designed template helps maintain consistency across all your diesel purchases. It saves time by eliminating the need to start from scratch with every transaction and provides a standardized format for both customers and vendors.

Diesel Receipt Template: Key Aspects and Practical Solutions

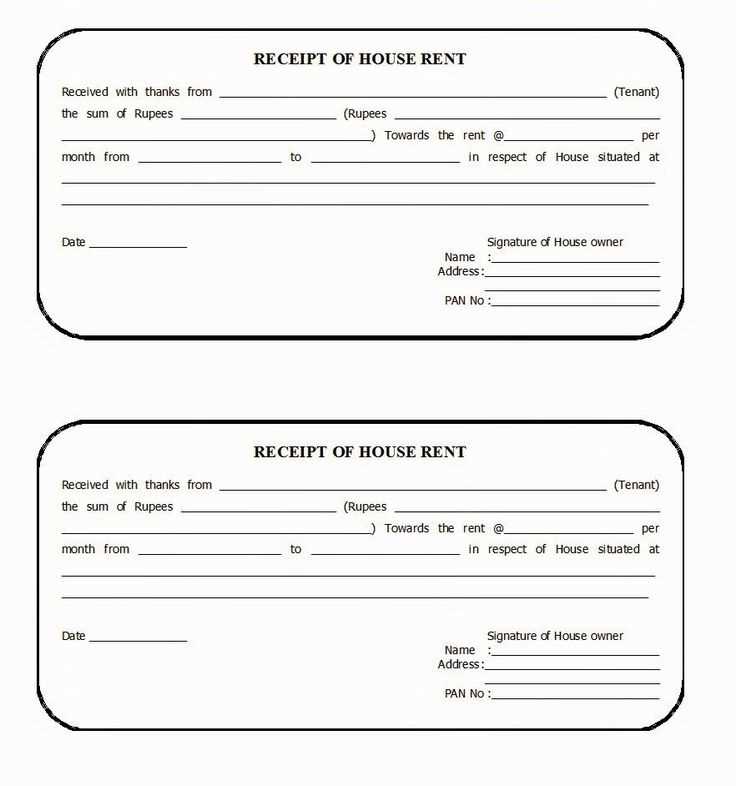

Mandatory Details to Include in a Fuel Receipt

How to Format a Diesel Invoice for Tax Compliance

Printable vs. Digital Fuel Receipts: Pros and Cons

Customizing Fuel Invoices for Business Branding

Common Errors in Diesel Receipts and Ways to Avoid Them

Best Free and Paid Fuel Receipt Templates to Download

When creating a diesel receipt, include the following mandatory details: transaction date, fuel type, quantity purchased, price per unit, total amount, and payment method. Also, add the business name, contact information, and any tax identification numbers if relevant. These elements ensure transparency and legality in every transaction.

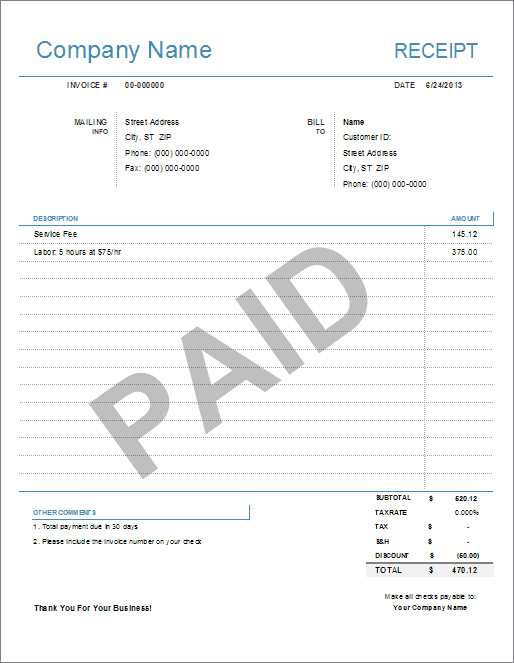

How to Format a Diesel Invoice for Tax Compliance

For tax compliance, format your diesel invoice to display the appropriate tax rate, total before tax, and the final amount after tax. Ensure that your business name, VAT number, and address are clearly visible. If applicable, include a breakdown of fuel types and their respective taxes, so the tax authority can easily verify your claims.

Printable vs. Digital Fuel Receipts: Pros and Cons

Printable receipts are tangible and can be stored physically for long-term reference. However, they require paper and printing supplies, making them less eco-friendly. Digital receipts are easy to store and manage electronically, but they require a reliable system for tracking and may not always be accepted in specific situations. Choose the format that best suits your business needs.

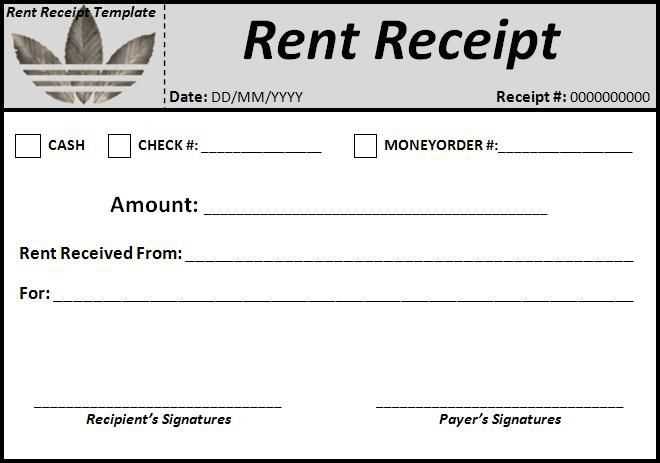

Customizing Fuel Invoices for Business Branding

Customizing your fuel invoices helps reinforce your brand identity. Use your logo, business colors, and fonts to make the receipt stand out. A branded invoice also improves professionalism and ensures that customers recognize your business in every transaction.

Common Errors in Diesel Receipts and Ways to Avoid Them

Common errors include missing or incorrect dates, incorrect fuel quantities, and miscalculations in totals. To avoid these mistakes, double-check all entries, use automated templates, and implement a system for reviewing receipts before issuing them to customers.

Best Free and Paid Fuel Receipt Templates to Download

Free templates can be found online, offering basic designs and customization options. Paid templates often come with more advanced features, such as built-in tax calculations and professional layouts. Consider your business’s needs and budget when selecting the right template for your receipts.