Key Elements of a Digital Receipt

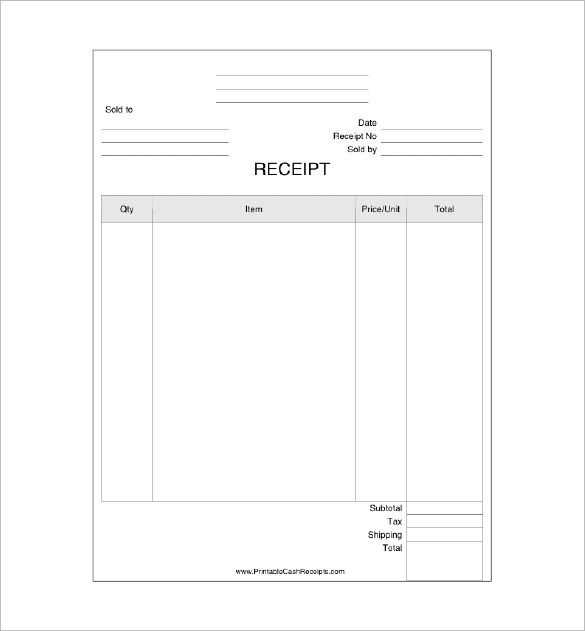

A well-structured digital receipt should contain clear and relevant details. Ensure the following elements are included:

- Transaction ID: A unique identifier for reference.

- Date and Time: The precise moment of purchase.

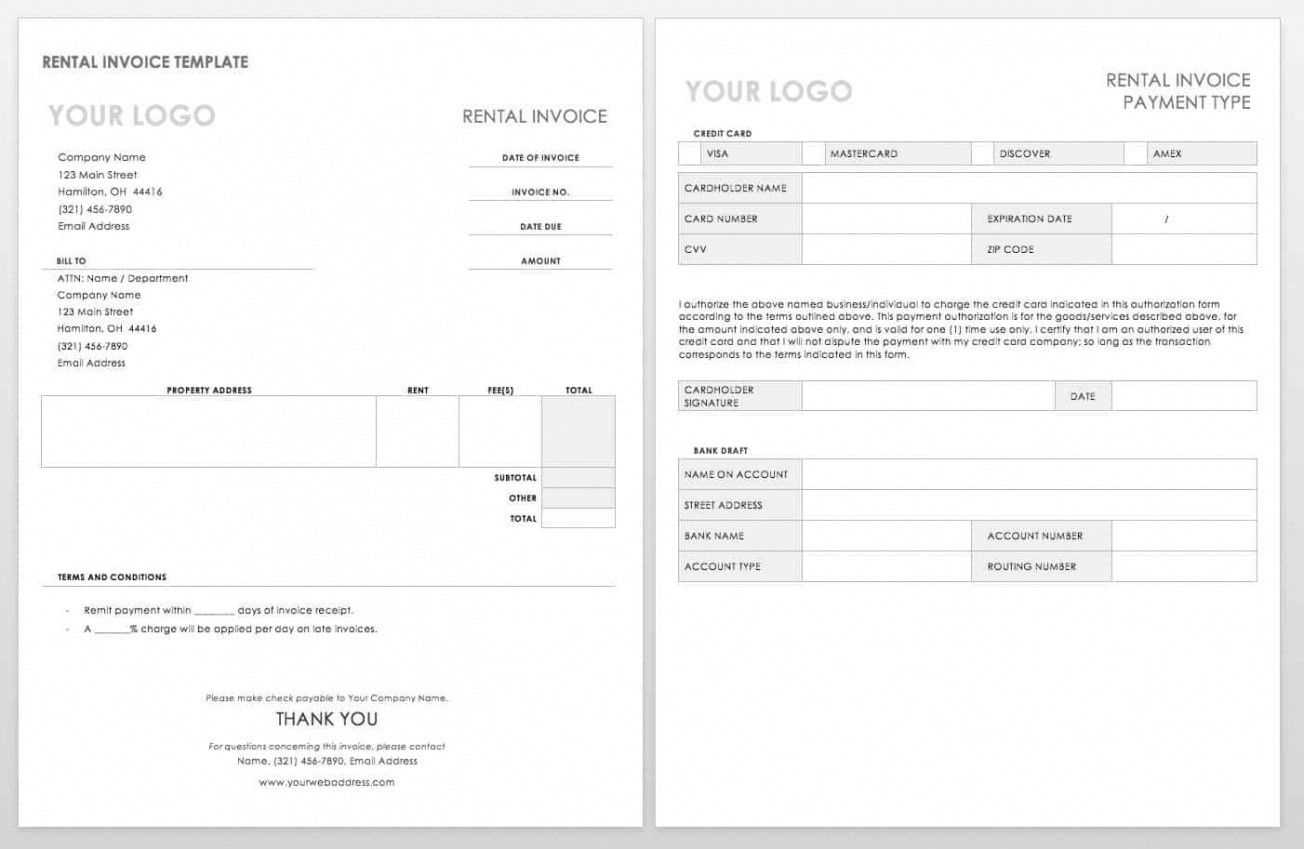

- Business Information: Name, address, and contact details.

- Customer Details: Name and email for personalized service.

- Itemized List: Product names, quantities, and individual prices.

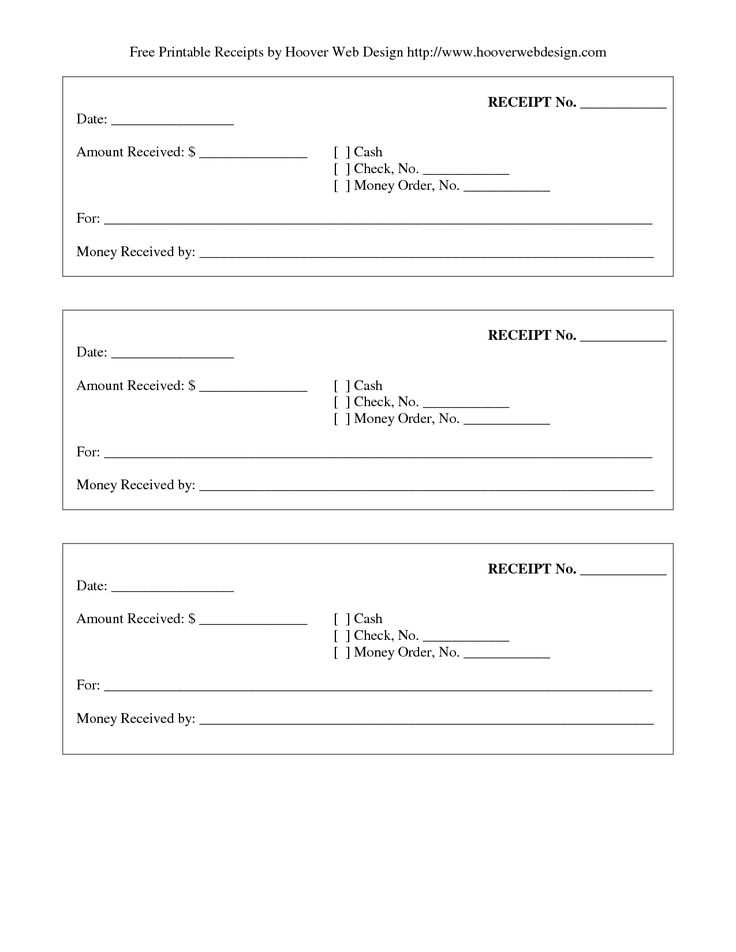

- Total Amount: Including taxes, discounts, and final cost.

- Payment Method: Credit card, PayPal, or other forms of payment.

- Return Policy: Clear instructions on refunds and exchanges.

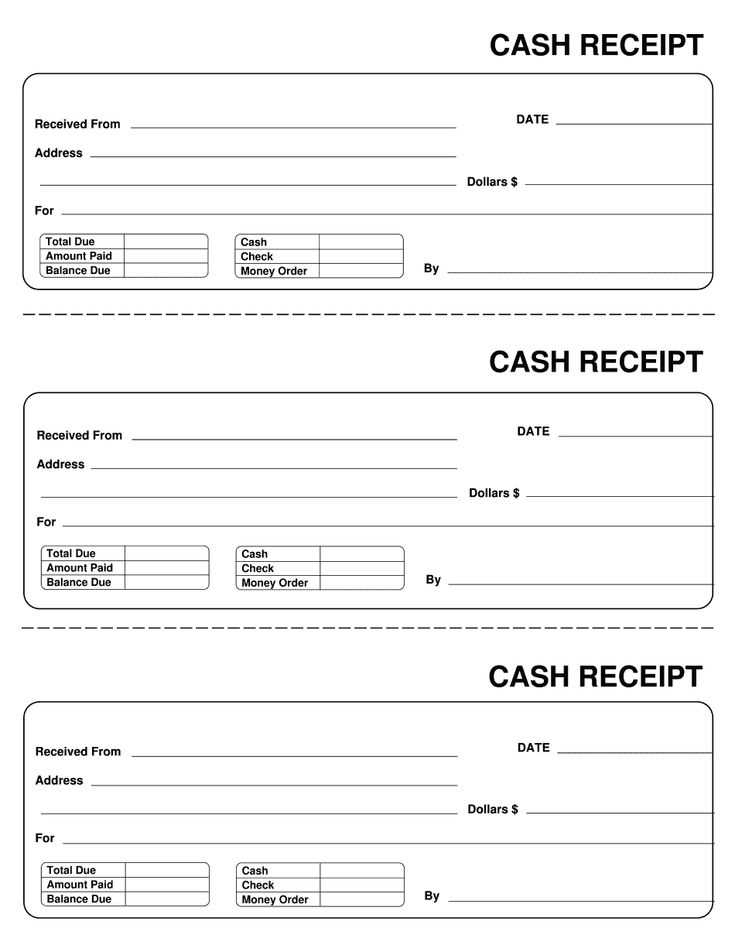

Best Practices for Formatting

Clarity and readability enhance the customer experience. Follow these recommendations:

- Use a clean layout: Avoid clutter with distinct sections.

- Ensure mobile compatibility: Design receipts that display well on all devices.

- Highlight key details: Use bold text for total amount and transaction ID.

- Include a call to action: Offer a feedback link or loyalty program signup.

- Attach a PDF option: Allow customers to download a printable version.

Automation and Integration

Streamline receipt generation by integrating with accounting software or e-commerce platforms. Automated templates reduce errors, save time, and ensure consistency.

Security Considerations

Protect customer information by implementing encryption and limiting access to sensitive data. Avoid displaying full payment details to maintain security.

Customization for Branding

Enhance recognition by incorporating your company logo, brand colors, and a personalized thank-you message. A professional design reinforces trust and improves customer engagement.

Digital Receipts Template: Key Elements and Practical Use

Structuring a Digital Receipt for Readability

Organize information in a clear hierarchy. Place the business name and contact details at the top, followed by the receipt number and date. Use bold text for itemized charges and totals to improve visibility. Align numerical values to the right for easy comparison. Separate sections with whitespace to prevent clutter.

Ensuring Legal Compliance in E-Receipts

Include tax identification numbers, payment methods, and refund policies as required by local regulations. Store receipts in a format that meets data retention laws, such as PDF or structured JSON. Ensure digital signatures or unique identifiers verify authenticity and prevent tampering.